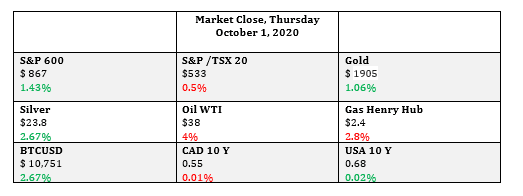

Hey Investors, today was a green day for the general market, and here is a quick wrap up of how the indexes did:

- S&P 600 (USA Small Caps) up by 1.43% and S&P 500(USA Large Caps) by 0.62% for the day

- S&P/TSX 20(CAD Small Cap) up by 1.7% and the S&P/TSX 60 (CAD Large Cap) up by 0.23% intraday

Market Movers

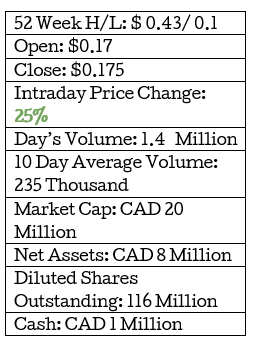

Today we the judges have picked: Lithium Chile Inc. (LITH.V) as the “most attractive common stock”

Business Summary

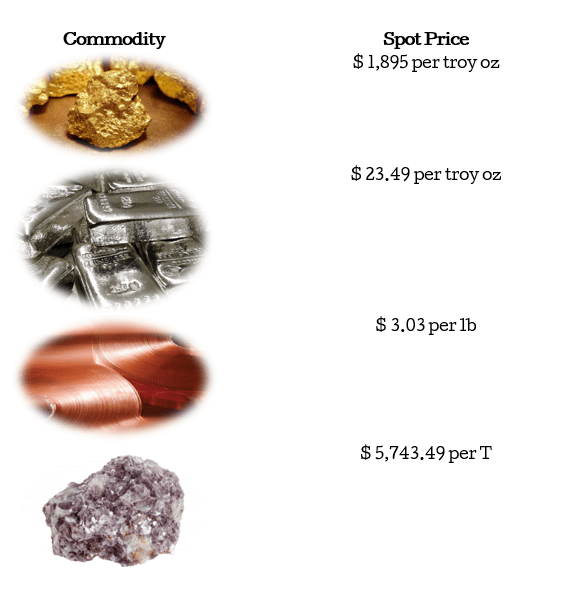

Lithium Chile owns fourteen projects on Li-rich salars in Chile, making it the largest landholder of lithium salars outside the Chilean government. It explores for gold, silver, and copper deposits.

The company primarily explores for a lithium property portfolio consisting of 110,280 hectares covering sections of 11 salars and two laguna complexes in Chile.

For this reason, today’s article will briefly touch on the history of lithium and why it been in the news of late from Tesla’s battery day AGM to economic studies like Economic analysis of CNT lithium-ion battery manufacturing by Hakimian and Co.

Lithium History

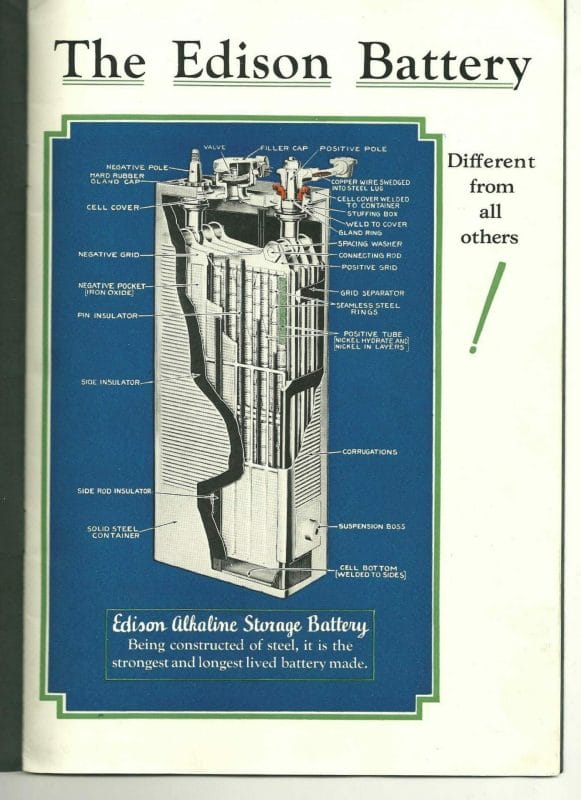

Thomas Edison, an American inventor, and businessman who has been described as America’s greatest inventor is the man who initiated the innovative roller coaster ride to cheaper and more sustainable batteries.

His reasons were not ambitious back in his time but were driven by economic gain. Seeing a way to make a profit in the already competitive lead-acid battery market Edison worked in the 1890s on developing an alkaline-based battery that he could get a patent on.

Edison thought if he produced lightweight and durable battery-electric cars would become the standard, with his firm as its main battery vendor.

After many experiments, and probably borrowing from older designs, he patented an alkaline-based nickel-iron battery in 1901

However, customers found his first model of the alkaline nickel-iron battery to be prone to leakage leading to short battery life, and it did not outperform the lead-acid cell by that much either

Although Edison was able to produce a more reliable and powerful model seven years later, by this time the inexpensive and reliable Model T Ford had made gasoline engine cars the standard.

Eventually, scientists needed a cell that was lighter but has similar energy output. This was because the technology was growing rapidly and demand for products pushed many companies to invest large sums in research for cheaper battery producing cells.

Lithium is the metal with the lowest density and with the greatest electrochemical potential and energy-to-weight ratio. Simply put this study of chemical processes that cause electrons to move saw Lithium had the lowest weight to energy potential allowing people to pack a punch in a small package.

Experimentation with lithium batteries began in 1912 under G.N. Lewis, but commercial lithium batteries did not come to market until the 1970s.

Chile & Lithium & Government

Fast forward to today where technology has advanced rapidly and demand for the commodity is presumably of high demand.

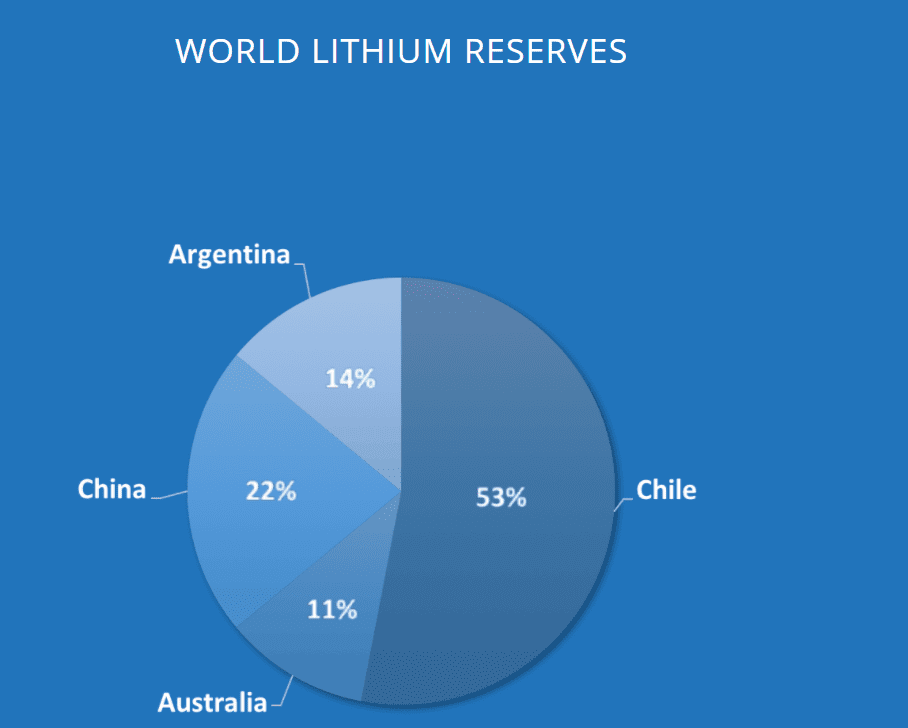

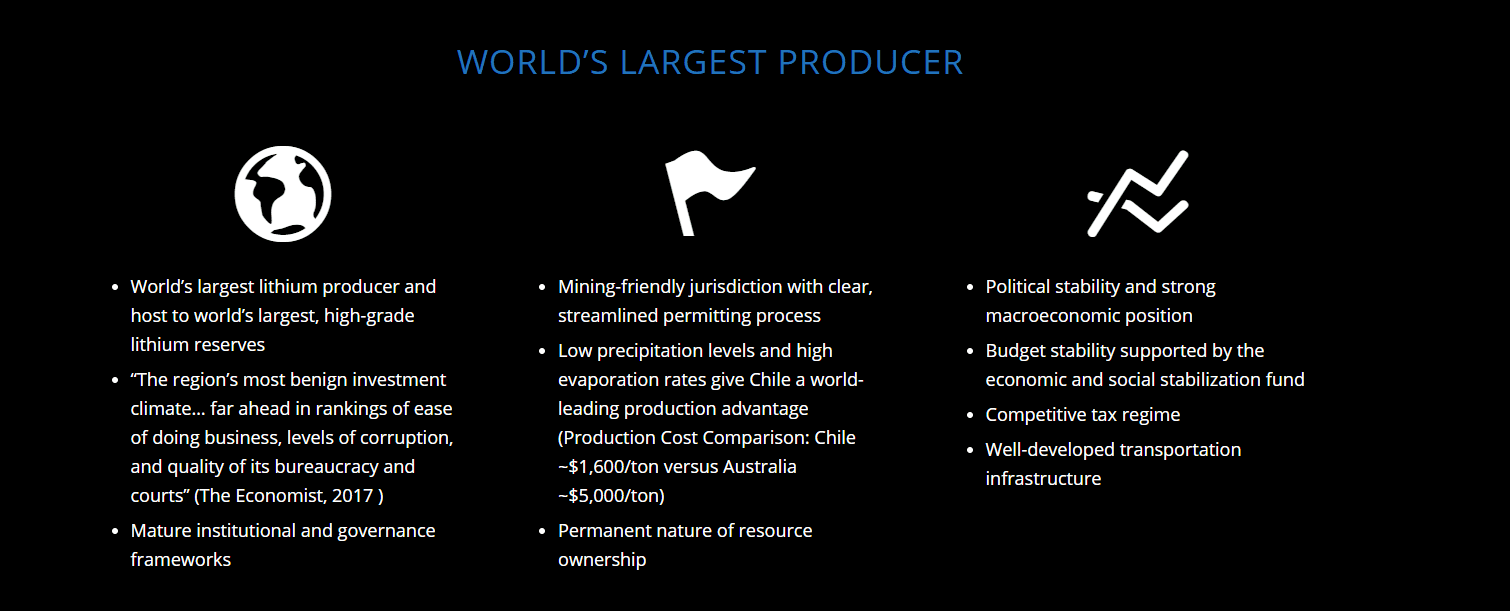

Luck has blessed the people of Chile with the largest deposit of lithium of a, particularly high quality. This abundance of raw resources would bring massive wealth to the economy where the government of Chile owns most of the Lithium deposits. China only comes in second when it comes to reserves at 22% compared to Chile’s massive 53% deposit.

Lithium Chile owns the second-largest deposits outside of those owned by the government and has been given the go-ahead by locals to explore the deposits in the area. The company also benefits from the government support and incentives set in place to cheapen the mining process. Meaning they benefit from having:

- the second-largest lithium deposits

- the highest grade of lithium

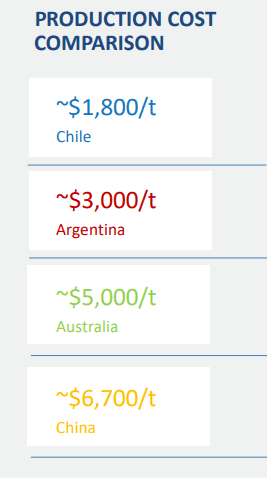

- the lowest cost to mine the commodity

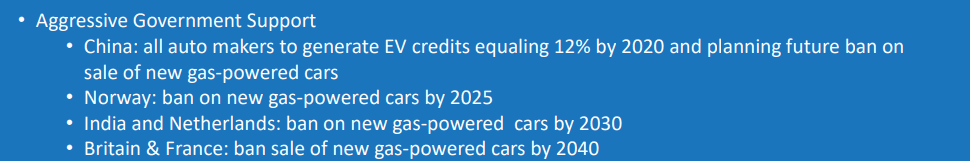

- and presumably an aggressive effort by governments to go electric by way of lithium-powered batteries

This all just seems too good to be true. As we have seen over time with businesses in the mining sector, do not always trust samart guy with a hole in the ground.

Assets owned by Lithium Chile Inc.

In full honesty this was the easiest section to write in this entire article, all that was asked of me was to list the 14 key assets owned by Lithium Chile. But I will not allow my laziness to get in the way of your investment success. I have taken the liberty to attach all the relevant links to each deposit. Enjoy!

Quality of Lithium owned

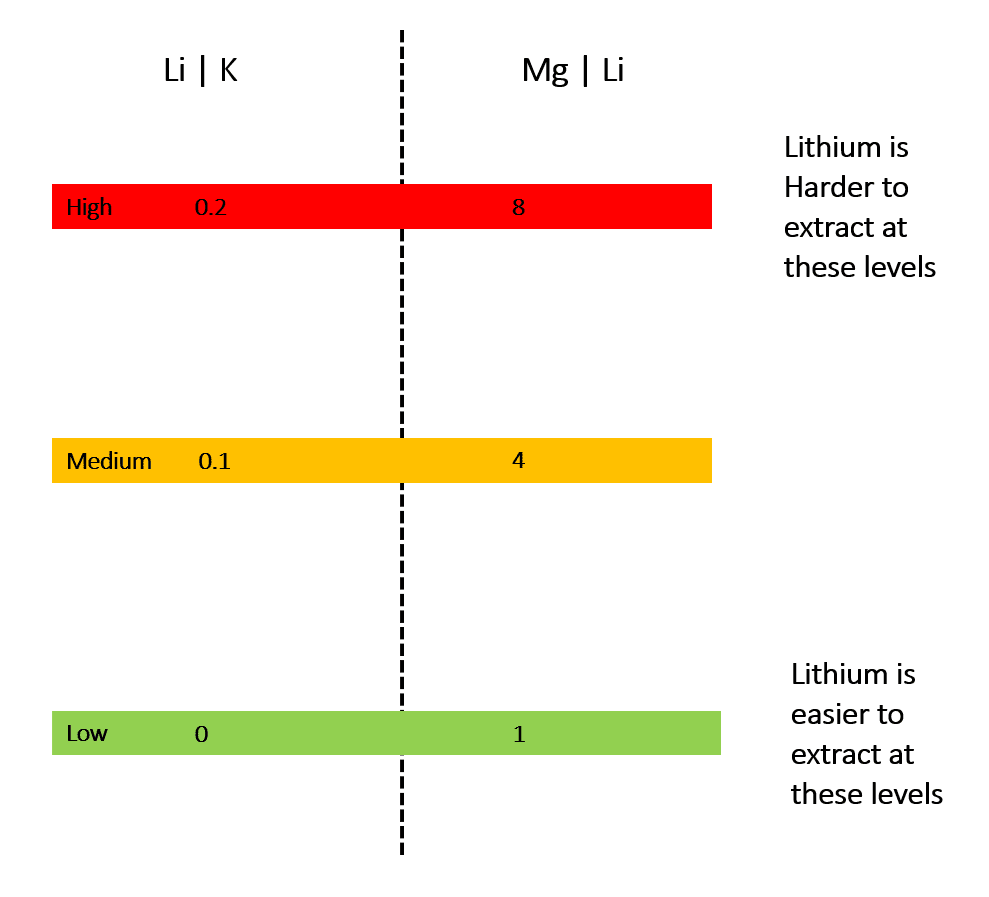

The Lithium scale below was made by your trusted author, but readers should use it with caution. It is pretty simple to understand and is intuitive. When lithium is extracted the materials are not completely pure all the time. Sometimes it is bonded to either Potassium(K) and Magnesium (Mg) and the higher the concentration of either of these materials the more difficult it is to extract lithium. For both the ratios below the higher up, it is in the table the lower the quality, and the lower it is on the chart the higher the quality.

Again the reader is cautioned from using this as a universal truth, but it is an appropriate place to start your lithium quality analysis.

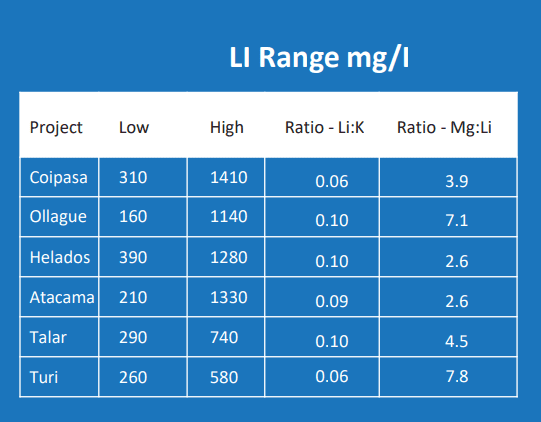

Lithium has a good mix of high-quality lithium deposits and medium-high-quality deposits. The chart below was extracted from their website.

Lithium today & Moving forward

And finally, the outlook for the lithium revolution.

The economy has three main market participants:

- Government bodies, Sovereign and Institutional

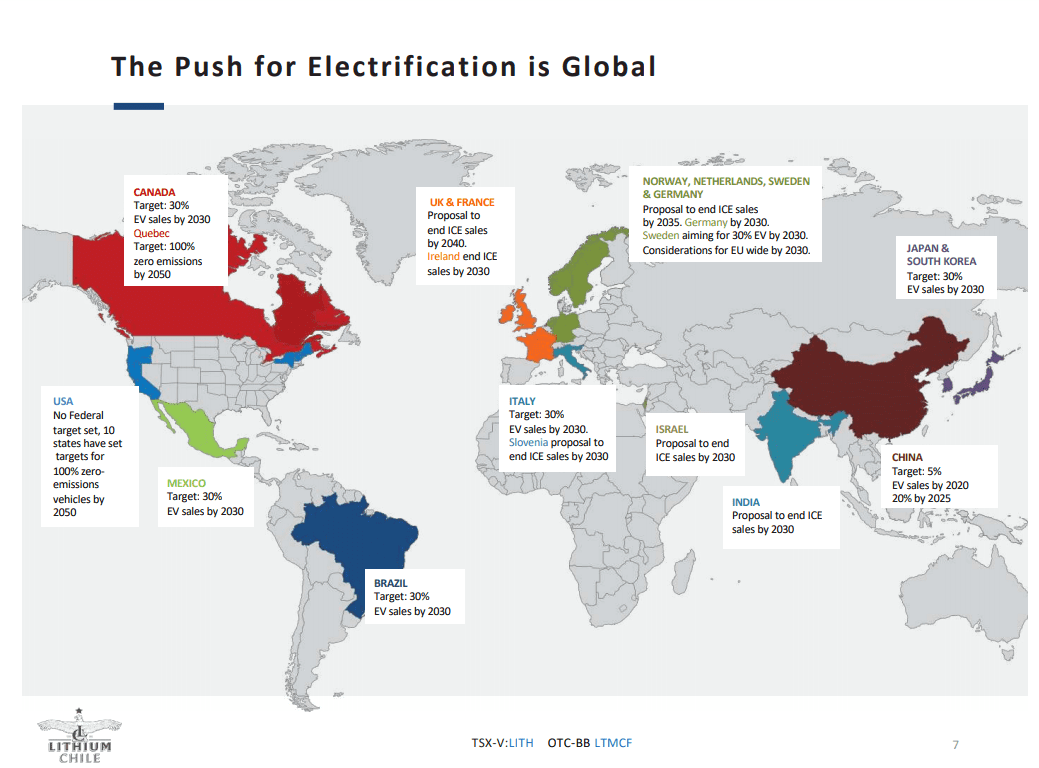

Governments around the world from the USA to China have laid out plans to implement sustainable energy programs that will help the global economy pivot to more cost-efficient energy sources.

They have also provided private firms with incentives such as tax credits, subsidies, and tax breaks or grants for firms that play an active role in going green.

2. Private Business

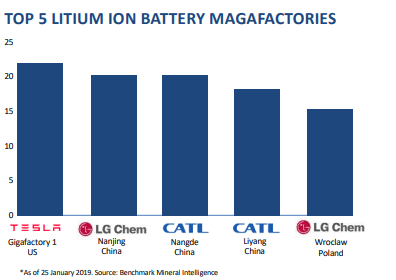

Businesses have not ignored the regulators but have embraced the various incentives with open arms. Take for example Tesla who are the pioneers of not only Electric Vehicles but of lithium batteries.

Tesla generates such a large proportion of tax credits that it is part of their business model to sell excess credits to other car manufacturers.

Investors large and small have also embraced this shift and have introduced ESG investing. Environmental, Social, and Corporate Governance (ESG) refer to the three central factors in measuring the sustainability and societal impact of an investment in a company or business.

You know it is a hot topic when capital allocators get their feet wet in the game as well.

3. Consumers who are usually the largest part of the economy

With the government promoting sustainability, protecting consumers from unfair practices, and companies striving to go, green consumers, are left with more sustainable higher quality products to purchases.

In this case, the numbers do not lie, there is a great push to go green, and the people with the largest proportion of money ( when it comes to buying power) consumers are demanding these products and demanding regulators and governments to promote more sustainable.

Having said all this, companies like Lithium Chile could potentially benefit from these dramatic shifts in consumer taste if they are able to meet the demand, but we know from economics 101 if demand is high enough eventually the business will reduce quality and or increase prices to meet capacity.

Now we (investors) watch.