There’s never going to be escaping criminals and criminal behaviour when it comes to cryptocurrency. It’s a sad fact. Sometimes, though, it can be funny.

It’s time for your Friday coin rundown. Let’s see what happened.

Here are your top ten coins.

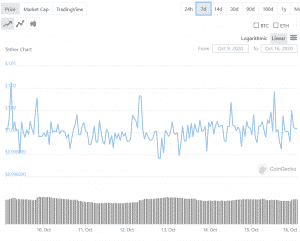

Bitcoin

market cap $209,712,454,436

Earlier this week, criminals in Kelowna, British Columbia tried and failed to steal a Bitcoin ATM. They drove their GMC Sierra into a storefront next door to where the Bitcoin ATM was as they tried to flee the scene. Now… this is dumb and here’s why.

I watched someone take one apart to service it earlier this year as a curiosity and to see how they were arranged. They’re heavy as all ATMs are and they’re often wall-mounted. But what’s especially dumb about these criminals and their attempted theft, in addition to leaving behind their truck’s tailgate at the scene, is that there’s virtually no way you’re going to get any Bitcoin from the machine. Bitcoin ATMs have a monitor, a QR scanner, bill acceptor and dispenser. On the backend of the machine, you’ve got software to facilitate Bitcoin transactions. No actual bitcoin. No access to private keys.

The best Bitcoin criminals learn to code.

Ethereum

market cap $41,879,368,346

Roughly 28% of Ether last moved between 12 and 24 months, compromising the largest amount of on-chain activity, according to Glassnode’s ‘hodlwaves’ chart, which notes on-chain transactions.

Ether hodling has gone up in 2020, and more than half of Ethereum’s circulating supply hasn’t moved in a year, which is decently smart if you think about it. There’s been a rise of accumulation in 2020, and that’s likely to change when staking starts.

Given how staking works—with the algorithm responsible for closing the block in proof-of-stake tending to choose folks with the most ether—it makes sense to accumulate and hold. That’s how you’re going to make money when Ethereum 2.0 goes live.

Tether

market cap $15,783,716,908

Nobody ever said criminals were particularly bright. See the Bitcoin entry for details.

That’s why it shouldn’t come as much of a surprise to learn that the United States Department of Justice yesterday unsealed documents regarding a Latin American drug-smuggling, money-laundering bust, in part facilitated by Tether.

Six men spent the past 12 years laundering millions of dollars for the drug cartels, picking up money from selling cocaine in parking lots and hotels, and then moving it between bank accounts, casinos and businesses.

These criminals were caught when an undercover drug enforcement https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration agent offered to buy US passports for $150,000 a piece, indicating he knew someone in the US government who’d do it if he paid $10,000 up front, which was part of the sting. One of the buyers paid the first four instalments $1,000 in Tether to the second DEA agent’s account before they slapped the cuffs on him.

It’s strange to not hear a story about cyber criminals that doesn’t involve hacking, isn’t it?

XRP/Ripple

market cap $10,942,718,172

Earlier this week, Brad Garlinghouse, Ripple’s CEO, speaking at the company’s Swell event, said that one in five transactions that happen on the global payment network RippleNet happen in XRP, amounting to $2 billion in nominal terms.

“In these 3 years of RippleNet’s life, we have made 2 million transactions with a nominal value of over 7 billion dollars. We are the most popular company in Asia. It is a fact that our customers have a great interest in emerging markets. The regions where these markets are located are Latin America, Africa and the pacific coasts of Asia… It is obvious that these regions are also excluded and prohibited by the traditional banking system,” according to Garlinghouse.

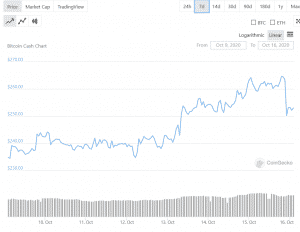

Bitcoin Cash

market cap $4,703,852,298

The total investment into Grayscale’s products was $2.7 billion over the 12-month period ending Sept. 30, which was more than double the $1.2 billion cumulative inflow into the company’s products from 2013 through 2019.

Grayscale Investments investments for the year ending September 30th were $2.7 billion, which was more than double the $1.2 billion cumulative for the years of 2013 to 2019. Damn.

What’s equally baffling is that three products have seen what they’re calling ‘unprecedented demand.’ Specifically, Grayscale’s Bitcoin Cash, Litecoin and Digital Large Cap products have seen more than 10 times the growth quarter-over-quarter.

Binance Coin

market cap $4,505,380,502

The Binance exchange provides financial resources to DeFi projects as long as they’re created on Binance’s blockchain, the Binance Smart Chain. Six of these projects have received their first payments.

Binance announced earlier this week that the first payment of $350,000 was made to DeFi projects it supports. It also launched a $100 million accelerator fund in September to help developers with their DeFi projects and create a new DeFi ecosystem.

“We have launched this $ 100 million accelerator fund to support the development of high-quality DeFi projects that we think will contribute to the industry’s infrastructure and technology, and to unlock DeFi’s potential,” said Changpeng Zhao, Binance’s CEO.

Chainlink

market cap $4,080,051,613

Blockchain knowledge company Everipedia has integrated with Chainlink to build oracle infrastructure designed to sign and public race calls for the US election on the blockchain.

The joint node will provide smart contracts access to the United States election data backed by a cryptographic proof used to verify the data from the node comes directly from the Associated Press API. This data will be available on-chain so smart contract developers can create financial products based on the outcome of the election. We’re talking things like prediction markets, derivatives and more.

“Chainlink is bridging the technical gap between blockchains and real world data. Making this powerful technology more accessible is key to realizing its full potential, and publishing the AP’s electoral race calls onto the blockchain for the first time is a big milestone in that journey. It will provide a verifiable, tamper-proof record for tracking a historic election,” said Daniel Kochis, head of business development at Chainlink.

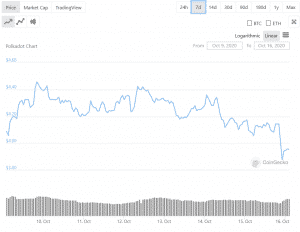

Polkadot

market cap $3,661,284,257

Cryptocurrency platform Bitfinex announced that they’re now allowing hodlers to stake Polkadot (DOT), which is the token offering of the Polkadot blcokchain. The amount one could theoretically expect looks like a %14 increase per year, at least for right now.

It’s also good to point out that when Bitfinex stakes a token, it’s delegated by the exhange, which means that the tokens stay under the control of the platform. So far, Bitfinex is offering staking for Cardano, EOS, Cosmos, v.systems and Tezos.

Cardano

market cap $3,240,044,852

Charles Hoskinson, the CEO of IOHK, which is the parent company behind Cardano, has recently put out a YouTube video of a recent Ted Talk he gave explaining the process behind ensuring accountability to funding on Cardano. His company is going to be pushing Voltaire, their blockchain’s governance code.

In its present incarnation, the blockchain doesn’t have any mechanisms in place to determine whether or not a good return on intention on the grants allocated to community members. The blockchain needs to get a tighter grip on distribution of community funds, but there’s no need to centralize its governance, he says. Instead, the network needs to get a set of processes in place that can act as a controllable, decentralized accountability management tool.

Here’s Hoskinson to explain more:

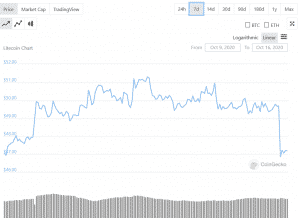

Litecoin

market cap $3,103,751,653

Litecoin is preparing for their collaboration with Cardano on cross-chain interoperability, according to David Schwatz, the project director of the Litecoin Foundation. Cardano’s CEO Charles Hoskinson invited Charlie Lee, Litecoin’s founder, to collaborate in July and now it’s looking like the two foundations are taking the first opening steps towards making that a possibility.

Stated improvement would include cross-chain payment settlmeents between the two coins, and it would also improve Litecoin’s scalability and introduce support for smart contracts.

—Joseph Morton