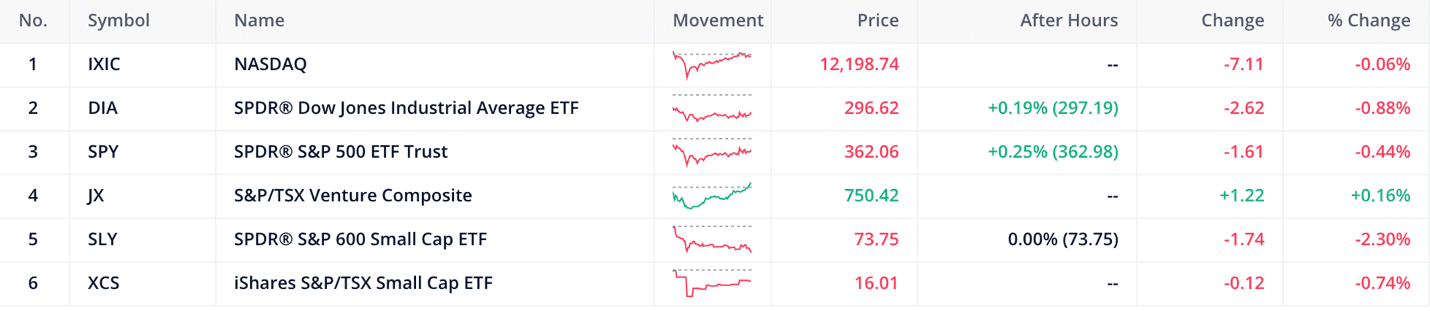

- The S&P 600 & TSX20 are down by 2.3% and 0.74% respectively

- The Canadian 10-year bond down by 0.00% and the US 10-year bond down by 0.00% as investors move capital into these safer asset classes

Today’s stock pick of the day is XS financial (XSF.C) a Los Angeles – based specialty finance company that provides equipment leasing solutions in the United States to owners/operators of cannabis and hemp companies including cultivators, oil processors, manufacturers, and testing laboratories.

As of June 30, 2020, XSF was able to generate a grand total of $2.9 million in revenue utilizing $5 million in net tangible assets.

XSF has been blessed by the market with a new valuation of $9 million today as the market reacts to the news that their revenues grew by 482% and a subsequent increase in adjusted EBITDA.

XS Financial loses $819,926 (U.S.) in Q3 2020

2020-11-30 10:46 ET – News Release

“Mr. David Kivitz reports “Our third-quarter results were highlighted by strong revenue growth and a swing to positive adjusted EBITDA. We made significant progress on several fronts, including signing 4 new leases during the quarter, which brings our total deployed capital to $6.1MM.”

Here are some of the key highlights from the news release (Q3/20 Highlights):

- Revenue grew to $3,858,329 from $663,468 in Q3/19, an increase of 482% year over year

- Monthly recurring revenue grew to $164,076 from $57,250 in Q3/19, a 187% increase year over year

- Gross profit was $76,053 versus a gross loss of $55,163 in the previous year

As we well know by now the market sometimes overreacts to new & old information. Sometimes the market overreacts on the downside and sometimes on the upside, it seems to me XSF shareholders may have overreacted on the upside. Obviously, there is a need for me to support this conclusion, and this is where proper due diligence comes into play. We’ll start by looking at the day to day operations of the business, and then dive into the fun stuff like valuation and price.

XSF mainly generates equipment sales and leases through its employee sales force, which focuses on equipment vendors and direct equipment users. XSF is noteworthy compared to the traditional equipment leasing companies in that it:

- offers equipment-specific leasing, sale-leasebacks, and purchasing solutions.

- contracts are primarily generated through its relationships with industry vendors that provide XSF services at the point of sale, and direct relationships; and

- provides analytical and support services, equipment procurement, and testing protocols beyond the equipment manufacturers whose products it is leasing

To manage the equipment and consultation portfolio they are lead by David Kivitz who is the CEO & Director. Mr. Kivitz has a Bachelor of Business Administration from George Washington University. He was previously Managing Partner and Co-Founder of Alta Verde Group a residential real estate development company creating architecturally elegant homes set in highly desirable.

The most notable executive team members would be Trever Kross the Operations Manager and Jim Bates the Director of Credit. Mr. Kross has extensive experience in cannabis extraction and maintenance of laboratory equipment as well as regulatory knowledge in both pharmaceuticals and cannabis.

Then we have Mr. Bates who has been an equipment and leasing professional and has over 30 years of managing risk. This experience allows him to watch over the lease portfolio for any redundancies or credit defaults that could happen from some of the clientele. It’s important for the quality of their leases to be good to keep cash flows in the business adequate for working capital or general cash needs.

With a somewhat healthy management team, the objective is to be competitive and hopefully sustain a competitive advantage. To stay afloat XSF is exposed to two main markets

- the first of which is the equipment leasing market usually done by larger financial institutions or specialty firms like XSF.

- the second would be the cannabis market. Although they are not directly involved with the selling and commercialization of cannabis they are indirectly exposed to the industry through their relationships with their clients. Whose main line of business is the commercialization of cannabis.

The management team is fully aware of these hurdles and states in their reports that :

While the Company recognizes the challenging market dynamics of the Cannabis sector, XSF remains well-positioned to execute its business plan due to the fact that many Cannabis businesses require mission-critical equipment to operate and grow, but lack sufficient access to new capital or are burdened with expensive sources of financing.

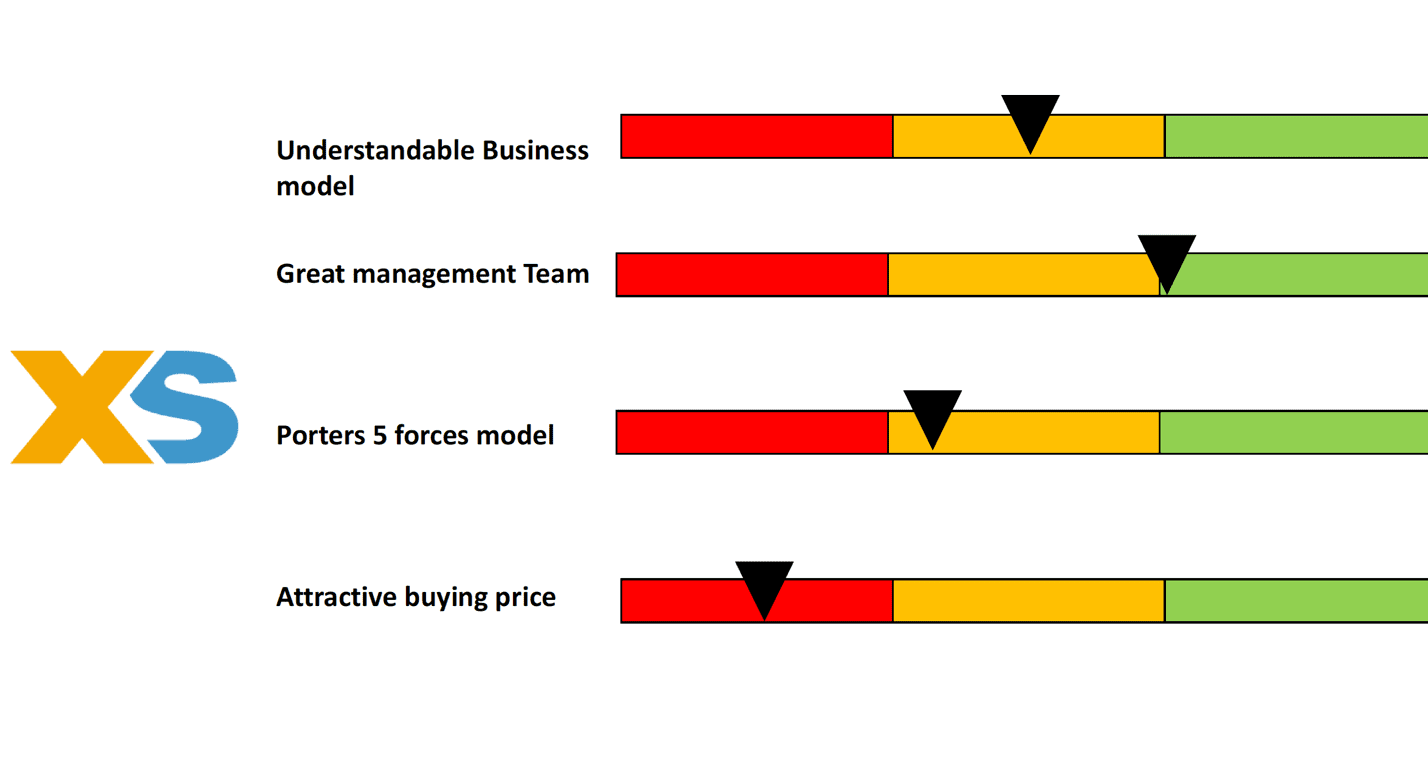

Now with a better understanding of how competitive the industry can be, the experience that the management team has to run the day-to-day operations, and how relatively difficult it can be to understand the XSF business model with little to no experience in equipment leasing and financing sector. We can now try to use this information to come up with a conclusion of how much we think the stock will be worth in the future as a potential investor.

Since we have no cashflows to discount, we are forced to use alternative valuations. Since these are secondary measures we will need a larger discount as a purchase price to be compensated for the added risk and uncertainty. This discount can be seen as a margin for error, just in case, our brief analysis is dead wrong.

Balance Sheet Analysis

This part is relatively simple and takes a few steps to get to a valuation. Since the business profitability is derived from investing cash in a sales force that is able to build a lease portfolio, we know the book value is important.

To start off we take some of the very liquid assets like cash and any short-term investments and take them at face value. This is because cash and stocks and bonds can be sold in the market for a settlement of between one to two days. Once we’ve done that, we can take a look at the other assets and subtract anything the business owes to come up with a valuation. This valuation is more commonly known as book value per share.

XSF has $5 million in assets(of which $3 million are in cash and short-term investments) and they have $4 million in total liabilities, giving us a book value of just below $1 million.

Peer Analysis

Now that our book value analysis is done we can use the $1 million valuations as a starting point. We can take a look at the EV/Sales ratio for XSF and use this as a very rough measure of how much the business should trade for compared to its peers. We use Sales instead of EBITDA or EBIT because the business is not profitable and shows no sign of breaking even soon factoring in how competitive the leasing market is.

XSF has an EV/Sales ratio of 3.9x compared to the industry average of 0.9x. Relatively speaking that puts XSF at an equity valuation of $2.7 million and should trade at 10 cents compared to the 30-cent price. This indicates a potential premium of 300%, meaning the stock might be overvalued.

Our price range from our analysis put the price of the business between $1 million ($0.02 per share) and $2.7 million($0.1 per share). This range can be room for many errors by itself but compared to the current market value of $9 million ($0.3 per share) we can conclude safely that the current price is unattractive.

Below is a great visual summary of our analysis and shows how subjective the investment analysis process can be.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.