Information technology is ushering in a new paradigm for the healthcare sector. This is fundamentally changing how and where medical services are rendered, and decisions are made.

From

- Wearable health-monitoring tech to

- Telemedicine and

- Home diagnostics.

The healthcare industry is starting to recognize the importance of treating patients remotely and how this can be leveraged to create a network of shops, a reduction in agency and principal costs, and an ability to improve efficiencies in client relations and diagnostics. All this in the good name of the bottom line.

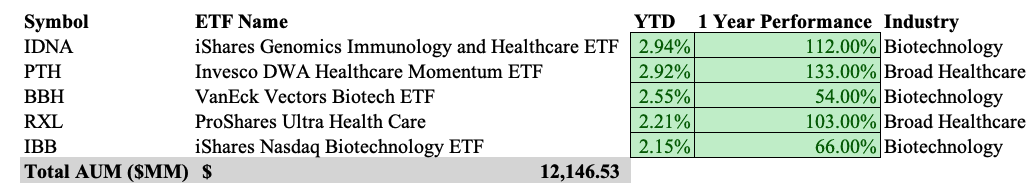

Investors have not ignored this economic boom and have deployed almost $USD 12 billion (in the Top 5 ETFs) in capital helping the sector chug along as the market bleeds.

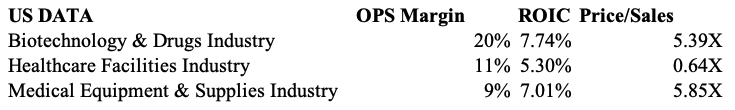

This exponential interest in the common stock of healthcare technology companies is not limited to their prices but has also reflected itself in the profitability and the return on invested capital compared to the more traditional add-on-services for the healthcare industry.

From the sample of 61 ETF’s(where I picked the top 5 performers in the table above) and thousands of public and private companies that are playing in this industry, how does an investor like myself (an amateur) pick through this wide selection to include only the most appropriate common stock for my portfolio?

With an industry that is fragmented and essentially selling products that are somewhat similar for about the same operating margins, your best bet is to go for quality over quantity.

To say it boldly … Diversification seems to be an approach used by those who don’t understand the quality of what they are buying!

If you are the person I am describing above don’t be ashamed, Healthcare is a confusing hodgepodge of information and jargon. I feel strongly that institutional investors in this field barely understand the tip of the iceberg of what’s going on behind some of these companies.

Having said that let us dig in!

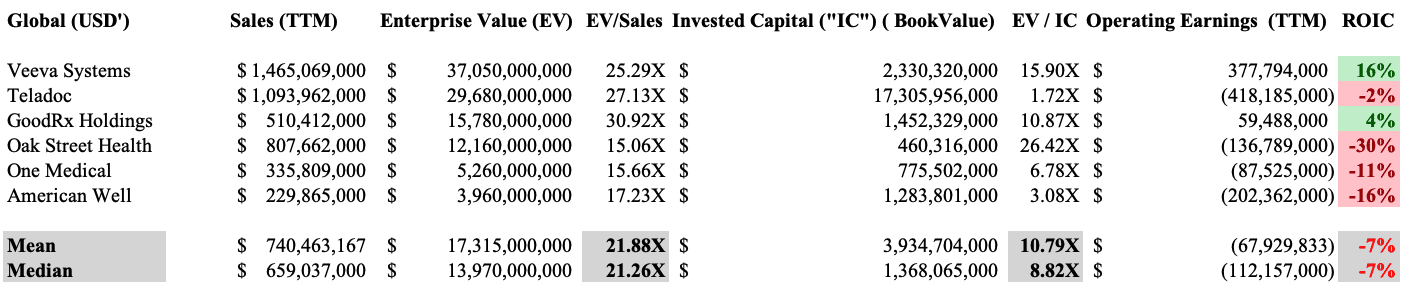

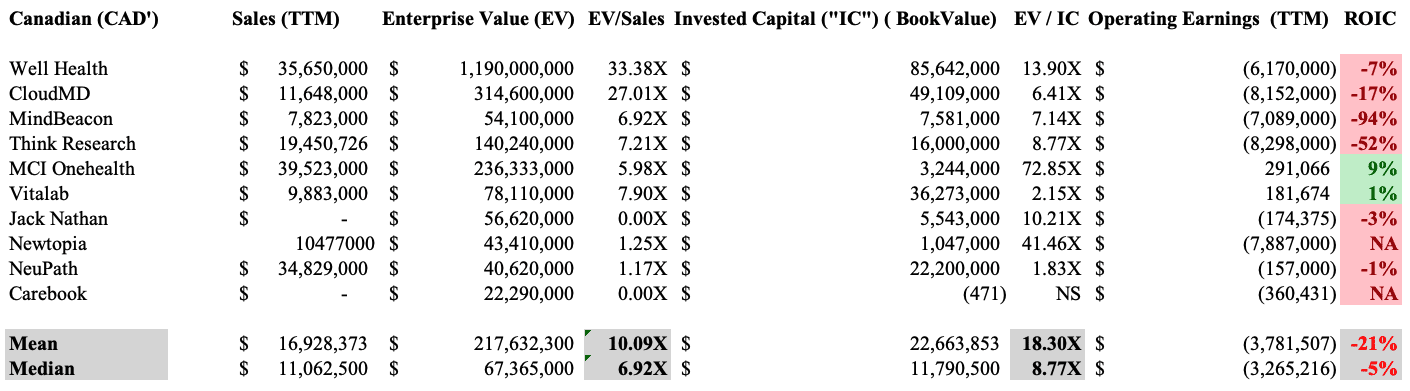

With the help of some ‘friends’ in the industry, I’ve curated the two tables above, with a list of healthcare IT companies that are publicly traded in the US and in the Canadian markets. These are known as the big players and a lot of market interest has flown into the company’s coffers through massive stock appreciation.

You will notice the majority of these companies are unprofitable and are generating negative operating earnings meaning they aren’t able to sustain their day-to-day operations with organic cashflows. This is further reflected in the return on invested capital being negative in some instances. To fund their business and appetite for acquisitions some corporate managers in the healthcare space have opted for alternative sources of funding.

- Since on average their stocks have gone up over the last year many companies are able to issue common equity in their businesses to raise cash for day-to-day operations or fund their debt obligations. Equity is usually the most expensive form of capital raising because the company gives a portion of your ownership to new owners through stock dilution. A portion of your future earnings will be shared by new people.

- Some have opted for cheap junk bonds or debt issuance through credit facilities or other bank-type loans. Debt is usually cheaper than equity but more expensive than organic cashflows. The biggest component of the cost of debt is the price you pay in interest and principal payments. A lot of the time these companies aren’t able to issue straight bonds and have to issue convertible debt further increasing the impact of dilution on shareholders.

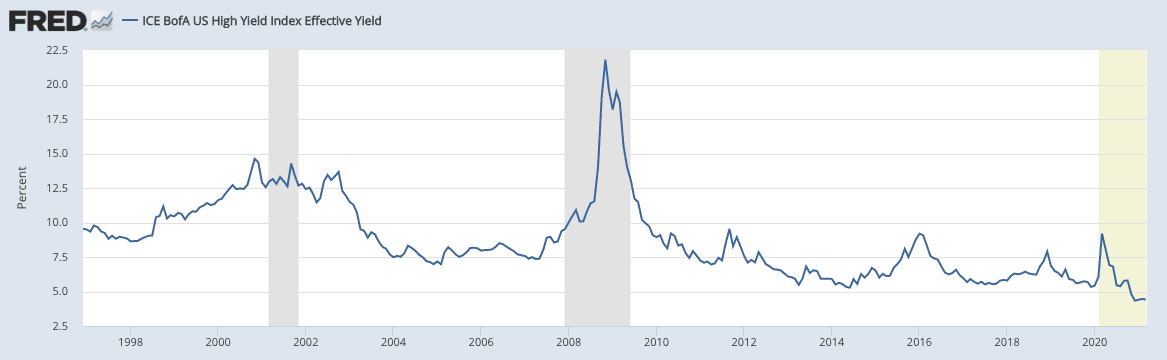

As we are all aware by now interest rates are nearing a nominal zero bound range globally. Meaning in real terms people are borrowing money for negative interest rates. These low-interest rates have attracted new debt issues that are highly speculative at historically low rates.

We should remember though that just because a bond is defined as a high yield bond or junk bond does not mean it is completely useless.

Usually, this means that the companies have a disproportional speculative component that could stem from the

- debt to equity ratios that are higher than average

- seasonality in earnings and revenue making forecast unpredictable

- a low income to debt payment ratio increasing chances of default during economic downturns

- lack of liquidity in their balance sheets that could force fire sales of tangible assets at a loss

- Working capital deficiencies that could hold production and operating activities

- and speculative stock prices

and many other characteristics that can be seen as risky.

Unflattering definitions aside the ease at which these companies can issue debt should not be ignored and should not deter the investor from further analyzing the fundamentals of the businesses.

Capitalism in its ‘purest’ form is an economical cultural system that pays risk takers for their creative destruction.

There are no two ways about it: technological developments in healthcare have saved countless patients and are continuously improving our quality of life. Not only that, but technology in the medical field has had a massive impact on nearly all processes and practices of healthcare professionals.

- Digitalization of Health Records

- Greater Patient Care

- Improved Public Health

- Ease of Workflow

- Lower Healthcare Costs

- The Advantages of Using Mobile Equipment

and many other lifesaving benefits.

According to a study from the Harvard Health School

Telehealth offers a convenient and cost-effective way to see your doctor without having to leave your home, but it does have a few downsides.

- It isn’t possible to do every type of visit remotely. You still have to go into the office for things like imaging tests and blood work, as well as for diagnoses that require a more hands-on approach.

- The security of personal health data transmitted electronically is a concern.

- While insurance companies are increasingly covering the cost of telehealth visits during the COVID-19 pandemic, some services may not be fully covered, leading to out-of-pocket costs.

On a macro level, we have an industry that is well entrenched in our daily lives allowing for stable revenue streams for businesses that are able to keep up their competitive advantage, through research and development investments. Others have curtailed the cost of research and development by buying up already existing practices allowing for synergies that can further increase operating margins.

As with most heated markets, there are companies that are always left behind. In the US on a valuation basis, most companies trade at an enterprise to sales value ratio of just above 20 times sales, and this number is way lower in Canada at 10 times sales.

Of course, the Canadian market is smaller relative to the US market on a revenue and market cap basis, but just those two factors alone don’t account for the full discount of an entire market. Using traditional valuation models Wall Street analysts will assume the US market has a higher addressable market compared to the Canadian market just based on nominal GDP growth, net birth rates, and population growth.

Although this assumption is true for most industries, we cannot forget the quintessential difference between traditional healthcare and the HITM. HITM allows for remote technology and services. This is a big competitive advantage that allows both the US and Canadian firms to venture into different geographic markets allowing local brands to have a more global reach.

This means there is on average a higher chance of acquiring a business at a deeper discount when the investor digs deep into the Canadian sector because of market inefficiencies.

For example, the Canadian average revenue for the last 12 months was $16 million with negative operating earnings. This means most of the top companies in Canada are generating a negative return on invested capital.

Outside of the companies that have not generated any revenue in the last 12 months, Neupath has the lowest valuation with an EV to sales ratio of 1.17 but is generating $34 million in revenue. The firm with the highest EV to sales ratio generated $35 million in revenue but had a return on invested capital of negative 7% compared to Neupath -1%.

CloudMD is another top contender of the negative compounding club and is one of the most recognized brands in the healthcare tech industry, but has only generated a total of $11 million in revenue which is below the average for Canadian healthcare tech companies. They have also been unable to manage their operating and financial leverage reflected in their negative 17% on invested capital.

Assuming ceteris paribus, the Canadian market seems to have more inefficiencies when it comes to the pricing of the common stock of the health care technology sector. This can be due to countless reasons that are too vast for discussion in this article, but it is fair to say a lack of interest or understanding by retail and institutional investors could be the most significant explanatory variable.

I don’t think the markets are always right or wrong but assuming that the efficient market is at play, on a common analysis basis the Canadian and U.S. markets are producing the same product at the same operating margins generating the same amount of return on invested capital. It seems like the Canadian market is being underpriced due to a lack of interest by institutional buying.

This sort of lack of market interest by smart money usually presents market inefficiencies that can create profit-gaining opportunities for the risk-takers.

The task at hand is applying the appropriate filters when selecting a few good contenders or for those who are not as interested, a well-diversified ETF that gains you exposure in the HITM market is available. Nonetheless, this diversification does come at a cost in the form of management fees, so one should always bear that in mind.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.