Poker is a card game in which players wager over which hand is best according to a set of rules and possible random probability outcomes.

The main purpose of the game is to layout as much of your capital today on bets you feel will bring an adequate return from the capital invested tomorrow after having done your due diligence with the asymmetric information at hand.

The catch is your return is also determined by the other players’ strategies in the game. Economists call this phenomenon a dynamic simultaneous game with dominant and dominated strategies.

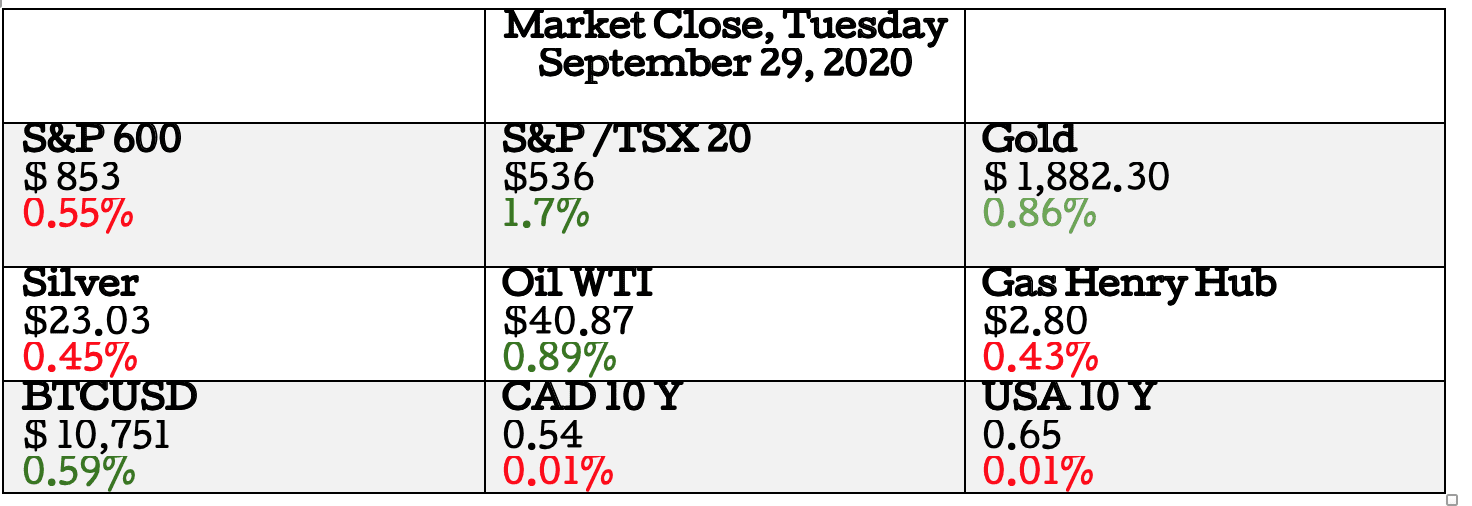

- S&P 600 (USA Small Caps) down by 0.55% and S&P 500(USA Large Caps) by 0.48% for the day

- S&P/TSX 20(CAD Small Cap) up by 1.7% and the S&P/TSX 60 (CAD Large Cap) down by 0.29% intraday

- Bitcoin up by 0.59%

- Demand for safe assets pushed the bond yields down for the day in both the USA and Canada, 0.01% and 0.01% respectively, pushing their prices higher.

Market Movers

Today we the judges have picked: ATEX Resources Inc. (ATX.V) as the “most beautiful common stock”

Business Summary: ATEX Resources Inc. engages in the exploration and evaluation of mineral properties in South America. It holds a 50% interest in the Fredonia property covering approximately an area of 15,000 hectares located in Antioquia, Colombia. The company was formerly known as Colombia Crest Gold Corp. and changed its name to ATEX Resources Inc. in February 2019.

Gold has a long history of being used as a hedge against two economic forces:

- The first being high expectations of pending inflation. Central Banks around the world have flooded the market with cheap cash causing global interest rates to plummet to a zero lower bound. This zero interest rate environment should stimulate the economy and cause sustainable inflation but many people believe we are due for some very rapid inflation. Investors large and small will flood the bond market and gold to protect from these uncertain expectations

- The second reason is that as governments print more money they reduce the value of their home currency and this is seen as a ‘political’ weakness. The citizens see this as a signal of a fundamental weakness in fiat currency and flock to gold as a store of wealth.

During this period of uncertainty companies who produce or store the rights to large gold deposits experience a revaluation of their assets(mainly gold bullion) causing investors to speculate on their potential profitability.

Example: Company A deals in the storage, exploration, and mining and sale of gold deposits to other firms who manufacture the gold bullion into jewelry and other consumables.

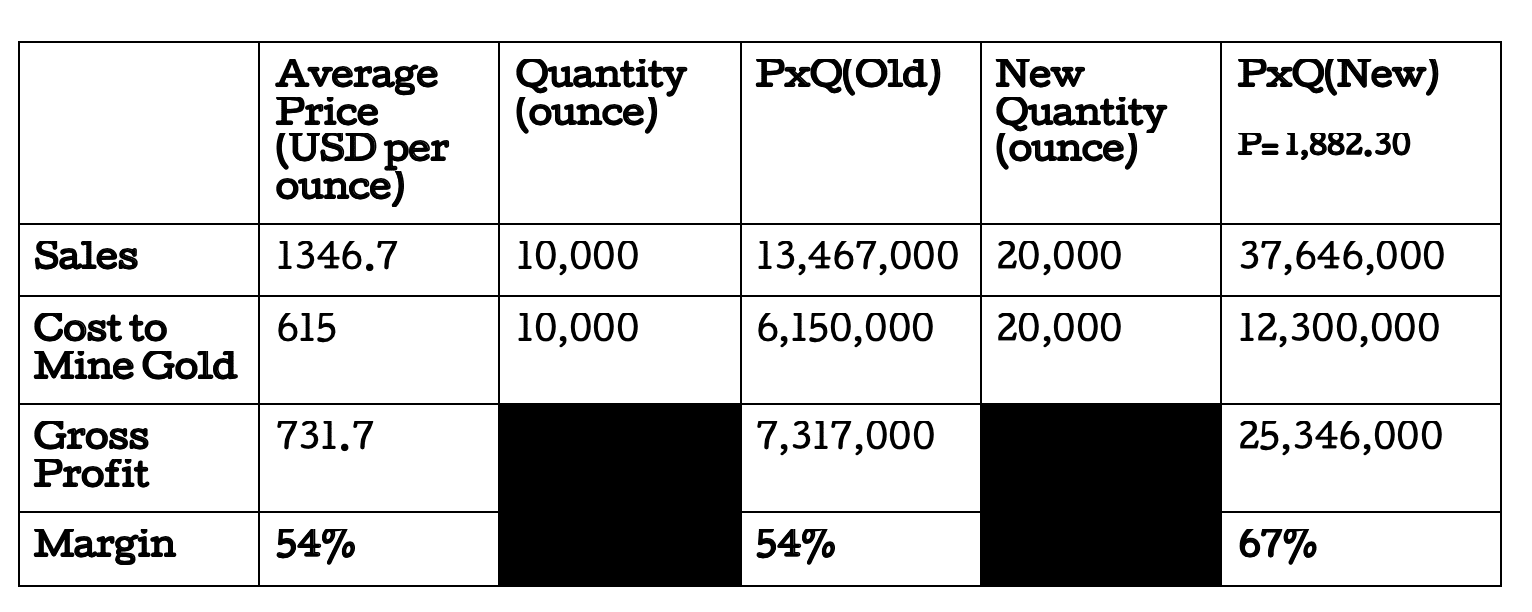

We can take some industry averages to see how much money the business makes from the simple sale of gold.

We can take the average gold price over the last 10 years as this is an industry convention and we get our price. Company A will sell the gold on average at that price if everything is normal and make a gross profit of 54%.

Which is really great, it costs Company A 46 cents to sell their gold at $1. The business has the capacity to produce 10,000 ounces of gold at current capacity and this means they can make $13 Million in revenue but they run into some luck and found a deeper strip of gold that was once hidden allowing them to produce 10,000 more.

We assume it does not cost them extra to mine this gold deposit(stay constant at 615), but allows them to sell at the current market price of gold which as of this writing was at 1,882. This will potentially push Revenues up to $37 Million and the gross margins up to 67%. Which is even greater, it costs Company A 33 cents to sell their gold at $1.

What does this all have to do with ATEX Resources Inc? They recently made a public announcement where they realized the capacity of their key asset, the Valeriano project, and bellow is a snippet from this press release and a link to the full release:

Atex pegs Valeriano at 621,539 AuEq oz inferred

2020-09-29 07:42 ET – News Release

Mr. Raymond Jannas reports

ATEX REPORTS MAIDEN RESOURCE ESTIMATES FOR VALERIANO GOLD OXIDE DEPOSIT AND COPPER GOLD PORPHYRY DEPOSIT

Atex Resources Inc. has provided initial resource estimates for two deposits on its Valeriano copper-gold project located in Chile’s El Indio belt. Both resource estimates were completed by SRK Consulting (Chile) SpA on behalf of Atex and have been prepared in accordance with the Canadian Institute of Mining and Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (2014). A National Instrument 43-101 technical report will be appropriately filed within 45 days of this release.

The analysis for company A helps us appreciate the recent news a little more. The markets believe at current prices with this new deposit of gold the company has the ability to produce some revenue once the gold has been extracted and taken through proper due diligence.

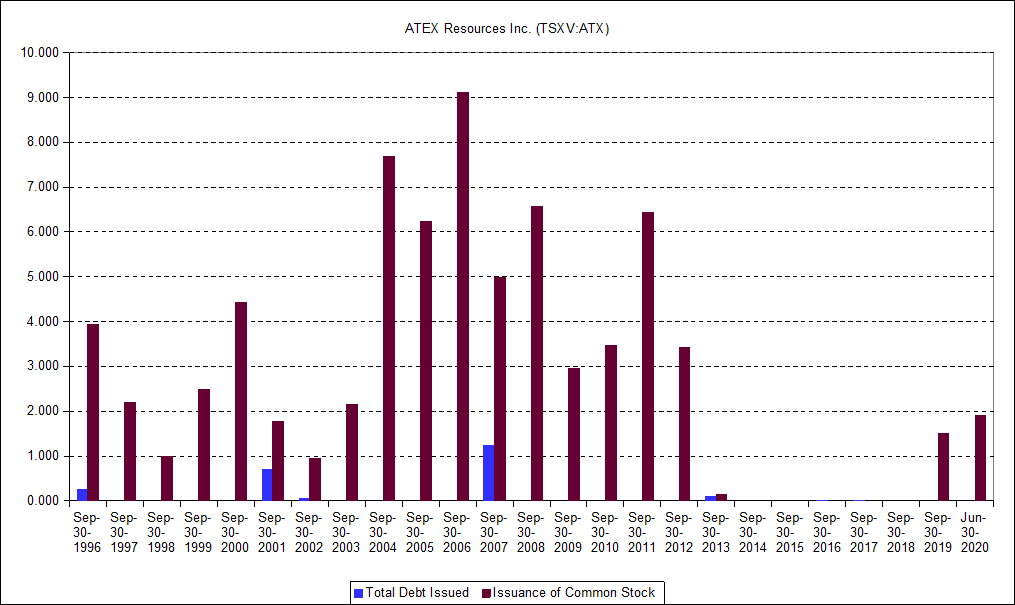

ATEX Resources has not generated any revenues since 1996 where they made $11,000 and cost them $330,000 to extract this gold. It has funded the majority of its operations from the issuance of many shares and to a smaller extent debt,

and this would not be sustainable for long as they continue to deploy shareholders capital into unprofitable projects, but now they potentially have struck gold(pun intended) whilst gold prices are at their historical highs.

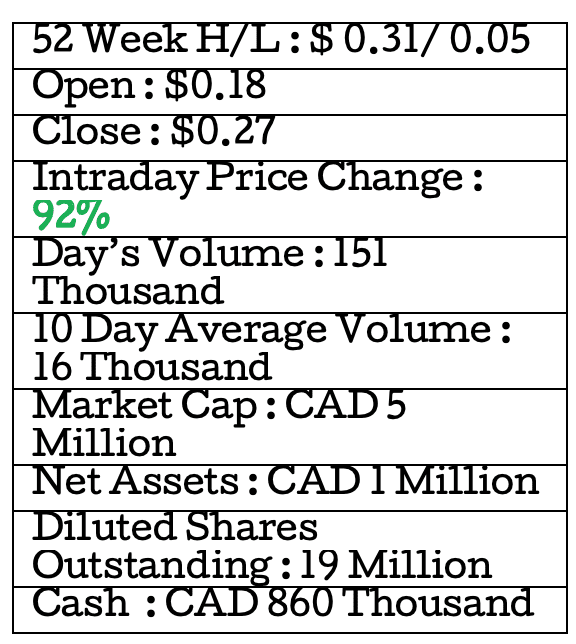

This has caused marginal opinion on the common stock to rise by 92% in one day meaning $2,000,000 in the capital has been injected into the businesses’ new potential valuation.

HAPPY HUNTING!