Ethereum 2.0 launched their beacon chain this week, but they’ve already got competitors lined up to drink their milkshake if it doesn’t meet its promises. Vitalik Buterin had better have crossed all his T’s and dotted his I’s, because if he didn’t, his coin’s days of prominence are numbered.

It’s time for your Friday coin rundown. Let’s see what happened.

Here are your top ten coins.

Bitcoin

market cap $353,674,262,092

A Bitcoin grows in ascendancy, so will scammers, thieves and hackers who try to profit from it. New scams are being created everyday, so it’s best to be vigilant and remember the maxim: if it sounds too good to be to true, then it probably is.

But there are other circumstances, like those using fear tactics, to play cash from the unsuspecting or the unwary. Ravi Patel and his wife Sarita own a convenience store in North Delta, British Columbia, where they recently stopped a young man from depositing over $5,500 at a Bitcoin ATM to fraudsters.

An officer stopped by the store in November to warn Ravi and his wife about a cryptocurrency scam in the community specifically targeting seniors and new Canadian who might be unfamiliar with Canadian laws.

These things are sadly going to happen and the best way to counteract it is to be aware, keep your eyes open, and help each other.

Ethereum

market cap $67,221,938,701

Ethereum fired up its Beacon Chain this week, firing off their much lauded Ethereum 2.0 and kicking off a scaling effort that’s been the talk of the cryptosphere for years now. Alex Mashinsky, CEO of Celsius, said that if it doesn’t fulfill its promise of scaling quickly and at a significant rate, it won’t be around for much longer. Lower-ranked cryptocurrencies offering similar services like Cardano and Polkadot that have been lining up to drink their milkshake from day one, will get a chance to do just that.

“Ethereum needs to prove it can scale its transactions 100x without compromising on security or decentralization,” Mashinsky said.

On Thursday, Ethereum was clocked at 13 transactions per second, according to data from Blockchair. A 100-times increase would bring the blockchain to roughly 1,300 TPS, which is still not enough. Ethereum has been the go-too network for decentralized applications over the past several years, and is now considered the hub of decentralized finance, which has jacked up the price of gas to its present rate and could be in serious trouble if this engine doesn’t start purring soon.

XRP/Ripple

market cap $26,397,291,222

Brad Garlinghouse has a bone to pick with the United States regulatory bodies. He’s adamant that it’s the general lack of regulatory clarity and uncertainty that’s causing the blockage to his company’s development in the United States.

“We have been big advocates of a bill that was introduced in the Congress called the DCEA, or the Digital Commodity Exchange Act … [which could be] a very important step in providing that clarity and certainty here in the US,” Garlinghouse said.

He was referencing to earlier statements that his firm was considering department the United States for other cryptocurrency friendly locations in Asia or Europe. It’s the lack of framework, likely coupled with their ongoing legal troubles, that’s been getting in the way of Ripple’s ongoing chats with numerous customers, which have been hesitant to join its network.

“Often times when I’m speaking with customers and we’re talking to them about our product that uses XRP in the payments flows, they will ask me about the regulatory dynamics, and they will [say] … look, until there’s clarity in the regulatory frameworks, we’re going to hold off. Now, that has not been the case because of the clarity and certainty in countries like… the UK, or the UAE, or Switzerland.”

Honestly, why they didn’t immediately move to Switzerland’s crypto-valley when the Securities and Exchange Commission got on their case about whether or not XRP is a security is beyond me. Then again, I’m not particularly fond of the idea of one corporation controlling a cryptocurrency in general.

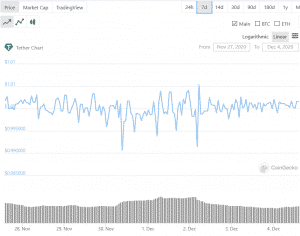

Tether

market cap $19,545,046,823

Today in hilarity, U.S. House Democrats reveal legislation that would force Tether to stop lying to its hodlers about how much money they have.

“Digital currencies, whose value is permanently pegged to or stabilized against a conventional currency like the dollar, pose new regulatory challenges while also represent a growing source of the market, liquidity, and credit risk. The bill intends to protect consumers from the risks posed by emerging digital payment instruments, such as Facebook’s Libra and other Stablecoins currently offered in the market, by regulating their issuance and related commercial activities,” the bill’s three Congressional sponsors, Rep. Rashida Tlaib, Rep. Jesús “Chuy” García and Rep. Stephen Lynch said in a joint statement.

The bill intends to settle the conflict over whether or not stablecoins should be considered “deposits.” In the financial indsutry, the term is legally binding and contractually obligates the institution to return the deposit immediately in legal tender upon request. Basically, if this passes, then Tether will be forced to either find what they lack in holdings to account for tokens presently in circulation, or drastically reduce the coins in circulation.

Litecoin

market cap $5,554,577,558

Litecoin’s fortunes have been buoyed recently by the amount of whales hodling the cryptocurrency, which has grown. A litecoin whale is someone who holds between 1,000,000 and 10,000,000 coins, or roughly $89,000,000 and $890,000,000, respectively. That number has increased by two in the past week, which is enough in this space to cause a substantial boost in fortunes despite the low number. The sum of money is high.

Bitcoin Cash

market cap $5,349,378,364

There’s growing evidence to suggest that Bitcoin Cash Node (BCHN) might become the leading software of the BCH network after the latest hard fork. Binance mined the last common BCH block before the split, and the first block post-split was done by AntPool. Most of the blocks after that have Bitcoin Cash Node acquiring the majority of the hashpower as miners have taken a substantial lead into seeing who gets to survive.

The kerfluffle leading to the fork was about a suggested update on the network in which BCH ABC, the proposed fork, would take 8% of mined BCH as funding for protocol development. Others, calling themselves Bitcoin Cash Node, didn’t like that. Now BCH ABC seems to be losing the race and if they don’t get enough support by way of hashrate, they’ll probably end up disappearing and the undisputed winner will be the group that didn’t want the tax.

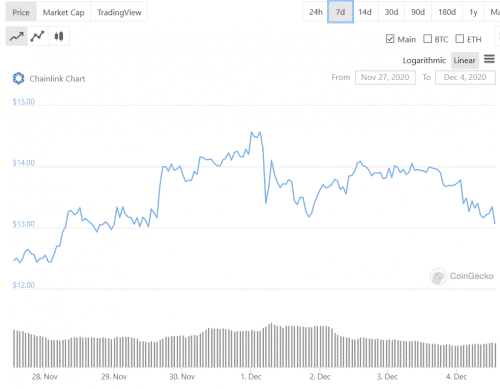

Chainlink

market cap $5,234,292,398

Chainlink revealed 77 different smart contract use cases this week. Damn.

The chainlink team went on to explain that smart contracts try to define the terms and obligations for “an exchange of value between two or more independent parties.” The developers go onto note that “historically, a centralized arbitrator is usually required to verify if those terms and conditions are met.”

Blockchain and smart contracts eliminate the need for an arbiter by introduced decentralized infrastructure. Chainlink suggests this will assist with the reduction of counterparty risk.

Polkadot

market cap $4,897,766,403

In the wake of ETH2.0 Polkadot is expanding its ecosystem by announcing a new decentralized finance alliance and support program for validators. Announced yesterday, the alliance aims to provide a platform for its community to discuss using the network and its underlying substrate technology stack for DeFi.

Chainlink is among the alliance’s founding members.

Here’s Dan Koshis, Chainlink’s global head of business development:

“Chainlink is excited to help steer the direction of Polkadot’s growing ecosystem of decentralized financial applications. By promoting developer best practices for DeFi protocols, the Polkadot ecosystem can become stronger than ever.”

Cardano

market cap: $4,847,328,119

Cardano joined the smart contract game this week by introducing developer programs IELE and KEVM. The KEVM environment can now be deployed in any smart contract on the blockchain, and therefore also be compatible with all types of programming languages.

This addition also means that KEVM will enable developers to implement Ethereum-based applications on the Cardano network, effectively getting itself poised to drink Ethereum’s milkshake if Buterin can’t make the blockchain scale.

The upgrade result means that more than 140,000 contracts will be compatible with the Cardano blockchain. Now it’s possible for developers to write decentralized applications in solidity and use them on Cardano’s network, enjoying faster speeds, verified security, better functionality and lower fees.

Binance Coin

market cap $4,385,708,462

Binance stated this week that they’re ready to go live with the Eth2 focused staking service. The company said the offering would go live on December 2 with the daily rewards paid out in BETH tokens.

“BETH tokenizes a user’s stake in the ETH 2.0 pool at a 1:1 ratio. BETH will allow users to redeem ETH at a 1:1 ratio when ETH 2.0 Phase 1 goes live,” according to the exchange.

Naturally, the announcement comes a day after Coinbase laid out its own plans for Eth2 support, including staking and a trading pair between ETH and ETH2 tokens.

—Joseph Morton