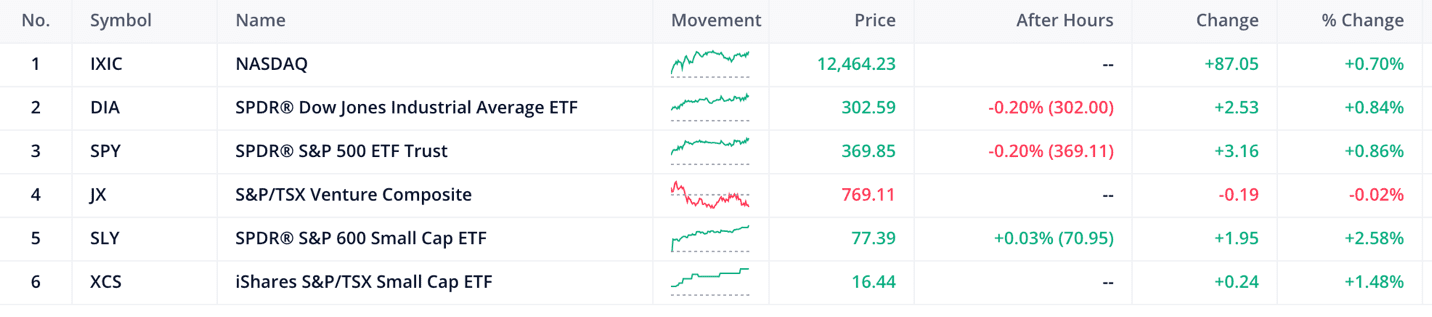

- The S&P 600 is up by 2.58% & TSX20 up by 1.48%

- The Canadian 10-year bond up by 0.06% and the US 10-year bond up by 0.05%

Friday’s market movers

Investors should be aware that when they invest in the small-cap industry they are exposed to more market risk; this should not be seen as a reason not to buy the common stock of these businesses but as an indication that there is great potential to make great buying choices and accumulate wealth.

The saying goes on Wall Street:

“To gain higher returns the investor should take on more calculated risk”

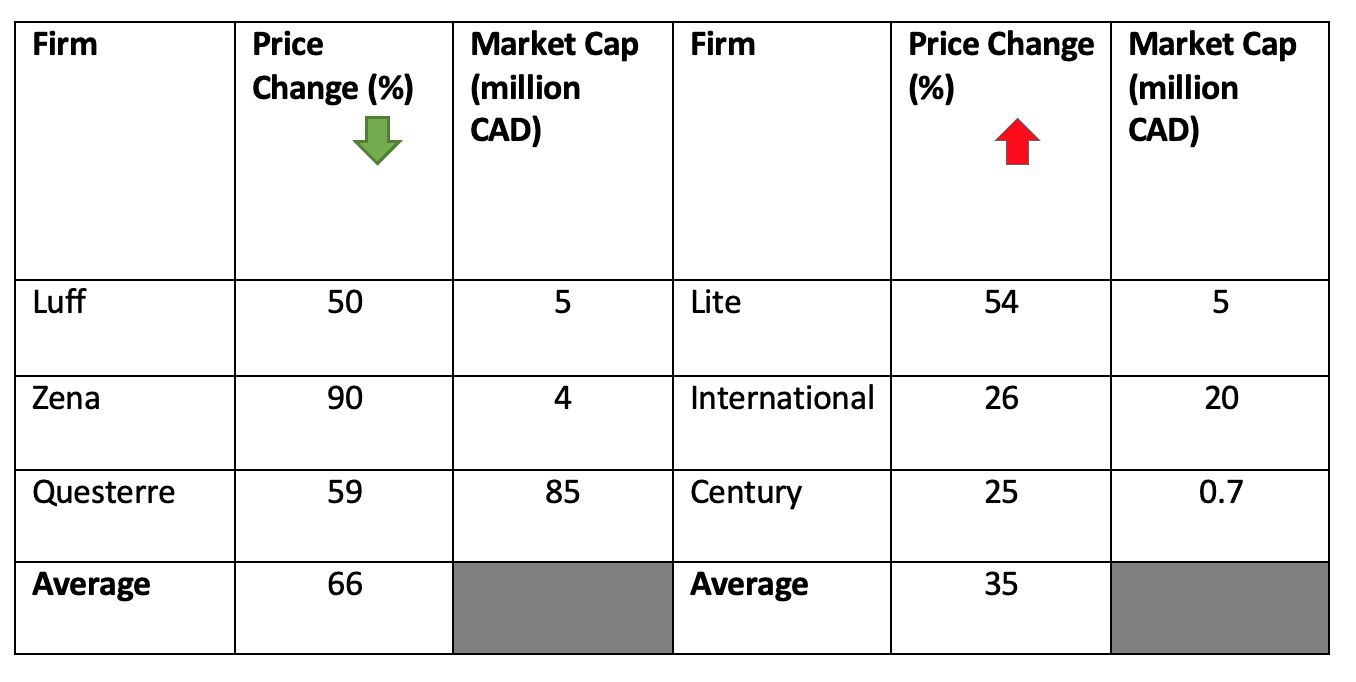

How true this is depending on the person asked, but most would agree. The Small Caps this week did well for their shareholders, the top gainers increased in value on average by about 66% & the “losers” lost about 27% for the day. This shows the “bullish” sentiment going into the end of the week in the Canadian market.

Economic data points

- Non-Farm Payrolls NOV on Friday, December 04, 2020

- Core USA Inflation Rate YoY NOV on Thursday, December 10, 2020

- Canadian Inflation Rate YoY NOV on Wednesday, December 16, 2020

- USA Retail Sales MoM NOV on Wednesday, December 16, 2020

Earnings

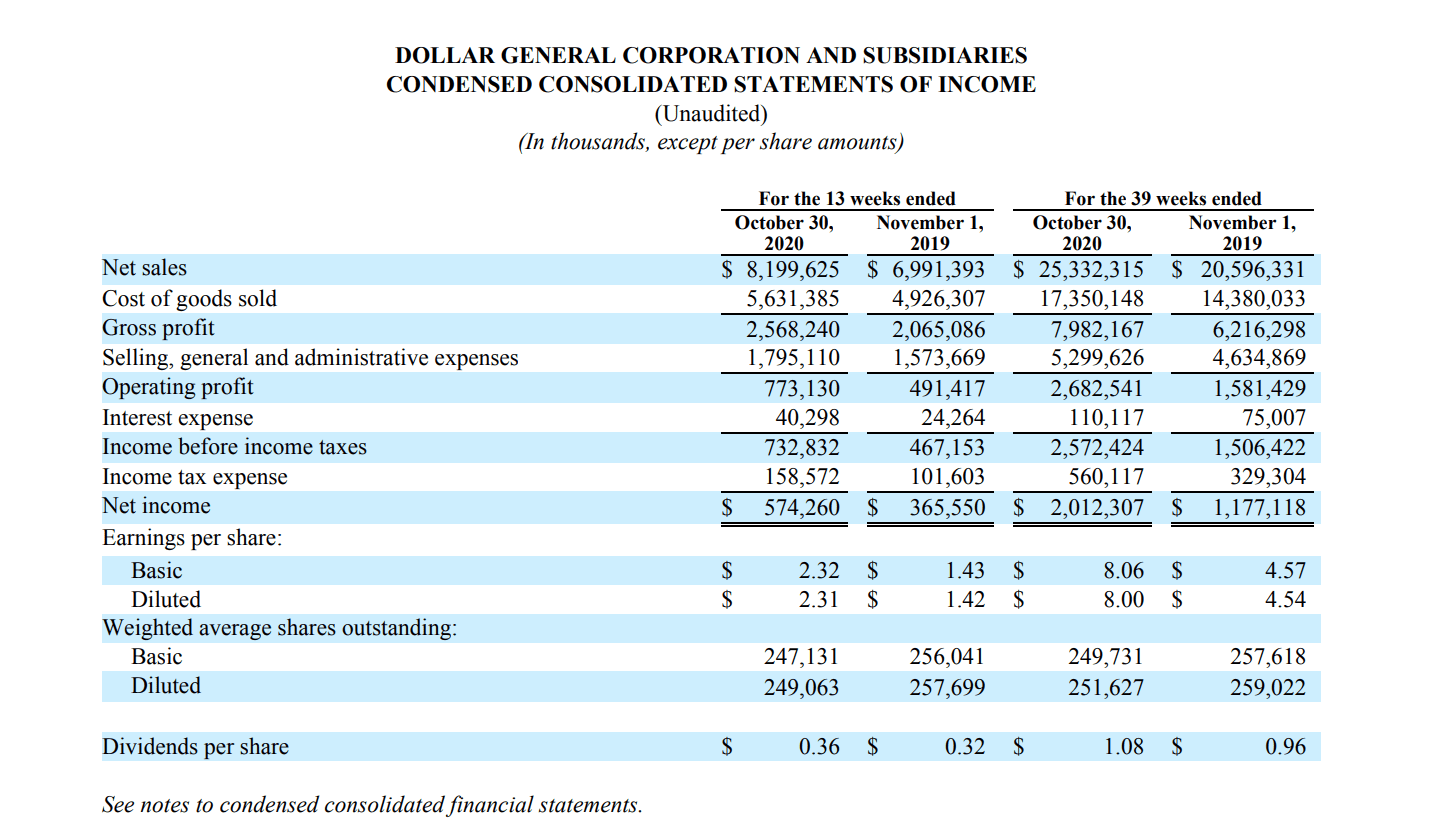

Dollar General is an American chain of variety stores headquartered in Goodlettsville, Tennessee. As of January 2020, Dollar General operates 16,278 stores in the continental United States.

Dollar General earnings per share in 2019 were $6.64 per share and analysts forecast their earnings for the full fiscal year are expected to be about 9.24 per share. This expansion in earnings is in line with the shift by consumers from larger more expensive brands(Wholefoods, Cosco, etc) as they attempt to cut their expenses. The stock has been tearing up the market and is up 36% year to date and closed today at 213 down 0.49% for the day.

Equity.guru reads

Airlines Breaking Out as Vaccine Nears! JETS, UAL, ALK, AAL, DAL

Core One Labs (COOL.C) unhalted today, and it will be a horror show: But that’s okay

Two strategic deposits, two strategic hires – Arizona Metals (AMC.V) and Defense Metals (DEFN.V)

DuPont(DD.NY) Analysis : TK’s market wrap up

Recent Equity.guru videos

The reality of the beauty contest that is the stock market is that if every stock is somebodies’ favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.