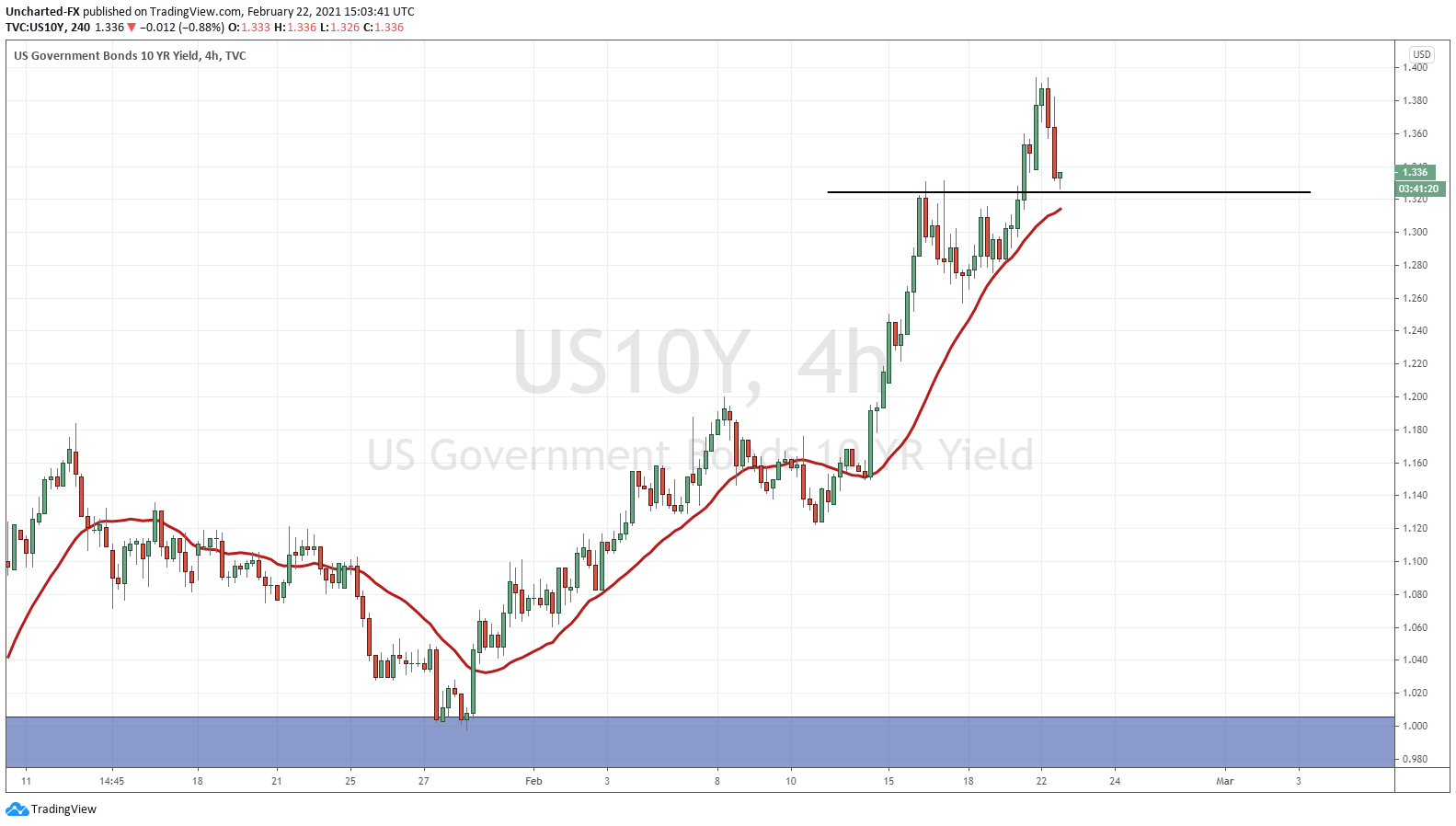

Precisely one week ago, I wrote about a potential stock market crash. What caused some concern was the spiking of the 10 year yield, and the fact that money exiting the bond market was NOT entering the stock markets, BUT running into the US Dollar. This was a worrying sign, and was indicating some fear and uncertainty. For the rundown on the dynamics between the Bond and Stock Markets, read last weeks Market Moment post here.

For this week, many traders and investors will continue to have their eyes on that 10 year yield. I suggest you do as well. At time of writing, the 10 year yield is drifting lower, but is it just pulling back to support before continuing higher? Once again, the issue is only if the 10 year moves too fast, and we see the US Dollar getting bid up at the same time.

When we talk about the Bond markets, we must also discuss the Federal Reserve. Technically, they can buy more bonds to suppress the 10 year rates lower. This is very likely to happen. Personally, I believe their issue is the fact they have told the markets and the world that the economy is improving. So any increase in their asset purchasing program might deter confidence…but then again, when there is nowhere to go for yield but stock markets, will people even care about that stuff?

Stock Markets last week had 5 full days of red, except the Dow which printed one green day. Something not seen very often in this recent environment. The 10 year yield was freaking the markets out.

What was the response? We heard Treasury Secretary Janet Yellen come out saying a larger stimulus package needs to be passed. My readers know that more stimulus is coming. More cheap money to keep assets propped.

This stimulus was shoved into our face by mainstream financial media. They were doing their part to keep the stock markets going.

People have said that this tag team with Janet Yellen and the Fed Chair Powell can keep markets going. Well, we shall see if this is the case, as this week Wednesday Fed Chair Jerome Powell will be giving his congressional report for the first time in the Biden era. Expect him to mention the Fed’s tools in their tool box, and how the Fed has plenty of tools to aid markets. The goal will be to use rhetoric to ease investors, and reassure them the Fed has the stock markets back.

Technical Tactics

I warned about reversal patterns on the stock markets, and over on Equity Guru’s Discord Trading Room, I have kept members up to date on these patterns playing out. Let us take a look at some charts:

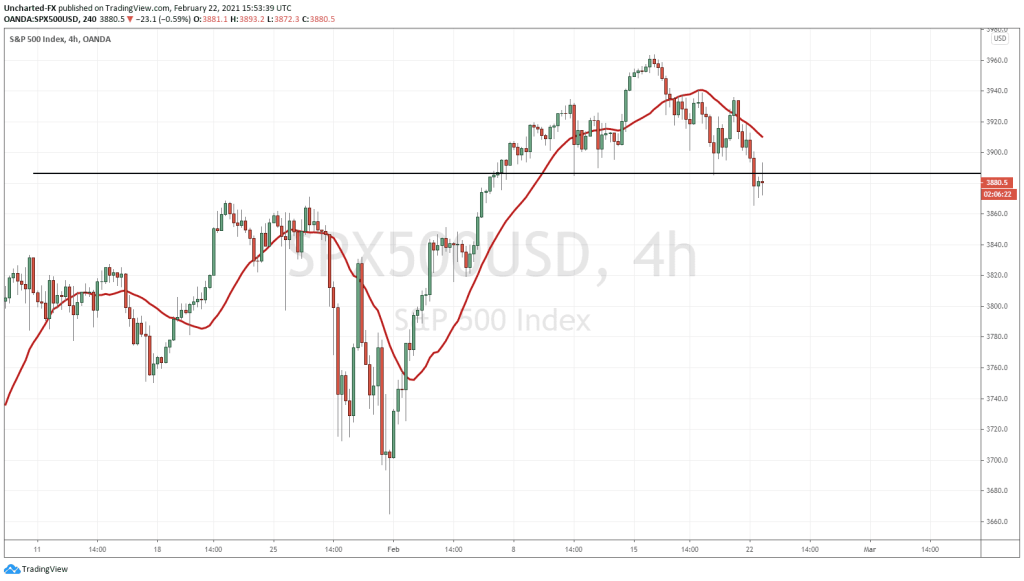

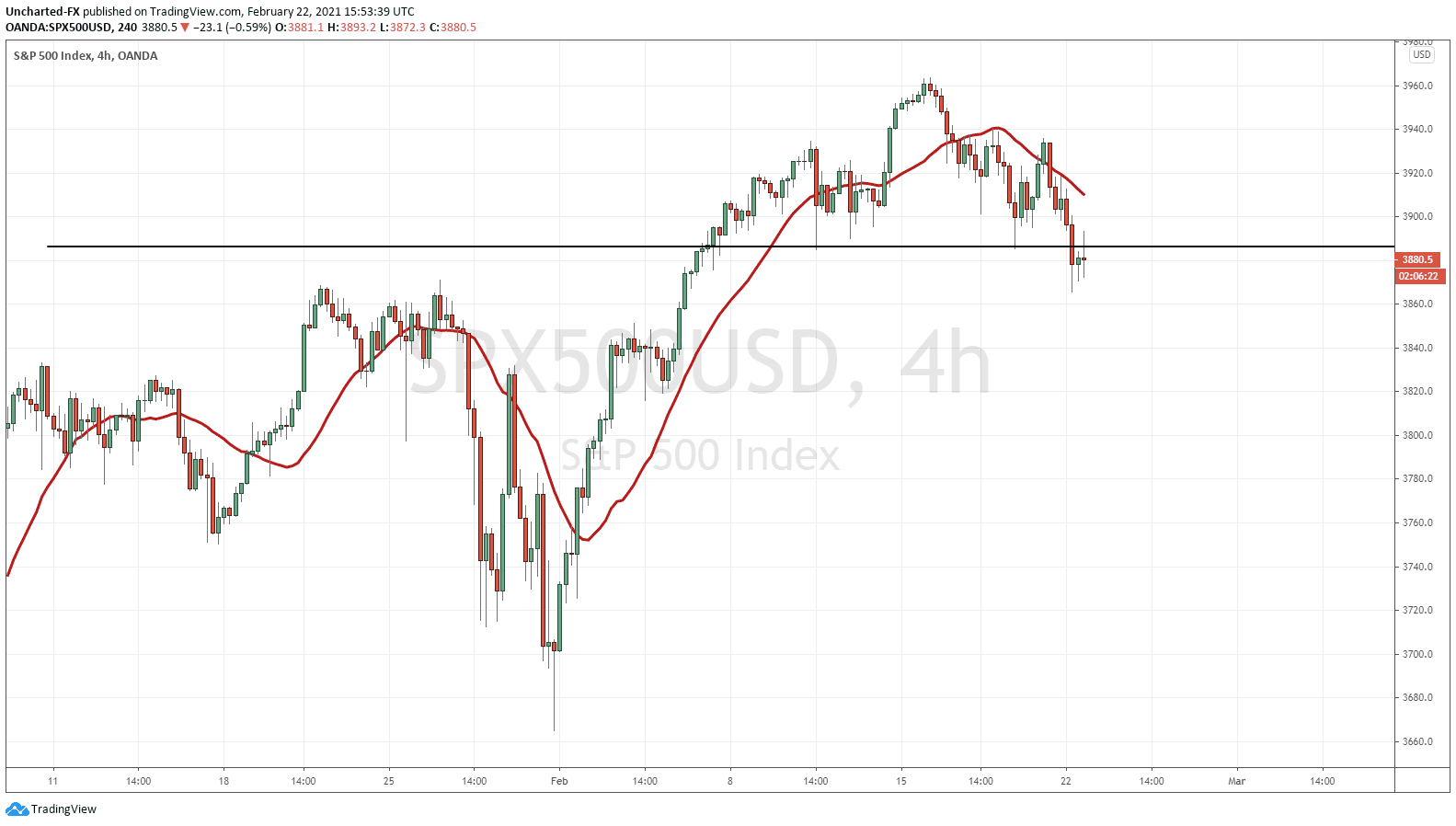

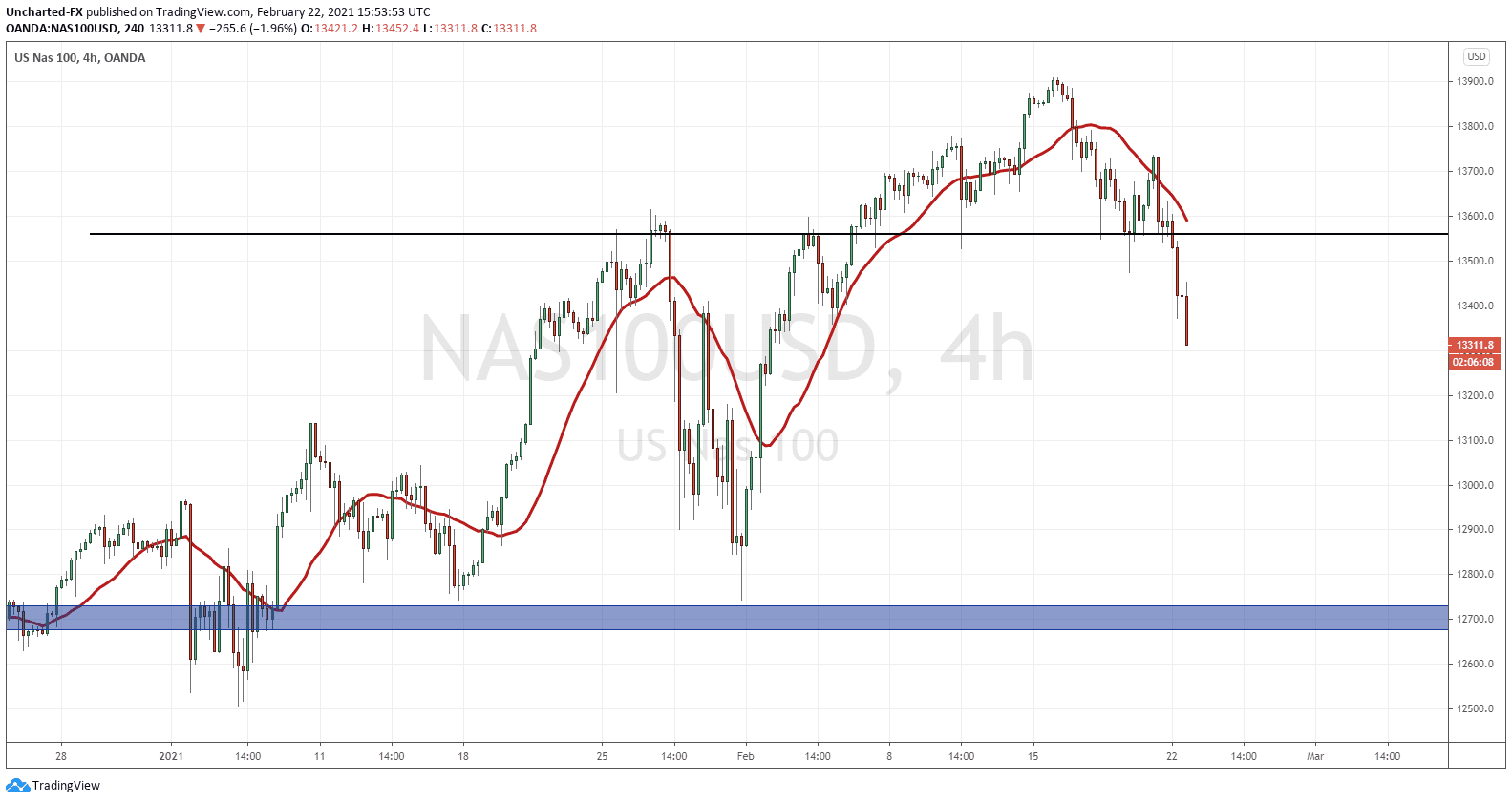

The S&P 500 and the Nasdaq have confirmed and triggered our head and shoulders reversal pattern.

The S&P just broke the neckline at 3885, pulled back to retest the breakdown zone, and is seeing sellers step in. If we continue to close below 3885, a further leg lower is likely…and is expected because of the reversal pattern.

Something similar to the Nasdaq is expected. The Nasdaq saw a breakdown overnight during the futures session, and continues to melt. Similar pattern. What appears to be effecting the Nasdaq even more is the price action on both Apple (AAPL) and Tesla (TSLA). More focus on Tesla, as it was indicating a reversal pattern for sometime. More on this tomorrow.

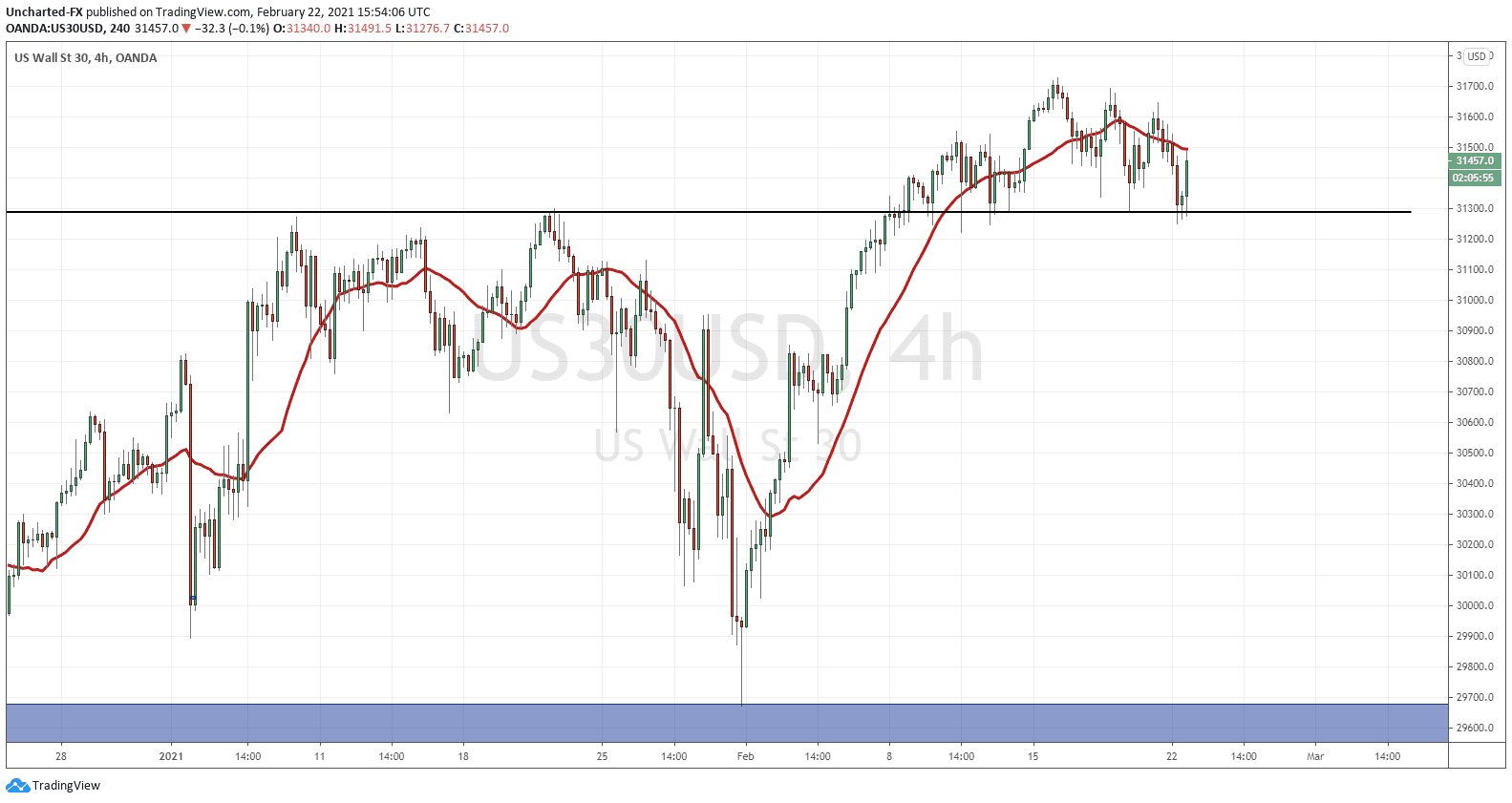

There is still some green out there. The Dow Jones remains strong compared to the S&P 500 and the Nasdaq. You can see that the head and shoulders reversal pattern has NOT triggered on the Dow. Boeing (BA), Chevron (CVX) and Disney (DIS) are keeping the Dow strong and propped.

So in summary, on a technical basis the stock markets are in a downtrend. Particularly the S&P and the Nasdaq. They both have triggered their reversal patterns. The S&P is worth following because the next candle closes will confirm whether we continue, or do we close back above the neckline and make a fake out. If we see more pressure lower on the S&P, we should expect the Dow Jones to follow along. The Dow might be the better short as it needs to ‘catch up’ to the other indices.

Eyes remain on that 10 year yield…and watch for Fed Powell to do his part this Wednesday to keep markets propped.

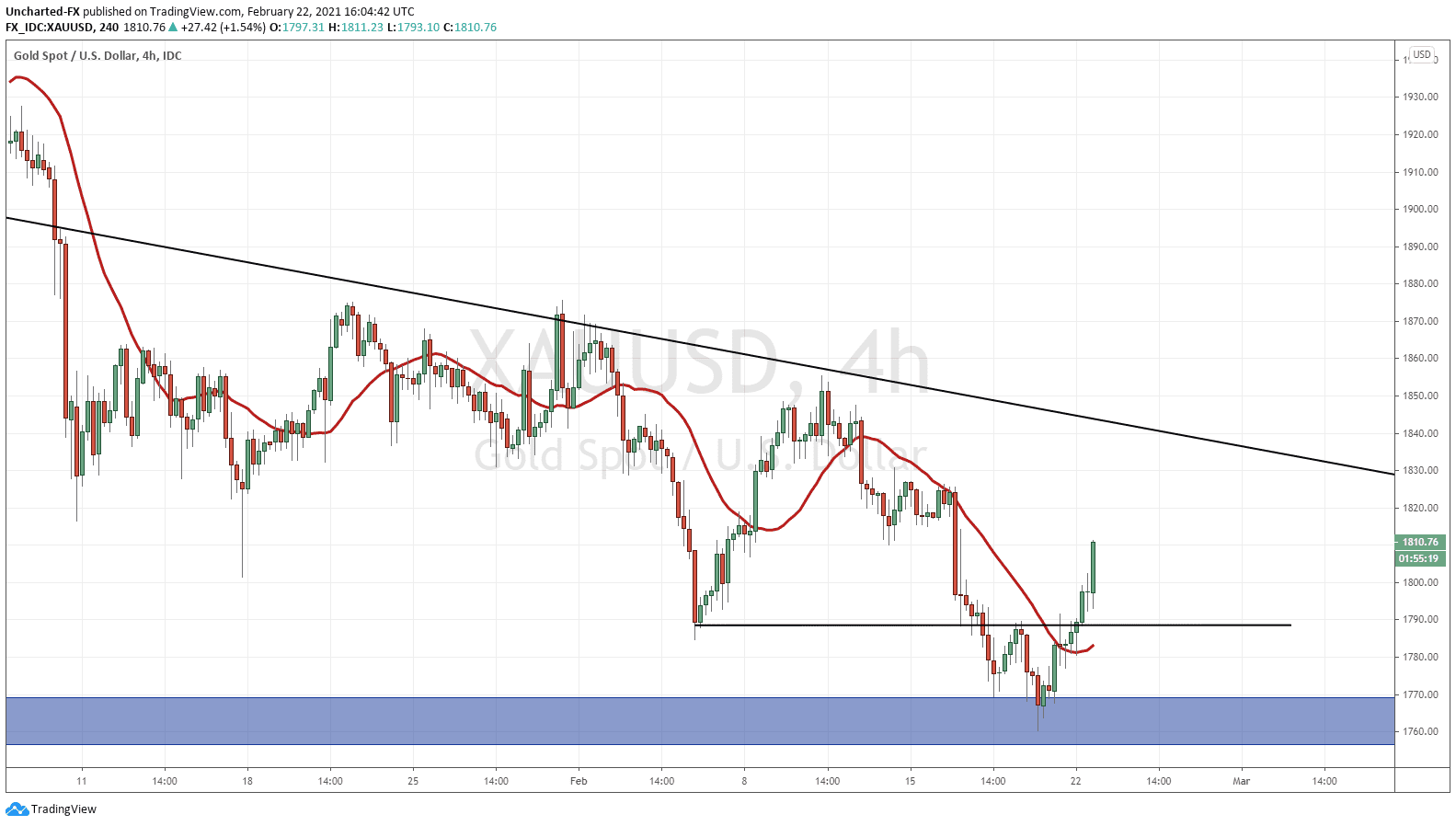

I also want to mention Gold:

Gold is strong. Really strong. It is bouncing from our MAJOR support zone which I highlighted in my 2021 Gold Outlook expecting a 180% move in the long term.

I will be honest. Things were looking very dire for Gold, but this bounce above support is easing most of my fears.

We were watching for a break above 1790 for an entry, and we got it. Currently riding Gold long positions. I am watching to see how Gold reacts at the 1830 zone, but if Gold continues the momentum, 1870 and 1950 are other targets to watch to the upside.

Since the everything crash in February of 2020, Gold has sold off when Stock Markets sold off. And rose when Stock Markets rose. With today’s price action, it seems we have now deviated. This is the important take away… but then again, some may argue that the Dow remains strong, so the deviation cannot be confirmed just yet.

Part of the 10 year mechanism affecting Stock Markets is the price action in the US Dollar. We do not want to see money leaving the Bond markets for the US Dollar. Currently, the US Dollar is battling support at 90.15, and this is having a major role in Gold strength.