New options for Litecoin users, the race for Bitcoin Cash and DeFi gets defenestrated.

It’s time for your Friday coin rundown. Let’s see what happened.

Here are your top ten coins.

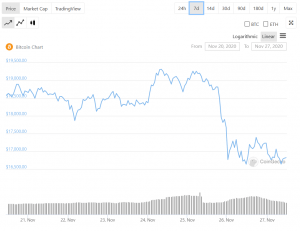

Bitcoin

market cap $311,888,124,140

When most people think of bitcoin mining (if they think of it at all) it’s usually tied to huge rooms full of servers taking advantage of subsidized electricity. Using that electricity doesn’t effect yours, and you wouldn’t even know anything was going on if you had any reason not too.

That’s more or a rich country bitcoin mining game, though. In other poorer countries, life is different.

For example, in Sukhumi, the capital city of Abkhaz, a breakaway Georgian nation that deals primarily with Russia, Bitcoin mining is draining their local electrical grid dry.

“Since 2016, cryptocurrency mining activities have started to develop in the republic in a chaotic manner. The lack of legal regulations governing this activity has led to uncontrolled consumption of electricity,” Kristina Ozgan, economy minister in the de facto government, told a cabinet meeting on November 18.

Food for thought for socially conscious types.

Ethereum

market cap $57,640,180,942

Here’s some numbers on the changes ETH 2.0 promises to bring when it rolls out next month:

Ethereum will be able to scale to around 3,000 transactions alone with rollups—without Eth 2.0—and up to 100,000 transactions per second once ETH 2.0 phase 1 arrives, by using sharded chains with data storage.

By comparison, Visa and Mastercard can authorize up to 56,000 transaction messages per second.

Alright. You’ve got my attention. Now let’s see if you can come through on your promises, Buterin.

XRP/Ripple

market cap $24,478,652,771

People often ask me what I’ve got against XRP so this week’s entry for XRP will be the answer.

XRP dumping, also known as programmatic sales, is one of the reasons I’ll never buy XRP. There’s nothing quite like waiting for a suitable rise and then having the company in control of the supply manipulate the price.

Now last year there was a change.org petition to stop the company from doing this, but honestly, who are we really kidding here? If it’s in their best interest, they’ll do it again.

Here’s @Crypto_Bitlord, who spearheaded the petition:

“Ripple continue dumping billions of XRP on us, crashing the price! Its amazing this sort of behaviour is widely accepted in the crypto world. Sure we know that XRP is a solid coin with major potential but this needs to stop!”

Tether

market cap $18,980,898,772

Australia-based West Coast Aquaculture (WCA) completed the first AUS$5 million IPO, becoming the first company in the nation to use cryptocurrency for a capital raise. The fintech firm STAX said it helped WCA raise over 89%, or a little over $4.4 million using tether. The remaining funds were in Australian dollars.

Bound to happen sometime.

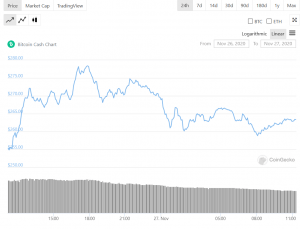

Bitcoin Cash

market cap $4,894,226,031

Given what we know of how forks work, it’s important to watch the price fluctuations directly after. Both coins will be competing for node attention with one fork generally becoming the dominant coin. In this case, we’re watching the peculiar bounces of Bitcoin Cash in the first two weeks post-fork to see if it’s going to maintain its standing. In this case, it’s jumped back up into the fifth place position, likely owing to people making their decision on which coin they believe should be the one.

Regardless, once the competition is over with one coin disappearing into the thousands and the other remaining ascendant, we’ll see how the back-office handles the change. It will also determine the coin’s true value, probably even more than market cap or price ever could. They reflect its value right now, but it’s true value is determined by the ecosystem by which it thrives, or dies.

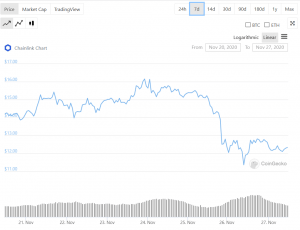

Chainlink

market cap $4,855,996,148

We covered this a little last week as it came out, but now we have a bit more information on it to impart. Decentralized finance protocols got jacked for $100 million in damages during a string of flash loan (think: instant crypto loans) attacks mostly due to the misappropriation of technology from decentralized exchange Curve Finance.

If you leave a back door open and money sitting there on the table, you shouldn’t be surprised if you find it gone the next time you look for it. The same is true on the internet, and that’s the main problem with decentralized finance. It’s too much of a temptation for a quick cash grab for folks hungry and knowledgeable enough to grab it.

Frankly, I wish the public school system had jettisoned cursive and replaced it with coding. Can you imagine where we’d be as a society if every kid was taught to code at a young age?

Regardless, Curve Finance recommended Chainlink’s decentralized oracle system as a fix.

Litecoin

market cap $4,510,098,537

It’s beginning to look like Litecoin’s going to get a bit of a push. According to a blog post, litecoin contracts are going to be available on Binance as a response to user demand. If you’re unsure of what options are, they’re a type of financial instrument that lets traders buy or sell an asset at a predetermined price either before or on a particular date. The dates on Binance’s contracts range from ten minutes through to 24 hours, which are shorter than traditional options. They can be executed at any time before the expiry date.

Litecoin is also Binance’s sixth options offering.

Polkadot

market cap $4,373,558,374

The Blockchain Service Network, or BSN, a Chinese government-based blockchain initiative announced that they will now be providing support for a batch of major blockchain protocols yesterday. The three being integrated into its ecosystem include Polkadot, Oasis and Bityaun on November 30.

Frankly, for cryptocurrency and blockchain entities, the litmus test on whether or not they’re here to stay is their reception in China.

It seems Polkadot’s doing just fine.

Cardano

market cap: $4,217,716,389

Cardano has two different things going on right now. They’ve got the decentralized identity system and interoperability with litecoin (and potentially other coins). The United States government is starting to take a cockeyed look at cryptocurrency, and since they can’t necessarily go after the blockchains and coins themselves, they’re aiming their regulatory hammer at wallets.

Treasury Secretary Steve Mnuchin is pushing regulations that would require companies like Coinbase to learn more about their customers. Specifically targeting users of self-custodial crypto-wallets. These wallets use software that allows their users to have full control over their coins, private keys and sometimes even lets users do coin management.

Now the American government wants Coinbase to know more about people and how they use their coins. Exchanges will have to verify if the users are using a self-custody wallet, and must ask their customers for information every time they attempt to make a withdrawal.

The inventor of Cardano has a response for that. He believes that regulators may try to limit users’ greater privacy options, forcing them to disclose more information by prohibiting technology like self-custody wallets.

They’re proposing Atala Prism, a decentralized identity solution that lets uses manage their own data and issue credentials. Addresses in a wallet could be authenticated by users who retain complete control over their data.

This doesn’t do anything for us few who don’t want the government knowing what we do with our bitcoin or litecoin or anycoin, or really give any data to governments or regulatory institutions, but we’re not without options.

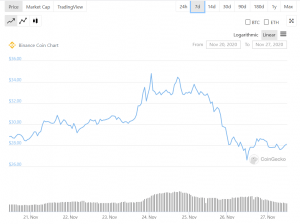

Binance Coin

market cap $4,155,203,696

If you live in the United States and you’re using Binance, you’re likely going to be receiving one of these missives in your e-mail soon:

Dear user, as we constantly perform periodic sweeps of our existing controls, we noted that you are trying to access Binance while having identified yourself as a US person. Please note that as per our terms of use, we are unable to service US persons. Please register for an account over at our partner, Binance US. You have 14 days to close all active positions on your account and withdraw all your funds, failing which your account will be locked.

Binance.US doesn’t have as many trading pairs as the main site, so it’s decently understandable why you’d prefer to use the main site, but get a high end VPN or something and spoof your IP like everyone else does. At least they’re offering litecoin options now. That’s a plus, right?

—Joseph Morton