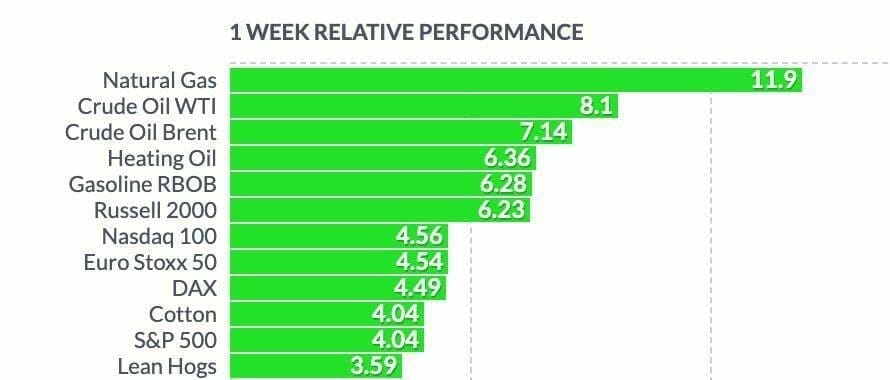

Peyto Exploration & Development Corp. a natural gas producer in Alberta’s Deep basin has benefited from an influx in demand in Natural gas futures ( up +12% for the week & +13% for the year). Its stock is up +50% year-to-date, and experts believe the business is also establishing itself as an oil patch climate changer.

I’ll be the first to admit that I never expected that as a 24-year-old, I’d be excited to see a gas exploration company trading at a discount in the Canadian securities market. To be fair, my very first experience with the financial markets was through my parents back in Zimbabwe, so my passion for the markets is deep-rooted in my upbringing.

I grew up in a household with two loving accountants. They constantly talked about accounting jargon and other business-related stuff that I couldn’t understand at the time. But because it was such a central part of their life, and my own, I couldn’t help but garner a natural interest in the topics they discussed.

Until this day I feel like these discussions paved the way for my general interest in balance sheets, income statements, and various other financial concepts. It also helped that my parents both played a big role in the firms they worked for.

I digress though. The main thing that I did pick up was that I should always do the research before I made any choices. This main concept has been so beneficial in the markets, and even outside my professional career, has yielded great profits. And there’s no better way to showcase this net benefit than by going through a deep value situation that is currently on my stock watch list.

I first heard about Peyto(PEY.TSX) in 2019 when my neighbor, who is a value-oriented investor, was speculating that the stock would appreciate in value for the next three years. His theory was sound, and it went something like this :

“ The business is currently being sold in the market for pennies on the dollar.”

I proceeded to ask how he could make such a proposition; at the time I was mainly focused on trading securities using technical analysis. On top of that, in my formal education, we had merely touched the surface of financial accounting.

“It’s very simple,” (usually what people say before they explain something complicated in a way that very few people end up actually understanding)

“The business currently (As of December 31, 2018) has working capital of $0.50 per share and a book value of $10 per share. The stock is trading between $1-3 per share.”

He paused and looked at me waiting for a reaction. At this time, I had no idea what he was going on about but I assumed it was something amazing, so I gasped. He obviously saw through my scam (I’m a horrible liar, your best gamble is to play poker with me) and continued :

“That means currently the market is selling the business for less than it’s actually worth. Meaning a bunch of investors are saying Peyto is better dead than alive because it is selling below its book value. Usually, sophisticated private business owners use this book value measure as an estimate of liquidation value if the business was to be sold.”

By this, he meant that the mechanics for a private business transaction should be the same for a long-term oriented investor into partial ownership of securities. In the market, we tend to focus on price action, which is by definition the movement of psychology over a short period of time in the interest of a security. But for the more “sophisticated” investor, their attention should be on the underlying economic value driving the business.

This was probably one of the most eye-opening conversations I’ve had about the markets. I will admit I had read literature that emphasized the same premise, but I was not able to make that important connection between the road of theory and the destination of practicality.

Obviously, I have glossed over the majority of our conversation. We used to spend hours discussing various securities, but today’s focus will be on Peyto. This live case exemplifies all the quantitative and qualitative variables needed for a cigar butt investment style.

Using the same premise that my neighbor did three years ago, I figured it was time to update that model on Peyto. Especially today, when people are focused on more of the software and technology part of the economy, which henceforth will be referred to as the intangible economy. As investment capital follows (market interest) to the intangible economy, hard assets(or tangible economy) like railways, financials (banks, etc.), and utilities have continued to lose their glamour.

With such a shift in investor appetite for these stocks, the demand and supply dynamics of the marketable securities have caused prices to be depressed for long periods of time. Meaning, no matter what these companies did pertaining to their profits or their revenue, they just have not been able to get back investor interest. It’s very difficult to compete with companies that need very little capital investment and have ‘easy’ businesses to understand, like payment processing, compared to the development, exploration, and commercialization of gas and natural oils. Plus, the development of eco and social-conscious investing certainly didn’t help.

For those who are adventurous enough to take a brief look at the track record of most tangible economy companies, there does actually seem to have some value left. In the case of Peyto, they have successfully maintained a return on assets(ROA) of 4.85%, return on equity(ROE) of 9.7%, and a return on invested capital(ROIC) of 6.1% for the last 10 years. In that same time period, they have kept their gross profit margins at 38%, their earnings before interest and taxes(EBIT) or operating income at 32.3%, and their pre-tax income at 35.8%.

For comparison, the oil and gas production industry had an average operating margin of 5.87% and a pre-tax margin of 3.92%, which is well below Peyto’s average. The ROA, ROE, and ROIC for the industry were all below 2%.

In other words, if Peyto’s above-average rates were seen in a tech company, its stock would be a hot commodity. Instead, it is rusting away.

With such an amazing performance fundamentally, one would have assumed the stock is doing just as well. Peyto has actually done terribly over the last 10 years. Since 2011, the stock has dropped by 73%!

There could be many reasons for this but the ones that I could identify were that :

- The gas and exploration sector is a very capital intensive industry. It demands large deployments of capital into intensive machinery and equipment. Over time this can be very expensive, and reduce the intrinsic value of the business if not done efficiently.

- If the business is not able to deploy capital into productive assets, this can depress the stock price for an extended period of time as earnings decrease while expenses balloon. This depressed stock price can make it very difficult for the business to raise needed cash from equity or debt financing, while it is almost impossible to fund expenditures from organic cash flows from day-to-day operations.

- With that in mind, since we’ve been in a historically low-interest-rate environment, a lot of businesses have opted to raise debt-equity or refinance their capital leasing programs.

- Investors, noticing the ballooning balance sheet of debt, an inadequate supply of organic cash flows, and large deployment of shareowners’ cash into unproductive assets, then caused the price to stay depressed for an extended period of time. This would cause a psychological barrier to the sentiment on the entire sector, even if other businesses are doing better than the average.

At this point, it would seem that Peyto is experiencing some sort of the last stretch of profitability. Who knows, maybe in the next 5 to 10 years, the business might not exist or be in a different industry completely (that said. turnarounds are not that easy, and are usually very unprofitable for investors ). But an investor knowing what they’re buying could profit from this situation if done correctly.

Like I mentioned at the beginning of this article, the stock is up 50% over the last year. This could mean multiple things, but I am choosing to believe that investors are starting to realize the value behind the business. Although the company is shrinking, and I would assume would shrink even faster as time passes, there are still a few great puffs left in this cigar butt.

As of their latest balance sheet (September 30, 2020), the company has a book value of just below $2 billion dollars. This means on a per-share basis, the value is around $9 per share. The current market price is $5, meaning there is a 40% discount currently. This doesn’t mean if you buy the stock today you are assured a 40% return, it could honestly go the other way if the company was not handled properly.

What this price tells me is that the market currently thinks that the business is better dead than alive, and to those investors who are willing to take on that market risk (risk here defined as loss of capital and not volatility ), they may profit from an asset arbitrage. This asset arbitrage could take two to three years to be realized, but this situation could potentially be an investment that brings a compounded annual return over the next three to four years of just above 10%. Currently, the Canadian three-year bonds yield a 0.24% return, meaning your alpha is about 6.76%, adjusted for inflation.

There are probably investments that promise a higher yield in the next month or two, but they can be very difficult to identify at the moment. That is why I believe in investing with the concept of:

‘A Bird in the Hand is Worth Two in the Bush‘

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.