Regular readers of Market Moment know I am a big fan of hard assets. Gold and Silver being among my favorite long term assets to hold. They are my hedge against mind boggling monetary and fiscal policy which will just continue. Easy money will not stop. It cannot stop.

I approach Gold through the lens of classical economics, and it seems Ray Dalio does as well. I recently read the book ” The Alpha Masters: Unlocking the Genius of the World’s Top Hedge Funds“, which came out in 2012. To my surprise, Ray Dalio was already bullish on Gold for the long term back then. I say this because I was under the impression he just became bullish on Gold a few years back with his “cash is trash” comments.

Essentially those that adhere to classical economic principles, do not see Gold as a commodity, but as a currency. In some ways, the world currency. When we see Gold appreciating against a currency and making new highs, it is a sign that the fiat is about to be inflated (it now takes more of the weaker currency to buy something).

I say this because back in early 2019, before the pandemic, XAUCAD, XAUEUR, XAUGBP, XAUAUD, XAUJPY, XAUNZD were all making all time record highs and kept on going. It was a sign that fiat was in trouble…a few months later, most nations cut interest rates and printed tons of money to combat the pandemic.

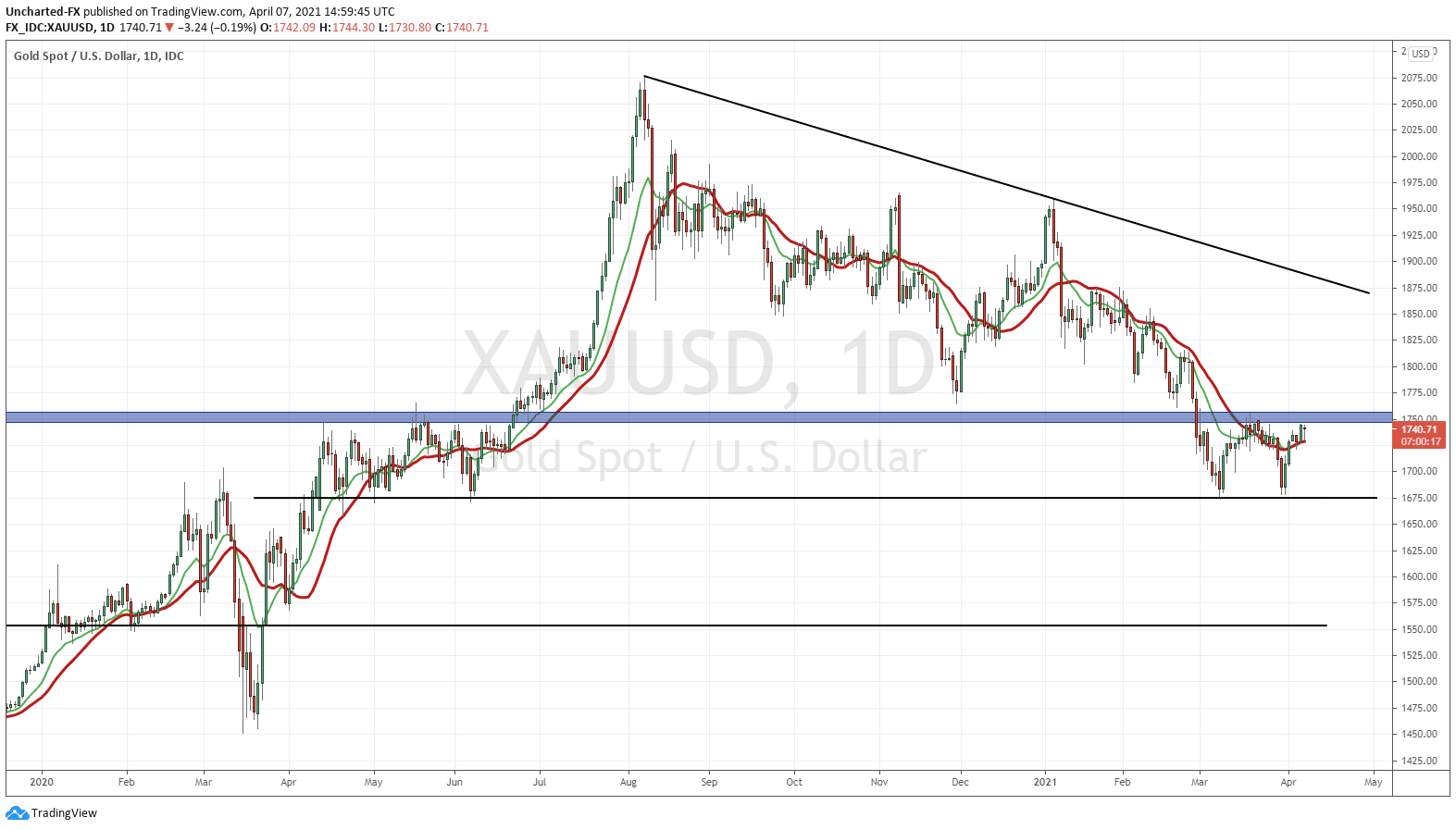

Gold and the US Dollar generally have a negative correlation. Meaning when the Dollar goes up, Gold goes down.

As a rule, when the value of the dollar increases relative to other currencies around the world, the price of gold tends to fall in U.S. dollar terms. It is because gold becomes more expensive in other currencies. As the price of any commodity moves higher, there tend to be fewer buyers, in other words, demand recedes. Conversely, as the value of the U.S. dollar moves lower, gold tends to appreciate as it becomes cheaper in other currencies. Demand tends to increase at lower prices.

BUT I do want to point out that there are periods when both Gold and the US Dollar can move together. We saw this during the GFC back in 2008 for sometime. Both can move up when there is fear and a confidence crisis in governments, banks, and the fiat money. Gold being the safe haven, while the US Dollar being the world reserve currency…and being the best fiat to hold under those circumstances, although many would give this title to the Japanese Yen.

Most Gold bulls are looking at the new $2 Trillion stimulus plan as a bullish sign. More money will be printed (US Dollar will weaken), and inflation fears will begin to rise. The key here is where this money goes. If it does not go to productive use, we have a situation where there are people with more money competing for the same number of goods and services, which means prices increase.

Technical Tactics

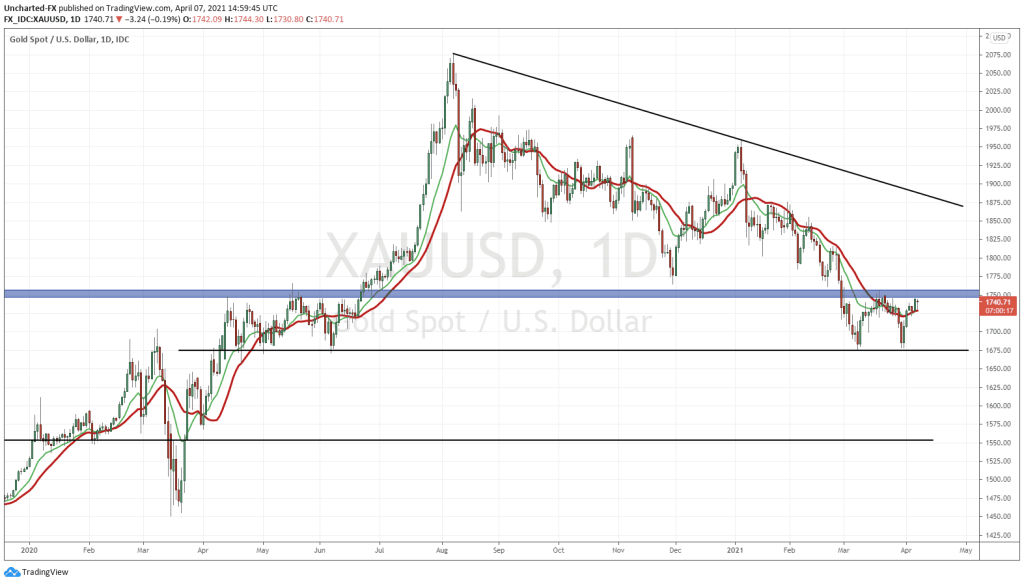

As much as the long term fundamentals will favor Gold, the technicals can give us better signs of when to start increasing our long exposure. I am happy to say that there are a few signs currently.

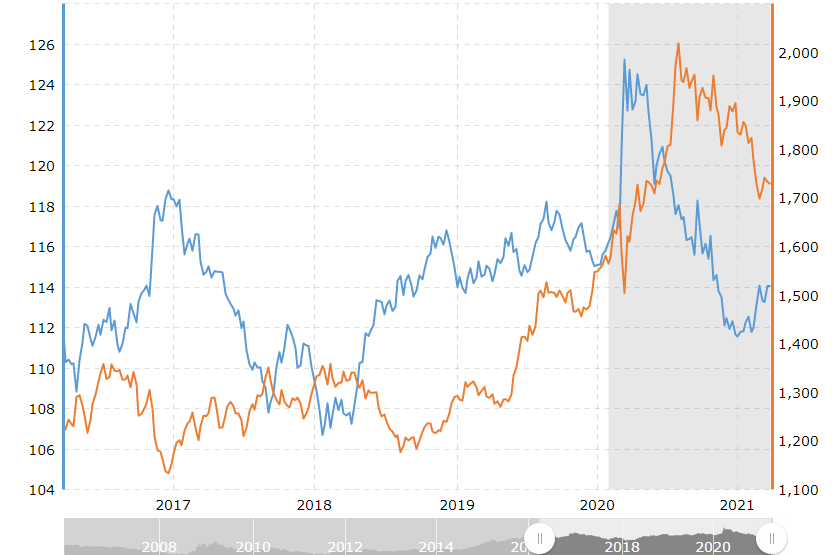

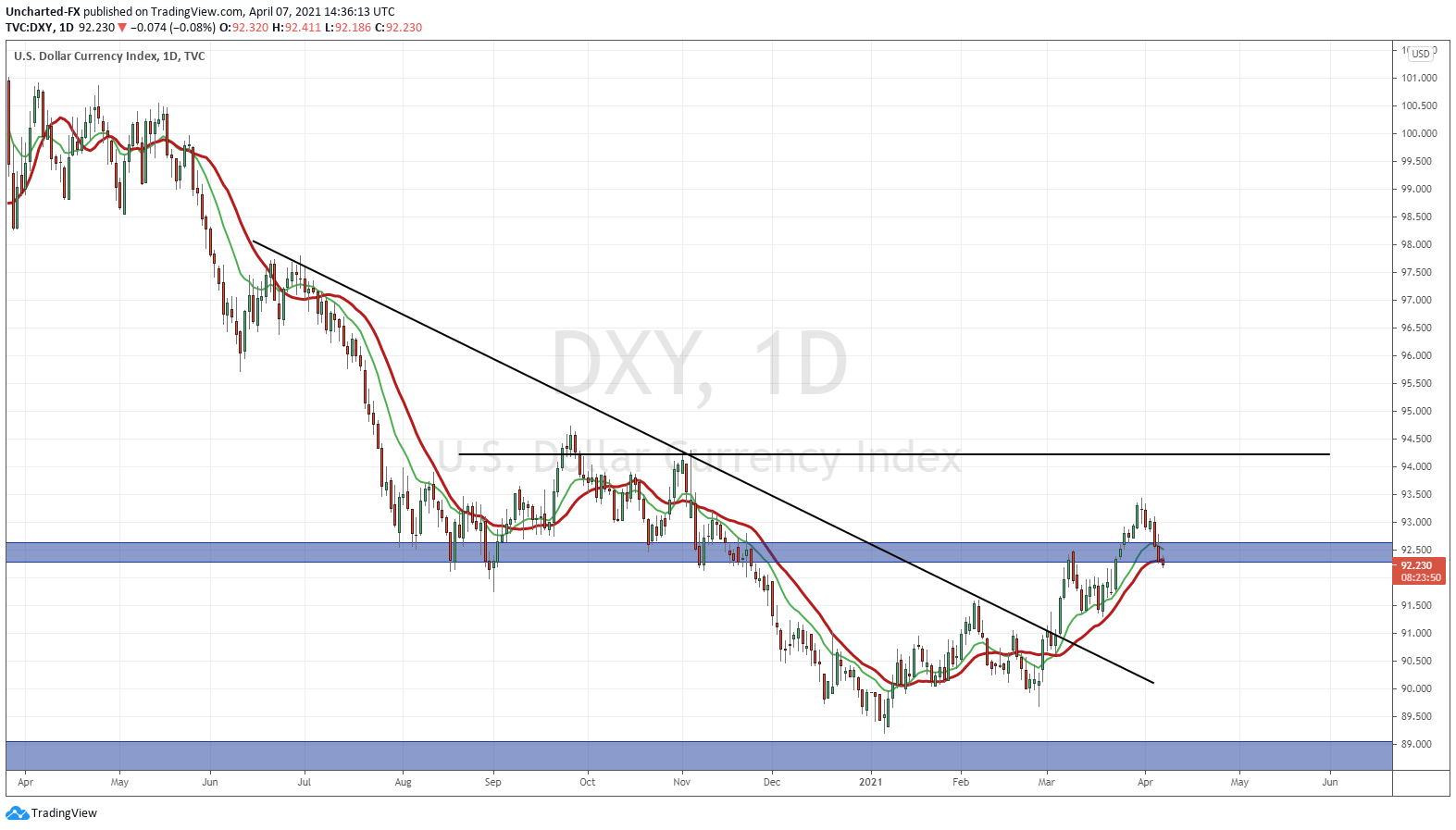

Firstly let’s take a look at the US Dollar.

The US Dollar has been making moves in the last few weeks. More to the upside that is, but it seems that the uptrend could be breaking down. Where the Dollar is currently, the 92.30 zone, is crucial. A major support (price floor) zone and if we can get a daily close below this area today, it points to more downside.

It is also worth noting that Gold prices have held well even with the US Dollar gaining strength recently! This is a very bullish sign for Gold in itself!

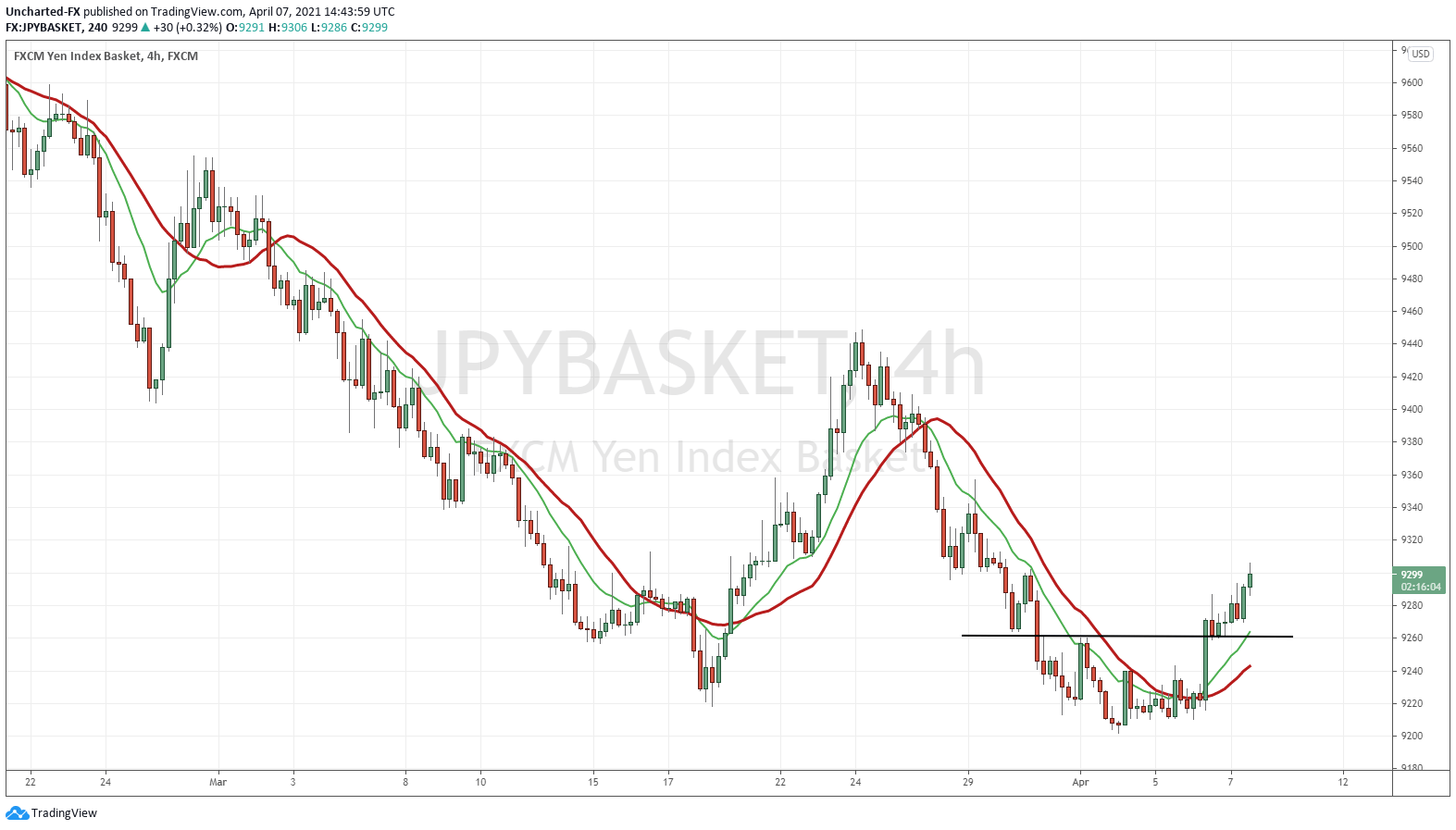

Believe it or not, but the Japanese Yen futures is also bullish Gold. Many people do not know but there is a high positive correlation between both the Japanese Yen and Gold. This has to do with both being considered a safe haven. If you want to delve more into this fascinating macro correlation, I recommend reading this article, and also this one.

What I have charted above is the JPY Basket. It is an instrument I use as a proxy for Yen futures. The chart meets our reversal pattern criteria, and the Yen is appreciating against other fiat currencies. This is a confluence we can use for Gold, but also could be hinting at a stock market pullback/drop.

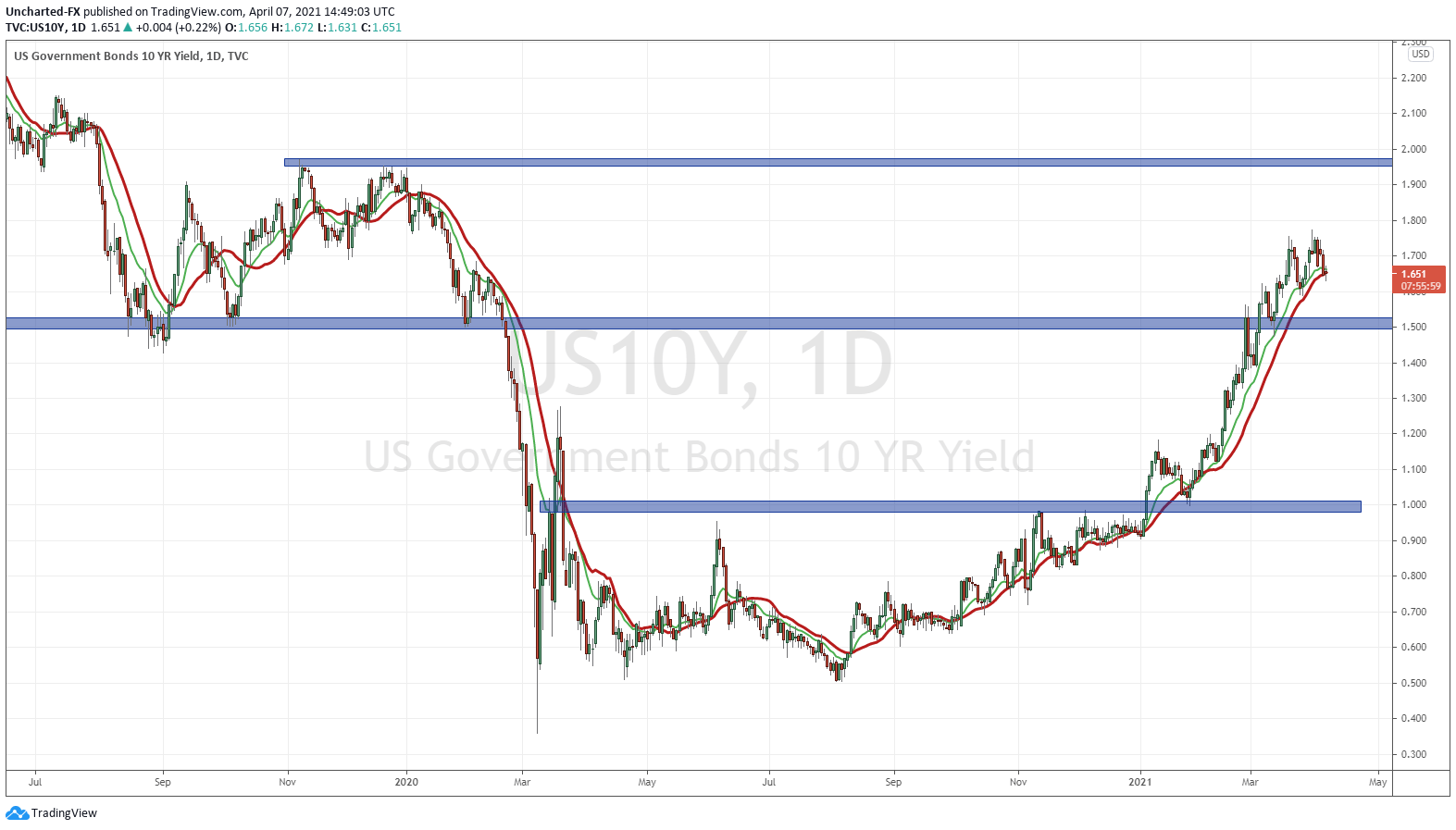

The 10 year yield has been the talk on the street lately, but things have quieted down. Yields hit highs of 1.773 recently, before rolling over and we are currently sitting at 1.649.

Plenty of Gold analysts pointed out that rising yields were pressuring Gold prices. Simply put because Gold offers no yield. If bonds also offer a low yield, or even a negative real yield, then you might as well hold Gold for safety. Bonds are primarily held for safety. Although in this inverted world, bonds are now being traded for capital appreciation, and stocks (value stocks) for yield.

Looking at the chart above, we are seeing signs of yields dropping further. Some with experience hunting down patterns can see a double top pattern forming. If this does, the key support is 1.60. This needs to break for further downside pressure on yields.

I want to point out though that 1.50 is a MAJOR support zone. I would like to see yields drop lower than that to be uber bullish Gold prices.

In the past, I spoke about the Fed doing some sort of yield curve control. The European Central Bank said they would intervene in the bond market to buy bonds to drop yields. Expectations were high that the Fed would follow suit. I still foresee this in the future…but with a caveat. Yields would have to climb higher before the Fed announces this. This would mean Gold prices can still range and even tumble lower.

Which would then take us to our Gold uptrend trigger.

Once again, those with technically inclined eyes can probably see what is getting me excited. A reversal pattern known as the double bottom has printed. Support comes in at $1675, while the neckline, or resistance, comes in at $1750.

It would be apt to say that the new uptrend in Gold is pending. What is required is the breakout trigger. In this case, Gold needs to confirm a close above $1750. We remain patient until this occurs.

We may even get our catalyst today. We have FOMC minutes out at 10 am PST/ 1 pm EST. We will get to read about the discussion the Fed members had in last month’s Fed meeting. Providing hints on the Fed’s next moves. We believe they will maintain their dovish stance.

If we break $1750, what comes next? I honestly think longer term, we make new record highs, taking out the $2075 zone. But before that I would be cautious around the $1875-$1900 zone as we could possibly see a third touch trendline rejection there.

In summary, I remain bullish on Gold but await the trigger breakout to enter long. If the other scenario plays out and the 10 year yield spikes higher, I would hope to see Gold range between $1675 and $1750. A break below $1675 would nullify my bullish stance, and we would need to wait months for another opportunity.