If I know anything at all – it is that I cannot keep up. The capitalist system à la quarantine is thriving as the fashion industry / “influencers” have been recycling and subsequently tossing out trends like bee stings on Sports Day. (I was religiously stung by a wasp every Sports Day – it has drastically impacted my sentiment towards all sports).

Trucker hats are a societal offense that scream “anti-abortionist” until they became “ironic” and “Y2K”. That pink Hawaii baby-tee you got on vacation in ’02 is now recognized as a “big mood”. And now, since Justin Bieber decided to do it, Crocs with socks are considered “trendy”.

And by next week, it will all be “out” and “lame” and “cheugy” (???) all over again as the cycle churns on.

This cute little Ferris wheel of indulgence and excess is a good way to look at investing in IPO’s. Just because there is particular hype around a certain something, doesn’t mean you must jump on the bandwagon. In a year’s time, you may look back proudly and say, no, I never did invest in those colossal, sparkly barrettes to clip my baby hairs back on either side of my middle part. (I am not one to give fashion advice, but I believe to my core that this whole dress like a preteen-at-25-years-old-movement is profoundly concerning).

In any case, IPOs, (for lack of a better term, and to try and relate to the youths), can be sketch.

*To clarify, this article covers investing in an IPO upon market open and not the private financing that goes on prior (the latter is generally always profitable).

The grass is usually never greener:

I find it physically difficult to pass up any sort of bargain. It may be what I miss most about travelling – not the culture, history or scenery – but rather, the art of the haggle. So, when a shiny new company offers itself up at a discounted rate to ensure sales (or, even worse, when there’s more demand than supply leaving no guarantee all investors will even be able to purchase shares), human nature wants in. We want what we can’t have, and we want it cheap. However, and don’t lie to yourself, we’ve all bought into a trend that we deeply regret (feather hair clips anyone?).

Take the story of Uber:

The stock went public in May 2019, at $41.57 per share.

It climbed as high as $46.38 on June 28th, but then began to struggle.

It reached a low of $21.33 on March 20th, 2020, then recovered.

On July 27th, 2020, the price was $30.99.

Had you jumped on Uber when it opened, you’d have been sitting on a loss of approximately 25% over a space of just 14 months.

(And that even includes the general stock market rebound that’s taken place since late March).

The Performance:

Here comes my favorite word: volatile

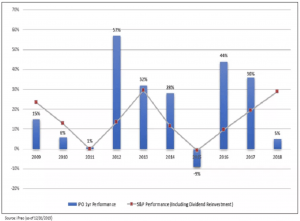

IPO’s easily outperformed the general market in some years but underperformed in others…

For example, in 2018, when the S&P 500 turned in a gain of nearly 30%, IPO’s provided only 5%.

In 2015, a year in which the general market was flat, IPOs showed a loss of 9%.

The numbers for an IPO performance are almost identical to the performance of any given individual stock against the general market.

This brings me to the ultimate reality of IPOs:

If you can remove all the hype and focus on what’s really going on (or what has happened in the past), an IPO may prove to be no more profitable than other individual stocks.

How to do your homework:

Since an IPO deals with a private company going public, it can be hard to analyze the fundamentals and technicals of an IPO issuance. Typically, if you are keen on a company, I’d tell you to go have a look at their chart – in this case, obviously, that does not exist.

The main source of information on an IPO is a fun ‘little’ something called the prospectus. This is available as soon as the company files its S-1 Registration. When looking at an IPO, investors should pay special attention to the management team and their commentary, as well as the quality of the underwriters and the specifics of the deal. (a quality assessment in the same vein as how I wouldn’t trust an ethics professor who wears cargo shorts – which is to say, make sure everything adds up).

Successful IPOs will typically be supported by big investment banks that have the ability to promote a new issue well. However, there is of course the usual caveat that Big Finance knows of their market moving abilities – being the underwriter usually gives them very cheap stock they can sell at a profit immediately upon market open of the IPO. There’s a whole financial undercurrent where market movers will invest because they know the market will move after them, and not because they believe in the investment themselves. Look for lock-ups, or other large investors (and their track records of holding pre-IPO stock).

*If you want to invest in IPO’s, be sure to learn all you can about the company before it goes public. The mere fact that it is going public doesn’t give the fundamentals of the company any intrinsic value.

Trends: Lock-Up

If you look at the charts following many IPO’s, you’ll notice that after a few months the stock takes a steep downturn. This is often because of the expiration of something called the lock-up period. When a company goes public, the underwriters make company insiders (such as officials and employees) sign a lock-up agreement.

Lock-up agreements are as severe as they sound. They are legally binding contracts between the underwriters and insiders of the company, prohibiting them from selling any shares of stock for a specified period of time. The period can range anywhere from 3 to 24 months. 90 days is the minimum period stated under Rule 144 (SEC law), but the lock-up specified by the underwriters can last much longer. (This was probably irrelevant to all of you seeing as none of us are underwriters, but it felt necessary to portray the dry, scary, financial tone). Typically, a long lock-up period is supposed to signify the insiders’ confidence in the long-term growth of the company, and also reassure standard shareholders of the low risk of all the insiders dumping the stock upon lock-up expiry

The problem is, when lockups expire, all the insiders are permitted to sell their stock. The result is a rush of people trying to sell to realize their profit. This excess supply can put severe downward pressure on the stock price – leaving little old you with potentially less money than you went in with.

Pearls of wisdom:

1. IPOs can be overrated

2. If a company is a good investment, it will still be a good investment well after the IPO

3. In fact, it may even be better to wait until after the IPO, when the price of the stock stabilizes or drops as the excitement fizzles

4. Never try out a new tanning salon before a big event

5. Tequila sometimes is, in fact, the cure

6a. Don’t get carried away with IPO investments

6b. Limit participation to no more than 10% of your portfolio:

6c. That way, if the IPO goes against you, the loss won’t be catastrophic

7. Miss Montana’s hit single “You’ll Always Find Your Way Back Home” says:

You can change your hair

And you can change your clothes

You can change your mind

That’s just the way it goes

You can say goodbye and you can say hello

But you’ll always find your way back home

But in my 25 years I have seen certain haircuts that there really is no coming back from. If you want front bangs – get the clip-in version first to test-run them out. Dream as we may, most of us will not look like a young Brigitte Bardot.

Until next week xx