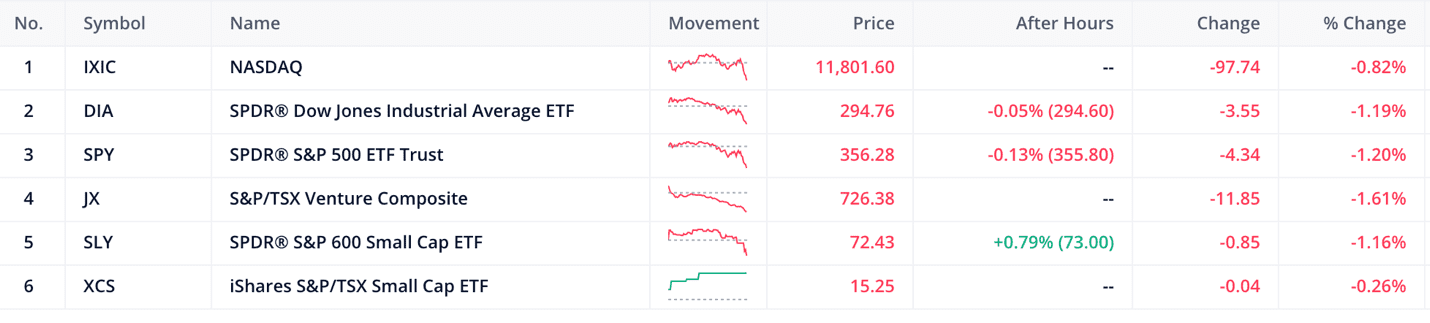

- The S&P 600 & TSX20 are down by 1.16% and 0.26% respectively

- US Bonds see a rush of capital inflows as investors move out ‘riskier’ assets.

- The Canadian 10-year bond up by 0.02% and the US 10-year bond down by 0.03%

It has been long believed by corporate America that the best way for a private company to go public is through an initial public offering. These days most companies are staying private because they want to avoid the scrutiny of the Wall Street analysts and the general stock market.

But even with the ‘decline’ of the IPO, a new beast has been formed the ‘SPAC’. I say new but this form of initial public offering has been around since the 1980s and is synonymous with the private equity industry.

According to an industry study published in January 2019, from 2004 through 2018, approximately $49.14 billion was raised across 332 SPAC IPOs in the United States. But why have they recently gained a newfound love in the professional money management field? Why are large institutions like social capital venture fund(SEE VIDEO BELOW) using this investing vehicle as a way to IPO a private company?

Is it because the process is less expensive, less time consuming, involves less legal hurdles? Or is it fraud, or a way to get the highest return for the investor?

Before we jump into the body of the article, I think it’s appropriate we explain what a SPAC is. A Special Purpose Acquisition Company(SPAC) is a company with no commercial operations that are formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company.

These sorts of operations are usually known as blank check companies. The SPAC process usually goes as follows :

- The Investor or group syndicate with expertise in a particular field will set up a blank cheque company.

- Once the blank check company has been registered in the particular jurisdiction A CEO or a group of directors is appointed.

- This group of directors will usually give themselves a strict mandate in the prospectus. With the money from the IPO that they are raising the one universal rule is that the money is being used for an acquisition of a private company in its entirety or a large portion or controlling portion of the stock in a private business. They don’t identify that target to avoid extensive disclosures during the IPO process

- Investors’ money from the IPO of the blank check company is usually invested in an interest-bearing trust for a lock-up period of between two to three years whilst the directors conduct their due diligence on the target company.

- Once the due diligence process is done and the business is acquired there is a merger between the blank check company and the target to create a new company or establish the private brand as a public company.

This is obviously a simplified version of the process but does elaborate on the general scheme of things.

This process is very similar to the IPO structure with banks’ underwriters. The difference here is that the investor in the SPAC IPO is putting their money in the hands of the CEO to select an appropriate company.

Having said this it is obvious that the most important thing is that the person or persons appointed to select the company. They need to have the expertise and the resource to select an appropriate company for investors to attain an adequate return.

This is why the SPAC process is usually done by private equity firms who are specialized in this line of business. These days large institutions like hedge funds who are allowed to invest in any type of security are getting their feet wet in the industry.

Most notably in recent news Bill Ackman the Founder and CEO of Pershing Square Holdings has broken the SPAC record with his raising of $4 Billion to invest in a ‘unicorn opportunity’. Not only has his hedge fund conducted this SPAC they also have a $400 million backing from Seth Klarman the Founder of Baupost Group a fund with $30 billion in AUM.

The interest by hedge funds shows a shift in the narrative for the SPAC as more alternative styles of investors chase yield by leveraging from outside money. Such institutions would only do this if they are promised an adequate return for their invested principal. And having looked briefly at both Bill Ackman and Seth Klarman’s styles of investing we know the businesses that they look for are usually great businesses with an economic moat and are being held for the long term.

So now we know why the investors are doing it. But what is causing these private businesses to use this alternative method of initial public offering?

Selling to a SPAC can be an attractive option for the owners of a smaller company.

- First, selling to a SPAC can add up to 10% – 20% to the sale price compared to a typical private equity deal.

- Being acquired by a SPAC can also offer business owners what is essentially a faster IPO process under the guidance of an experienced partner, with less worry about the swings in broader market sentiment.

Although SPACs have gained some steam, they are still far off from being the new way to structure a public offering. The traditional way is still used by many firms for example Doordash & Airbnb who have submitted their prospectus in recent weeks with the S.E.C.

The first modern IPO occurred in March 1602 when the Dutch East India Company offered shares of the company to the public in order to raise capital. The Dutch East India Company (VOC) became the first company in history to issue bonds and shares of stock to the general public.

The large banking institutions and investment bankers have been in the industry since the 1900s when JP Morgan popularized the deals. The IPO is still king and will be around for the foreseeable future, but more deals might flow to the SPACs when there is a lack of interest by the investment bankers.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.