On March 29, 2021 Plurilock Security (PLUR.V) announced that it has signed an agreement to acquire 100% of Aurora Systems Consulting – a provider of advanced cybersecurity technology and services based in California.

“Aurora will operate as an additional sales force to deliver Plurilock’s state-of-the-art identity assurance solutions to Aurora’s vast network of clients,” states PLUR.

Aurora’s main clients include the U.S. Department of Defense, U.S. Department of the Air Force, U.S. Department of the Navy, U.S. National Aeronautics and Space Administration, U.S. Department of the Treasury and U.S. Department of the Army.

That’s a high-value book.

Plurilock is an identity-centric cybersecurity company that reduces or eliminates the need for passwords by measuring the pace, rhythm and cadence of a user’s keystrokes to confirm their identity.”

It’s not intuitively obvious, but your typing-style is a unique identifier.

If I need to write a capital “Z”, I hit SHIFT with my baby left-finger, then swoop my right hand across the keyboard to hit the “Z”. It’s quirky and inefficient. Probably some other people do that too. But my hand-speed won’t be the same as theirs.

Plurilock’s Artificial Intelligence (A.I) can learn my “unique typing signature” in under 60 seconds.

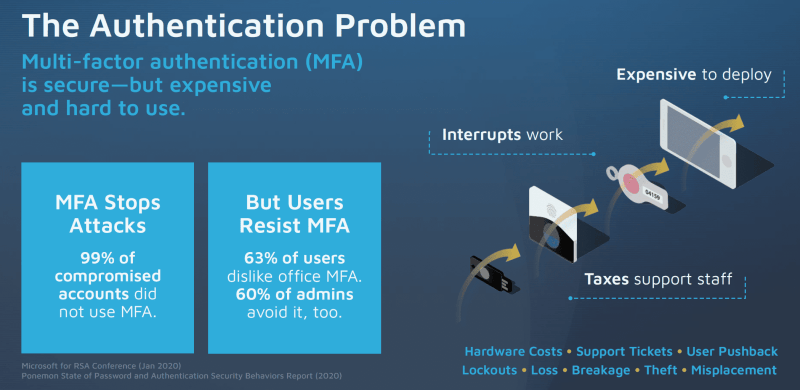

The company’s technology has the power to disrupt the current status quo: Multi-factor Authentication (MFA) – which is widely disliked and unreliable.

Note: if I’m in Beijing with a Chinese SIM card, texting an authorization code to my Canadian cell number isn’t going to work. Dealing with situations like this – locked out of a trading account – you experience the modern impotent rage of hating a piece of software.

“Dedicated hackers have little problem bypassing through the weaker MFA implementations, either by intercepting codes or exploiting account-recovery systems,” reports The Verge.

Since 2001, Aurora has provided cybersecurity products and offered professional services to U.S. clients across three main segments:

- Federal government institutions

- State, local, education government agencies

- commercial firms

Key Highlights of Aurora

- Revenue of US$28.1 million (CAD$35.8 million) in 2020

- Gross Margin of US$1.4M in 2020

- Diversified client base consisting of over 140 tier-1 organizations

- Numerous prominent master service agreements with state and federal agencies in the United States

Aurora’s margins are low (4.9% of revenue) but the kicker here for Plurilock is that Aurora has customers and an existing high-performance sales team.

“It is expected that the acquisition will accelerate Plurilock’s sales growth to rapidly deploy its high-margin software products within regulated industries such as finance, healthcare, and defense in the United States,” states PLUR.

Plurilock’s upside on this deal:

- Obtain a professional services team

- New office on the West Coast of the U.S.

- Larger market presence in the U.S. cybersecurity industry

- Offshore office in India built for quoting government deals.

Aurora will gain access to PLUR’s cutting-edge AI platform, resulting in a high-level of cross pollination between Plurilock’s and Aurora’s technology offerings.

“The acquisition of Aurora will represent a significant milestone in Plurilock’s development and in our M&A strategy of acquiring attractive assets that have the ability to scale,” stated Ian L. Paterson, CEO of Plurilock. “With an established customer base of top-tier organizations, the Aurora acquisition provides us with an opportunity to integrate our higher margin cybersecurity software into their existing solution offering in order to increase sales while expanding their overall margins”.

“By incorporating Plurilock’s cutting-edge technology platform into our product offering,” stated Philip de Souza, Founder and President of Aurora, “Clients will receive a more robust and comprehensive identity authentication solution, which has been adapted to provide safe and secure remote work access to employees working from home.”

Three weeks ago, Plurilock (PLUR.V) CEO Ian Paterson spoke with Jody Vance (E34) to give an overview of PLUR’s business objectives.

“With our technology, we’re able to identify a computer-user continuously, without them having to do anything extra,” explained Paterson, “They don’t have to reach for a phone, they don’t have to type in a login password. We’re just able to continuously authenticate them throughout the day.”

“There hasn’t really been a paradigm shift in how you prove your identity to a computer,” added Paterson, “Human behavior is difficult to forge or fake. We’re able to not only identify you once, but we’re able to do that continuously.”

“You log in first thing in the morning, you’re still working two hours later, four hours later, eight hours later, the business can have confidence that you are in fact the correct authorised person at that computer terminal.”

This technology has extra resonance with the increased in number of remote workers.

Terms of the Definitive Agreement

- Plurilock will Aurora US$900,000 in cash

- Plurilock will pay US$300,000 in common shares of Plurilock

- Shares will be issued at a deemed price of C$0.54 per share.

- Closing Cash Payment will be paid from proceeds raised from Plurilock’s recent C$5.1 raise.

Once the acquisition is completed, Aurora will operate as a wholly-owned subsidiary under the guidance of Plurilock’s management team.

The word “synergy” is over-used – but how else can you describe the mutual benefits of this acquisition?

At mid-morning, March 29, 2021 – Plurilock’s stock remains halted.

- Lukas Kane

Full Disclosure: Plurilock is an Equity Guru marketing client