2020 Election Vs the general stock market

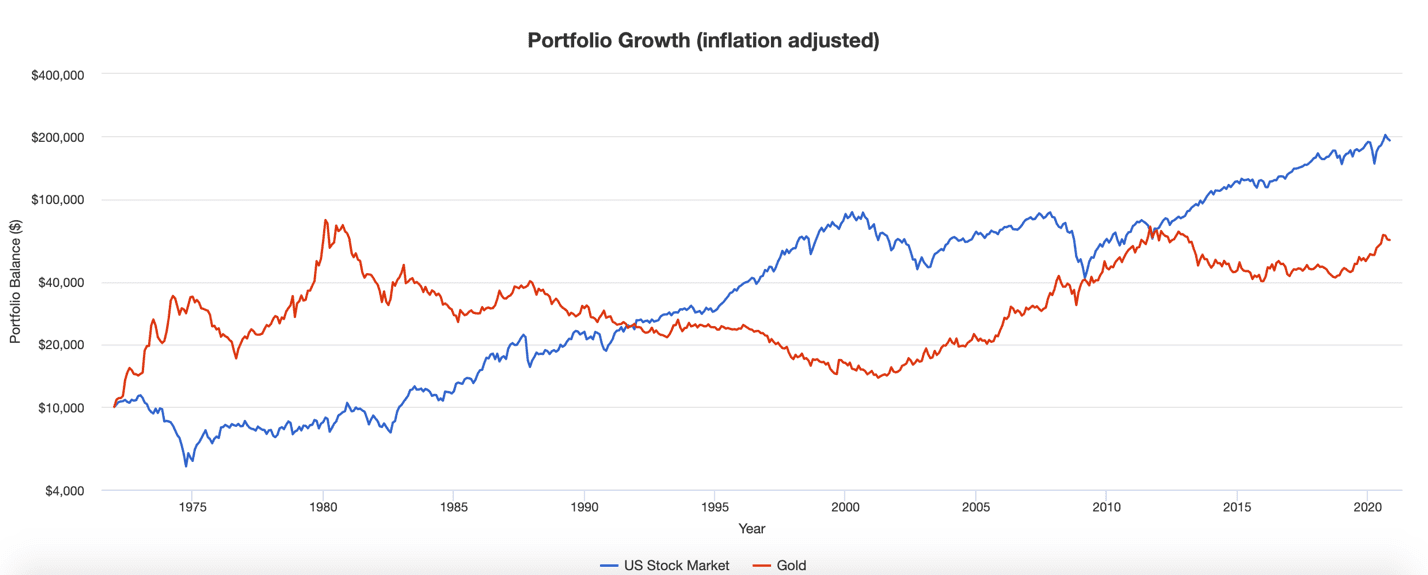

The chart above is the premise for today’s article and is an inflation-adjusted return comparison between gold and the US stock market.

This premise is the key to the conclusion of this article, this conclusion being investors should not allocate more than two minutes of their time trying to predict the outcome of the political election as it provides little to no value.

This topic is of particular interest today because we are in the midst of the US election. This election is probably one of the most anticipated and observed elections in the world because of the geopolitical economic influence that the United States has.

Most democratic elections have become a 2-party race, particularly in the United States. This year it is between Donald Trump representing the Republican Party and Joe Biden representing the Democratic Party.

But for a moment we will take a look at history as a means to an end to the question, where should the wise investor allocate their assets as they try to predict or better said navigate the outcome of the United States presidential election?

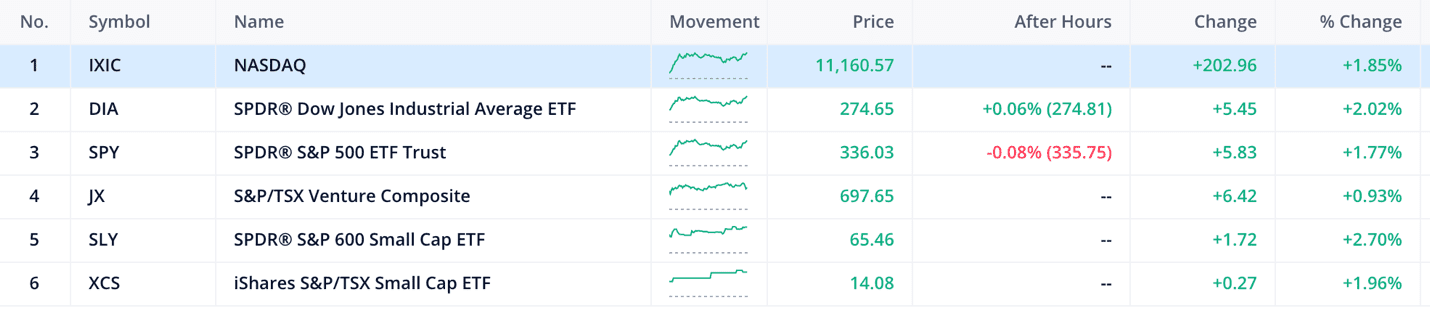

Over this 48-year period, an investor who would have purchased $10,000 in both the US stock market or the gold market would have had a compounded annual return of 6% and 3% respectively. This essentially means the investor would have turned $10,000 in the total stock market into approximately $200,000; but if they had invested in gold, they would have returned about $70,000.

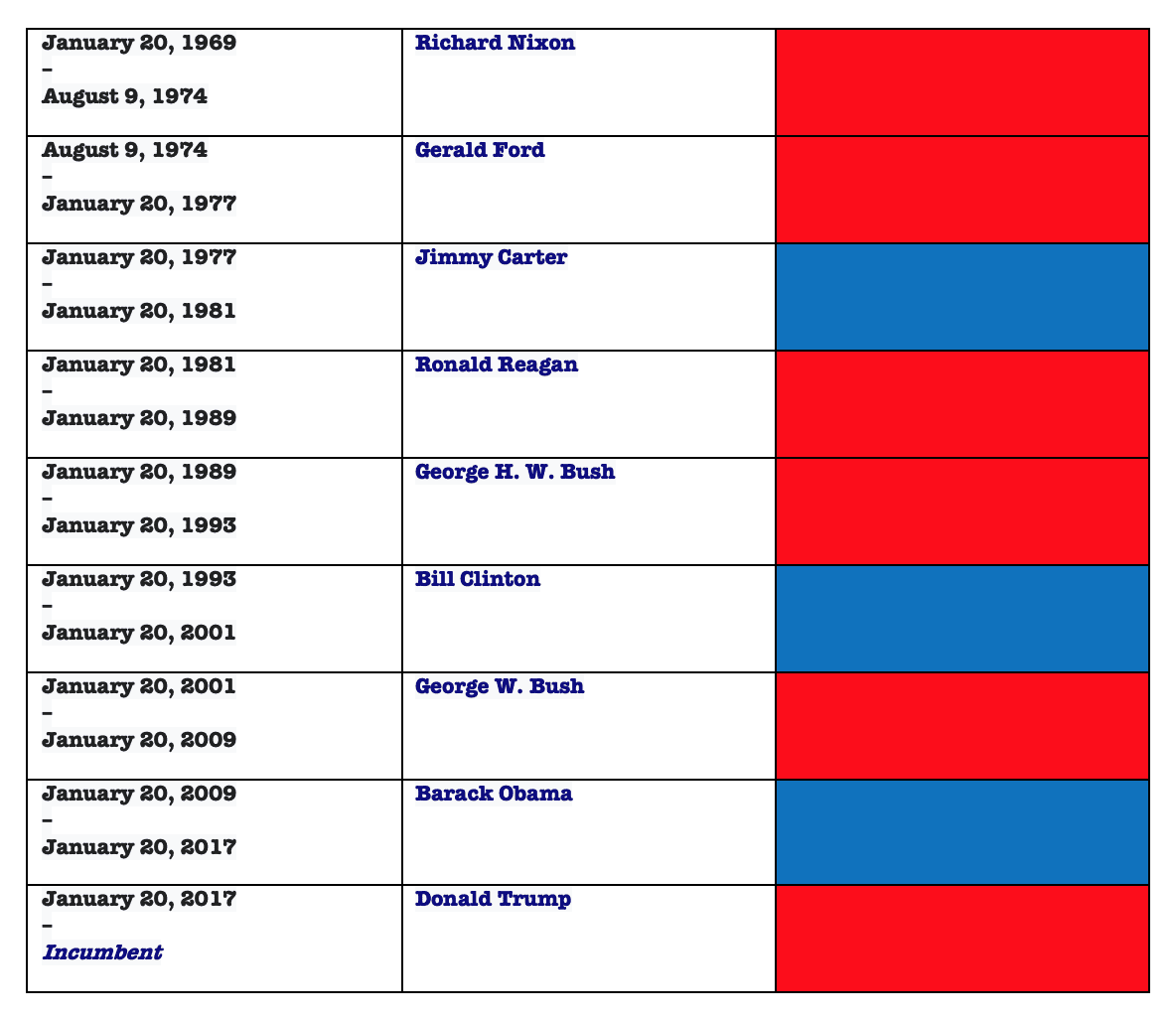

During this same period, an investor would have invested under a Republican president six times and a Democratic president three times. (See Table Below)

Each term the investor would have had to anticipate the effect of economic and political policy in their asset allocation. But for simplicity, we will assume no allocation was made, no rebalancing was conducted and the investor bought and held their respective portfolio for that 48 years.

To make matters worse in that time period we went through 8 economic recessions, the two most recent being the great recession of 2008 and the 2020 COVID-19 recession. (1972 to 2020 seems like the worst time period to be an active investor)

Despite all of this an investor who had stuck to their guns would have done fairly well over that period.

Many will argue that it is important to consider the political climate or political risk when it comes to investments, and this is true. Consideration of taxes, interest rate, social welfare, foreign currency risk should all be part of the due diligence process. These factors should be accounted for by the capitalization rate used to reduce the purchasing power of future dividends distributable from a common stock.

But the amount of time that most market participants dedicated to this practice can destroy value if not done properly.

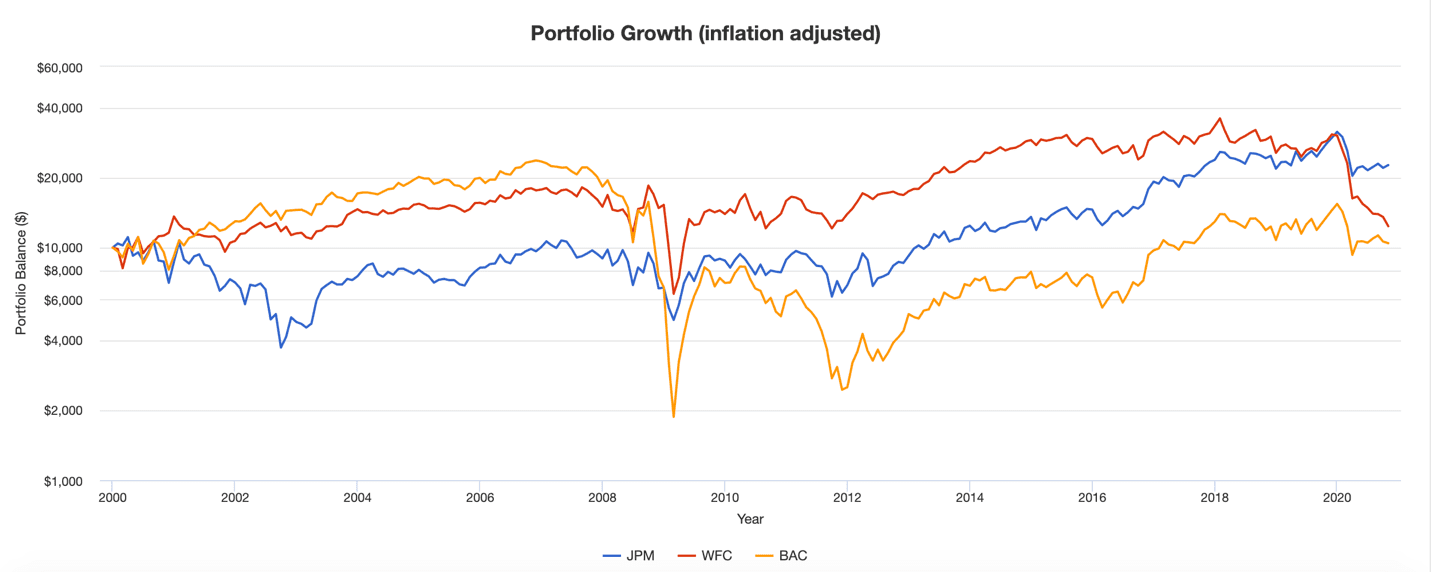

To elaborate this we will take a look at the investor in 2008 who had the job of allocating their assets during the Great Recession or better known as the 2008 financial crisis.

This was a period where many thought The Obama https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration would not be able to manage the economy and bet against the recovery of America. They felt the Federal Reserve and the United States Treasury had fallen asleep at the wheel and allowed big banks to take advantage of the public.

These same banks were allowed to walk away with little to no repercussions, and many of the bailouts used taxpayers’ money. This pessimism towards the banks caused their stocks to fall rapidly.

In true Democratic fashion, the Obama Administration reacted to this backlash by implementing the Dodd-Frank Act.

The Dodd-Frank Wall Street Reform and Consumer Protection Act is a United States federal law that was enacted on July 21, 2010. The law overhauled financial regulation in the aftermath of the Great Recession, and it made changes affecting all federal financial regulatory agencies and almost every part of the nation’s financial services industry.

But had you invested in the largest banking stock at this time you would have realized a compounded annual return of 9% from JP Morgan(JPM) compared to 8% for the total market.

What does this all mean?

Joe Biden – Career Politician

- Increase investments in American-made products and companies, pouring $400 billion into procurement and $300 billion into research and development, with the aim of creating 5 million new jobs.

- Reverse Trump tax breaks to corporations and seek a higher minimum wage and expanded benefits for low- and middle-income workers.

Donald Trump – Businessman

- Create 10 million jobs in 10 months, as well as 1 million small businesses.

- Push American companies outsourcing jobs in China back to the United States to establish 1 million new domestic jobs.

Although the two nominees have different economic policies, the implementation of these policies will have the same net effect on the economy both creating and destroying value. This last statement is not a critique of the economic policies, as it is very difficult to implement economic policies or predict the outcome of how a certain policy would affect the general economy.

This being said the investor should allocate more of their time now in investing in great businesses that earn a high return on equity, create shareholder value, and have leaders or managers that are shareholder-friendly and great capital allocators.

A warning is warranted here, the businesses described above are very difficult to come by but with proper due diligence, enough patience, and a general understanding of business economics the wise investor will find it more profitable to allocate their time and resources to the investment process instead of the political process.

Happy Hunting!

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.