Not So Constipated Market

I owe Flinstones Gummies my life. That’s a bit of an exaggeration, however, there’s no denying I cared more for my health as a kid than I do now as an adult. I mean, if it looked and tasted like candy, I was more than happy to take my vitamins. After all, those gummies were Yabba-Dabba-Delicious. Today, Flinstones branded vitamins continue to disguise themselves under the veil of ‘candy,’ finding their way into the hearts and stomachs of naive children.

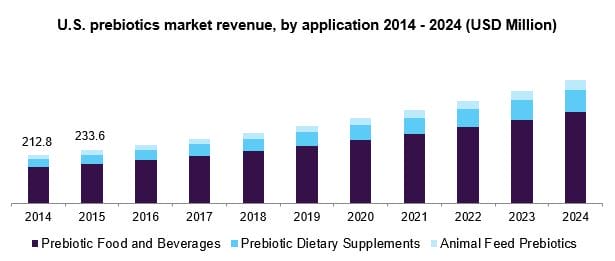

As a whole, the Global Vitamins and Supplements Market was valued at USD$119.66 billion in 2020. In the future, this market is expected to grow from USD$129.60 billion in 2021 to USD$196.56 billion in 2028, expanding at a Compound Annual Growth Rate (CAGR) of 6.13% during the period of 2021-2028. Of this market, the prebiotic segment has grown substantially following the onset of the COVID-19 pandemic.

In 2015, the global demand for prebiotics was 623.5 kilotons, which is the equivalent of more than 6,000 Right Whale testicles. There’s your fun fact for the day. In terms of value, the Global Prebiotics Market was valued at USD$8.95 billion in 2020 and is projected to expand at a CAGR of 7% until 2030. This market is expected to grow in relation to the rising demand for supplements, along with increasing consumer awareness about the health advantages of prebiotics.

According to QMI, the prebiotics market is experiencing positive growth due to the role of prebiotics in strengthening the immune system. As such, prebiotics are considered an effective supplementary process for combating the COVID-19 virus. Additionally, prebiotics are being explored for use in treating gastrointestinal disorders such as Irritable Bowel Syndrome (IBS), which could introduce prebiotics to an entirely new market.

What’s the difference between probiotics and prebiotics? Well, probiotics are living strains of bacteria that add to the population of good bacteria in your digestive system. On the other hand, prebiotics are specialized plant fibers intended to act as food for the good bacteria, stimulating growth among the preexisting good bacteria. Kombucha is a good example of a probiotic while foods rich in fiber such as oats are classified as prebiotics.

Other Prebiotic Examples:

- Garlic

- Onion

- Leeks

- Asparagus

- Bananas

- Barley

In addition to feeding good bacteria in the digestive system, prebiotics can help the body absorb calcium faster, change the rate at which foods cause spikes in blood sugar, and ferment foods faster so they spend less time in the digestive system. As previously mentioned, prebiotics are also being studied in relation to IBS treatment. However, in most of the studies I found, it was concluded that prebiotics did not improve gastrointestinal symptoms or Quality of Life (QoL) in patients with IBS. Bummer.

Tetra Bio-Pharma Inc.

- $33.178M Market Capitalization

Tetra Bio-Pharma Inc. (TBP.T) is a biopharmaceutical company focused on cannabinoid-derived drug discovery and development. The Company has an FDA and Health Canada cleared clinical program intended to bring novel prescription drugs and treatment to patients and their healthcare providers.

Furthermore, Tetra’s evidence-based scientific approach has enabled the Company to develop an extensive pipeline of drug products for a range of medical conditions, including pain, inflammation, and oncology. Tetra’s current product pipeline includes QIXLEEF and CAUMZ for pain, REDUVO and REDUVO ADVERSA for chemo-induced nausea, and ARDS003 and PPP003 as immunomodulators.

Latest News

Most recently, on February 22, 2022, Tetra announced that it has signed a Licensing Agreement with Thorne Health Tech Inc. For context, Thorne develops innovative solutions for a personalized approach to health and wellbeing, including the company’s patented prebiotic dietary supplement. Thorne utilizes testing and data to create improved product efficacy and deliver personalized solutions to consumers, health professionals, and corporations.

Thorne also offers tests for Biological Age, Gut Health, Sleep, Stress, and Weight Management. It is worth noting that all of Thorne’s tests can be completed at home, with the exception of the company’s Biological Age test which requires a lab. In particular, Thorne’s Gut Health test provides deep analysis and a tailored wellness plan intended to address gastrointestinal discomfort and optimize wellness.

According to the Licensing Agreement, Tetra will assist Thorne in commercializing its patented protected prebiotic supplement in the United States (US) market. In doing so, Tetra will receive a royalty on sales and milestone payments. Keep in mind, in the US alone, the Prebiotics Market is expected to exceed USD$9.5 billion by 2027, growing at a CAGR of 9.6% in 2021.

“Thorne has an established reputation as a world leader in the sales and distribution of evidence-based supplements for consumer self-care and physician-directed therapies and Tetra is excited to partner with them to bring this product to market,” said Guy Chamberland, CEO of Tetra Bio-Pharma.

BioMed Propulsion Program Loan

Tetra’s latest news comes on the heels of the Company’s previous press release announcing the approval of a CAD$4.5 million participative loan from the ministère de l’Économie et de l’Innovation (MEI), on February 16, 2022. This loan was granted to Tetra under the BioMed Propulsion Program, managed by Investissement Québec (IQ).

For context, the BioMed Propulsion Program is intended to financially support Quebec companies with high growth potential in the life sciences sector to encourage commercialization. In order to receive approval, Tetra will need to transfer its Head Office in the province of Ontario to the province of Quebec. That being said, more than 60% of Tetra’s personnel already reside in Quebec.

Funding from the MEI will support the development of Tetra’s ARDS003 in the indication of acute respiratory distress syndrome, which may provide a treatment option for patients with COVID-19 and sepsis. Keep in mind, this transaction is conditional on the approval of all shareholders and will be subject to a vote at the General Meeting of Shareholders in May 2022.

“Our support of Tetra Bio-Pharma will lead to the development of medication to treat acute respiratory distress syndrome, such as in severe cases of COVID-19. Our government will always be there to support potentially life-changing initiatives for the population…,” said Pierre Fitzgibbon, Minister of the Economy and Innovation and Minister Responsible for Regional Economic Development.

Financials

According to Tetra’s Q3 2021 Financial Statements, the Company had cash of CAD$8,571,863 on August 31, 2021, up from CAD$2,500,612 on November 30, 2020. As of August 31, 2021, Tetra had total assets and total liabilities of CAD$36,986,970 and CAD$6,371,554, respectively. As of November 30, 2020, these numbers translate to CAD$29,338,545 and CAD$6,749,759, respectively.

For the nine months ended August 31, 2021, Tetra started the period with CAD$2,500,612 and ended the period with CAD$8,571,863. With ongoing clinical studies, the Company’s Research & Development (R&D) expenses were CAD$2,438,060 for the three months ended August 31, 2021, compared to CAD$3,092,724 on August 31, 2020.

For the nine months ended August 31, 2021, Tetra’s R&D expenses increased to CAD$9,190,070 compared to CAD$6,599,378 in the previous year. In total, during the period ended August 31, 2021, Tetra incurred a net loss of $21,988,930 and a working capital surplus of CAD$7,232,531.

On August 31, 2021, Tetra had 100% ownership interest of active subsidiaries PhytoPain Pharma, Panag Pharma, Tetra Bio-Pharma Europe, and ENJOUCA. As of August 31, 2021, Tetra had 5,577,250 options outstanding, 2,350,000 of which are unvested. Upcoming, the Company has 150,000 options vested at an exercise price of $0.70 expiring on February 23, 2022. Keep in mind, Tetra still has a $4.5 million loan from MEI in its back pocket. Anyways, if you’d like to see more from yours truly, check out my Substack here!

Tetra’s share price opened at $0.09 today, up from a previous close of $0.08. The Company’s shares were trading at $0.08 as of 12:23 PM EST.