My sister and I are real Christmas fanatics for two Jewish girls.

Every year, my mother would place stockings at the end of our beds to save herself an extra 30 minutes of sleep come December 25th morning (excess is dismissed in the face of a 5 and 8-year-olds 6 a.m. Christmas energy). The true heroine of this story (and ultimate mom-sleep-aid) was not the supplementary bedpost stocking itself, but rather, what she put inside it:

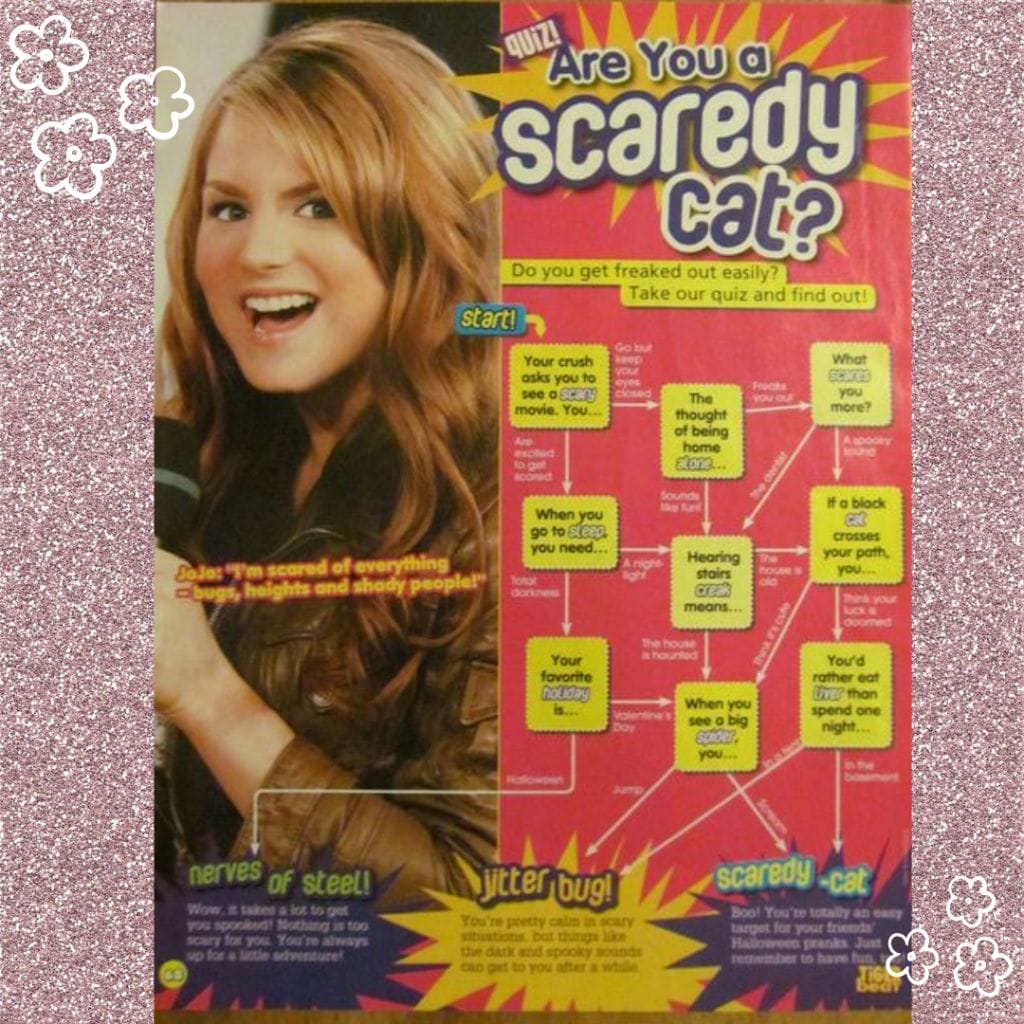

the J-14 Magazine.

And more specifically, the J-14 Magazine Quiz.

I truly believe that my age (both literal and in terms of an era) is characterized by those who know every word to Avril Lavigne’s Sk8er Boi, and those who have found out what their belly button reveals about them in an early 2000s magazine quiz.

If you have never heard of J-14, M Mag, Tiger Beat, QuizFest or Bop, this may not be the terminally nostalgic article for you as it is for me. In fact, if you have not once read any of these literary giants, I suggest you move your readership elsewhere (you’re making me feel really old). Nevertheless, here is my inevitably botched finance spin on the classic magazine quiz, general ode to low-rise denim and pixelated reminiscence of all early 2000s things that glitter.

Rules of the game: tally up your points.

Start!

- When you hear the term “index fund” what is the first word that comes to your mind:

1 point) “What?”

2 points) “Trendy”

3 points) “Safe” (in the sense of “boring”)

- Are you confident in your abilities as an investor?

1 point) no

2 points) ish

3 points) yes

- You just got your pay check, you:

1 point) go for sushi with friends and pay using your debit card

2 points) go for wine with friends and pay using your credit card

3 points) go to the casino

- Do you believe in the idea of borrowing money to make money?

1 point) no

2 points) depends what for

3 points) yes

- Your grandma gave you $500. What do you do with it?

1 point) stash it in your room

2 points) deposit it into your TFSA

3 points) invest it in stocks

- Would you prefer to maintain control of your own investments or would you rather delegate that responsibility to someone else?

1 point) I have no idea what investing entails so I cannot answer this

2 points) delegate

3 points) maintain control

- Which is stronger: your tolerance for risk to build wealth, or your desire to preserve wealth?

1 point) desire to preserve wealth

2 points) depends on my monetary situation

3 points) tolerance for risk

- When you think of big corporations, you think:

1 point) environmental destruction

2 points) opportunity

3 points) power

- Job A guarantees a steady and livable income for life.

Job B pays lower than Job A but offers a promising commission.

Job C offers a 50/50 chance of doubling your lifetime income and a 50/50 chance that it would be cut by a third. You would choose:

1 point) job A

2 points) job B

3 points) job C - In your work and personal life, do you prefer to take initiative or take direction?

1 point) depends the situation

2 points) take direction

3 points) take initiative

- You’re opening an investment account. You would choose:

1 point) I don’t know what the below options mean

2 points) robo-advisor

3 points) self-directed brokerage account - Your president:

1 point) Pete Davidson

2 points) Nicole Richie

3 points) Warren Buffet

30-36 Points: You are the Active Investor

The active investor is entrepreneurial and confident. You love the thrill of a good investment and are hands-on with all of your financial decisions. You’re the type of person who may choose to turn on the news and read the ticker that displays stock quotes, rather than scream at the hair dye running down Rudy Giuliani’s cheek (not that these two have to be exclusive). The active investor, on a bad day, may assume a sort of frat boy arrogance and make impulsive purchases at the expense of long-term saving. It’s important for you to slow-down and think about your overall financial goals prior to making an investment decision.

21-30 Points: You are the Informed Follower

You have some investing knowledge but also, like, a life. You can’t be bothered with managing the details of your investments on your own but are still quite fiscally responsible. You’re the type of person who likes being in the know and having all the hot goss on the next best investment that you can share with your friends and colleagues. The informed follower’s judgment can sometimes get clouded from the bandwagon effect (we’ve all had that wine night where we got too excited over something that the morning proves to be fairly uninspired). When it comes to preparing for your financial future, learning more about investing is key. Try not to get distracted by the next big thing and learn about the kind of companies that inspire you!

12-20 Points: You are the Rookie

You find the finance world pretentious and feel like all the stuffy billionaires and environmentally unfriendly companies are here to take your money and maybe ruin your life. Or, in less dire terms, you simply think that learning to invest is too confusing, too much work and too time-consuming. The rookie feels at home in their local savings account and impulsively clicks the not interested button when your online banking brings up ‘TFSA this and investing that”. You’re the type of person who may feel that investing, and the learning thereof, somehow robs you of your artistic, free-spirited, stick-it-to-the-man identity. However, if you can’t beat’em (“em” being inflation), join’em (“em” being the investing world at large). I promise, it isn’t as complicated as it seems.

I will close out my final article of 2020 and this appalling year with a quote from a true bard of our time:

“I’m scared of everything – bugs, heights and shady people!” – Jojo, circa 2005.

Wishing you all a less scary 2021.