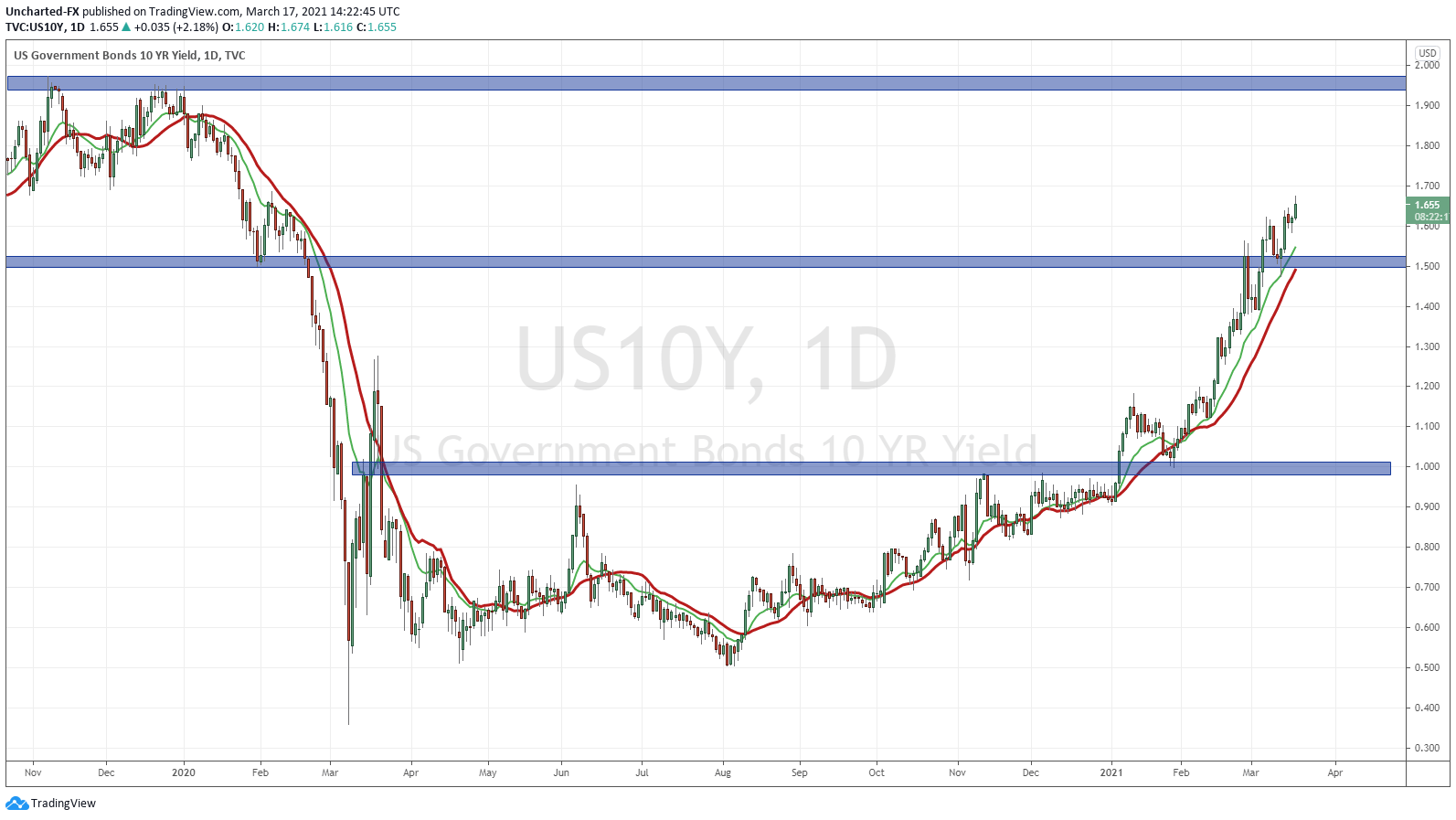

It’s Fed day! It seems recently that every time a Federal Reserve meeting comes by, market participants always say it will be an important, if not the most important, Fed meeting in recent times. With what is going on in the Bond markets currently, I do not think it is an exaggeration to say that this is a very important meeting. One that will make or break markets.

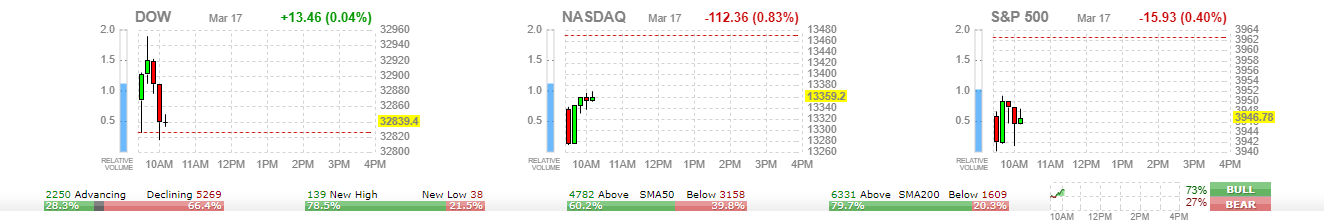

Currently the markets are mixed heading into the Fed decision. The Dow is the only one holding onto gains at time of writing. The S&P 500, the Nasdaq and the Russell 2000 had red overnight futures sessions. The Federal Reserve will put a statement out on their decision at 11am PST/2pm EST with the all important press conference 30 minutes after the decision, at 11 30am PST/2 30pm EST.

In my opinion, I do NOT think there will be any major policy changes at this meeting.

There will be no announcement of yield curve control just yet. Even though expectations from the market might be high due to the European Central Bank (ECB) increasing their asset purchasing program last week in order to control rising rates. But chair woman Christine Lagarde was adamant in saying that this is not some type of yield curve control.

Do the markets have high expectations for an ECB type asset purchasing program increase to tackle rising yields? We will only find out by witnessing how stock markets react when Fed chair Powell speaks.

This is what I think happens today. The ‘patience’ approach.

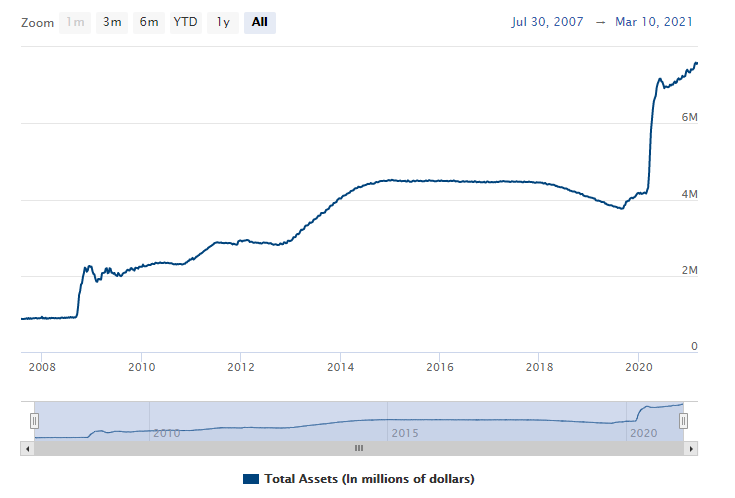

Once again, no major change in monetary policy. But Jerome Powell will choose his words carefully to reassure the markets that the Fed WILL backstop these markets. Particularly, that the Fed will implement yield curve control and handle rising rates IF necessary. The rhetoric is key. They will do nothing today, but will reassure everyone that the Fed has plenty of tools left in the toolbox to step in and manipulate the bond markets.

Expect Jerome Powell to make comments on the new $1.9 stimulus relief and praise the politicians. In previous meetings, Powell has been pleading for fiscal policy to step in where monetary policy cannot: fiscal policy can put money directly into the hands of the American citizen. This will aid in keeping the economy afloat and bringing us one step closer to recovery. Judging by yesterday’s dismal US retail sales numbers, which was blamed on the bad weather (even though most people shop online), and by Job loss claims still coming in over 700k per week, we are nowhere near a recovery.

Oh and there will be no inflation for a very long time…even though money velocity (ie: people spending money) is what drives inflation. So don’t worry about the Fed planning on raising interest rates anytime soon.

Technical Tactics

I am not one who trades or opens positions front running the Federal Reserve on Fed day. They are very volatile days. We can predict what the Fed says, but we just don’t know how markets will react. Every single word in the press conference is dissected and analyzed by the traders and algo’s, creating very volatile intraday action.

If this is your first Fed meeting, I recommend you watch the intraday (1 minute or 5 minute) charts of the stock markets as well as the US Dollar while Jerome Powell gives his press conference. You will see how wild it gets.

I tend to let the craziness and volatility settle down before entering new positions.

But let’s take a look at what the stock markets are doing.

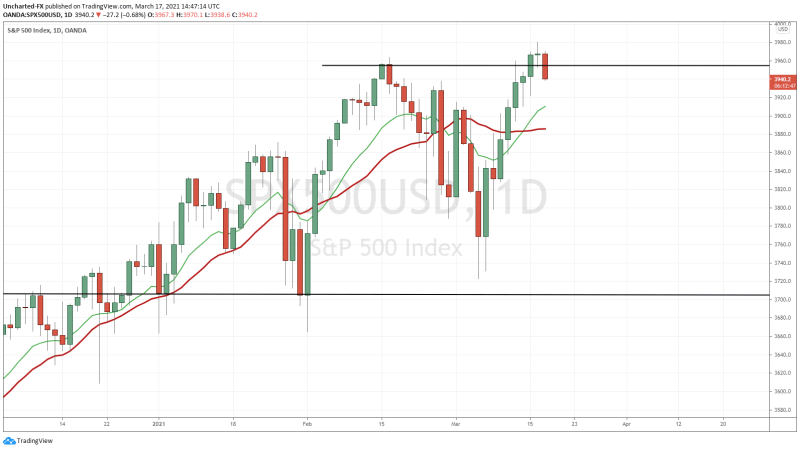

A lot of eyes are on the S&P 500 currently. We broke out into all time record highs, but have not carried the momentum further. Price is dropping back below 3955 which was our previous support. If today’s daily candle closes below 3955, then we must consider the possibility of a double top reversal pattern.

It is all up to Fed chair Powell to make these markets. Can he cause an intraday rally to give the S&P 500 a strong close back above 3955? Time will tell.

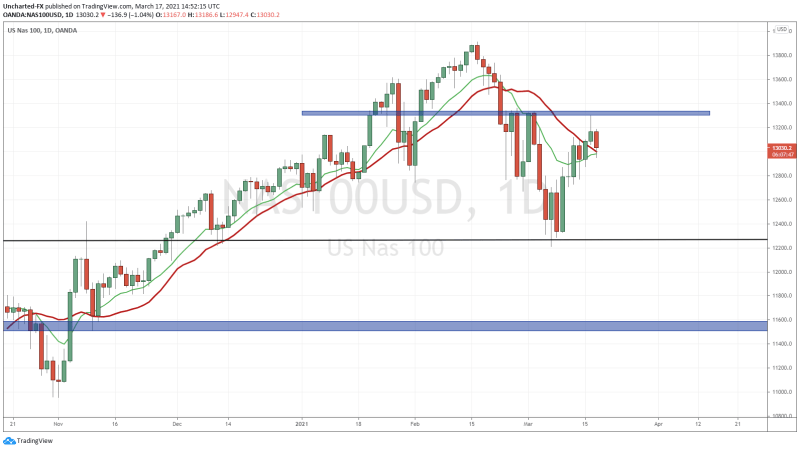

The Nasdaq is the weakest market. We have seen Tesla gap down today, and Apple has also gapped lower. Two stocks that play a huge part in the Nasdaq’s direction.

What I am watching is if the Nasdaq can climb back above the 13333 zone. If it does not, expect a ranging or weaker market.

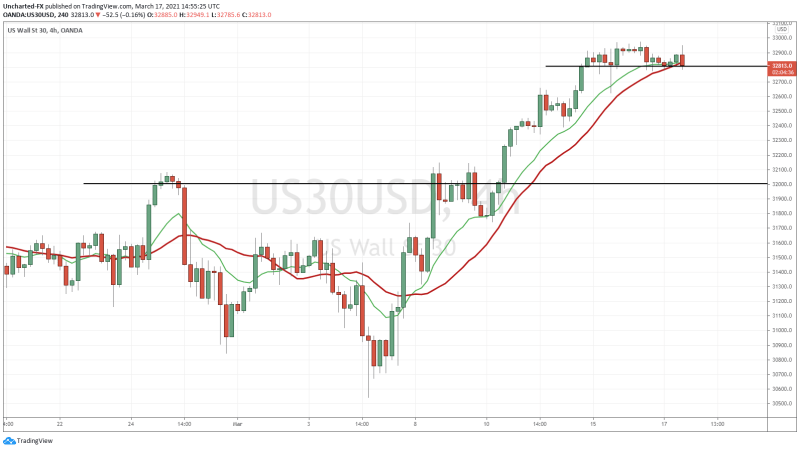

The Dow Jones started the day green with moves in Boeing and JP Morgan leading the index, but those gains have subsided. The Dow is the market I am keeping my eyes on closely. It has remained strong while the other indices have fallen. If markets do drop, the Dow has some catching up to do.

I am watching for this range to break, and if I get a 4 hour candle close below 32810, a case can be made for a short. but once again, I will be looking to enter overnight because of the Fed meeting volatility.

There we have it. A big Fed day, with the markets on edge awaiting to hear what Fed chair Powell says. Much more important given what the 10 year yield is doing, and the stock markets do not like rising yields due to how much debt there is in the system. The question is, can the Fed convince the market that they can, and will, step in to control rising yields when the time comes?