Investing is a particularly fluid art. This fluidity shows itself in the selection of an appropriate intrinsic value. And it is always best to go back and recheck your analysis just to make sure. Today that’s exactly what I will attempt.

About a month ago, I wrote about XF Financial, a firm that deals with cannabis and hemp equipment leasing, in this article, I came to the conclusion that :

“Our price range from our analysis puts the price of the business between $1 million ($0.02 per share) and $2.7 million($0.1 per share). This range can be room for many errors by itself but compared to the current market value of $9 million ($0.3 per share) we can conclude safely that the current price is unattractive.”

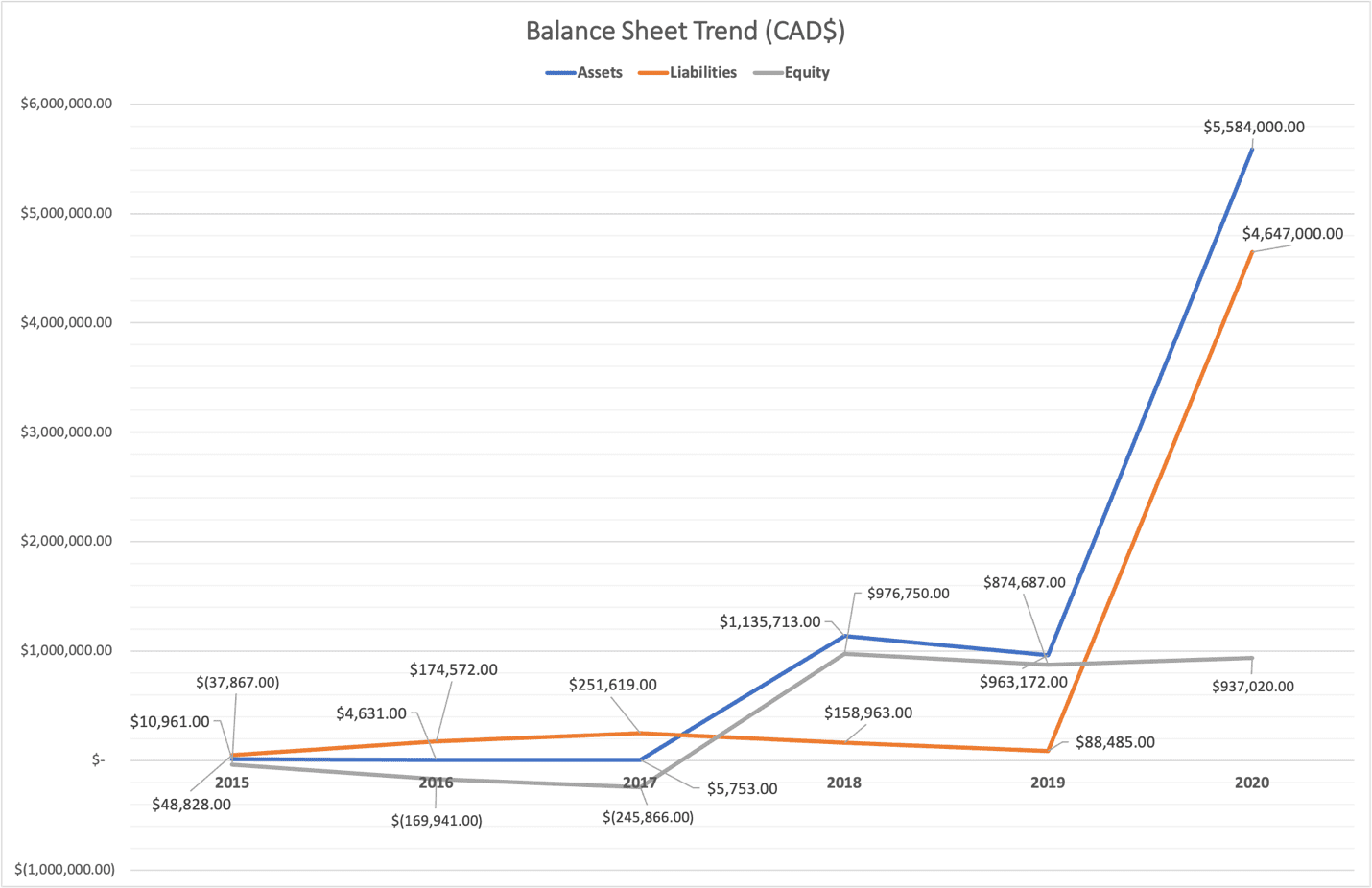

The first part of that valuation range came from the balance sheet analysis. By briefly using the quarterly financial statements, I came up with the value for the entire business tangible assets of about CAD$ 1,000,000.

When I wrote this, it seemed pretty clear to me that this was an appropriate starting point for the price. But many people have asked me how I came up with such a low number when the market at the time was selling the business at CAD$ 7,000,000.

So, I thought the best way to explain this would be to go through my balance sheet analysis and explain each line item. The benefit of doing this research a month later is that now we have new numbers (meaning the financial statements ending September 2020), meaning that we can update our model.

This should go to show that investing should not be static, and your theory should always be changing as you receive new information.

John Maynard Keynes, an English economist, who is popular for his writings on asset prices said that:

“When it comes to making guesses about the movements of an auction market (like the stock market), It is better to be roughly right than precisely wrong.”

Balance Sheet Analysis Redux

“This part is relatively simple and takes a few steps to get to a valuation. Since the business profitability from investing cash in a sales force that is able to build a lease portfolio, we know the book value is important.”

P.S. -The observant reader will notice I described the beginning of the analysis by referring to it as simple. The irony is now I have to explain the simplicity. I guess Einstein was right when he said :

“It can scarcely be denied that the supreme goal of all theory is to make the irreducible basic elements as simple and as few as possible without having to surrender the adequate representation of a single datum of experience.”

Or simply put …

“Everything should be made as simple as possible, but no simpler.”

The fact that we’re doing a balance sheet analysis implies that we’re using book value as a proxy of economic worth. Today most businesses don’t have a lot of tangible assets, and they have very little in terms of property plant and equipment. The majority of earnings power comes from economic goodwill. This goodwill can be thought about as brand name, intellectual property, patents, and other things that aren’t tangible, that allow businesses to be highly competitive.

However, companies deal primarily with companies that deal with financial assets, some examples of which are stocks and bonds. Others that aren’t as recognizable would-be mortgage-backed securities, loans, deposits, and other instruments that are similar. Because of this, financial companies derive most of their earnings potential from their interest-earning assets. This matter alone gives weight to the book value of the business (over normal business profits,) when it comes to calculating the potential economic worth.

Using XSF as our case study, we see that the company predominantly generates equipment sales and leases through its employee sales force, which focuses on equipment vendors and direct equipment users. It provides customers with the option of leasing equipment and consideration for monthly lease payments according to the lease agreement with each customer.

From this, it seems clear that the business net sales revenue minus https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative costs would be a great approximate of the profitability before taxes and interest payments.

As of the nine months ended Sept 30, 2020, the business generated CAD$5,000,000 in revenue after deducting almost the entire amount(about 97% of the sale) in the form of costs of sales. This left the business with a gross profit of CAD$133,824 over nine months.

With total operating expenses of about CAD$1million, it meant the business was generating red ink. They had to finance their operations by issuing debt securities. A large portion of their expenses comes in the form of https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses used for payroll, stock compensation, and other sales costs.

At the end of September, the total https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses were 24% of the total revenue. In 2019 https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses were 170% of the sales revenue for the same time period. This shows a general improvement in cost management and hopefully leads to better corporate efficiency. Although the business is efficient it is yet to produce a sustainable cash flow, prohibiting such an analysis.

“To start off we take some of the very liquid assets like cash and any short-term investments and take them at face value. This is because cash and stocks and bonds can be sold in the market for a settlement of between one to two days. Once we’ve done that, we can take a look at the other assets and subtract anything the business owes to come up with a valuation. This valuation is more commonly known as book value per share.”

Having looked at the business and established that book value is important, we need to make some adjustments to some of the assets. These adjustments will help us get an approximate liquidation value, assuming XSF was to be sold today with prevailing market conditions.

The business has a stockpile of cash in their Q3 report of about CAD$ 2,210,083. As with most businesses, this money is usually invested in marketable short-term bonds (usually risk-free government bonds or high-quality corporate bonds ). The term marketable here refers to the saleability that these financial instruments pose. Usually, this means the cash number represented in the financial statements is a good approximation of how much the company will receive.

Management believes the majority of their customers are of high quality. They stated in their Q3 report that :

“Target leasing opportunities will primarily consist of leases to businesses underpinned by recurring, predictable revenues, sound balance sheets, and an experienced management team.”

Of course, this is management’s ‘best’ judgment, and their words should be taken with a grain of salt. But for our analysis, it is enough to assume most of their clients are creditworthy and are ‘good’ on their payments.

This is reflected in bad debt expenses with clients that were over 90 days past due. But because receivables are less liquid than cash, we can assume that long-term and short-term receivables can be sold at about 80% of their market value.

To sell their receivables in the market, they usually have to get the services of a factoring company. These firms specialize in the sale of receivables and they take the credit risk away from the selling company. On average the cost will be about 20% of the total receivables that XSF will have to pay for the factoring companies’ services. As of September 30, they had CAD$961,418 in short-term and CAD$2,512,124 long-term accounts receivables.

They have two forms of property planting equipment(“PP&E”). The first is the brick-and-mortar property plant and equipment. This consists of office spaces and storage houses used to store the 2nd type of PP&E. Usually, larger real estate is harder to sell because of an illiquid market of buyers. It would be even harder to sell if the equipment was specialized. In this case, we can assume they would be able to sell their office space for about 50% of their cost price.

They also hold the specialty equipment that is leased to their customers. This one is harder to make an assumption about but luckily the financial reports give us an indication of what the market is like for this equipment. During the nine months ended September 30, 2020, the company sold excess servicing equipment and spare parts to a third-party company.

The total of these transactions resulted in the company reducing the book value of the equipment and inventory by approximately CAD$672,000. They recognized gross proceeds of approximately CAD$522,000 and book a loss of approximately CAD$150,000. The assets that they were holding lost 28% of their value.

This means there seems to be an active market for the equipment and spare parts and a healthy assumption of between 70 to 80% of the realizable value on future sales would be appropriate.

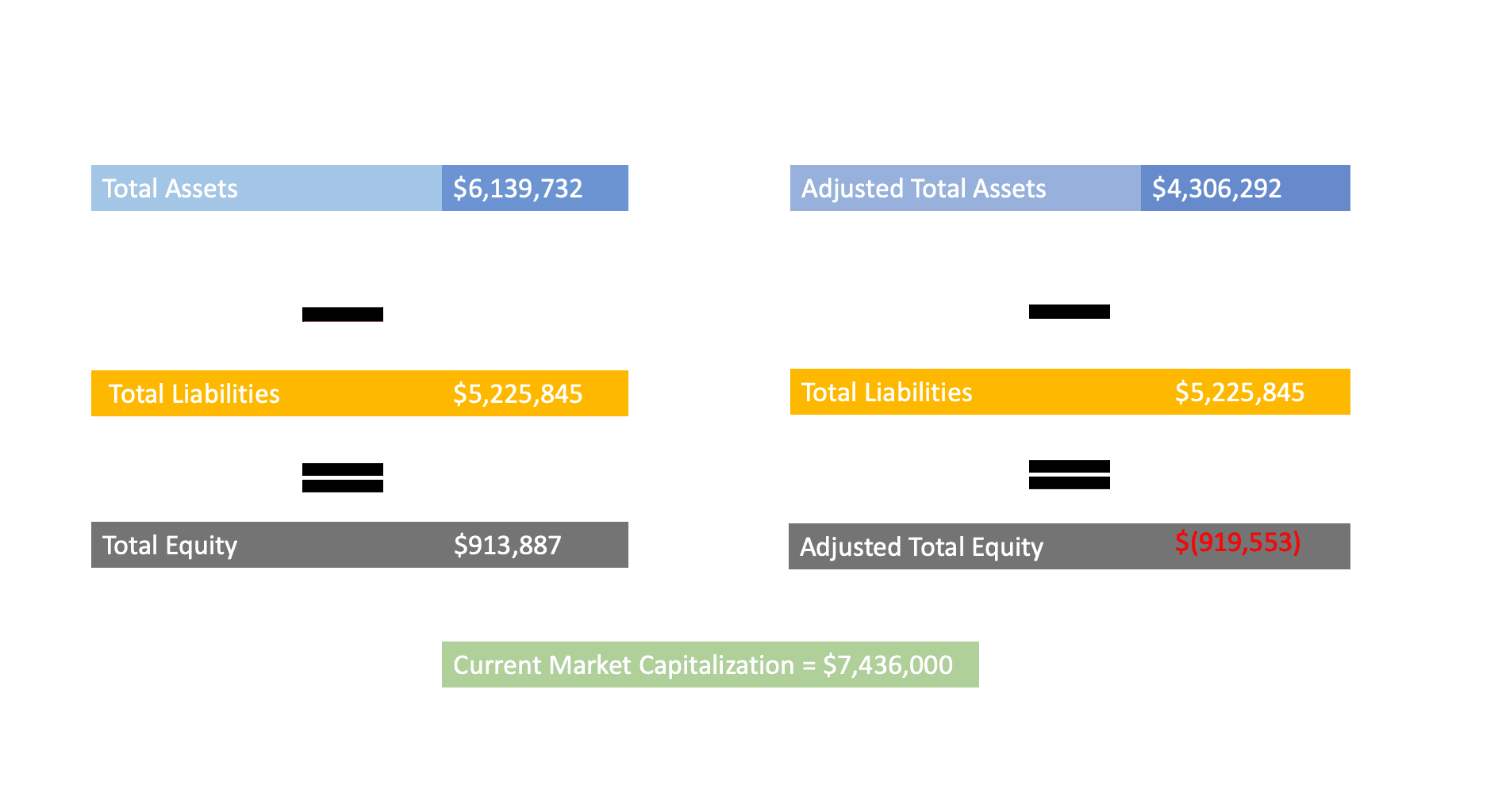

“XSF has $5 million in assets(of which $3 million are in cash and short-term investments) and they have $4 million in total liabilities, giving us a book value of just below $1 million.”

In any case, total liabilities will always be 100% paid off.

Let’s assume that some of the debt outstanding for XSF is trading at a discount of about 20% Investors would only purchase the bonds if they are trading at a discount to compensate for the risk of how unstable the cannabis industry and equipment leasing sector can be. If the bonds sold at par ($100) initially, they would be currently selling for $80.

We will assume the bonds had a maturity date of two years (making them short-term in nature ), and because of the bond covenant, the investors have to be paid the full amount of the bond at $100 when they come due. This is only possible because bonds are a contractual agreement between a lender and borrower that a certain amount of principal and interest is payable to the lender. This right is enforceable by law and any contributions made in a case of liquidation we’ll go to the bondholders first and then anything left off to the shareholders.

So once XSF pays off its short-term and long-term liabilities the residual amount left would be our equity value.

From the visual above we have two distinct scenarios. The first being the normal balance sheet that gives us a total equity value of $913,887, and the second would be adjusted total equity of -$919,553. Having done this before our conclusion last time without any adjustments was a total equity value of $1,000,000 which has significantly reduced by about 10% now. This is an indication of one of two things :

1. a reduction in the intrinsic value or earnings power of the business

2. or an inability for the XSF business model to function well in a declining economy.

Knowing this, a negative adjusted total equity does not seem too far-fetched. The situation becomes even more absurd when contrasted to the current market cap of $7 million. This implies an overvaluation of the current price per share compared to the net tangible assets per share.

Hopefully, I have achieved my goal here of de-simplifying, my previous simplified analysis.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.