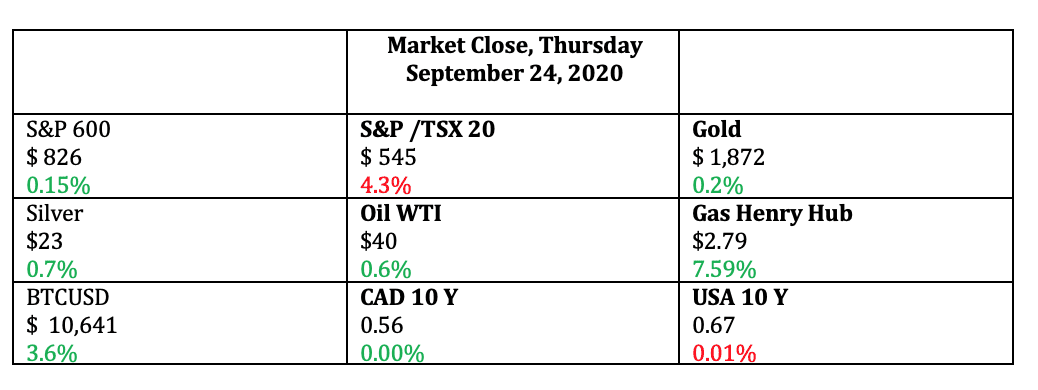

Hey Investors, very frothy market movement for the day.

Bitcoin and natural gas leading the way with 3% and 7% upside.

Market Movers

Today we have a winner in:

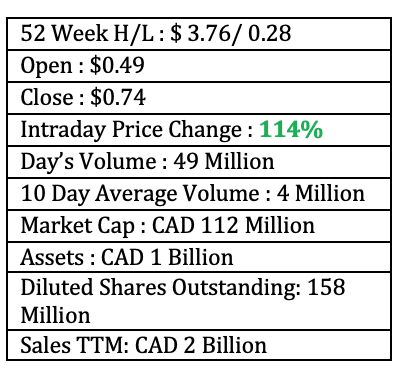

Just Energy Group Inc. (JE.T)

Just Energy receives US. FERC OK for recapitalization

2020-09-23 15:37 ET – News Release

Mr. Jim Brown reports

JUST ENERGY ANNOUNCES UPDATE FOR CLOSING OF PLAN OF ARRANGEMENT

Just Energy Group Inc. has received the approval from the US. Federal Energy Regulatory Commission for the company’s previously announced plan of arrangement. The company has obtained all necessary approvals and may now proceed with the closure of the recapitalization transaction. The company expects to close the recapitalization transaction on or about Sept. 28, 2020.

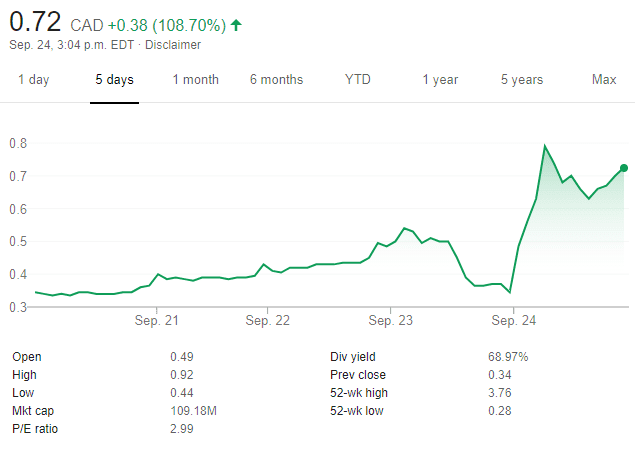

Just Energy Group halted at 7:44 am. PT

2020-09-24 10:47 ET – Halt Trading

Just Energy Group Inc. has been halted at 7:44 am. PT on Sept. 24, 2020, by a single-stock circuit breaker.

Just Energy Group to resume at 7:49 am. PT

2020-09-24 10:48 ET – Resume Trading

Just Energy Group Inc. will resume at 7:49 am. PT on Sept. 24, 2020.

*************************************************************************************

So much happening in the news what does it all mean? The stock price jumps over 80% in one trading day what does the market know? Who the hell is Just Energy group?

We will start by looking at the history of Just Energy over the last 10 years to get a Birdseye view of what’s happened to the business.

Just Energy is a retail energy provider specializing in electricity and natural gas commodities and bringing energy efficient solutions and renewable energy options to customers.

Currently operating in the United States and Canada, Just Energy serves residential and commercial customers. Just Energy is the parent company of Amigo Energy, EdgePower Inc., Filter Group Inc., Hudson Energy, Interactive Energy Group, Tara Energy and TerraPass.

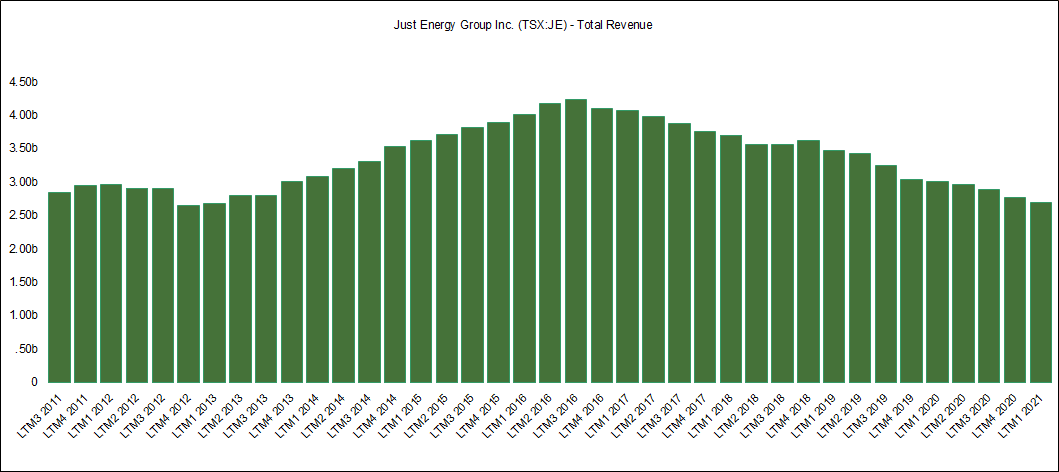

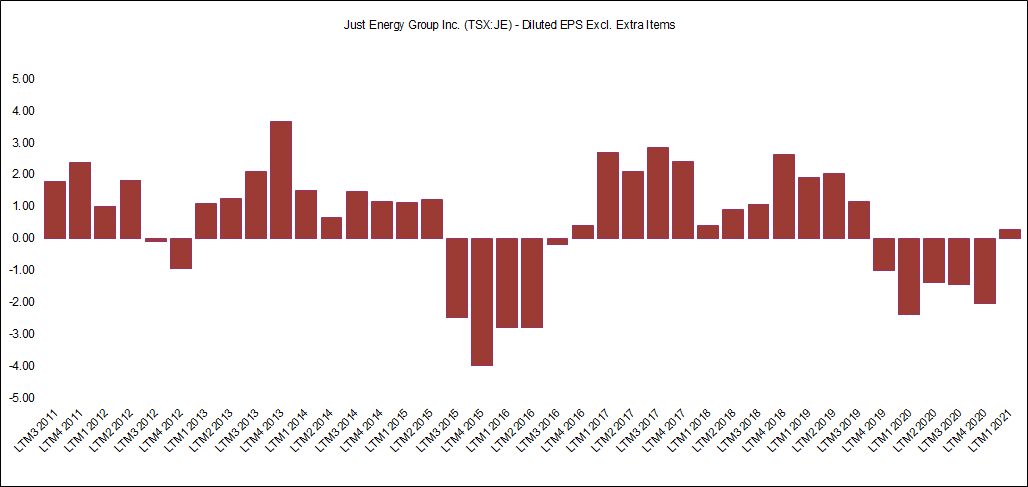

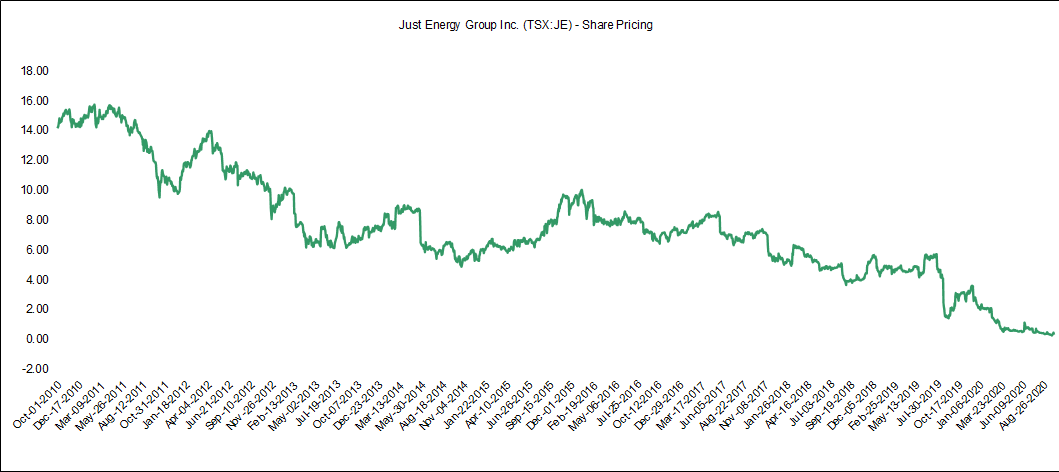

I felt the three charts above are the “best” way to quickly look at the history of Just Energy Group without digging too much into the specifics.

What we have here are the charts for Revenue, Earnings and the stock price movements from 2010 till 2020. I choose these charts because they tell the complete story in an easy to understand way.

Some math for those inquisitive readers

Revenues – Cost to run the business = Earnings to Shareholders Before Dividends

Earnings to Shareholders Before Dividends – Dividends + Last years retained earnings = Shareholder Value

Key Assumption; Shareholder Value and Stock Values have a strong positive correlation and move up together most of the time.

But remember correlation does not mean causation.

Therefore: As Earnings Increase the Shareholder Value Increases and thus you should experience an “equal” increase in the value of your stock

Of course, it goes without saying this is very simplified and we ignore the effects of debt or any capital expenditures but for our purposes this should be enough.

Just Energy Group has stable revenue and means they probably have a steady customer base. This makes a lot of sense when you logically think about it as a consumer of energy and electricity.

We need a constant supply of energy, in this case natural gas, to heat our homes and cook our food.

HAVING POWER IN A HOME AND A BUSINESS IS A BASIC NEED AND MEANS THERE WILL ALWAYS BE DEMAND FOR THEIR PRODUCT.

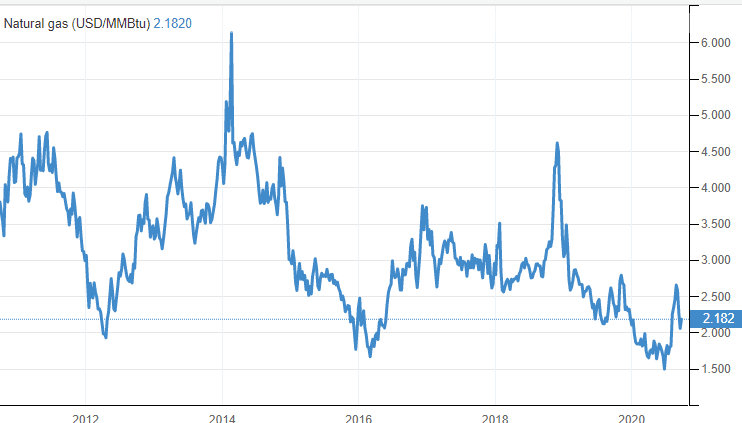

But revenues move in this very cyclical up and down pattern for Just Energy because of the movement of natural gas prices.

Natural gas prices are governed by the general market and Just Energy does not have control over this element. For them to break even or make a profit natural gas prices have to be above or close to the $ 3 – 4 range.

Looking at the chart below we can see that we

- are at historical lows,

- and the price fluctuates a lot.

- And earnings for Just Energy follow a similar pattern

This translates into stock price that will move in a similar way with the prices of natural gas and this trend is also persistent in the stock price of Just Energy. For them to avoid this the company will have to do two things:

- Make sure the other costs they can control are low, they could try reducing marketing or other unnecessary costs

- Buy and sell complicated financial instruments to cover their assets and earnings from these fluctuations. For example, buying a contract that will generate money as the price of natural gas goes down.

These are very easy to suggest but difficult to implement.

This next section can be skipped by the reader as it does not provide much information.

Most of the financial jargon involved in this type of reorganization are drafted by investment banks and lawyers we are paid millions of dollars to capitalize business(the process of organizing or in this case reorganizing the common stock and debt of a business to reduce the cost of attaining new capital)

But for those with a deeper understanding of the capital markets and investment banking and secularization you can go ahead and begrudgingly read through this section. Enjoy!

RECAPITALIZATION

On July 8, 2020, the Company announced a comprehensive plan to strengthen and de-risk the business, positioning the Company for sustainable growth as an independent industry leader (the “Recapitalization”). The Recapitalization will be undertaken through a plan of arrangement under the Canada Business Corporation Act (“CBCA”) and includes:

• Exchange of $100 million 6.75% subordinated convertible debentures due March 31, 2023 (TSX: JE.DB.D) and $160 million 6.75% subordinated convertible debentures due December 31, 2021 (TSX: JE.DB.C) (the“ Subordinated Convertible Debentures”) for new common equity;

• Extension of $335 million credit facilities by three years to December 2023, with revised covenants and a schedule of commitment reductions throughout the term;

• Existing senior unsecured term loan due September 12, 2023 (the “Existing Term Loan”) and the remaining convertible bonds due December 31, 2020 (the “Eurobond”) shall be exchanged for a new term loan due March 2024, with interest to be paid-in-kind and new common equity;

• Exchange of all 8.50%, fixed-to-floating rate, cumulative, redeemable, perpetual preferred shares (JE.PR.U) (the “Preferred Shares”) into new common equity;

• New cash equity investment commitment of $100 million;

• Initial reduction of annual cash interest expense by approximately $45 million; and

• Business as usual for employees, customers and suppliers enhanced by the relationship with a financially stronger Just Energy – they will not be affected by the Recapitalization.

The implementation of the Recapitalization is expected in September 2020, pending court and securityholder approvals required under the CBCA, as well as applicable approvals by the Toronto Stock Exchange. The Recapitalization has been approved by Just Energy’s Board of Directors. Just Energy’s financial advisor, BMO Capital Markets, has provided an opinion to Just Energy’s Board of Directors that the terms of the Recapitalization, if implemented, are fair from a financial point of view to of the holders of the existing Euro bond Subordinated Convertible Debentures, preferred shares and common shares.

The Company has obtained a preliminary interim order from the Ontario Superior Court of Justice which, among other things, grants a limited stay of proceedings and establishes the record date for voting of security holders with respect to the plan of arrangement as July 8, 2020.The Company will be seeking an interim order in the very near term.

The Company’s ability to continue as a going concern for the next 12 months is dependent on the continued availability of its credit facilities; the Company’s ability to obtain waivers from its lenders for potential instances of non-compliance with covenants, if necessary; the ability to refinance, or secure additional sources of financing, if necessary, or the completion of this Recapitalization transaction; the liquidation of available investments; and the continued support of the Company’s lenders and suppliers.

These conditions indicate the existence of material uncertainties that raise substantial doubt about the Company’s ability to continue as a going concern and, accordingly, the ultimate appropriateness of the use of accounting principles applicable to a going concern. There can be no assurance that the Company will be successful in these initiatives, that lenders will provide further financing or relief for covenants, or that the Company can refinance or repay credit facilities from new sources of financing.

This is from their latest published reports and the government bodies involved have approved this recapitalization process causing the common stock of Just Energy to run up by over 80% in one day.

Having factored all of this the market has given the business an injection of value based of these fundamentals.

The ability for the business to actually achieve this is dependent on many variables

- The general strength of the Canadian and American markets for natural gas.

- The ability for management to utilize business assets in a productive way over time

- and the general sentiment in the stock market as they try to achieve key operational objectives

Warning authors opinion coming up!

We will pose a theory and call it The Law of the Preservation of Investment Value.

For an investor to actually figure out if this news of recapitalization means the business it worth more today than it was before the announcement, we have to figure out what the investment value of the business is.

Investment value has been defined by the financial industry as the present worth of the cash an investor is able to take out of a business, understating that a dollar today is worth more than a dollar tomorrow, so the cash has to be capitalized appropriately.

This means the business value can only change if the cash that can be taken out of the business over time increases or decreases, and simply changing bonds into new common stock or common stock into new bonds does not affect the value of the business. This latter part is called capitalization, this is what leads to The Law of the preservation of Investment Value.

This is somewhat similar to The Law of Conservation of Matter in physics where energy is neither created nor destroyed it merely changes form.

In conclusion, no change in the investment value of the enterprise as a whole would result from a change in its capitalization.

– John Williams

HAPPY HUNTING!