Revive Therapeutics (RVV.C), a specialty life sciences company focused on the research and development of therapeutics for medical needs and rare diseases, announced today that it has entered into a feasibility agreement with LTS Lohmann (LTS). According to the agreement, LTS will work with the Revive to manufacture proprietary oral psilocybin thin film strips for the Company’s clinical and commercial initiatives.

“We are very excited to work with LTS, as one of the world’s largest innovators and suppliers of oral thin films, to develop our proprietary oral psilocybin thin film strip product for pharmaceutical use…Revive positioned itself as an innovator of novel uses and delivery forms of psilocybin, as a potential treatment for unmet medical needs. Revive, with our relationship with LTS, will be able to expedite its clinical and commercial ambitions with psilocybin as a pharmaceutical, globally,” said Michael Frank, CEO of Revive.

Unlike Crest white strips, Revive Therapeutics’ psilocybin strips aren’t going to make your teeth pearly white. Instead, the Company’s psilocybin thin film strips are intended to combat mental illness, neurological and substance abuse disorders. Compared to other delivery systems, oral strips provide rapid dissolving and onset of action to the bloodstream. Moreover, strips can be ingested without water, chewing or swallowing. As someone who has almost choked to death countless times swallowing pills, I welcome innovations like Revive’s oral strips.

“At LTS, we are unrelenting in our commitment to make life better for patients…Under this agreement, we will deploy our full expertise and experience to the development of new therapeutic options in an area that fits perfectly with our strategic focus. The cooperation with Revive is an opportunity to demonstrate once again how LTS creates commercial value at every stage of development,” commented Bas van Buijtenen, CEO of LTS.

Prior to its latest agreement, Revive collaborated with the University of Wisconsin-Madison to develop oral thin film technology. The Company is currently working with the University of Wisconsin to evaluate psilocybin as a potential treatment for methamphetamine use disorder. With this in mind, Revive recently submitted an application with the U.S. Food and Drug Administration (FDA) to receive Orphan Drug Designation (ODD) for psilocybin to treat traumatic brain injury. If accepted, Revive will have access to a variety of benefits including tax credits, FDA assistance, and potential research grants from the Office of Orphan Products Development (OOPD) to support clinical studies.

The Company is currently engaged with North Carolina State University to develop a novel biosynthetic version of psilocybin based on a natural biosynthesis enzymatic platform developed by Dr. Gavin Williams, a professor and researcher at North Carolina State University. This platform is intended to provide a potential method for the rapid production of natural products like psilocybin. With regards to Revive’s latest agreement, LTS will begin formulation development of oral psilocybin thin films to support preclinical studies for product development, as well as GMP manufacturing of clinical trial supplies.

With a growing pipeline of products and a multitude of studies being conducted across the mental disorders and rare diseases sector, Revive is positioned to see some growth in the future. Compared to its peers in the psychedelic market, Revive’s market cap of $151 million is dwarfed by a company like MindMed, which has a market cap of $1.4 billion. With potential growth on the horizon, Revive shows potential as a low risk investment.

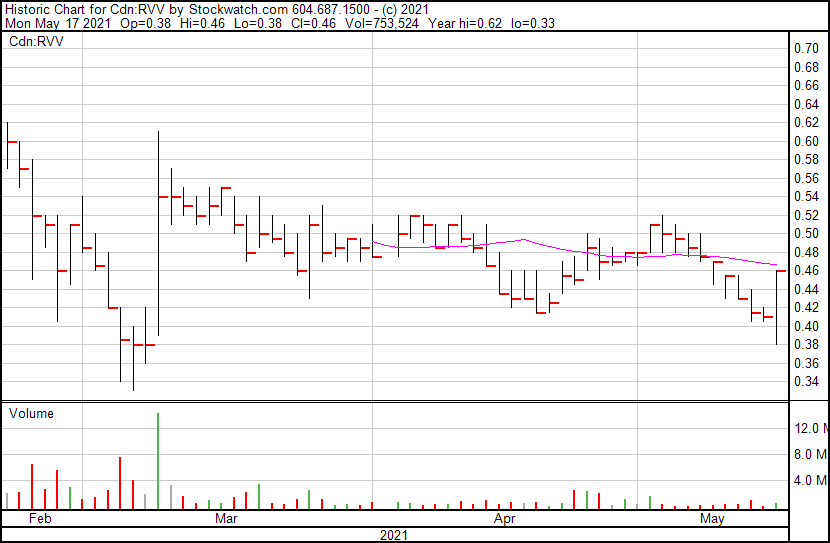

Revive Therapeutics’ share price opened at $0.38 and is currently trading at $0.47 as of 10:40AM ET. The Company’s shares are up 14.63% indicating that there has been some noticeable change following the news.

Full Disclosure: Revive Therapeutics is a marketing client of Equity Guru.