Tetra Bio-Pharma (TBP.T) announced they are accelerating their PLENITUDE Phase II clinical trial, which is studying QIXLEEF.

QIXLEEF is Tetra’s proprietary drug formulation which contains THC and CBD and is inhaled through a medical vaporizer, which is used by patients with advanced cancer to manage uncontrolled pain. By using pharmaceutical-grade cannabis and a medical vaporizer, the patients are not subjected to the inhalation of smoke or combusted by-products, which could be harmful to those with cancer. The ingestion method has proved a difficult problem for those seeking to use cannabis to treat uncontrolled pain in patients with cancer.

The PLENITUDE study is a four-week, randomized, double-blind, placebo-controlled study, after which all patients will be able to receive the active study medication.

Dr. Guy Chamberland, CEO and CRO comments, “The PLENITUDE© study has been underway for many months and we are now accelerating its enrollment activities. Tetra currently has two Phase 2 clinical trials ongoing in the United States. Though both trials, PLENITUDE© and REBORN1©, will evaluate QIXLEEF™, each has a very different objective. The PLENITUDE© trial will assess how QIXLEEF™ may manage uncontrolled cancer pain in patients living with advanced cancer and the REBORN1© trial is a head-to-head study against an opioid treatment in the management of short and frequent episodes of incapacitating pain requesting immediate release opioid treatment in cancer patients. We believe based on our years of research that QIXLEEF™ will be proven to be safe and effective, and if so, provide patients with cancer pain a safer treatment option with potentially greater benefits than the current standard of care.”

In other Tetra news, Tetra Bio-Pharma announced a $10 million bought deal private offering led by Echelon Wealth Partners, who will act as the underwriters for the deal. The underwriters agreed to purchase 25,000,000 units which will be sold at $0.40 a unit. Each unit will consist of one share of Tetra and one purchase warrant, exercisable at $0.51 for 24 months after the closing date. Tetra also provided the underwriters with a 15% over-allotment option.

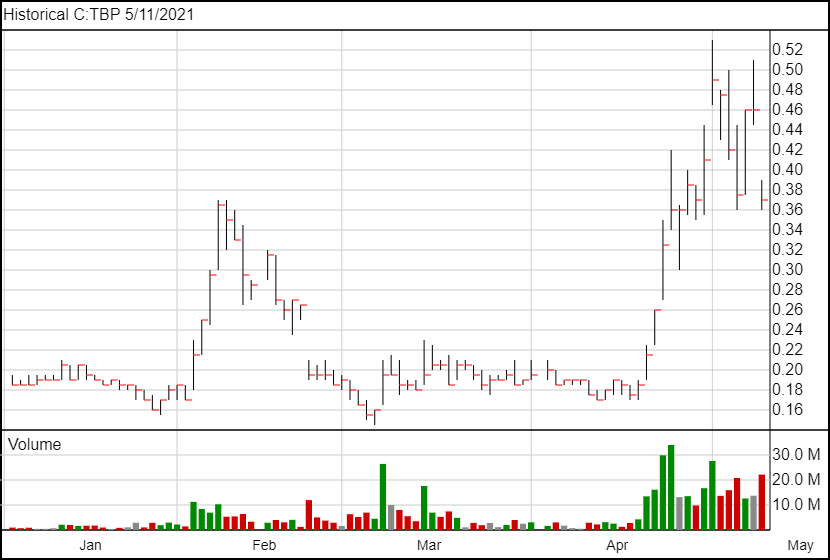

This private offering comes after the stock has had some crazy swings up and down in the last three weeks, with massive trading volume in the tens of millions. What’s surprising is that the warrants are exercisable at the low price of $0.51. At the time of the announcement, that was only five cents higher than the current share price, and the total unit price was six cents lower than the stock’s current price. Because of all this, there is a good chance that the underwriters will exercise their over-allotment option, meaning Tetra will likely raise $11.5 million.

The company says they plan on using the money raised for clinical trials, of which they have many.

Following the news, Tetra’s share price fell nearly 20% and is currently trading at $0.37.