KWESST Micro Systems (KWE.V) announced they have appointed Rick Bowes to the new position of Vice President, Operations.

Rick Bowes is being brought on to accelerate the market introduction of KWESST’s Digitization and Tactical Products (DTP), which comprises the bulk of KWESST’s products and services, including their TASCS, ATAK integration, GreyGhost, laser defense system and the Phantom electronic decoy.

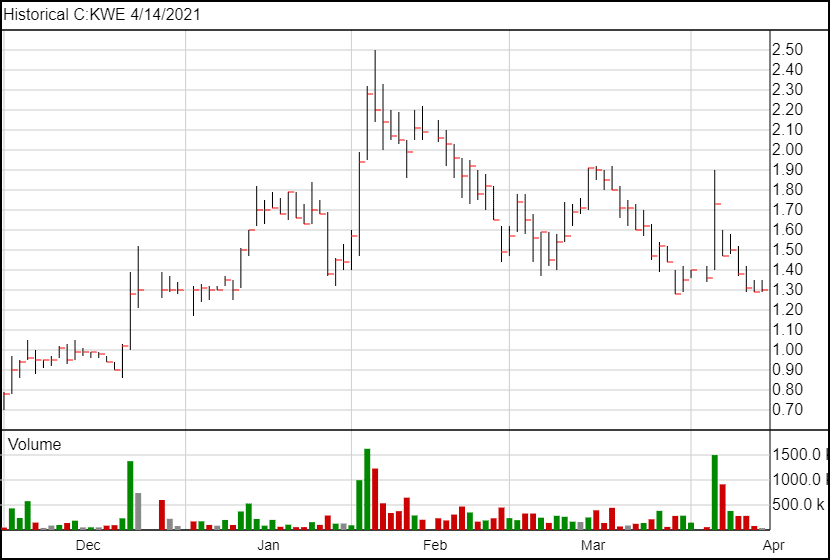

Last week, KWESST released a video demonstrating their TASCS at a US military base, and after they announced an amendment to their agreement with ArielX over the GreyGhost anti-drone technology, their share price surged up (although it has since come back down). KWE.V has also recently expanded their ATAK operation, setting up at ATAK Centre of Excellence in Ottawa.

Rick Bowes will likely be tasked with continuing KWESST’s attempts to expand their customer base for these products and further developing them.

KWESST also announced that Steve Archambault, currently their part-time CFO, will be increasing his time with the company and will be working full time as their CFO. Archambault has been with the company since September 2020.

“We are very pleased indeed to welcome Rick as VP Operations,” added David Luxton, Executive Chairman. “He brings a rare combination of senior defence industry experience and domain knowledge that is directly relevant to our key markets and programs. He also has proven business capture experience and long-standing relationships with major defence contractors. We are equally pleased that Steve Archambault has committed to the Company on a dedicated, full-time basis in the role of CFO.”

These hirings come after they announced a $4 million private placement last week. The placement had originally been announced at $2.5 million, but likely because demand was so high, they decided to issue more shares.

With cash on hand, KWESST is likely feeling like the time is now to be aggressive, and so they are getting a team together that can help them grow.

As part of his compensation, Bowes is receiving 300,000 stock options, exercisable at KWE.V’s closing price on April 16, 2021 and Archambault is receiving $25,000 (using April 16, 2021’s closing price) worth of KWE.V shares.

“With the expected closing of our recently announced $4 million over-subscribed brokered private placement, KWESST is positioned to execute on an expanded business plan,” said Jeff MacLeod, KWESST Founder, President and CEO. “The appointments announced today add bench strength for accelerated market introduction across our growing portfolio of products and services.”

Following the news, KWESST’s share price went up 3 cents to $1.33 but is back down to $1.30.

Full disclosure: KWESST Micro Systems is an Equity Guru marketing client.