One of the strangest, most surreal elements of 2020 has to be that there are retail outlets out there which no longer accept fiat currency and those that still are, do so with an abundance of caution. There are signs in some of my favourite places that suggest paying with card instead of cash, when every other year of my life it’s been the opposite. Cash is king and cards are optional. Now COVID-19 and the prospect of transmitting a potentially fatal illness along with your $5 bill have turned that upside down.

If there’s a silver lining to all of this it’s that it’s made the argument for digital currencies that much stronger. There’s an increased interest in digital currencies from central banks and consumers, and there had been rumblings about PayPal Holdings (PYPL.Q) getting onboard with cryptocurrency for awhile. Today’s announcement brings it to fruition.

They’re offering the ability to buy, hold and sell Bitcoin, Ethereum, Bitcoin Cash and Litecoin, each within the PayPal digital wallet. The service will go live in the coming weeks for PayPal account holders in the United States, and will extend to Venmo and some international markets in the first half of 2021. The service is coming to the United States at the behest of their partnership with Paxos Trust Company, which is a regulated cryptocurrency product and service provider.

I’m generally not a fan of PayPal for reasons that have everything to do with past experiences as a customer. I think they’re a terribly managed company with byzantine customer service operations, and frankly, aren’t suitable to be in charge of a tyke on a trike let alone my money, but your mileage may vary.

Regardless, if PayPal doesn’t botch it, then it will be good for cryptocurrency, because it will push funding options for digital commerce out to their 26 million merchants. Granted, you won’t be able to transfer your cryptocurrency out of their walled-garden system without cashing out into fiat, but that’s what you can expect with a proprietary system. If there’s anything positive to say about this it’s that it compliments the argument that widespread adoption of cryptocurrency is coming.

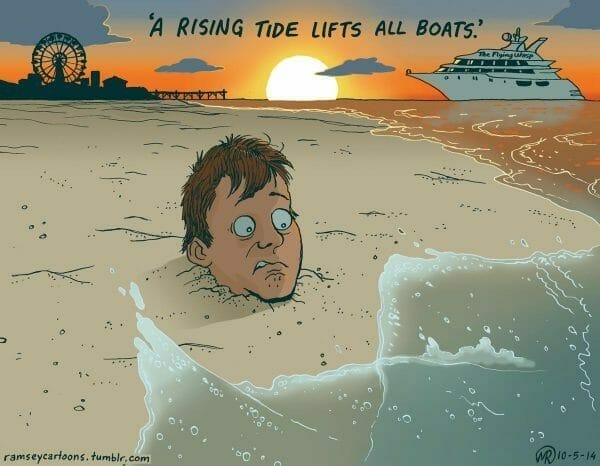

Some of the hurdles to widespread adoption to date have been the learning curve, volatility, scaling, and cost.

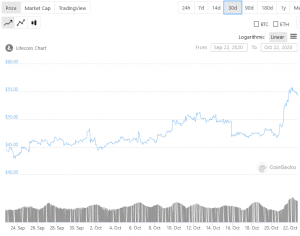

For example of volatility as determining factor let’s consider that you can buy one Litecoin for $72 today. (Technically it’s $72.89 today, but let’s not split hairs.) Theoretically you could exchange it for $72 worth in goods and services, but if you’re wise, then you know that your litecoin was worth $61 on Tuesday and $69

yesterday. If the trend continues then it’s entirely possible that the $72 you spent today could be worth double that in a month or two, or maybe half what you paid. It’s this kind of ‘what if’ that’s impeding adoption as a medium for exchange. FOMO invites paralysis.

PayPal isn’t going to fix that problem nor are they saying they will be. As long as cryptocurrencies float freely without manipulation, they’re going to be reliant on the contrary weight of supply and demand, but there has been some evidence that volatility eases over time.

What I’m curious about is what PayPal is planning on doing regarding scaling, especially with Bitcoin, and specifically how they’re going to mitigate their own counterparty risk. It still takes ten minutes to close the block, which means ten minutes to complete a transaction. The problem with using PayPal for crypto-purchases before is that there was nothing stopping the Bitcoin seller from voiding the purchase before the block closed, and then running off with the sellers money. There’s going to be some variety of intermediary between the two for this system to draw the necessary confidence.

Regardless, here’s Dan Schulman, president and CEO for PayPal:

“The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of financial inclusion and access; efficiency, speed and resilience of the payments system; and the ability for governments to disburse funds to citizens quickly. Our global reach, digital payments expertise, two-sided network, and rigorous security and compliance controls provide us with the opportunity, and the responsibility, to help facilitate the understanding, redemption and interoperability of these new instruments of exchange. We are eager to work with central banks and regulators around the world to offer our support, and to meaningfully contribute to shaping the role that digital currencies will play in the future of global finance and commerce.”

There are some rather curious changes started by the events of 2020. First and foremost among them is that the Bank for International Settlements states that one in 10 central banks expect to issue digital currencies in the next few years. China, for example, is already onboard, having forged deals with companies to start testing out their digital yuan.

Here’s a YouTube clip on the subject:

PayPal is going to be looking to get a piece of that pie. Not necessarily the Digital Yuan, but the central bank issued digital pie. For the past five years they’ve had a blockchain focused research time exploring digital financial services infrastructure and enhancements to digital commerce. Last year, PayPal Ventures, their venture capital arm, invested in TRM Labs, a company that works with financial institutions to prevent cryptocurrency fraud and financial crime, and Cambridge Blockchain, a blockchain-based identity management software company.

The second most curious function of this shift is the creation of a zygote of a functional regulatory regime for cryptocurrency—rolled out specifically for PayPal in the form of what’s being called a Bitlicense by the New York State Department of Financial Services (NYDFS).

“NYDFS’ approval today follows our June 2020 announcement for a new framework for a conditional Bitlicense to encourage, promote, and assist interested institutions to have a well-regulated way to access the New York virtual currency marketplace in a way that is both timely and protective of New York consumers, through partnerships with New York authorized virtual currency firms,” said Linda A. Lacewell, superintendent of the NYDFS.

PayPal will also be including education material for their account holders, teaching them the risks and opportunities available when investing in cryptocurrency as well as teaching them about blockchain technology in general. As of yet, there aren’t any related fees for buying and selling cryptocurrency, but that’ll change in 2021, and there aren’t any fees for holding crypto in your PayPal account.

Despite my reservations with PayPal and their ineptitude even I have to admit that this is a step in the right direction, as long as they don’t totally foul it up.

—Joseph Morton