Equity Guru readers and members of our free Discord Trading Room are familiar with the Blackberry story. In fact, Discord members were notified about the chart breakout in November, and then in the first week of December, I posted my Market Moment titled ” Why I am Buying BlackBerry Stock for the First Time“. In that article, I outlined the positive fundamentals for BlackBerry going forward, which by the way, are still a catalyst for the future and gets even more exciting with NIO and Apple rumors. Technically, BlackBerry gave us buy signals, and I outlined multiple ways for entries.

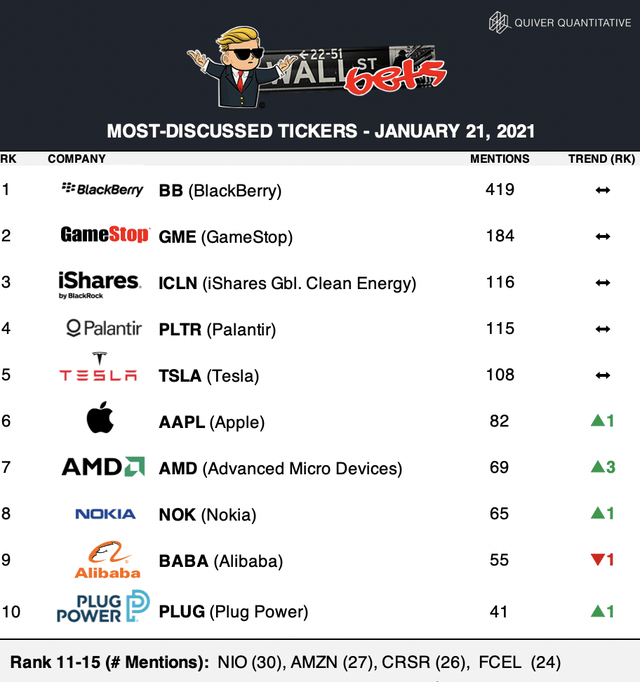

Once the breakout occurred, my market structure method of trading told us that we were starting a new uptrend and should expect multiple higher low swings, our job was to ride this wave. This wave continues. Thanks to the WallStreetBets crew.

Gamestop (GME) has been the talk of the street. Just an epic short squeeze with the stock being halted multiple times. In fact, the stock gapped up today and touched $100…at time of writing, Gamestop is trading at $120.

Last week, I spoke about the short squeeze in Gamestop (GME) and why Blackberry would be next. The WallStreetBets boys had their eyes on it.

Citron Research put out a short recommendation on Gamestop, and then the day later they got cucked. The WallStreetBets crew took it upon themselves to ruin Citron Research and to create an epic short squeeze. They did it.

This leads to an interesting dilemma. The battle between the retail and the institutional traders. Imagine having a well thought out fundamental case for shorting a company based on real stats and facts, only to see a reddit community nullify it and likely take out your shorts. Institutional traders are ticked. We have seen this with Tesla, now Gamestop and it appears that BlackBerry could be next.

As people are staying home due to the pandemic, more trading accounts have been funded with stimulus checks. By the way, this leads to a dilemma for the central bank side as well. People spending money in the real economy, or money velocity, is required to create inflation. Central banks and governments need to find a way to force people to spend this money in the real economy rather than investing. Keep this in mind because some action might be taken. Whether this is an unrealized capital gains tax, or just straight up regulations we will have to see.

With this new retail money coming down the pipeline, we are seeing people trying to make it rich and quick. We are seeing almost the HODLING philosophy from the first crypto mania. Over the weekend I was reading some posts on WallStreetBets and the price targets for the short squeeze are insane. Over $300 for Gamestop and over $100 for BlackBerry.

Honestly, this is now a new way to play the markets. A nice niche. Follow WallStreetBets, see what stock is trending and front run the eventual short squeeze or just major buying.

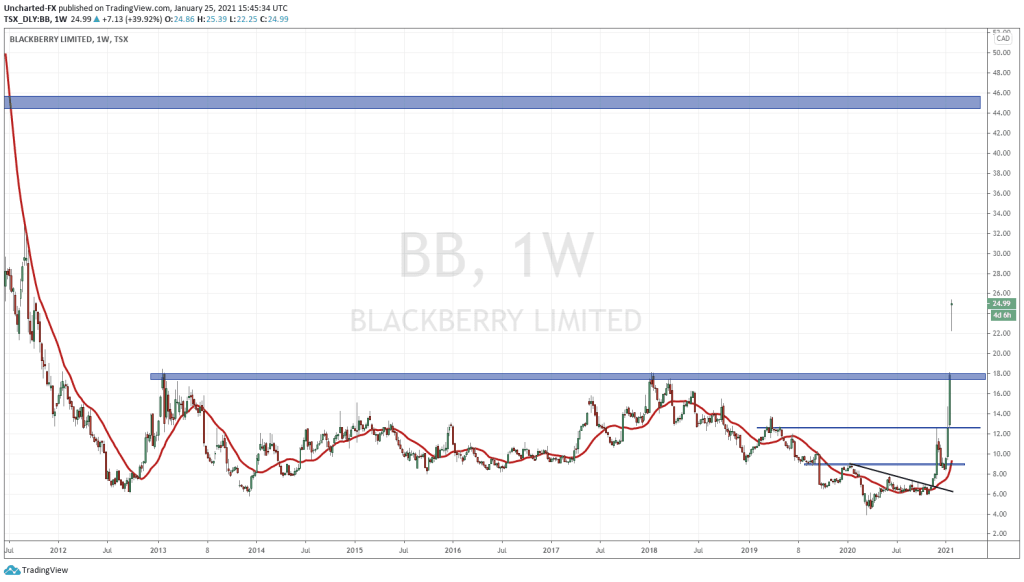

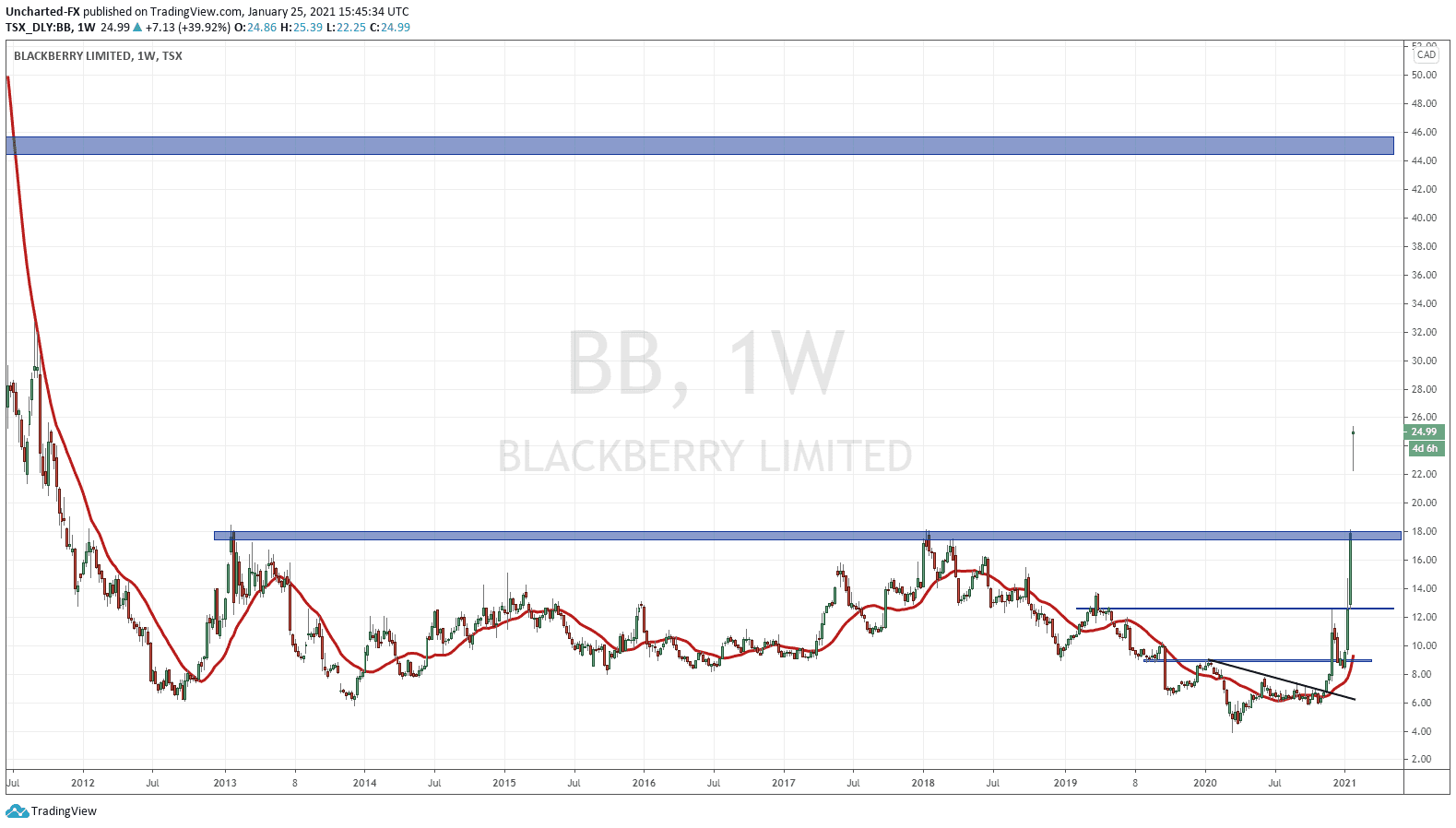

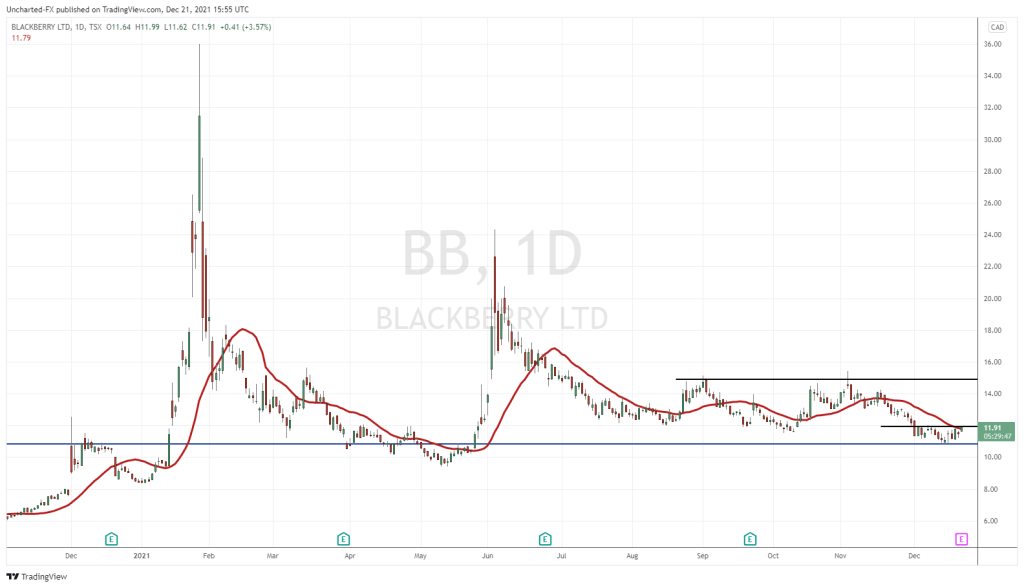

As I said earlier, I really do like the fundamentals for BlackBerry. But let’s take a look at the technicals. And for this, we need to go to the weekly chart.

Our Discord members were told about this weekly set up on Friday. We really like the weekly close, and said that a breakout could be confirmed THIS week with a weekly candle close above 18.00. Well we started off with a bang and a gap up. Chances are quite high that BlackBerry closes above 18.00 by the end of the week, which would trigger our weekly breakout.

Equity Guru Market Moment Readers are familiar with this market structure pattern. Downtrend, then a range ( in this case since 2012!) and then an uptrend. The Range is super important as it is our transitioning or bottoming pattern. This range for the long term is set to be broken with the weekly close.

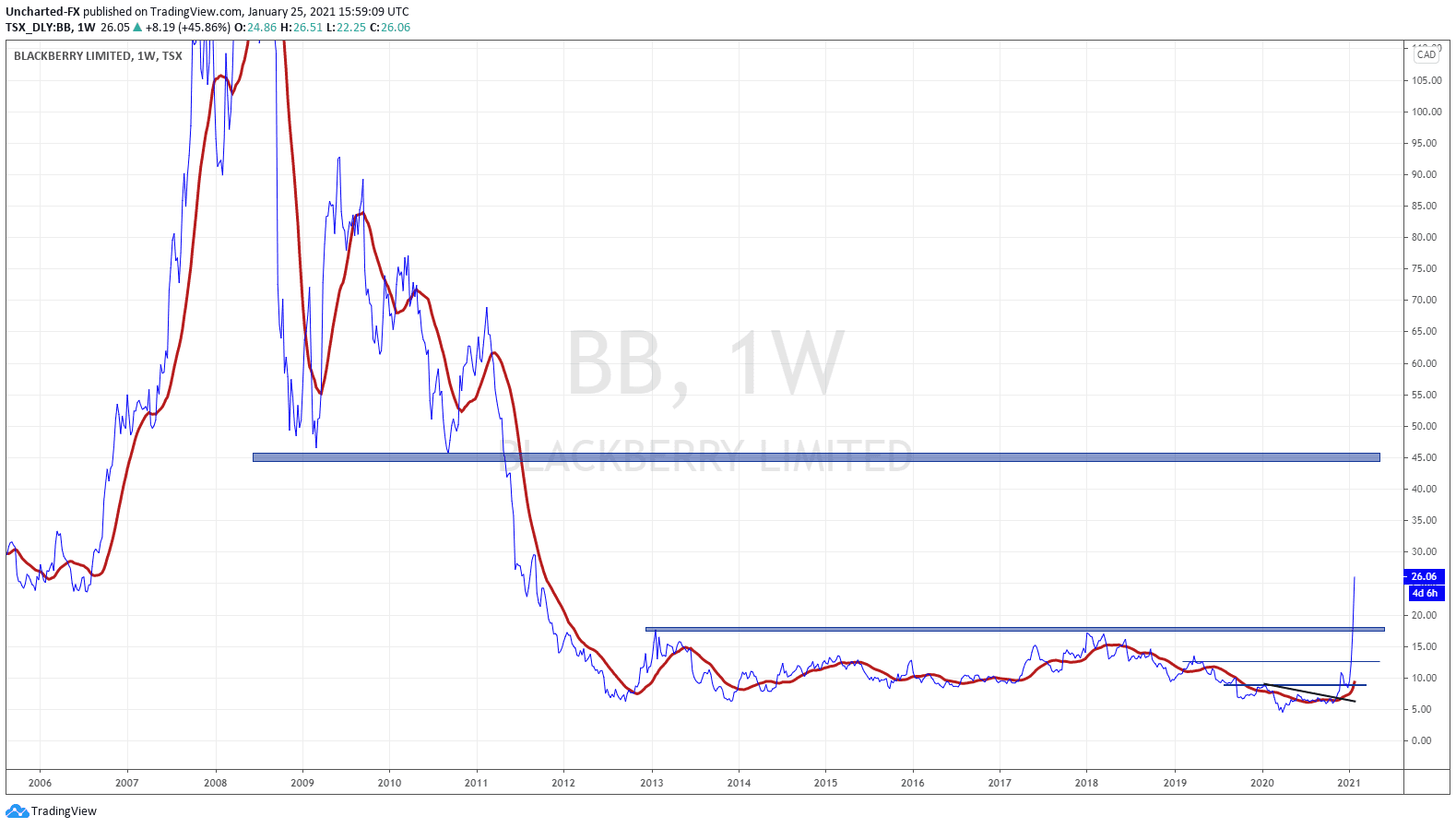

Targets I hear you say? Well this is where things get spicy, and remember there are legit fundamentals about BlackBerry, especially the QNX system, Amazon partnership etc and more which can take us there.

I shifted into a line chart so you could all see the support and resistance levels more clearly. Exciting right? Yup, there is no resistance until we hit the $45 zone. A case can be made for around $30 which is also a major whole number and could provide psychological resistance. And we should expect some profit taking along the way.

As long as price remains above $18, the uptrend and breakout is still valid and we remain bullish.

Just fair warning, there is a chance that price could pull all the way back to 18 before continuing higher. This would meet the retest expectations which occurs on breakouts. If you are new to this, price tends to pullback or retrace back to the breakout zone to flushout the weak hands before continuing higher. Many breakout traders remain patient for days even weeks for this pullback before entering longs on the retest.

But honestly, the momentum is far too strong and the WallStreetBets guys may not allow this to fall that low. Case in point: take a look at Gamestop (GME). Monster rally, and we should expect similar price action with BlackBerry. In fact, it may draw more eyes because it may still be considered ‘cheap’.