As a student of economics, I believe the stock market at times acts like an old-style ‘beauty contest’. This theory is not new but has been around for 84 years.

A Keynesian beauty contest is a concept developed by John Maynard Keynes and introduced in Chapter 12 of his work, The General Theory of Employment, Interest, and Money (1936), to explain price fluctuations in equity markets.

It describes a beauty contest where judges are rewarded for selecting the most popular faces among all judges, rather than those they may personally find the most attractive.

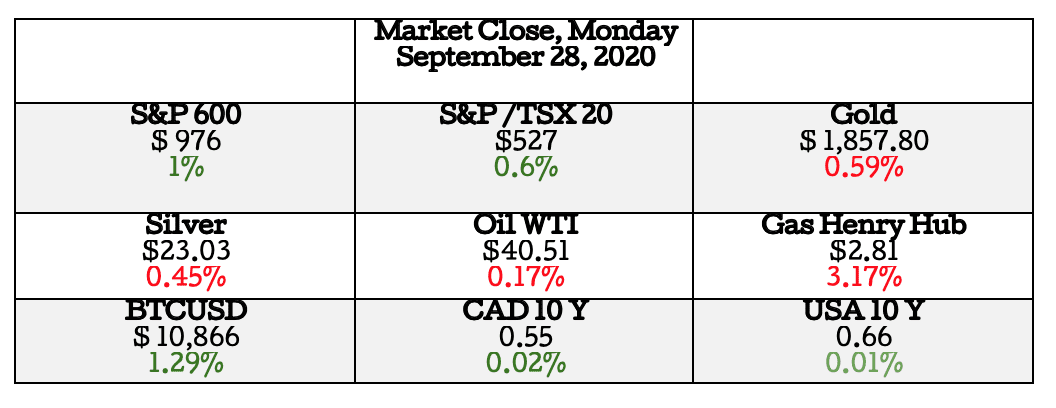

- S&P 600 (USA Small Caps) up by 1% and S&P 500(USA Large Caps) by 1.61% for the day

- S&P/TSX 20(CAD Small Cap) up by 0.67% and the S&P/TSX 60 (CAD Large Cap) by 1.08% intraday

- Bitcoin up by 1.29% as investors move away from commodities, Gold down 0.59%, and oil down 0.17%

Market Movers

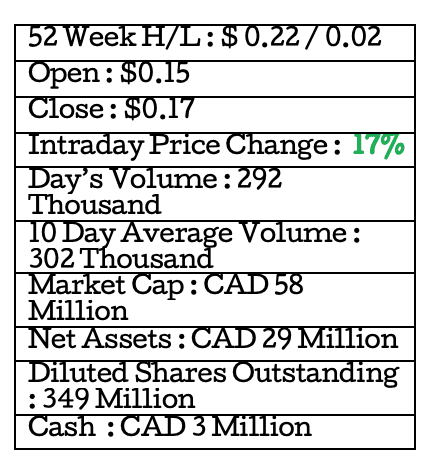

Today we the judges have picked: Nickel Creek Platinum Corp. (NCP.T) as the “most beautiful common stock”

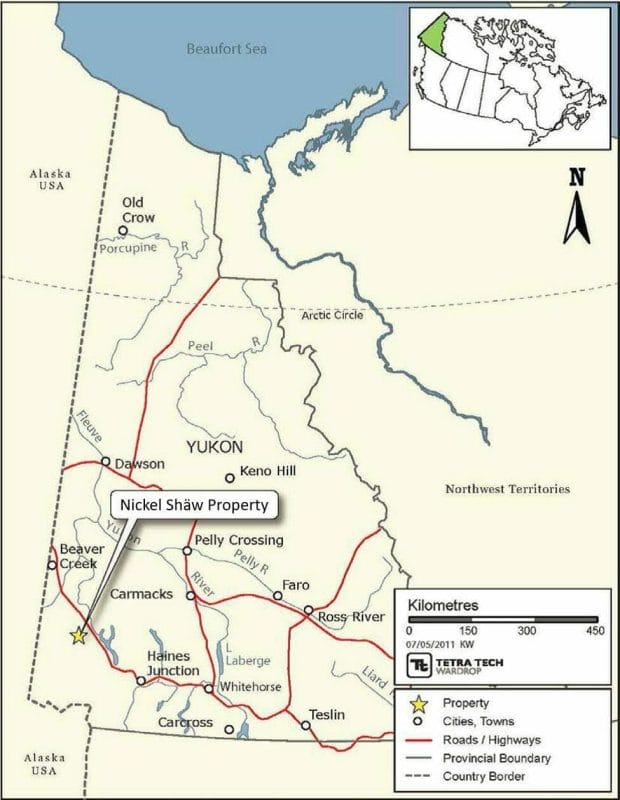

Business Summary: Nickel Creek Platinum Corp. (TSX: NCP) is a Canadian mining exploration and development company focused on advancing its 100%-owned Nickel Shäw project with a view to creating Canada’s next world-class nickel sulfide mine.

The flagship asset is the 100%-owned Nickel Shäw project.

The Property lies within the Kluane First Nation core area as defined by their treaty with Canada and the Yukon Government.

The Nickel Shäw project deposit is a polymetallic deposit with mineralization that includes the significant co-occurrence of nickel, copper, cobalt, PGM, and gold resources.

Platinum and its uses

The most important use of platinum is in vehicles, as a catalytic converter, facilitating the complete combustion of unburned hydrocarbons passing through the exhaust.

Platinum is used in jewelry, decoration, and dental work. The metal and its alloys are also used for electrical contacts, fine resistance wires, and medical / laboratory instruments.

The metal is also used to make electrodes sealed in glass.

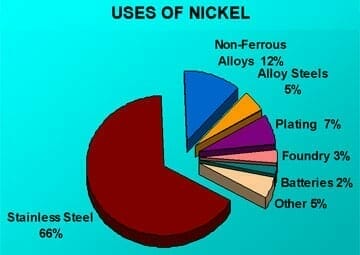

Nickel and its uses

Stainless steel is used in kitchen accessories, cutlery, and cookware. Stainless steel is ideal for food production and storage as it does not affect the flavor of the food.

Stainless steel’s corrosion resistance is important as some foods, like orange juice, can be acidic. Also, stainless steel is easily cleaned which helps keep undesirable germs at bay.

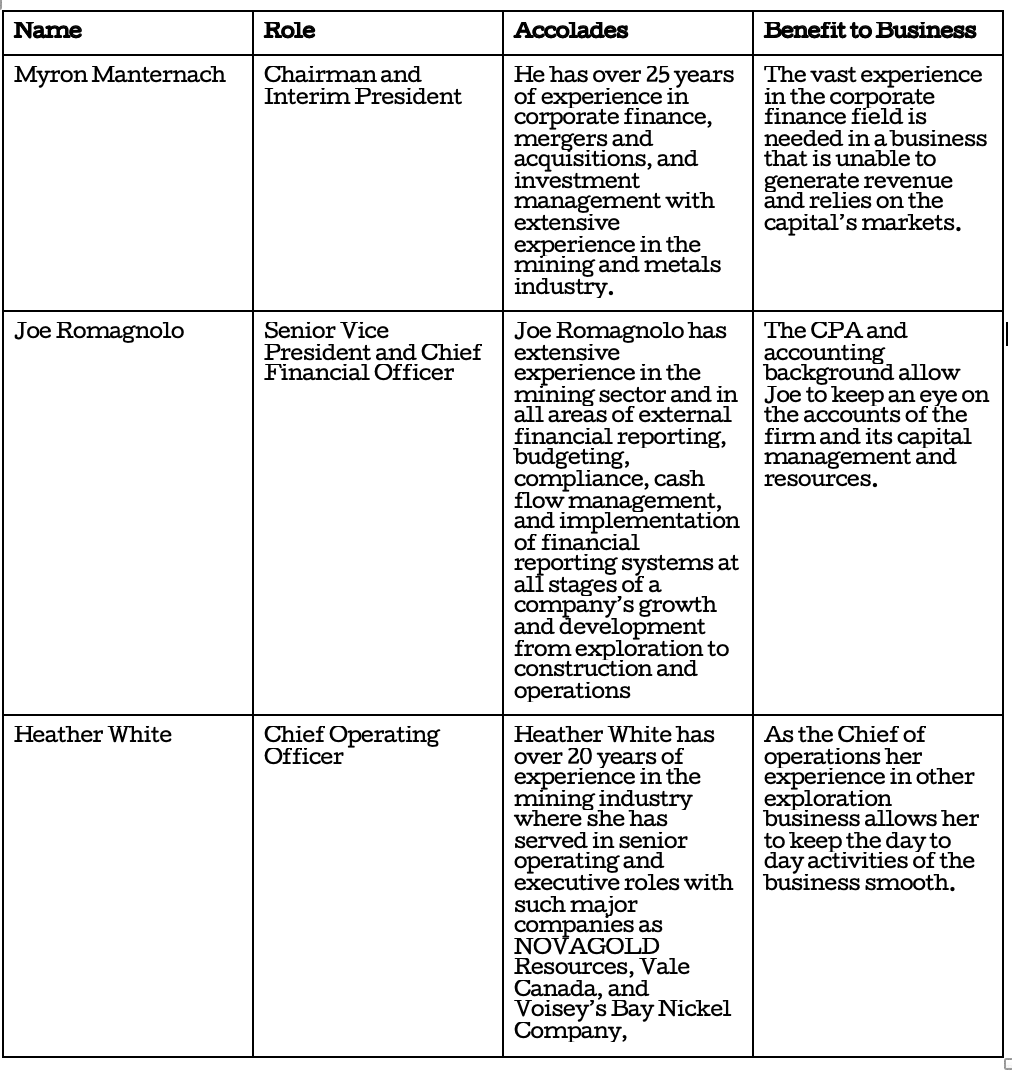

Management team

But again, this is merely a guess. The reality of the beauty contest is that if every stock is somebody’s favorite, then every price should be viewed with skepticism.

Assets vs Cash Flows

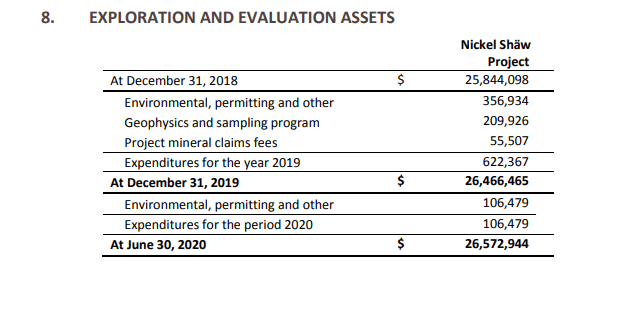

The company has not been able to generate cash from operations as it is currently not making any revenues. It has financed most of the business by selling shares and bonds to private investors. Below is an extract of what management believes will happen in the foreseeable future.

Company Outlook from latest quarterly report

The Company will continue to maintain environmental baseline studies, community engagement and ensure the Project’s quartz claims and surface leases remain in good standing. Further, the Company will commence its 2020 Exploration Program during the month of August 2020. In addition to the activities on the Project, the Company continues to be focused on reviewing and evaluating potential acquisitions and other opportunities.

The Company’s sole source of funding has been the issuance of equity securities for cash and the sale of the Wellgreen NSR Royalty in 2015. The Company has not generated any operating revenue from its operations and does not expect to generate any revenue during the next twelve months.

Knowing this we know that the assets are very critical to vaulting the business and this is currently the best way an investor will know if the currency price is good or not.

Since this is the fact the best way an investor can figure out the “true value” is by conducting an analysis of the key assets of the business.

Quick Asset Assets Analysis

To do this we need to realize that if the business is to sell all the assets it has on its books it will not be able to let go of them for the same prices that they acquired them for. We have to make appropriate adjustments for the liquidity and marketability of the assets.

A simple equation to remember is the one below:

Book Value of Asset X Assumed Liquidation % = Asset Realized Value

Total Cash & ST Investments

The Company’s investment policy is to invest its surplus cash in highly liquid short-term interest-bearing investments with maturities of less than one year from the original date of acquisition, all held within major Canadian financial institutions.

This means we will be able to sell all the cash in the accounts for an equal sum(giving us a liquidation % of 100)

3,391,117 X 100 % = 3,391,117

Total Receivables

Amount receivable consists of goods and services tax receivable. These are close to cash but have to be discounted as the demand for them might be lower and 80% is a conservative guess.

22,855 X 80 % = 18,284

Prepaid Exp.

It is a type of asset on the balance sheet that results from a business making advance payments for goods or services to be received in the future for example insurance premiums.

100,313 X 80 % = 80,250

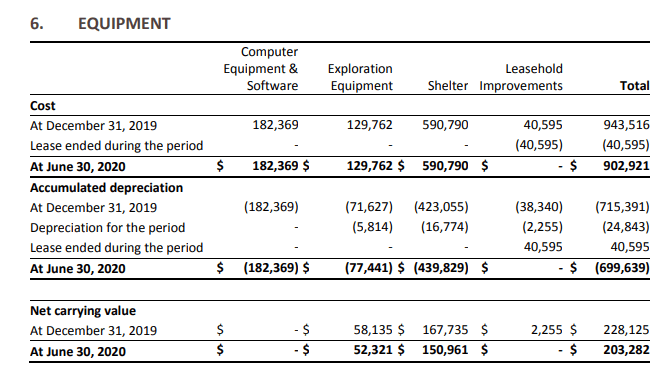

Net Property, Plant & Equipment

The majority of the company’s equipment is in Shelter and equipment used to extract the minerals from the ground and if sold we would not be able to get the full price. The machinery is used and thus will depreciate over time or become obsolete.

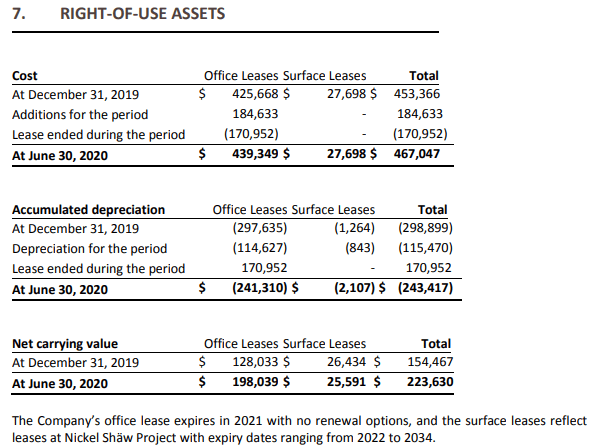

The same goes for right-of-use assets, these are assets that are purchased under a lease agreement. They have contracts that stipulate the sale price and usually, the lessee does not get the same value when they decide to sell the asset early. This will reduce the purchase price.

This is their main asset and is mostly the ground where they plan to explore to find the minerals. We can only assume they will only be able to sell this land back for half the price since they are yet to start extracting minerals.

26,999,856 X 50 % = 13,499,928

Liabilities

Accounts payable and other liabilities like Lease obligations & Reclamation provision that have to be paid in full and are owed to other parties hence they have a negative effect on the value of the business.

1,174,170 X 100 % = 1,174,170

Equity Value on accounts compared to liquidation Value.

Once we are done with our calculations we need to figure out if the stock price is anywhere near our estimates of value. We should compare the,

$ 29,339,971 of Book Value vs $15,815,409 of Liquidation Value vs $58,000,000 of Market Capitalization.

And then convert these into the per-share figures to see how much each share will cost.

Book Value – $ 0.084

Liquidation value – $0.045

Market Price – $0.166

To invest or not to invest, that is the question?

Under current conditions and the rough liquidation estimates the business seems overvalued and the current price would be unattractive to potential investors. The premium you would have to pay is about 200%.

The premium could be the market speculating on future profitability once the business has been able to extract the minerals and turn a profit because of how marketable nickel and platinum are.

But again, this is merely a guess. The reality of the beauty contest is that if every stock is somebody’s favorite, then every price should be viewed with skepticism.

HAPPY HUNTING !