The Very Good Food Company (VERY.C) has acquired Lloyd-James Marketing Group in accordance with a share purchase agreement.

“Lloyd-James’ core services and expertise in the plant-based food industry will add significant value to both VERY and our investors. By acquiring Lloyd James, we not only significantly save on broker fees going forward but now have a Canadian retail sales team whose focused approach to brand representation will help us further establish a national market presence,” commended CEO Mitchell Scott

Lloyd-James is a boutique wholesale and food service broker that specializes in the plant-based food industry. Additionally, the marketing group has a history of placements in large natural specialty and conventional grocery retailers. Some of these major retailers include Whole Foods, Sobeys, and Walmart. With this in mind, Lloyd-James has assisted the Very Good Food Company (VERY) since 2019, helping the Company develop distribution networks into major retailers.

Regarding the acquisition, due to the elimination of brokerage fees the Company will save 5% of future gross revenue. VERY will also be acquiring Lloyd-James’ experienced sales representative team who will serve as the Company’s internal Canadian retail sales team. By creating an elite wholesale team, VERY will be able to greatly increase its retail network. Ultimately, this would increase the Company’s current points of distribution from 275 up to a target of over 2,000 by the end of 2021.

Nitty-gritty details aside, Lloyd-James also offer a “Grocery Insights Program” intended to educate up-and-coming food businesses. In doing so, the program hopes to provide brands with a clear road-map to assist in launching or expanding in the Canadian market. With this in mind, VERY plans to select one or two participants of the program per year. The Company will then invest in and help develop selected brands for future research development and brand acquisitions.

VERY’s acquisition was completed in accordance to a share purchase agreement arranged with the sole shareholder of Lloyd-James for an aggregate purchase price of (C) $1,075,000. The price itself is comprised of a (C) $400,000 equity payment consisting of 62,239 VERY common shares at an approximate price of (C) $6.42 per share. The remainder consists of a cash portion amounting to (C) $675,000. Of this amount, (C) $350,000 is contingent on the successful attainment of certain milestones related to the specific sales targets during the fiscal period ended 2021. For indemnity purposes, (C) $75,000 of this will serve as holdback until August 31, 2021.

Lastly, all shares issued to Lloyd-James are subject to a four month hold lasting until July 12, 2021. This is in addition to a contractual lock-up where shares will be released from in equal quarterly instalments beginning on June 11, 2021 and ending March 11, 2022.

It is worth noting that VERY has been approved to list on the TSXV effective March 17, 2021. However, the Company’s trading symbol (VERY) will remain the same.

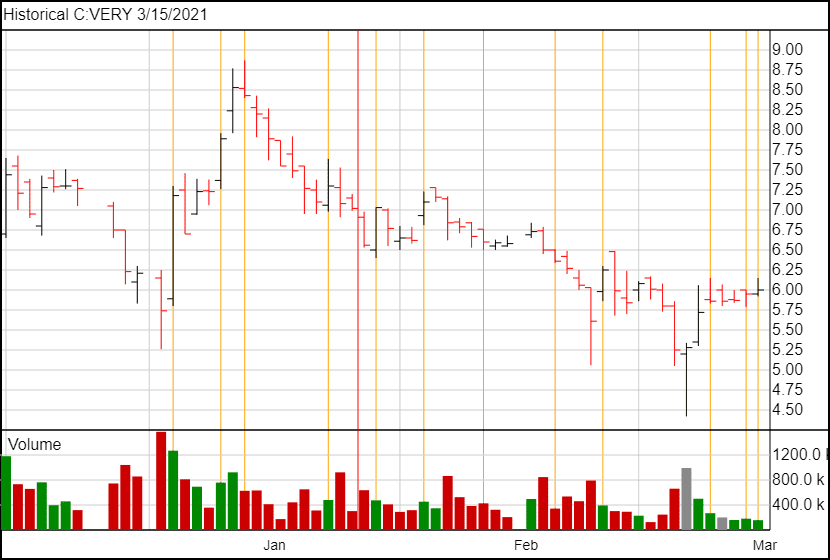

VERY’s stock price opened at $5.95 and reached a high of $6.15. The stock’s price currently sits at $5.97.