Nobody really talks about defense as an investment opportunity in the Canadian smallcap space, primarily because the Canadian government isn’t perceived as being as much a free spender on defense tech as, say, the United States. Down there, where a military toilet seat might cost $2400, being in the defense sector can be a license to print money.

But in Canada, we’re a nicer people, so the idea of investing in things that blow holes through people or create negligible benefit is a little less intriguing for many.

One interesting exception to that rule is a company called Kwesst Micro Systems (KWE.V). This company has made an interesting inroad into the global defense space by creating and acquiring small tech that fits into existing military hardware and systems to bring it closer to the sort of thing you see in video games like Call of Duty and Battlefield. In video games, ideas like bullet counters on guns, and systems that can identify drones and attack them with other drones, or scramble electronic signatures to make detection more difficult allow better policing and reduced human exposure to death. They protect the good guys by allowing them to better track, repel, dissuade, and (if necessary) eliminate bad guys.

In layman’s terms, they’re focused on the ‘defense’ part of defense spending.

I’m not someone who buys gun stocks after a massacre, or military stocks because it feels like war is afoot. Karma is a thing to me, and capitalizing on death and destruction isn’t my jam.

But, if you’re going to be involved in military and policing as an investor, a company that specifically helps not kill people, is one that I can get behind, and the people behind Kwesst have ensured that they are a comfortable place for me to be.

It’s taken a little while for the story to get out, because it’s not as sexy as cannabis, or shrooms, but defense tech is a much, much, much bigger industry. Especially at a time when the world, politically, seems to be always on edge, a company that can take harsh political situations and help police them without ramping up the death tally is karmically okay by me.

Another reason I can get behind Kwesst is because the people behind it have been in this industry for decades. They’re not just guys who have come up with a couple of flashy keywords and a nice presentation. There are people that have sold technology to governments for a long time, have solid exits behind them, and have been vetted by military to do business in places where most people could never qualify to do business.

They’re trustworthy and they’re trusted and they’ve acquired great little pieces of tech that work together seamlessly, and bundled that up into something that can be sold to any global government or defense Force in a manner that indicates they’ll be around for a while, and growing solidly.

Other people now are starting to take notice. Bruce Campbell, President and Portfolio Manager of Stonecastle Investments, appeared on BNN Bloomberg this week, calling Kwesst one of his top three picks.

(Jump forward to 2:00 in)

“What Kwesst has done is, they’ve actually brought technology down to the app level for the soldier, so that they can use it for logistics, as far as smart targeting, as far as situational awareness. [..] Things like drone bullets, basically that shoot down drones. [..] If you look at the press releases, they just added a former General from the Canadian Armed Forces. In the defense industry, this isn’t an industry where you just sort of look at the presentation. And obviously, they’ve got success in the business, they’re just starting to roll this out. The stock looks fairly inexpensive, especially compared to some of their peers that trade in the US, and this could be another example where they have a number of different use flow that comes out to get bigger and bigger contracts.”

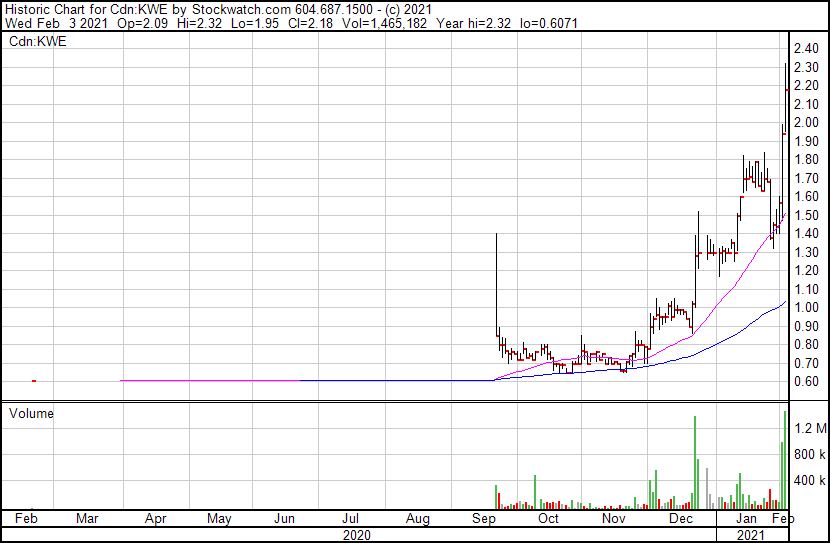

I’ve written about this company before, and in the time since it has been on a hot trajectory. Regular readers have made bank and that curve keeps moving up.

I love it when a plan comes together.

— Chris Parry

FULL DISCLOSURE: Kwesst Micro Systems is an Equity.Guru marketing client