If social media has taught me anything, it is that you can keep lowering the bar.

It is a race to the bottom, and the bottom somehow seems to keep dropping out from under itself. Imagine my naivety at thinking the 2015 Kylie Jenner lip challenge, where people everywhere took to sucking on a glass to inflate their lips on camera, was as bad as it could get. (Or that Tide Pod thing? SOS.)

This morning I made the mistake of opening Tik Tok, only to find a young girl licking an airplane toilet seat with the caption “Coronavirus challenge”. I’m not sure if she knows this isn’t how Covid-19 spreads or really what she was trying to get at here.

In any case, people never cease to shock.

(I recently turned 25 and am feeling it most in my lower back and general irritation towards others).

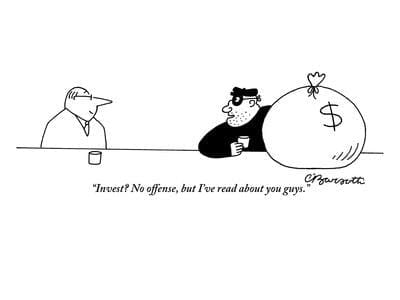

All this to say, I would argue that life, particularly at present, is hard enough without being subject to investment fraud. And the perpetrators (I love this word – very Goodfellas) have recently gone full throttle. With an ever-expanding reach (social media), desperation (poverty) and investment interest (pandemic), there are now more than ever millions of primed candidates vulnerable to investment fraud.

And I know what you’re thinking – I’m too smart to fall victim to such schemes. But unfortunately, these perps tend to look like the people we are told to trust (the rich man in the fancy suit or that really sincere looking mom). (Why we were ever conditioned to trust such an image is beyond comprehension – the rich white man continually proves himself to be the most dangerous of types). No matter, RCMP Superintendent of Financial Crimes says that “it is safe to say people are losing billions” to fraud in Canada alone.

Over in the UK or “’cross the pond” (as people I hate would say), Action Fraud (the National Fraud & Cyber Crime Reporting Centre) reported in November 2020 that there had been a 27% increase in reported investment fraud in the year to September – 17,000 reports amounting to £657.4M in reported losses.

These numbers are likely only the tip of the iceberg, with many frauds going unreported because victims are too embarrassed to report it.

Signs of Investment Fraud:

High Returns with No Risk:

If something sounds too good to be true – it is. We live in a world where people are willingly licking toilet seats on camera and sharing it proudly to the general public. This is not a utopia. As we’ve learned, the higher potential return of an investment, the higher the risk. If someone promises you an investment with high returns and no risk – it’s a scam. If you’re reading this column, you probably don’t have the kind of trust fund needed to access that kind of investment (we’ll talk about private placements and insider financing rounds later).

“Hot Tip”:

A term that is also known by authorities as “insider information” which, when acted upon, is illegal under insider trading laws. This seems self-explanatory. Don’t be coaxed into doing illegal things.

Pressure to Buy:

This one gets me because I feel it every time I walk past a store with a sale. As if I will never again find such a deal on a pair of basic denim jeans in my lifetime. Never trust any high-pressure sales tactics, (it pains me to tell you that the Aritzia salesgirl did not, in fact, think that skirt was slimming).

They’re not registered:

Fun little truth, anyone selling securities or offering investment advice must be registered with their provincial securities regulator. This is why I always remind you that I am highly unqualified to be advising you on virtually anything finance-related (as if my Tik Tok references were not indication enough). Before you invest, make sure to check the registration of the person offering you the investment. (Learn more about checking registration here).

Common frauds and scams:

- Affinity fraud: Where fraudsters approach potential victims through a group or community organization they belong to. These groups could be religious groups, ethnic groups, or even workforce communities like unions. (Don’t trust your own). (I’m absolutely kidding). (But be wary of random investor-speak before your next sermon).

- Ponzi/Pyramid scheme: The Wuthering Heights of investment fraud. We all have that friend from elementary school in ’05 that has recently messaged us trying to sell shampoo and a lifestyle of passive income. A promise of “big money”, working from home, and “turning $10 into $20,000 in just weeks!” is the equivalent of the “I lost 100 pounds sitting on my couch doing nothing at all but eating chips!!” type of adverts. Stay away from this lofty rhetoric with a 10-foot pole.

- Advance Fees Scam: Is exactly what it sounds like. The victim is persuaded to pay money up front in order to take advantage of an investment opportunity promising significant gains. But (surprise, surprise), the scammer takes the money and the victim never hears from them again. Also, very MLM.

- Offshore Investing Scam: I would really hope we all have the wherewithal to not fall victim to this one. (But no judgement – I too have had my fair share of panics when the “government” calls and tells me “I have committed tax evasion” and owe “thousands”). This scam promises huge profits if you send your money “offshore” to another country. The hook is that you can lower or avoid taxation with these investments. The reality is that if something goes wrong (as it most definitely will), you won’t be able to take your case to civil court in Canada. Just take a quick guess as to how many offshore legal and travel fees you’d need to accrue to chase the fraudsters – and how likely you are to be successful there.

- Crypto fraud: It must come as no surprise that such a trendy and nightmarishly complicated industry comes with a myriad of potential scams. Crypto fraud is basically where investors are encouraged to purchase crypto assets that subsequently disappear, plummet or are held to ransom.

- Pump and dump schemes: An unsettling name for an equally unsettling thing. Scammers will contact you to promote a low-priced stock that they just so happen to own large amounts of. As you and other investors buy shares, the value of the stock rises (pump). At peak price, the scammer sells their shares and the value of the stock plummets (dump), leaving you with a worthless stock.

Watch your back: (kidding, not kidding).

A false sense of security is just that – false. We are all confident in our belief that we would never fall for a fraud in the same way we all believe that we will never become our own mothers, (until we do). Everyone is a potential target for criminals and unfortunately, nobody is too smart (I am well aware of the drama of this statement – using the word perpetrators has made me feel unstoppable – I stand by it anyhow). With interest rates at an all-time low, the economy in a state of flux, and more business than ever before being conducted remotely, the chances of being duped are higher than ever.

Life is hard enough. Let us not, on top of it all, be victims of investment fraud.

Until next week.