So I wish I did post this Market Moment a bit earlier given the price action on the stock today, but let’s just say some of our Equity Guru Discord Trading Room members are quite happy. Many of my readers and followers know me as a contrarian when it comes to my long term plays and my swing trading. A little known fact, but I am also a contrarian when it comes to my cell phones. I have never owned any Iphones, and last year was the first time I purchased an Android phone. Since 2012, I have always been a Blackberry phone user. The only Blackberry phones I missed out on were the Blackberry Q10, and their most recent offering, the Key2. Other than those two, I have owned and used every other Blackberry phone. You bet I am excited about their upcoming Key3. Yes, Blackberry is making a return to the cell phone market in 2021. Honestly, this is very positive news as it means the company is doing well in their other businesses in order to compete in the cell phone market once again.

Before we look at the technicals, let’s flesh out some fundamentals.

Firstly, the company is sitting with near 1 Billion in cash. Not too bad in these trying times.

Secondly, the company is known for their cybersecurity software and other software solutions. Government contracts have been big in the past, although Apple Iphones seem to be used now by government officials rather than the keyboard of the Blackberry phone. With what has happened to the economy due to Covid, we all can see the Canadian government doing their best to help domestic companies. I think one can make a good case they could once again make the upcoming Blackberry Key3 the government/civil servant phone of choice.

Oh, and it doesn’t end there. Enter the QNX OS.

QNX is:

BlackBerry® QNX offers a broad range of safety-certified and secure software products, complemented by world-class professional services, to help embedded developers increase reliability, shorten time-to-market and reduce development cost.

Currently, it is being used in multiple industries to provide the software foundation for safe, secure and reliable systems. These industries include Life Critical Medical Devices, Robotics & Industrial Automation, Safety-Certified Software Components, Secure Product Lifecycle, and what I am seeing as a major bullish catalyst, Connected and Autonomous Vehicles!

Security for autonomous (self-driving) cars will be important going forward. Many are focused on Electric Vehicles (EV), but many analysts expect progress in autonomous cars to come faster. We already are seeing non EV’s with self driving functions and capabilities.

The idea of someone being able to hack into a self driving car, lock the doors and then drive the car off the road, killing the occupant(s) is unsettling. Secure systems will be essential.

Blackberry has already announced a collaboration with Jaguar Land Rover, but today’s news is HUGE and the stock is up over 32% at the time of writing. Blackberry is partnering up with Amazon.

To end off the Fundamentals, why not also invest in the company the Canadian Warren Buffett is bullish on? Prem Watsa, CEO of Fairfax, and dubbed the Canadian Warren Buffett, has been buying up shares of the company. He now sits on 101.8 million shares of the company.

Now onto the chart.

Many of my readers know my theory of market structure. That all markets move in three ways: uptrend, range and a downtrend. Our job is to wait for an exhaustion of one trend, and then await for a signal to indicate that price is reversing. Everything moves in waves and cycles. My track record on Market Moment and our Discord Channel speaks for itself.

I did not know big news like this was coming, but the chart of Blackberry was indicating a shift in trends. The downtrend was over, and a new uptrend is beginning. If you zoom out on the chart long term, you will see what I mean.

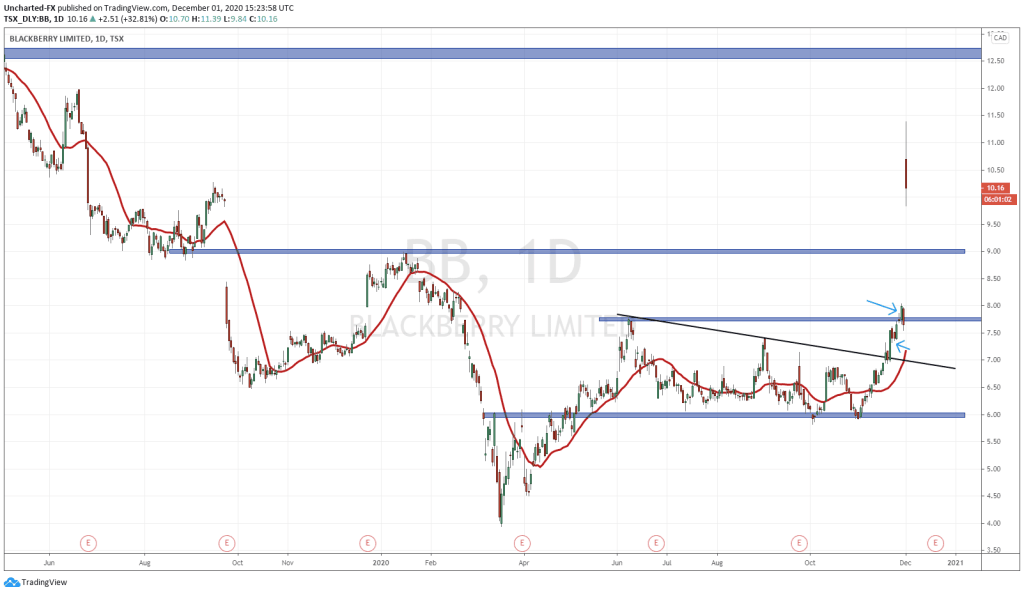

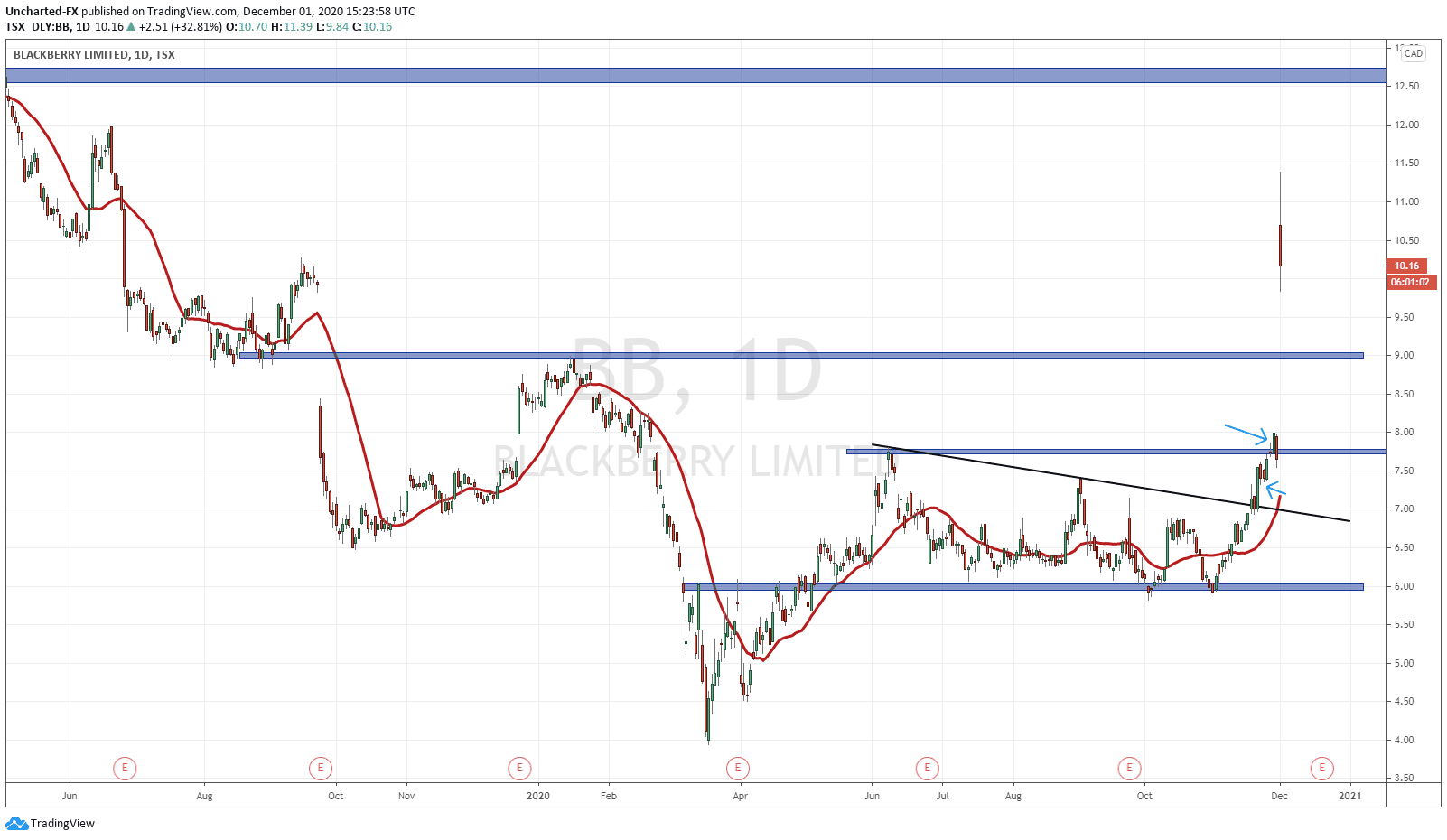

Technically, we were watching for a broader cup and handle breakout reversal with a breakout above $7.75. This happened a few days back.

The blue arrows point to the times I mentioned I was buying shares on the Equity Guru Free Discord Trading Room. The first entry was a trendline break and retest. Look at how strong the green candle was on the retest. There was a bit of a risk since price did not get above our resistance zone of $7.75, but that large green candle was a STRONG indication that buyers were stepping in.

The second entry was on the confirmed breakout on November 27th. The day after, price retraced to retest the breakout zone. Perfectly normal. The close on the retest was not the greatest, but I do not want to make this post too technical. There actually was a higher low swing which was holding so there really was not a fake out here.

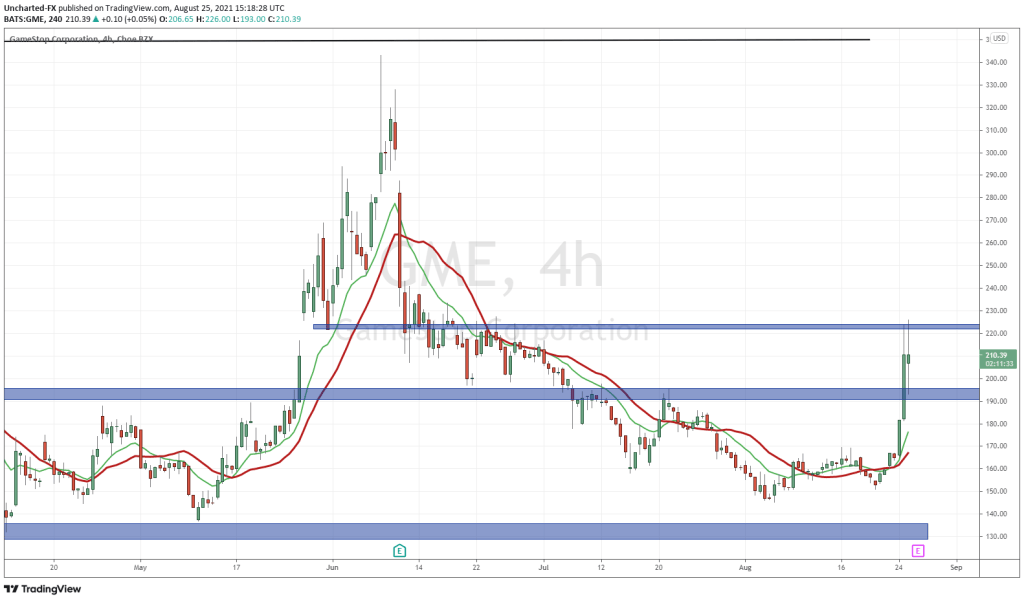

I really liked the Blackberry technical set up because the structure was similar to another big winner: Village Farms. Take a look at my post on VFF here, and look at how similar the charts are. Obviously minus the large gap up pop.

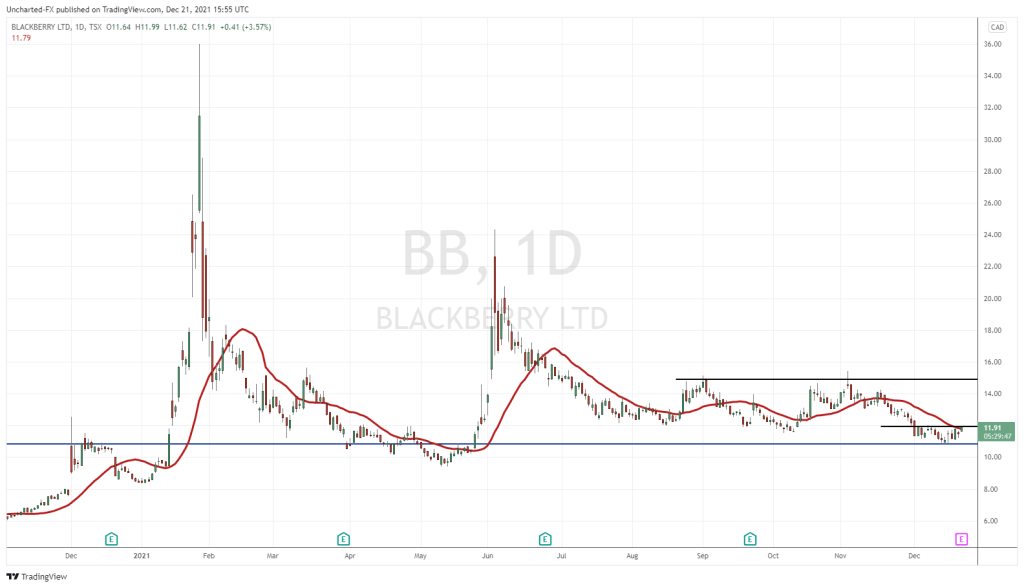

What next for Blackberry? To be honest, I thought price was moving higher because it was anticipating better than expected earnings for December 18th. But it seems now that money was frontrunning this Amazon deal. But this Amazon deal changes the fundamentals up a lot. This has now become a long term hold for me.

On the chart, you can see $9.00 was a resistance zone I had in mind. We flew right past it. We are actually now close to hitting $11.00. Knowing this, $10.00 becomes a major psychological support zone. A nice round and whole number. Other than that, the next large flip zone (area where price has been both support and resistance) comes in at $12.60.

Really good combo of fundamentals and technicals. Again, I did not call a deal with Amazon, but the technicals were indicating a reversal and something coming down the pipeline.