I got 13 emails asking about this so I figured it deserved its own little spotlight.

Also, I haven’t the will or brain capacity to delve into more than this one topic.

Let me tell you, it is grim out there on the CRA website.

They are not making quippy jokes about this kind of thing.

PSA: this one, again, is for my cute Canadians. For the Americans and that one Euro reader I have – I promise to be more inclusive next week.

What is GST/HST? PST??

When you sell something or provide a service, you charge tax. It is why the tag on your Aritzia top says $100 and the pushy retail girl at the cash register tells you it’s actually $112.

GST stands for goods and services tax. To no one’s surprise, this is a tax you pay on most goods and services in Canada. It applies nationally. Some things are GST-free such as basic groceries, farm livestock (no one other than the government and an airport customs form would call meat and eggs “farm livestock”) and, not until 2015 (wtf Canada), feminine hygiene products.

PST stands for provincial sales tax. It is basically the exact same thing as GST but is only applicable when a taxable good or service is purchased, acquired, or brought back into a province, for use in that province.

HST stands for harmonized sales tax. It is as if GST and PST had a baby, to make one combined single-value added sales tax. This was seemingly implemented for ease (we’re not out here looking to memorize a million acronyms), however, it did the exact opposite.

Why must we complicate things more?

Canada decided it’d be fun to change this up per province – in case financial literacy was coming too easy to some? Yes. Reading about T2125s and RRSP deduction limits is just such a riot…

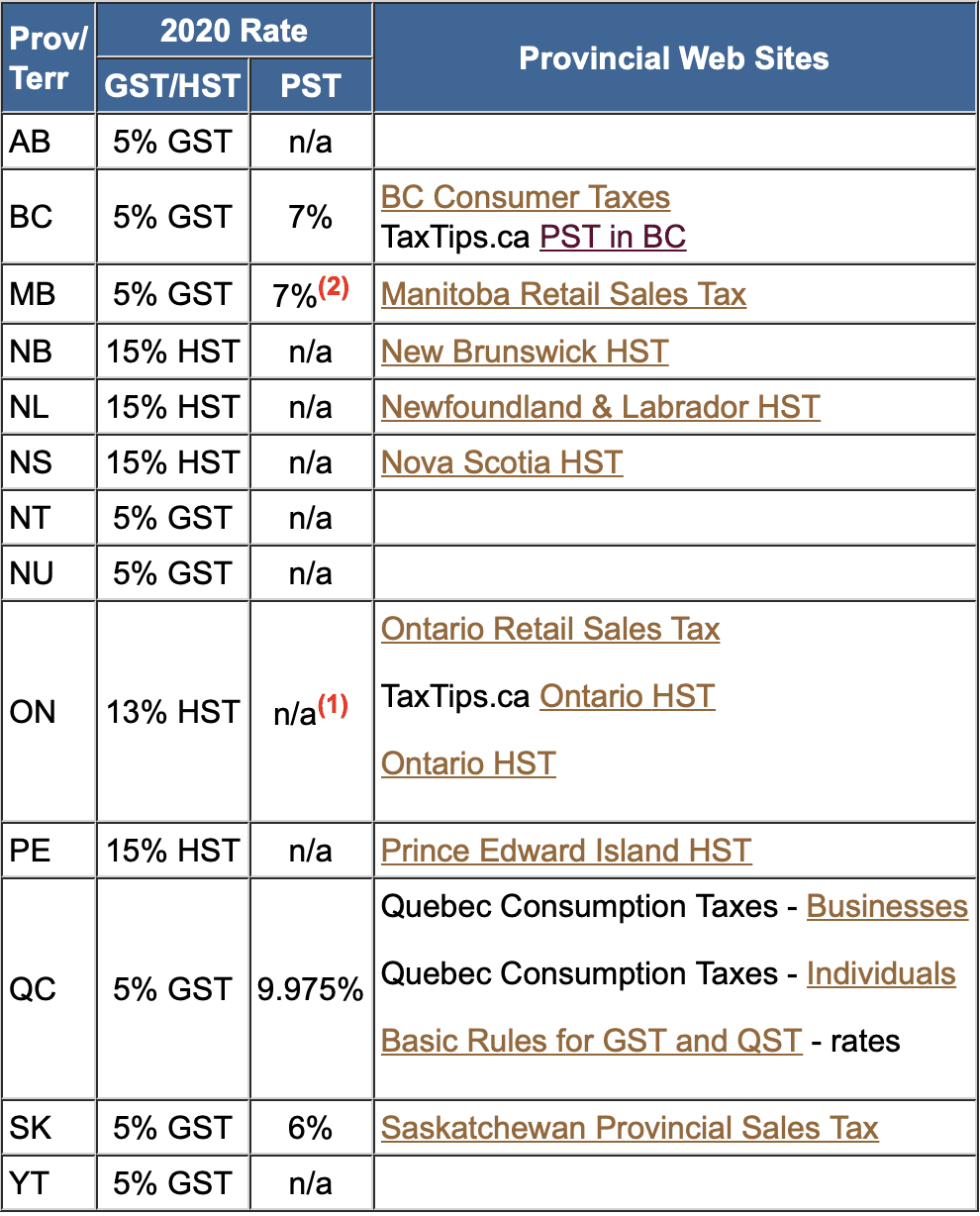

To see how ridiculously convoluted this all is, see the chart below:

So, to use my home province BC as an example: there is no HST here. Only GST and PST. This is for a variety of niggly political reasons you can read about here. But also, who cares?

What is a GST/HST number?

In the vein of being repetitive and boring: if you sell a good or service, you must charge GST/HST (again, depends on your province). To do so, you need to log on to your CRA account and register for a number. Or, if you’re ancient, call them and deal with subsequent phone lines.

This number is used to legitimize and identify your business so when that GST/HST number goes into your invoice, they know you aren’t charging an extra 12% for the hell of it. At least once a year you pass on what you’ve accumulated to the CRA, like a report card for mom and dad.

Break it Down:

- Register for a # (this is actually very easy)

- Collect the correct amount of GST/HST from clients (check your province)

- Both:

-Put aside this $: it never was or will be yours and,

-Spend what is needed of your GST/HST on business expenses - Tell mom and dad (CRA) how much you collected and spent

- Pay the CRA the difference between your collected GST and what you had spent on business expenses.

*If this whole set -aside-money-for-a-year seems unfeasible given your nature, you can pay monthly or quarterly online in your ‘My Payment’ section of your CRA account. Read more here.

Who needs to get a GST/HST number?

Anyone whose business made over $30,000 from Canadian sources that provides a good or service.

Things like daycares, music lessons, charities, trade schools and private career colleges are exempt.

Self-employed kiddies, remember that you are your own business, so this applies to you too.

This $30,000 number does not only apply to the calendar year. If in any 12-month period, you cross this threshold – get yourself a GST/HST #.

You don’t need a GST/HST # if your business revenue from Canadian sources is less than $29,999 this year. No matter the extent of your revenue, you don’t need a # if your clients are exclusively American or international. The CRA cannot legally collect tax from residents or businesses of other countries.

The story of the plumber named Jack:

Jack was, what I imagine to be, the quintessential plumber. Gruff voice, a bit chubby and, of course, too low on the hip denim. He’d be predatory if not for his dimples. Jack told me if I paid cash for his service, he’d knock off the tax. This was a win-win for the both of us. I didn’t have to pay the extra 12% and Jack, being the savvy man he was, didn’t have to pay income tax on the total cost. This is why, with any tradesman or small business that feels under the table, you’ve probably been offered a cash-only option. I am OFFICIALLY not condoning this, of course.

How much GST do I charge?

This week has been one long rainy day to the soundtrack of Rachel Maddow so, my deepest apologies for the brutal amount of repetition here.

The rate you charge is dependent on the province in which you made your sale (not the one in which you live). You’re a copywriter in Ontario who works for an Albertan company? You will charge them 5% GST (Alberta rate not Ontario). You’re a copywriter in Ontario who works for a company in New York? You don’t charge them any sales tax. (You’re still required to report all business income on your tax return). If the above chart didn’t do it for you…

- 5% GST in BC, Alberta, Manitoba, Northwest Territories, Nunavut, Quebec, Saskatchewan and Yukon

- 13% HST in Ontario

- 15% HST on all the ones I always confuse the names of on a Canadian map: New Brunswick, Newfoundland and Labrador, Nova Scotia, PEI.

Can I get $ back? Please??

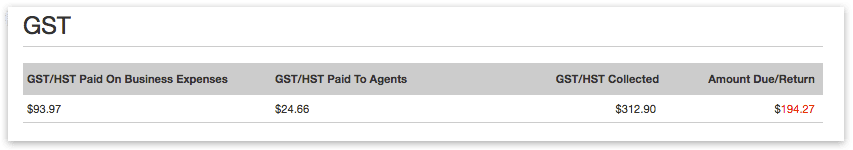

One of the only pros to this hassle of having a GST/HST # is that the CRA reimburses you for business expenses. This is called input tax credits (ITC). Luckily it is self-explanatory: you input (literally write in) what you expect to be credited back.

On the same form you report all your GST/HST collected, there’s a little space to enter the total GST/HST you spent over the course of doing business.

Total collected – total spend = net GST/HST

*This is just like a mini version of your income taxes and deductions.

The Fine Print:

- If you have a GST/HST number and have been collecting tax but don’t meet the $30,000 threshold…You still have to pay that money out to the government. I repeat it was and never will be yours. You can cancel your number the following year if confident you will not meet that $30,000 threshold.

- You cannot claim GST/HST back for personal expenses. You only get to write off business expenses incurred while operating your business. (Same list you can deduct from income tax return).

For my actors in the back because you all asked:

Check the GST/HST paid to your agents. This is a write-off.

I’m officially taxed out. But still feeling generous and giving a free invite to email any and all investment/finance Qs at mgrace@equity.guru!

Until next week.