Defense Metals (DEFN.V) announced they have entered a securities purchase agreement for a private placement for institutional investors.

The private placement aims to raise $5 million through the sale of 15,625,000 common share and warrant packages, which will cost $0.32. Each package will contain one DEFN common share and one purchase warrant, exercisable at $0.425 for three years after the placement’s closing date.

Defense Metals say the proceeds are expected to be used on a preliminary economic assessment (PEA) of their Wicheeda rare earth elements (REE) property, to conduct an exploration program at the site, and do further environmental studies on the property. A PEA is an important and necessary step in the development of a mining project.

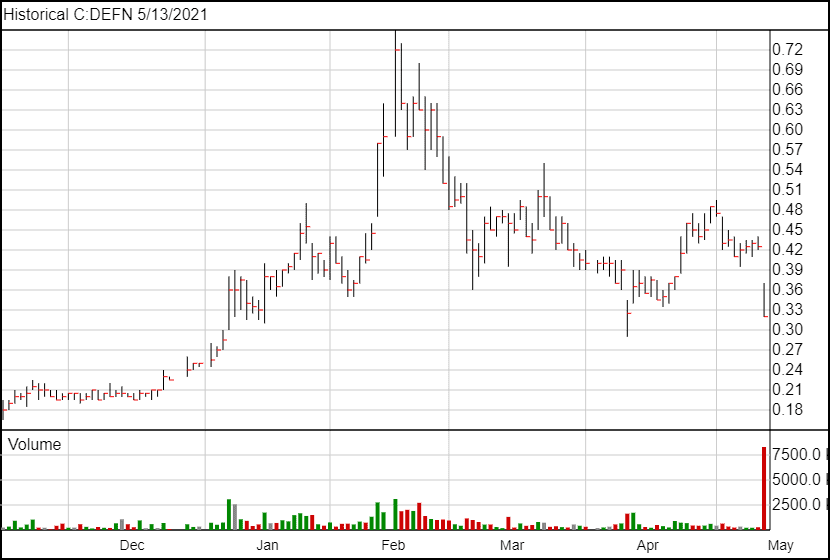

The pricing decision on the private placement is a bit of a head-scratcher. At the time of the announcement, DEFN’s share price was $0.425. This placement allows institutional investors to get in at a more than 10 cent discount compared to where the share price was and offering warrants at the share price at the time of the offer.

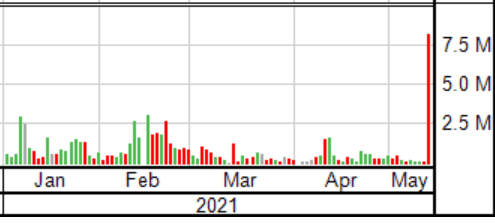

Predictably, the share price fell as people rapidly sold shares, with more than three times the volume of any previous day this year.

Investors had a variety of reactions, ranging from anger to optimism.

Some investors were upset about the big discounts being offered to institutional investors, writing “the pp [private placement] price sucks. But, I think it has nothing to do with the property. With that PP, they are bringing institutional investors only.” Others said that “It’s good to have institutional investors on your side, which is likely why they got a good deal” and noted that his opinion was that “true longs” should be happy with the news.

One investor expressed anger that “I’ve been buying over the past while. I should have been selling” while another proclaimed it was “a great time to buy the dips”. Some directed their anger at management, while another investor remarked that “every company that does a financing with Wainright gets hammered”.

As of writing this, the share price is down at $0.325 (just half a cent over the pp package price), representing at 23.5% drop in DEFN’s share price.

Full disclosure: Defense Metals is an Equity Guru marketing client.