It was a very volatile day on Wall Street yesterday. A red day the likes of which we have not seen in quite some time, on the back of what has been boring range days. In yesterday’s Market Moment post, I spoke about why we should expect this type of price action leading to the US election, which is now 7 days away! If you are a money manager using the asset allocation model (stocks/bonds), this is the time to exit stocks and go heavy into bonds. A risk off environment. It really is not worth trying to guess who will win the election, and more importantly, HOW the market will react to that winner. If you are about to initiate a larger position, it is probably best to await until after the election to avoid all the noise. The key word here is uncertainty. The stock markets hate uncertainty, but after the election things will be more clear. Or so we hope. My confidence crisis in government analysis still holds, and I do believe that whichever part wins this US election, the other side will not accept the results.

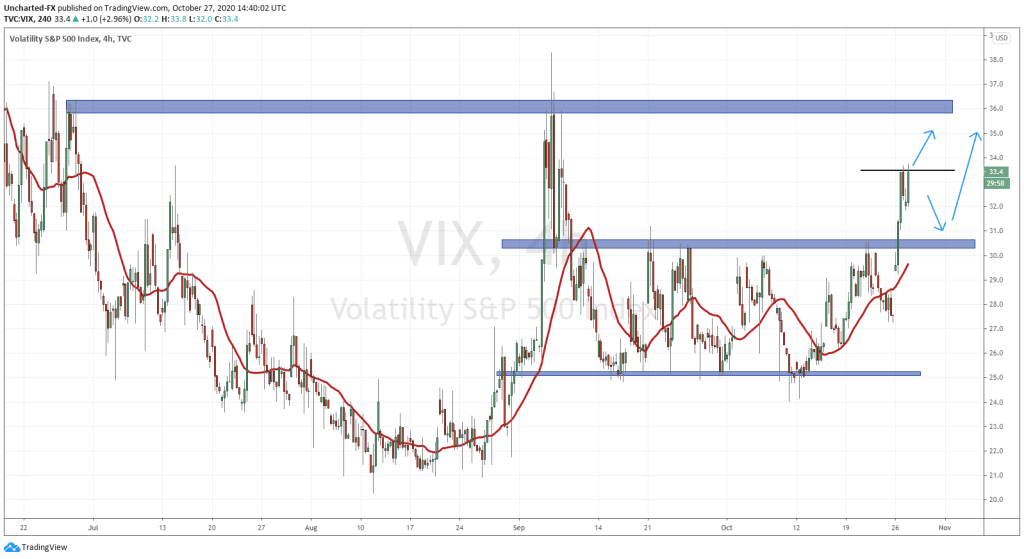

Also in yesterday’s Market Moment post, I showed the evidence of money flowing into risk off assets. The chart of the 10 year yield was dropping, indicating that money was leaving stocks and either remaining in cash, or heading into the safety of bonds.

Remember, when the yield moves down, it means bond prices are moving up. There is an inverse relationship between bond prices and bond yields.

The big key for us was whether yield would break below the 0.80 level. Even though we are looking at yields, all markets share the same structure: uptrend, range and a downtrend. This means my analysis can be applied to all markets. Bond yields are no exception. This is a big key break, which is indicating money will be heading into bonds. Now the candle has not closed yet, so we need to await this close to confirm the breakdown. It is still possible for this candle to reverse and close back above.

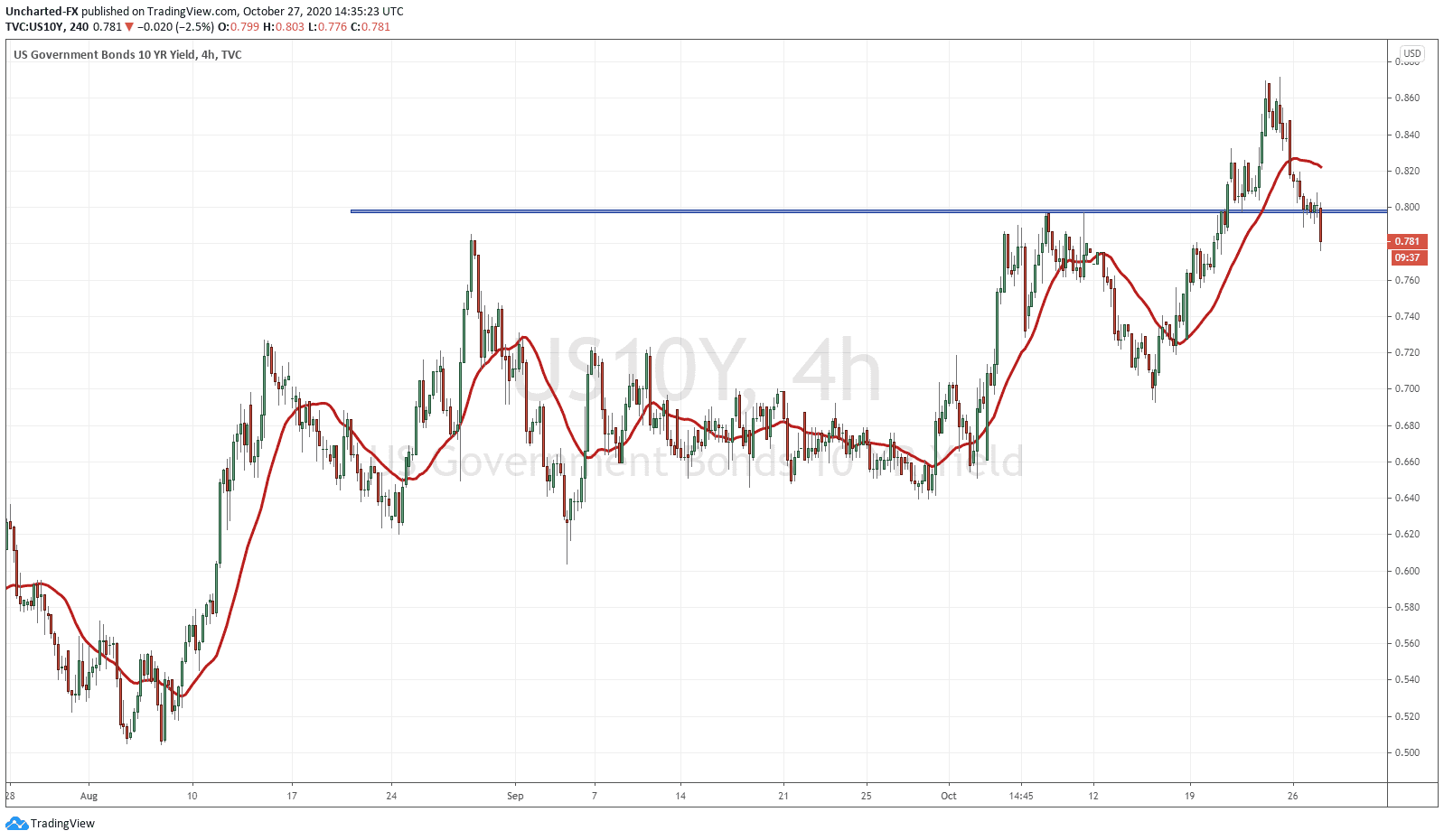

A very popular way to gauge fear and uncertainty in the stock markets is by looking at the volatility index (VIX). Very simple to use. When the VIX moves higher, it means there is fear and uncertainty. When it moves lower, there is no fear. The move higher means more volatility, and the move lower means less volatility. Believe it or not, but the favorite trade on Wall Street for years has been to go short the VIX, and then go long a stock index. Wall Street makes more money when there is LESS volatility than when there is more volatility. It is something I stay true to as well. I tend to avoid very volatile markets and focus on market structure.

However, we can use the VIX to aid us in making trades in other assets/markets.

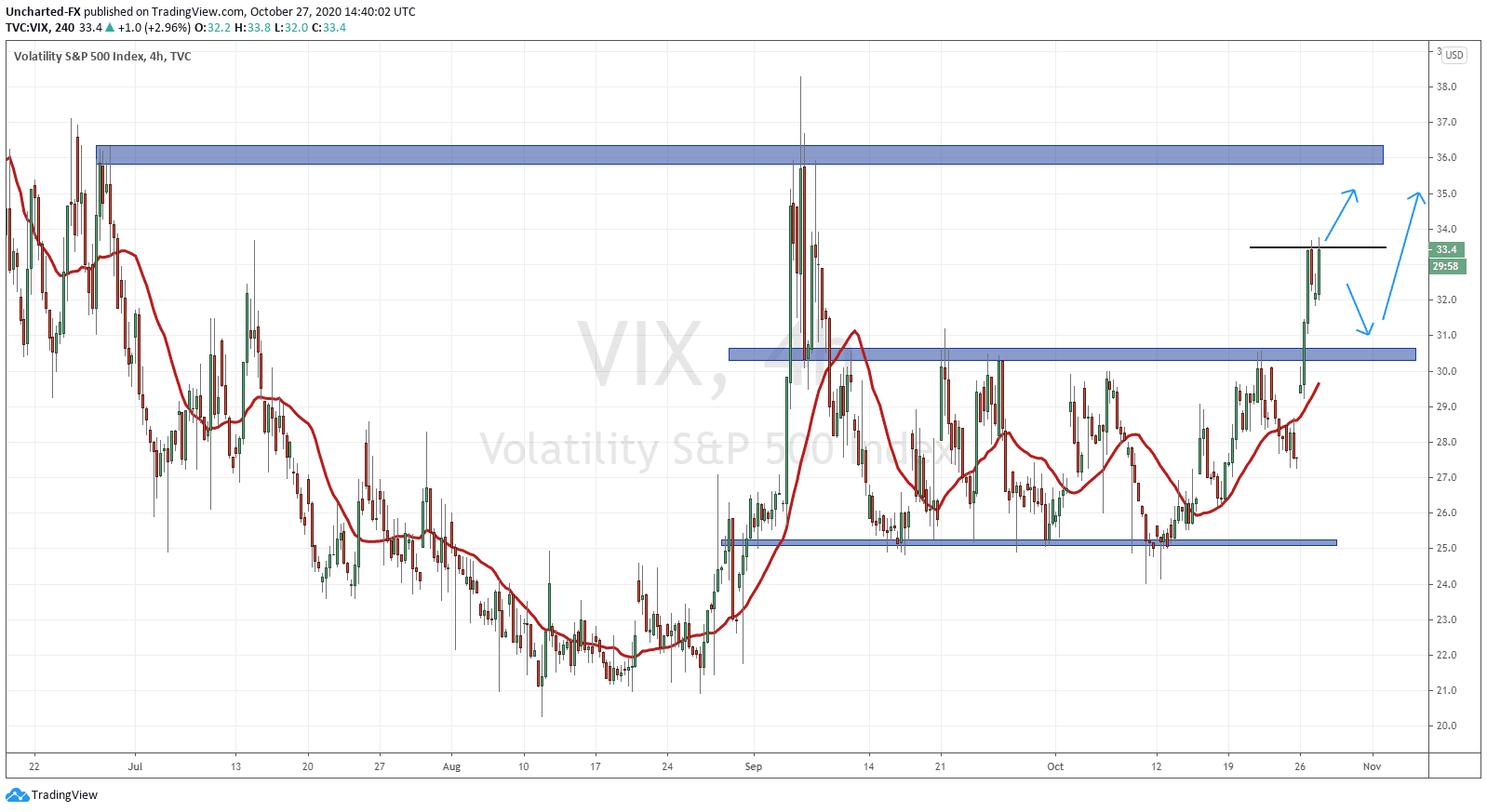

If you are a member of our free Discord trading room, we have been watching this VIX range for weeks! We have used the upper and lower band of the range to forecast the choppy moves in the stock markets. As long as this was ranging, markets also tended not to make a concrete move in either direction. Well this is about to change!

After nearly two months, the VIX finally broke and closed above the 30 zone. This breakout was telling and indicated fear is returning…but more importantly, that more fear and volatility is ahead. Once again, no surprise as we are heading into a US election.

There are three things which can happen now with the VIX, and how this will impact the stock markets.

Firstly, we either pullback to the breakout zone at 30, retest it and then breakout higher. This would form a higher low swing for the VIX, which is key for an uptrend. This would mean stocks fall lower due to more volatility.

Secondly, we fail the breakout. The VIX moves back down to retest support at 30, and we do not bounce. Price rather breaks and closes below. A fake out or false breakout. This scenario would see stocks shake off this volatility and uncertainty and move HIGHER.

Thirdly, and what seems to be playing out currently, is price forms a higher low swing here rather than pulling back all the way down to support. As you can see on the chart, price retraced a tiny bit before seeing another pop up to yesterdays highs. What we need now is a close above yesterdays highs and then we will confirm a new higher high. This would take us higher to resistance at 36. Stocks would feel the pressure.

The third scenario has a higher probability because the stock markets also seem like they want to make another lower high swing in their recent downtrend. The VIX can be used to confirm that the downtrend in stocks still has some room to go.

Heading into the US election, let’s keep our eyes on both the 10 year yield and the VIX. They both highlight the risk off environment and the uncertainty the markets are coping with. We should expect volatility heading into Tuesday and then the day after the election on Wednesday.