Unregulated markets produce lawless hordes. In a way, they don’t have overzealous nanny state governments telling them what they can and cannot do with their time and energy. In another way, they lack protections and fraud, theft and sneaky behaviour reign supreme.

There’s an object lesson about the behaviour of the lawless hordes in the first two entries here. One is that the net is closing and the arms race between law enforcement and criminals is swinging towards the cops. The other is that the government of Italy evidently doesn’t recognize opportunities to hire and retain the best people. A little later on, we get into a more institutional form of lawless, criminal behaviour.

Also, further down is where we’ll find the real meat. Chainlink finally gets the explanation of its popularity, and something I’ve personally be ranting that we need for years—the ability to control the flow of our own information—has almost arrived.

It’s time for your Friday coin rundown. Let’s see what happened.

Here are your top ten coins.

Bitcoin

market cap $250,598,983,728

Prosecutors in the Netherlands got 2,532 bitcoins worth $33 million richer after the Rotterdam District court handed down a conviction of money laundering to a couple this week. The husband and wife dastardly duo each got two years for illegal money transmission for their lawless deep web activities.

The Dutch Public Prosecution Service from the Rotterdam District Court stated that the two suspects laundered close to $19 million using bitcoin over the past two years. Most of the couple’s earnings were stored in Bitcoin.

This kind of thing is why companies dealing with Bitcoin need Know Your Customer and Anti-money laundering guidelines in place.

“Traders did not ask customers for identity papers, while large amounts were often exchanged. The suspects, a man, and his wife, came into contact with customers through advertisements on the Internet and a marketplace on the dark web. Much of the bitcoins traded bore traces of the dark web. The court has established that the suspects laundered more than 16 million euros in two and a half years,” the Rotterdam court filing notes.

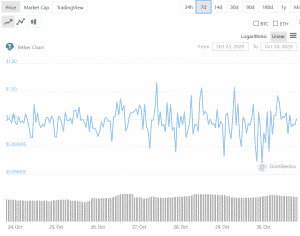

Ethereum

market cap $43,106,509,456

More criminality, but this time of a different stripe.

Airport officials at Lemezia Terme International in southwest Calabria, which geographically is the big toe of Italy, caught a 41-year old technician illegally mining ethereum off of their power supply, according to a report.

The miner was in charge of managing computer systems at Lemezia, but employed by Sacal SpA, the company responsible for maintaining the airport. The report indicated that the miner installed malware to exploit Sacal’s IT infrastructure and mine ethereum, and allegedly compromised the airport’s security infrastructure.

A translation of the authorities’ accusation stated that the employee at the airport was illegally mining ETH:

…without having to bear the costs of the electricity necessary for the 24-hour operation of the equipment, exploiting the connection of the Sacal plants and compromising airport IT security.

Seriously.

If the Italian security services were smart, they’d give the guy a job.

Tether

market cap $16,514,329,516

Let’s step away from criminality and the closing trap on cryptocurrency and have a look at another first.

West Coast Agriculture (WCA) is an Australian company operating marine farming operations in Malaysia, and they’re going to be the first company to accept a cryptocurrency—in this case, Tether or USDT—alongside fiat currency in their IPO.

“The acceptance of USDT in an IPO is a transformative move in Australia and a significant step forward for cryptocurrency adoption in general. It paves the way for the future of capital markets down under. We are democratizing access to a market which has been hard for overseas investors to get into, which will only benefit Australian businesses longer term,” said Kenny Lee, CEO of crypto-trading firm, Stax.

XRP/Ripple

market cap $10,760,383,834

Brad Garlinghouse, Ripple’s CEO, has opinions.

He’s stated recently that tech companies have an obligation to solve societal problems. This is one of the reasons I don’t like Ripple, and won’t buy XRP. Because Garlinghouse seems to not understand that his core role as CEO of a company is to make his shareholders money and raise the value of his coin.

“We think about our mission as enabling an internet of value, but we seek positive outcomes for society, adding, The sad reality is — and I say this as a long-time veteran of Silicon Valley — some of these (societal) problems are, at a minimum, exacerbated by the tech platforms themselves,” said Garlinghouse.

Most of the coins are in the red this week. Maybe he should stop trying to solve the world’s problems and focus on his own house.

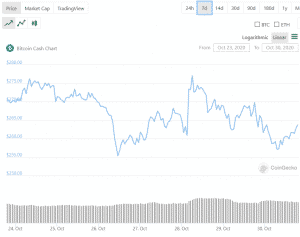

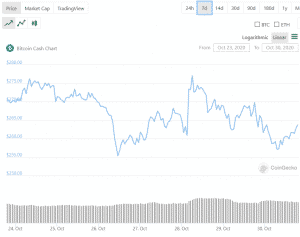

Bitcoin Cash

market cap $4,795,558,315

Monero is now beating some of the leading altcoins in terms of payments.

Monero isn’t on this list because it’s not in the top ten per market cap. It’s actually 14th, with $2.1 billion. Why it’s being mentioned in the spot normally offered to BCH is because it’s performing much better than BCH as a payment option. BCH is supposed to be the payments version of Bitcoin. It’s supposed to scale better, and periodically makes it into the news whenever a company in the far east adds a vending machine that takes BCH into their break room.

Maybe Monero would be the better option. Especially as concerns about personal privacy begin to take centre stage. The total fees on Monero have passed Bitcoin Cash in April. The coin preferred by lawless types like cartels, Al-Qaeda and your Mom is performing better than BCH in terms of payments.

“There seems to be a perfect storm going on where liquidity is up, supporting more payments than were previously reasonable, which thus are driving more liquidity. It’s a positive feedback loop from more payments moving to Monero with its greater liquidity as far as I can tell,” said Justin Ehrenhofer, a community lead in the Monero project.

Chainlink

market cap $4,302,556,642

If you’re anything like me than you’ve been curious about the source of Chainlink’s popularity. It doesn’t have the OG cred that Bitcoin’s got, nor is it the world’s supercomputer, or backed by a corporation, or (questionable) utility like BCH.

The popularity comes from a few different sources, including the firm’s business model. Chainlink isn’t looking to compete with other cryptocurrencies. Instead, it wants to push the entire sector ahead through its protocols.

First, Chainlink is trying to solve one of the biggest problems with blockchain—which is how to communication information to and from the blockchain. Normally, this is done through sensors called oracles. They’re set up to monitor nearly anything—be it the weather, sports scores, account balances, the movement of stocks.

Oracles are centralized, and that makes them the weakest link in the blockchain. If one gets compromised then it puts the entire network at risk. It causes something called the Oracle Problem where a backlog of faulty information bogs down the chain, effectively compromising the integrity and value of the information. Chainlink’s raison d’etre is to tackle these issues by integrated various next-generation protocols, effectively creating the world’s first blockchain oracle network.

It’s purpose would be to use the same tech found in traditional blockchains to ensure that the nodes are functioning properly and that their data is accurate.

Binance Coin

market cap $4,209,293,321

Let’s return briefly to criminal behaviour, shall we?

Forbes magazine released an article detailing Binance’s operations—how it would funnel revenue to Binance through a web of corporations without drawing the scrutiny of regulators. Based in the Cayman Islands, Binance is responsible for about $10 billion in total cryptocurrency trades per day.

It’s kind of amusing in a way. The as yet unnamed U.S. company involved is called the “Tai Chi entity” after a principle in martial arts called ‘yield and overcome’ wherein an opponent will use his own opponent’s weight and inertia against him. Except that Binance is huge. The company has gone out of their way, short of wearing high-vis vests and taking out a billboard, to make it known to regulators that they’re not a lawless shill for criminal enterprises, and are on board %100 with compliance. Except this document says they’re not and it seems that Binance.US has an ulterior motive.

What does this mean for BNB? Again. Whatever happens to the Binance exchange—which may be the most crooked exchange of all the high visibility exchanges—invariably trickles down to holders of BNB.

Polkadot

market cap $3,782,749,121

Polkadot collaborated with 49th ranked Ontology last week to improve on the efficiency of its Decentralized Identity (DeID) solution.

Decentralized Identity is precisely what it says it is. A way of codifying, controlling and protecting your information on a blockchain – be it passports, metadata from your e-mails. Using blockchain for identity is about digital validation and keys, just like getting access to your holdings. You’ll need to have access to a device to validate identity but if some lawless type steals it, then it would be the functional equivalent of stealing a Trezor wallet. You won’t be able to go into it without the passwords.

The development will increase market outreach and accessibility for Ontology’s DeID using Polkadot’s cross-chain features, which allow for interactivity between blockchains. That will make Ontology’s DeID available on other chains operating on Polkadot when the integration is finished.

Litecoin

market cap: $3,530,405,077

Venezuela has this on-again off-again relationship with cryptocurrency. When their currency went to hyperinflation hell, the average citizen took to Bitcoin and Ethereum to bypass most of the state-sponsored corruption and lawless bullshit associated with … well, dealing with anything the state of Venezuela does.

Then Venezuela introduced their own cryptocurrency, the petro, and needless to say, it was something of a bust.

Now in a case of ‘if you can’t beat em, join em,’ they’re going to overhaul its crypto-compatible remittances platform Patria to allow folks to use litecoin and bitcoin. The twenty million user strong platform lets people send money overseas to family and friends in Venezuela in both fiat and crypto.

Remittances have been a good way for individuals to get around the United States led sanctions against the country that prevent banks and payment providers from dealing with transactions too or from Venezuela. The changes could see a flat commission rate for all transactions conducted in LTC, BTC and the Petro.

Bitcoin SV

market cap $2,981,859,195

There isn’t much to say about Bitcoin SV. It’s retaken the tenth spot by market cap, but not by much, and it likely won’t be here next week or the next time Cardano offers any reasonable movement. But there is one positive thing to note, and it comes at the behest of a cryptonews.com analysis article:

“When it comes to the last coin on this list, a whopping 94% of the wallet addresses are making money. 2% are at the money, and only 4% are at a loss. 90% are said to be holding it for more than a year. Additionally, 28% of the holders are defined as whales.”

There are people making money from this coin and that’s about as close as I’m going to get to an endorsement for one of Bitcoin’s Bastards.

The increasing attention on the crypto-space from business and world governments could theoretically be a good fix. The addition of regulations could do much to ease off some of the lawless reputation, but at what cost?

—Joseph Morton