IPO’s come in all shapes and sizes, some are giants with billionaire support, and others don’t have a pitch deck readily available.

Investors get giddy with news of IPO’s as it signals a chance to get in early. It’s important to note that ‘getting in early’ isn’t a guarantee in an IPO, relatively speaking.

Take ATAI Life Sciences, they are a massive multinational psychedelics company that has raised over $200M USD to date. Since 2018 they have already completed 4 raises with huge funds like Thiel Capital backing them.

Yes, the company is only 3 years old, but how early are you really getting in?

ATAI Life Sciences: an ETF of psychedelic compounds

The psychedelics investor community is buzzing around a potential ATAI Life Sciences IPO coming in 2021. After the giant success of Compass Pathways (CMPS.N) IPO this Peter Thiel-backed company (and current Compass partner) is looking for a similar outcome.

Cybin (CYBN.NE) is working to eliminate the single most annoying part of every mushroom trip

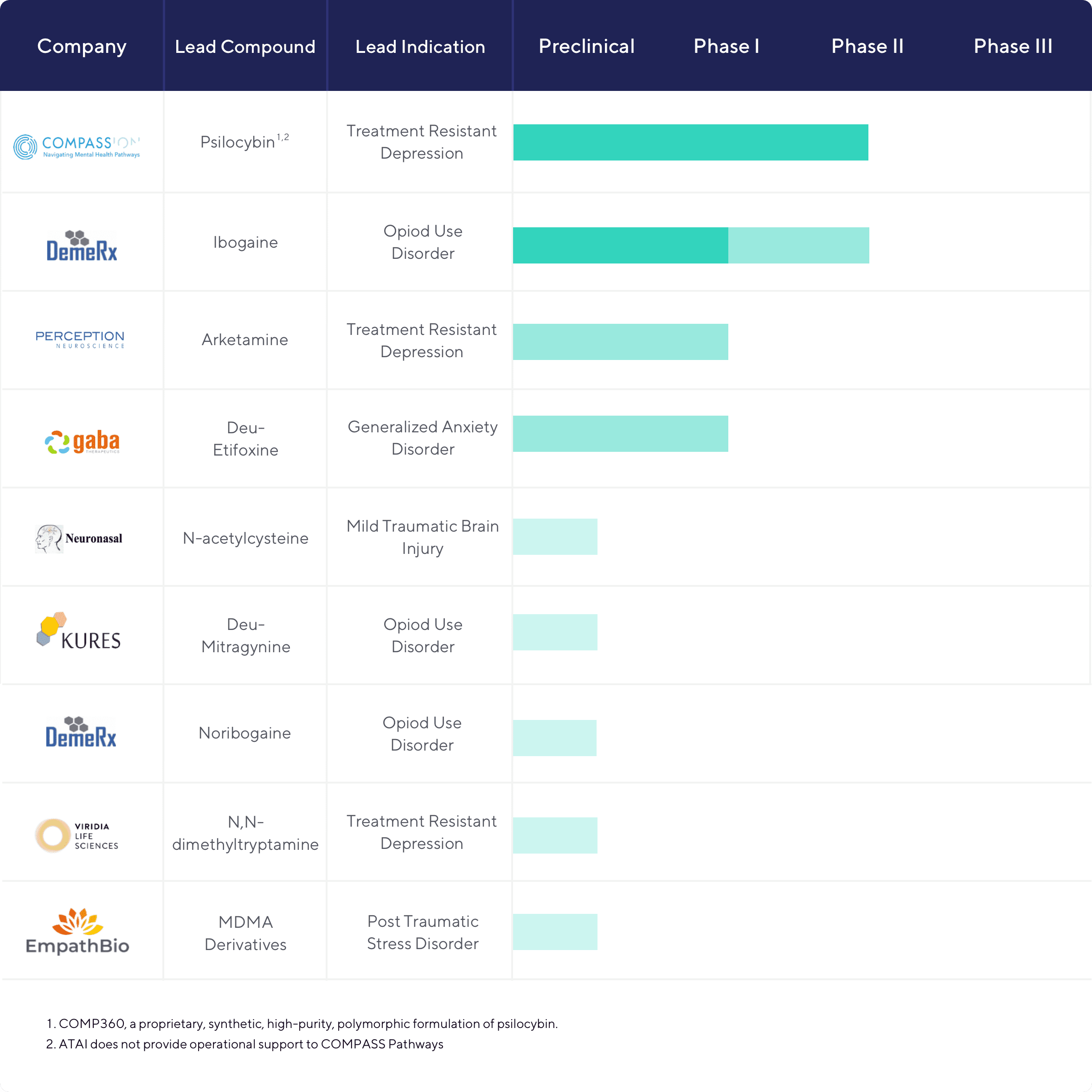

The Berlin-based psychedelics giant is combating 3 major mental health problems: substance use disorder, anxiety, and depression. They appear to be extremely drug agnostic in their approach so far, with their current trials and future plans based around psilocybin, DMT, MDMA derivatives, arketamine, and ibogaine to name a few. It’s like an ETF of psychotropic compounds.

ATAI is a global biotech company builder that leverages a decentralized, technology- and data-driven platform model to serve millions of people suffering with mental health disorders. We are committed to acquiring and efficiently developing innovative treatments that address significant unmet medical needs and lead to paradigm shifts in the mental health space.

ATAI now has over 13 companies in their project portfolio including Compass Pathways (psilocybin for treatment-resistant depression), DemeRx (ibogaine for opioid use disorder), and EntheogeniX (leveraging AI and computational biophysics), and more recently it acquired a majority stake in Recognify, a company making drugs to combat schizophrenia.

Here is a look at their current projects, and their progress to date.

The Thiel family

ATAI is in the Peter Thiel family, so it is very well funded.

The company completed its series C financing round of $125M USD in November 2020 lead by Peter Thiel, among others. Thiel also got in on a $24M USD debt financing in 2020, which also saw one of Thiel Capital’s own join ATAI’s board.

The company raised $43M USD in its series B round in 2019, and $25.5M in its series A round in 2018. The company has raised approximately $210M USD pre-IPO and declared its intention to go public in the spring of 2021. The company is expected to have a valuation of $1 – $2 billion USD based on IPO price.

ATAI is pretty loaded right now with a $210M USD war chest pre-IPO, the company will have room to scale and move laterally. The company has done 4 raises in the past 2.5 years. It’s such a big name, with so much hype and attention that some of the more seasoned investors are likely to pass on this IPO, potentially waiting for a post-dip. Early institutional investors will have a chokehold on this thing, I am looking forward to finding out what insider ownership is when that information becomes available.

ATAI seems to be a much safer bet than a potential 10 bagger. Or maybe ATAI still is a 10-bagger, they’ve accomplished a shit ton in the last 3 years and seem to be moving full steam ahead. There are around 30 jobs posted on their site currently, many are looking for M&A and venture capital experts.

This company is going to scale and make moves fast, and with its diversity of clinical trials, they are definitely set up for a bevy of favorable press releases in the near future. Not only will ATAI’s budget allow for marketing, but it will also allow for a constant news flow, a key tool for any new company to gain traction in the marketplace.

Can newer companies who are raising $10-20M figure out compelling stories and narratives to tell new and seasoned investors? It’s always difficult, but never impossible, which leads me to the next company here – Psybio Therapeutics.

PsyBio Therapeutics: TBD

PsyBio Therapeutics is described as

a biotechnology company developing a new class of drugs intended for the treatment of mental health challenges and other disorders. In partnership with Miami University, the company is leveraging a proprietary platform technology to biologically synthesize psilocybin and other targeted next generation active compounds in Psilocybe Cubensis and other fungi and plants.

Pretty standard stuff so far.

They are doing a reverse takeover with plans to list onto the CSE, which, if you are from the cannabis industry may sound traumatic, but not every RTO onto the CSE is evil, so I won’t judge yet. The company raised $14.5M CAD in a private placement in December 2020 underwritten by Eight Capital and Cannacord.

An email is required to get the company’s pitch deck and the website is very Microsoft Word 2007 clipart vibes, this does have me a bit worried at first glance. I get it, it’s a medical company, but still, so many psychedelics investors are millennials who look at brands like this and immediately remember their grade 10 science textbook.

Not a good look, folks.

According to their site, the company plans on extending into new natural products and ongoing psychedelics R&D with a lab in Ohio.

In searching for CEO Evan Levine, and his relationship to the company all I could find was a Reddit post on r/shroomstocks saying the guy is ‘the real deal’.

My real issue with this company is there doesn’t appear to be any kind of differentiator or specialization. This feels like an amalgamation of every psychedelics deck I have seen over the past couple of years, there really isn’t one thing they have honed in on. $14.5M is nothing to scoff at, but this is a very cash-intensive sector, quite a lot different than cannabis when you really break down the common business models from each industry.

Not having a real UVP means this company could easily get lost in the deck. For investors who missed out on the very first boom, this does give you access to get in rather early as the company has only done one raise to date.

https://equity.guru/2021/02/15/the-most-interesting-debate-brewing-in-the-psychedelics-community-right-now/

Hopefully, before going public the company will put some work in messaging and branding as I think it could help them out greatly. It’s still too early to give a definitive grade on this company, although I like the idea of getting in early, there are far too many unknowns still.

Their most recent MD&A is only 10 pages long, and there isn’t a concrete going public date, but we will keep you posted.