Tourmaline Oil (TOU.T) announced they have entered into a definitive agreement to acquire the privately owned Black Swan Energy for a total consideration of approximately $1.1 billion.

The $1.1 billion consists of 26 million Tourmaline common shares and the assumption of net debt up to a maximum of $350 million, including all transaction costs. The transaction is expected to close in the second half of July 2021, subject to regulatory approvals.

The $1.1 billion consists of 26 million Tourmaline common shares and the assumption of net debt up to a maximum of $350 million, including all transaction costs.

In their press release, Tourmaline noted that the acquisition was part of their plans to consolidate North Montney, a region which straddles Alberta and British Columbia. The region is expected to produce 1.4 million barrels of oil equivalent per day (boepd) and Tourmaline expects Black Swan assets to generate free cash flow of up to $200 million in 2022 and beyond.

In the Montney region, Tourmaline owns and operates five significant natural gas processing facilities with an aggregate capacity of 325 MMcf/d with related gas gathering systems and NGL handling infrastructure. The Company is also planning a new 200 MMcf/d facility at Gundy in 2019 to efficiently process the liquids-rich natural gas produced as a result of ongoing development in the Gundy CK area including installation of an ethane rejection deep-cut gas processing facility.

Tourmaline believes the acquisition will allow them to become a half-million boepd company by helping to grow their North Montney boepd to 175,000 during 2022.

Tourmaline also has the ability to double the capacity of the forthcoming Gundy plant.

Upon closing of the acquisition, Tourmaline will acquire 50,000 boepd of production and reserves of 491.9 million barrels of oil equivalent (boe).

Tourmaline believes the acquisition will allow them to become a half-million boepd company by helping to grow their North Montney boepd to 175,000 during 2022. They also expect a 100,000 boepd after 2025.

While the rise of clean energy and green technology stocks, like Tesla, have dominated headlines and collective consciousness recently, it’s worth remembering that electric cars currently tend to account for ~1% of cars on the road. Gas is still king, and the transition away from oil is, at best, going to be a slow process. In the meantime, there is plenty of money to be made pumping oil.

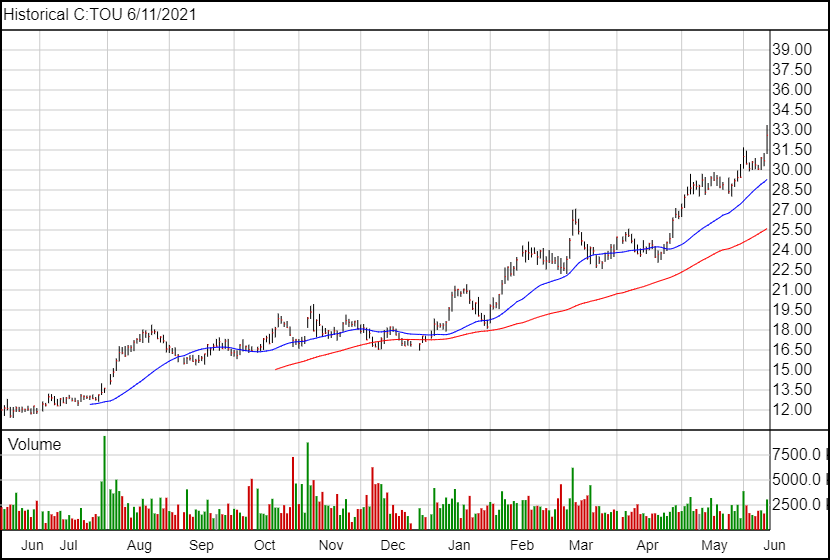

Following today’s news, Tourmaline shares are up $1.90 and are currently trading at $32.60.