Hey Investors, as markets bleed you only need to remind yourself of one thing, and that is no prediction or market timing has ever been successful over long stretches in the capital markets.

When asked what he thought the market would do next, John Pierpont Morgan Sr who was a financier and banker allegedly said;

“I Believe the Market Is Going to Fluctuate”

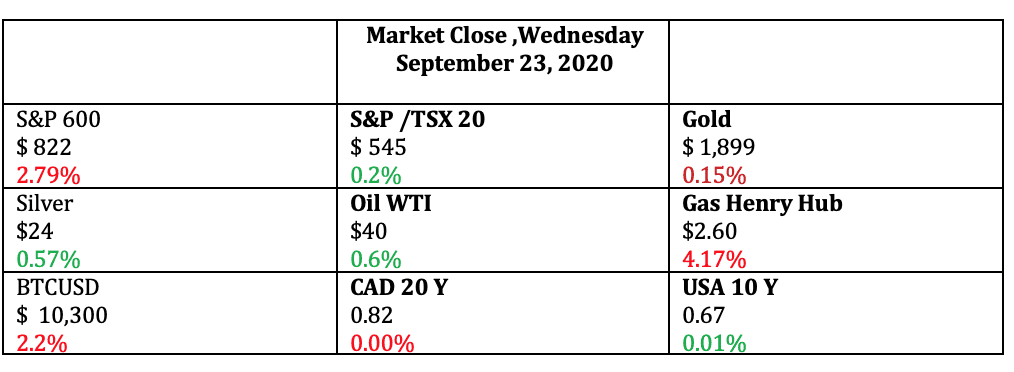

- S&P 600 (USA Small Caps) down by 2.79% and S&P 500(USA Large Caps) down by 2.4% for the day

- S&P/TSX 20(CAD Small Cap) up by 0.2% and the S&P/TSX 60 (CAD Large Cap) by 1.75% intraday

- Bitcoin down by 2.2%

- Natural Gas down by 4.17%

Market Movers

Today we have a winner in:

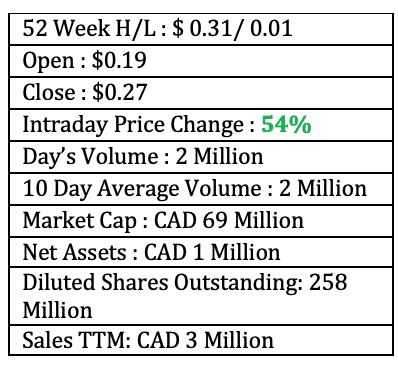

Killi Ltd. (MYID.V)

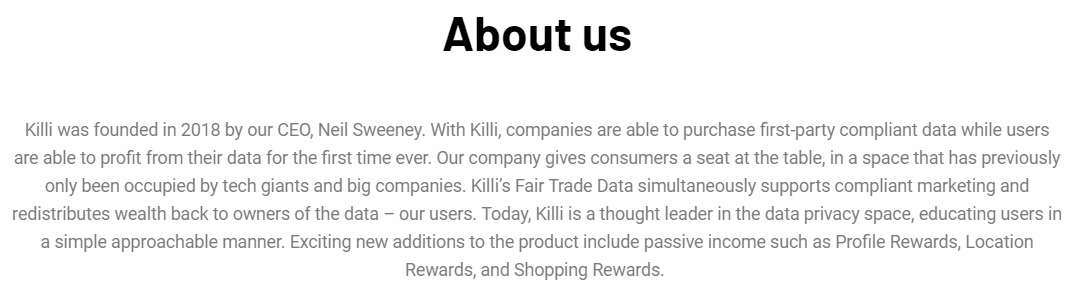

Business Summary: Killi Ltd., together with its subsidiaries, provides media measurement and identity solutions in the United States and internationally

In short, the main focus of the business deals with consumer data and privacy. The process is complicated but here are the steps:

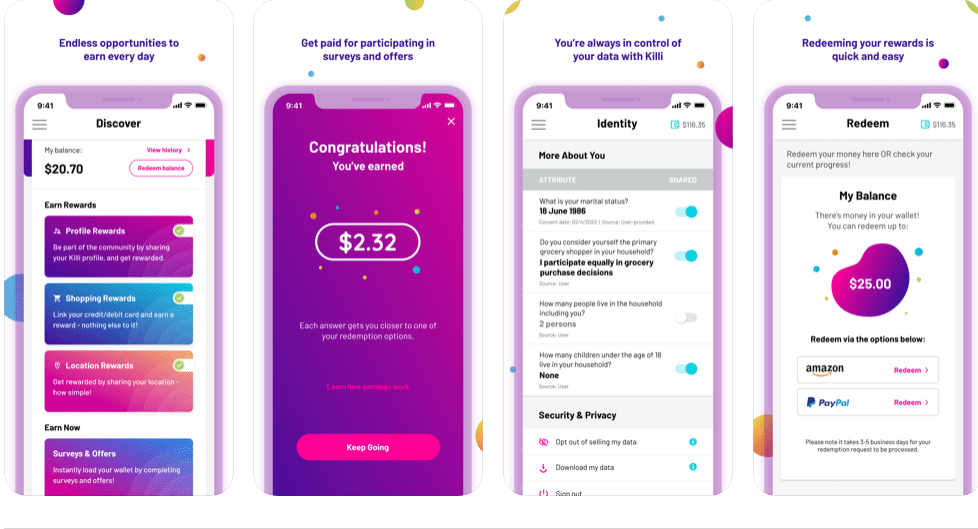

- Download the App on your Apple or Android device

- Set up your Account

- Get Paid!

The data we provide to online services is now a multibillion-dollar industry and companies have been in the watchful eyes of regulators recently on how protected the consumers’ data is.

We know this trend will persist because a lot of capital is being invested in companies that deal with the processing of data, think snowflake(SNOW.NY) who had a historic IPO recently in the USA with a market valuation of $61 Billion USD.

Killi is trying to give consumers back control of their own personal data by being transparent about who is using it, and compensating people on the use of this data.

As a human in the 21st century, we have three basic rights

- Right to Life and Happiness

- Right to liberty and freedom

- Right to property

As we share more and more of our data online, we have given up the basic right to our own intellectual property, or our digital ID. In the process of losing our liberty and happiness. And the team at Killi says they are here to fight for us.

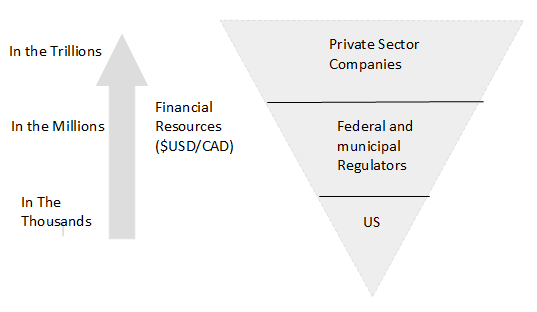

This battle for consumer protection without them has three tranches :

Companies literally have Trillions of dollars of capital at their disposal to invest in programs that collect and store our data. They can spend millions of dollars on lawyers and fees and not feel the pinch on their bottom line because they generate billions of dollars of revenues from us.

But this is not to say they are the bad guys, capitalism in its core rewards entrepreneurs for innovating and creating goods and services that the market demands.

The problem arises when you compare their resources to those of government bodies who are there to protect consumers and the financial resources of the consumers themselves.

The disparity in egregious and having a business in the private sector acting as our hero and savior might be beneficial.

The company has recently announced that its service is now available on Google Chrome, Microsoft Edge, Brave, and Opera browsers, paying consumers in cash to block advertisements, which is a “market first”.

2020-09-22 09:18 ET – News Release

Mr. Andrew Elinesky reports

KILLI INTRODUCES AD BLOCKER FOR GOOGLE CHROME, BECOMING THE FIRST COMPANY TO PAY CONSUMERS TO BLOCK ADS IN THE BROWSER

Killi Ltd. has launched its new browser extension, available for Google Chrome, Microsoft Edge, Brave and Opera browsers, paying consumers in cash to block advertisements, a market first.

The team at Killi believes that the browser is one of the worst offenders of data leakage. Every page, interaction, and purchase that a consumer does is tracked and sold by the browser companies without any consumer inclusion or transparency.

The new Killi browser extension blocks the transaction of consumers’ data and allows the individual to link their browsing data to their Killi account by signing in.

What does this mean for potential and current shareholders? Great app aside and market sentiment put aside has their business model been successful so far?

In all honesty, at this moment it is very difficult to tell if the strategy is working and any wise person would also appreciate that the business is relatively young.

But an easy and simple way to see if they are attracting business is by looking at their ability to generate business whilst maintaining costs to produce the product. The key accounting metric to look at would be the Gross Profit margin

For those readers who hate accounting, you cannot skip this basic lesson as an investor. For those well versed in accounting, this section can be skipped.

Sales = Price paid by customers X number of Customers

Cost of Sales = Cost to Produce One-unit X number of Customers

Sales – Cost of Sales = Gross Profit

Gross Profit can be defined as the ability of the firm to produce business per the cost of each unit sold.

Gross Margin = Gross Profit/Sales: for example

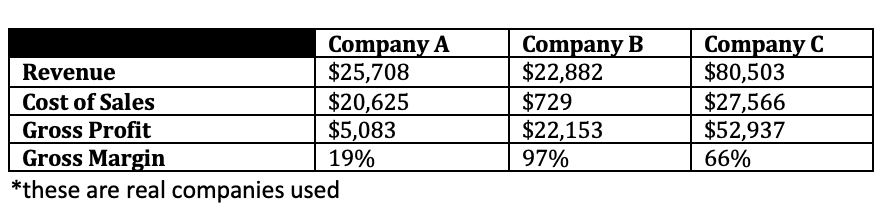

Company C produces the highest amount of revenue and when comparing revenues seems like a better business. Followed by A and then C.

But the beauty of the Gross Margin ratio is that it unlocks a whole new level of analysis.

- Company A produces the second largest revenues but has very high costs and its ratio is 19%. Simply put it sells at $100 and costs them $81 only keeping $19 for themselves

- Company B produces the lowest revenues but its costs are almost negligent. Their ratio is 97%. Selling at $100 it costs them $3 and they keep $97

- Company C brings the largest volume of business and its costs relative to its revenue are ok, but high when compared to the rest of the firms. Surprisingly its ratio is 66%. They sell for $100 and it costs them $34 and they keep $66.

Now, who is the best?

Again, I apologize for this brief lesson in accounting, but this is fundamentally one of the most important ways to check if a business is doing well over time and compared with its peers. Of course, it’s not the only way but for today we will pretend it is.

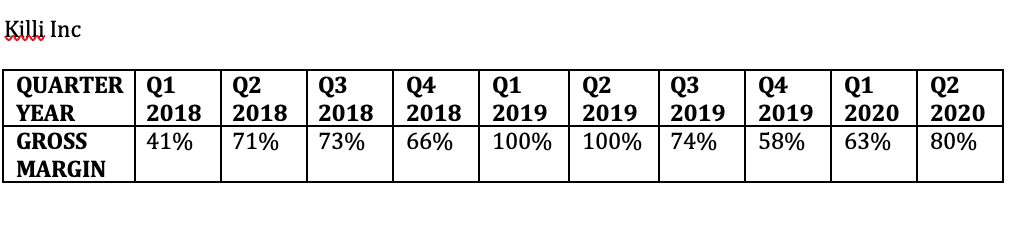

From the table above its pretty evident that Killi is able to control its cost and generate business. But as is common with industries where there are high margins like this one, to stay competitive and keep competition out the business has to establish some competitive advantage.

Firms can do this in many ways from brand loyalty, patents, or trademarks and just being the low-cost producer. The expectation for Killi as time goes by is that margins should reduce as they scale up but if they stay competitive this is a business worth watching over time.

HAPPY HUNTING!