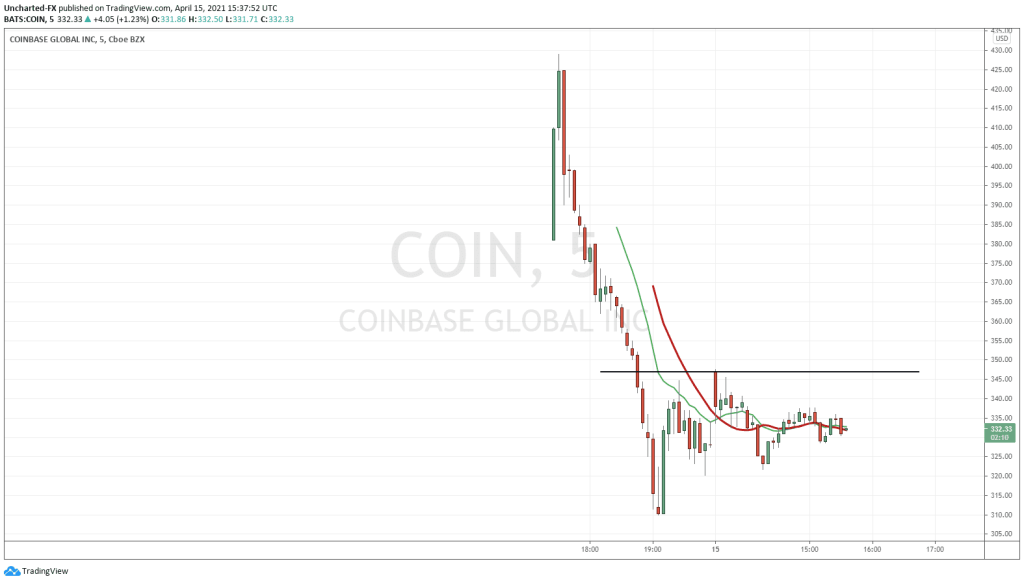

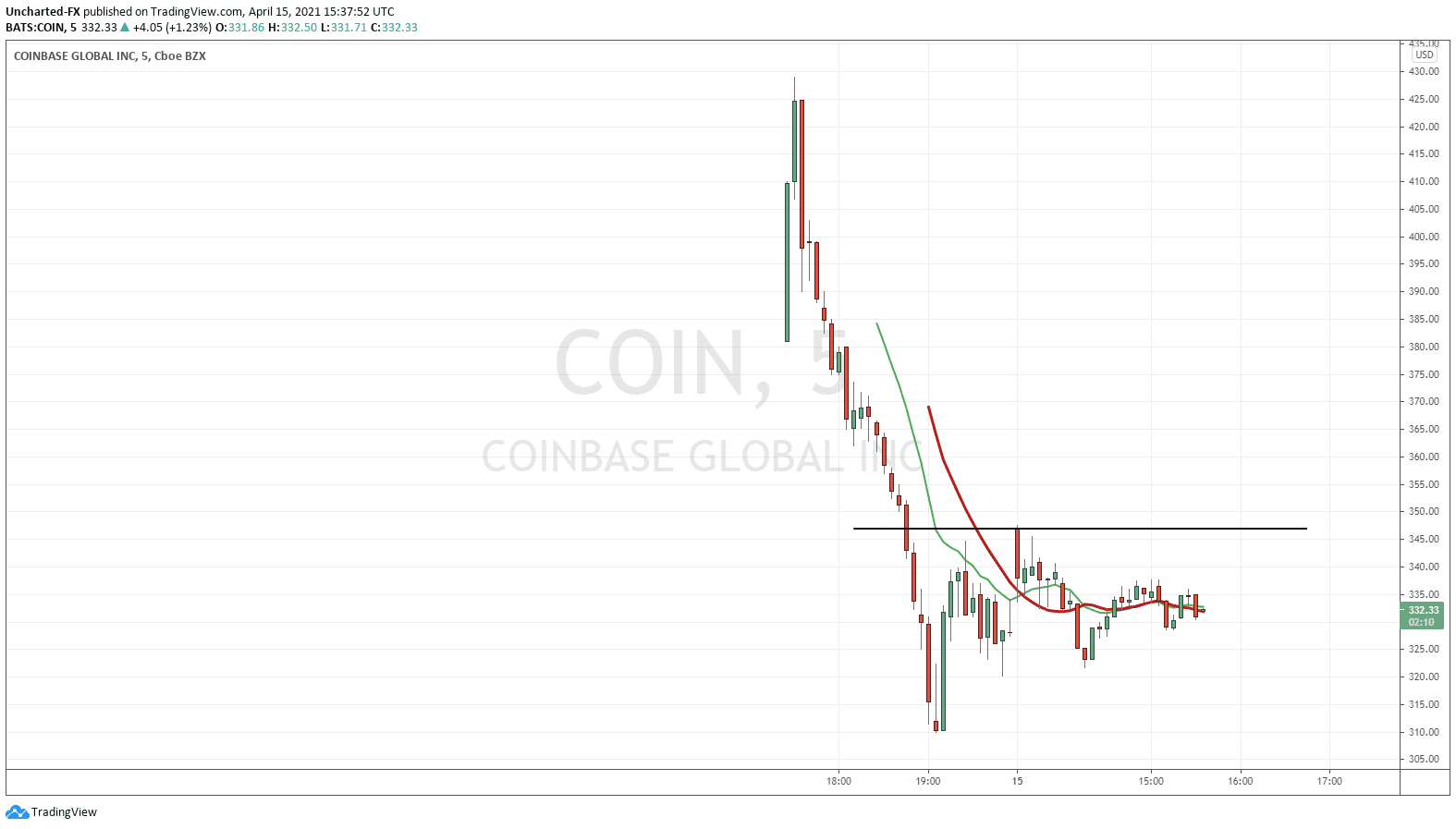

The highly anticipated Coinbase (COIN) IPO saw its first trades yesterday. It definitely lived up to the hype in terms of price action and interest. Wild swings which saw the first trade open above $380, from the reference price of $250, hitting highs of $429.54 and lows of $310.00.

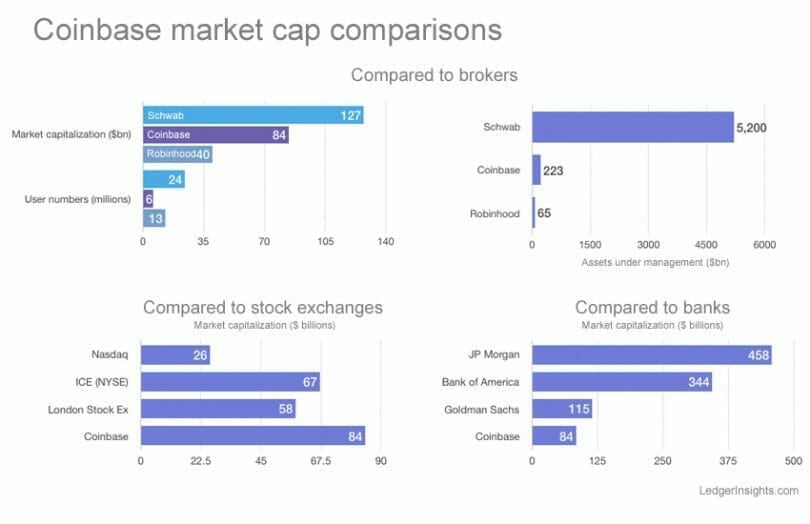

The market cap of Coinbase is currently sitting at $65 Billion, but valuation did open at $85 Billion and even eclipsed $100 Billion at one point during the trading day. This opening value was larger than those of famous recent IPO’s such as Palantir, Slack, Roblox, and Spotify.

Expect to hear more about Coinbase in the upcoming weeks. Just today, it was announced that Cathie Wood over at ARK picked up $250 million worth of COIN shares on the first day of trading. Amounting to 749,205 shares, while selling $170 million worth of Tesla shares to do so. More on this in just a bit.

The question everyone is asking? Should I buy the stock?

With Bitcoin and Ethereum creating new highs, monster moves in XRP, Doge, and other alt coins, as well as the mania in NFTs and interest in DeFi, Coinbase couldn’t have picked a better time to IPO. General interest in cryptocurrencies is at a high.

My readers have known my stance on cryptocurrencies since last year: they are a way out of fiat currency, and you should be holding some knowing what central banks are going to be doing. In terms of them being real money…not so much. We are not seeing people spend their Bitcoin as money because why would you when it keeps going up? The store of value or safety is the better description right now. Or as Wall Street wants to term it: a new asset class.

The hype is real. I admit, the Coinbase price action was one of the worst first days of trading I have seen after a long time. It was a clapfest. However, the interest will still remain, and I am sure man will be buying the dip.

The Problem with Valuation

Valuations and price targets for Coinbase will be a hot topic going forward. Yes, this is important for every stock, but Coinbase presents a unique challenge.

Before I address this challenge, let’s take a look at the revenues and numbers put out by Coinbase before the IPO. Joseph Morton, our resident Technoking and master of all things crypto, wrote a piece on Coinbase and if it is worth the hype. I am getting the numbers from his article, but be sure to read it in its entirety, as Joseph details what comes next for Coinbase.

Its revenues were $1.28 billion in 2020, 86% of which were from transaction fees, according to Forbes. The company grabbed about 0.57% of the $193 billion in crypto trading volume in 2020.

The company’s revenues jumped 139% in 2020 from $534 million in 2019, according to its prospectus.

The trading volume also enjoyed a bounce of 142% in 2020, up from $80 billion in 2019. They also made a $322 million profit in 2020, where the year before they took a $30 million loss.

First Quarter 2021 Estimated Results

For the first quarter of 2021, the Company currently expects the following as of or for the three months ended March 31, 2021:

•Verified Users of 56 million

•Monthly Transacting Users (MTUs) of 6.1 million

•Assets on Platform of $223 billion, representing 11.3% crypto asset market share

◦Includes $122 billion of Assets on Platform from Institutions

•Trading Volume of $335 billion

•Total Revenue of approximately $1.8 billion

•Net Income of approximately $730 million to $800 million

•Adjusted EBITDA of approximately $1.1 billion

Coinbase’s quarterly revenue estimate of $1.8 billion is 906% more than the Q1 of 2020 at $179 million. Trading volume in Q1 was $335 billion, which is a 60% increase over all of 2020, and their profit range is between $730 million to $800 million.

The company is making money. Most of the money comes from trading fees.

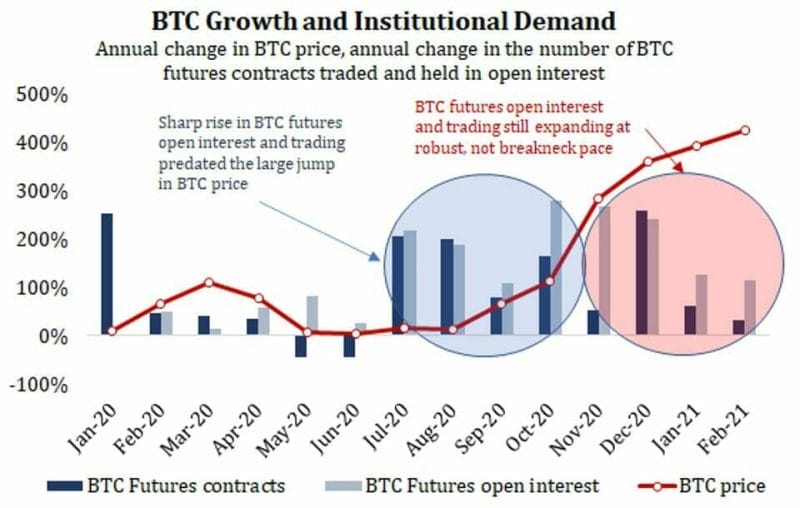

But here is the kicker: The analyst’s first Quarter 2021 estimates can be thrown out the window and changed frequently in about 1 hour or 1 day or 1 month from now. Because it all depends on the price changes in Bitcoin and other cryptocurrencies. Earnings are dependent on trading volume. As long as crypto’s remain in a bull market and the hype remains, things will be rosy.

What About Institutions?

This is where things get bullish. When I was listening in to CNBC yesterday before the first trade on Coinbase, the trades placed were 95% retail and 5% institutions. Expect the institution side to gain some steam.

In past Market Moment’s, I have said (and with some controversy) that regulations on crypto’s will be bullish because it means institutions can jump in. Because crypto’s are not regulated, there is no depositor insurance meaning if these crypto exchanges go bust, your money is not guaranteed. We have seen many instances of this in the past.

The way Wall Street has taken on crypto/Bitcoin exposure was through Tesla, Riot Blockchain, Microstrategy, Square, and the Grayscale Bitcoin Trust. All of them having Bitcoin on their balance sheets.

Coinbase now provides a way for institutions to indirectly play crypto’s AND they get exposure to crypto’s through a more traditional way. Just buying shares of a company that is highly leveraged to the price of crypto’s. Nothing fancy. No fancy derivative or financial products. This is big.

Remember I mentioned how ARK sold off Tesla shares? Expect institutional money to flow out from Tesla and the other stocks mentioned above, and make its way eventually to Coinbase for a better crypto exposure.

Challenges Ahead

Many analysts see the Coinbase IPO as a stepping stone for crypto’s as an accepted asset class on Wall Street. The chances of a US Bitcoin and crypto ETF are already increasing.

However, this does mean that regulations are coming. Firstly, this could impact Coinbase earnings. Brian Armstrong, the CEO of Coinbase, recently did say that regulations is one of the biggest threat to crypto. I believe these are guaranteed, but will see MORE institutional money flow into cryptocurrency raising the prices.

The Coinbase IPO was the watershed moment for the beginning of legitimizing and institutionalizing crypto’s, BUT the crypto purists do not like this one bit.

Bitcoin and other cryptocurrencies were meant to be decentralized and out of the hands of big government, big banks, and big institutions. Taking it to the man. A way to fight and rebel against the system. It is not turning out to be the case as banks and institutions are getting involved.

The average Joe Schmoe and Jane Doe don’t really care. They see crypto’s as a way to make money, and do not necessarily care about the traditional and initial Bitcoin ethos. The purists are already making their moves. Decentralized Finance, or DeFi, is becoming what Bitcoin and cryptocurrencies were supposed to be before Wall Street and Institutions started getting their hands on it. Watch this space. I certainly do and am expecting big moves in the DeFi space.