Recently, I posted a Market Moment post on a bullish case for the US Dollar. Yes, I know the Federal Reserve is printing like crazy and yes I know they are buying things up. Yes, I know they are targeting an inflation rate higher than 2%. However, many other nations are doing the same thing! In this currency war, every central bank is attempting to weaken their currency in relation to others. It is a race to the bottom. In this type of environment, what fiat currency would you choose to hold? Many have argued the US Dollar as it is the reserve currency, and still holds that safe haven status. The Japanese Yen is the other safe haven currency people run into. In fact, I have met money managers who never leave their homes without some Japanese Yen! They argue the Yen is the better safe haven currency because the Japanese government is relatively stable, as in we do not see the type of division in Japanese politics that we are seeing in American, Canadian and European politics. The main argument, is that the Yen is the premier safe haven because the debt of the Japanese is backed by the savings of its citizens. Of all the western allied nations, Japan has the highest savings rate. This cannot be said about the Americans.

Enough about the Yen, I can write a lot about that currency for pages. Let us stick with the US Dollar and the set up that has triggered.

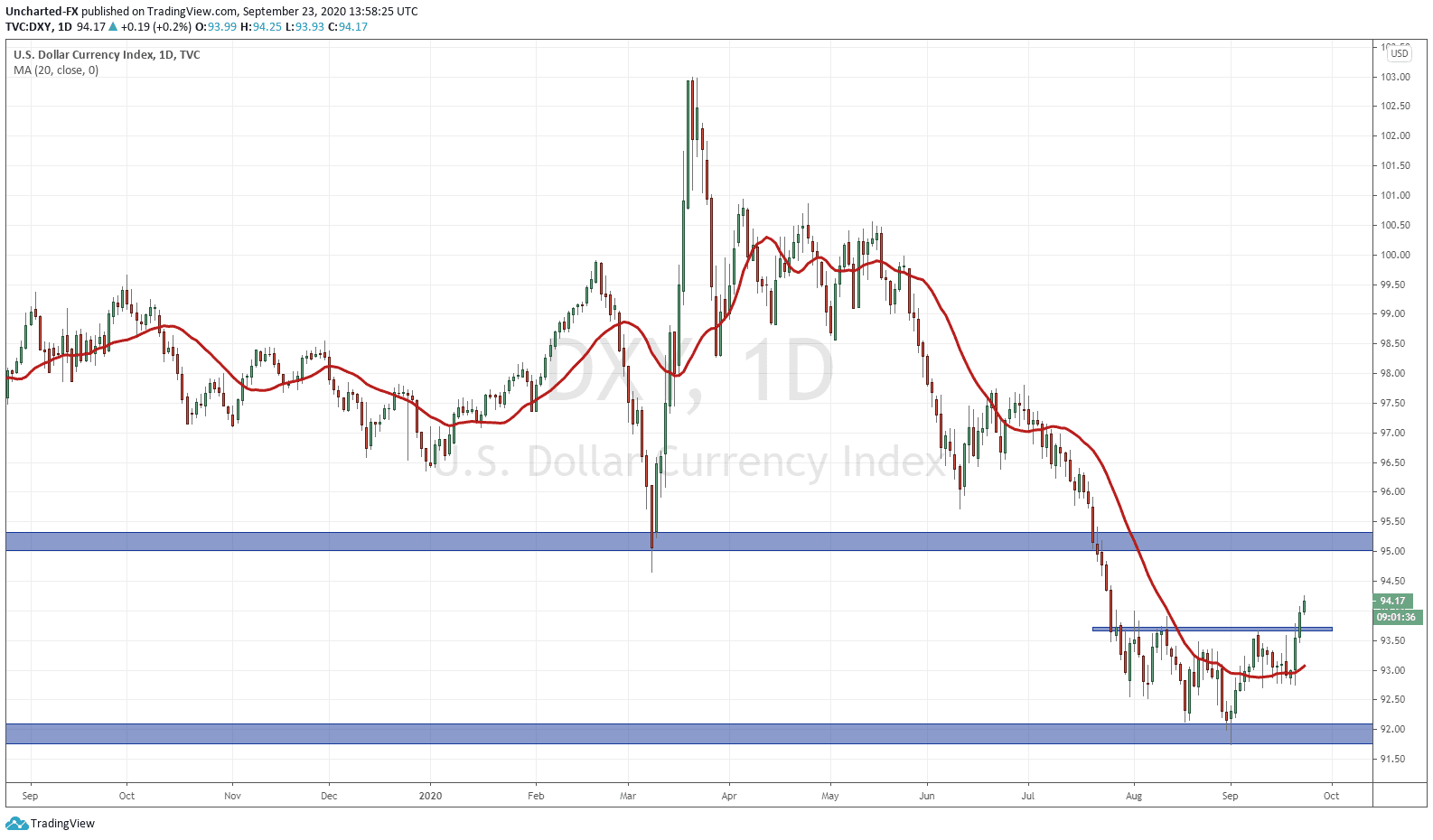

As previously mentioned, I spotted a reversal pattern on the US Dollar (DXY) chart. Our trigger for an entry has been to await for the breakout above. Well…

We got the confirmed breakout yesterday, and we are now aiming for a first target at the 95-96 zone. This uptrend is intact as long as we remain above the breakout zone (now support) at 93.70. This is big. My readers know how important this move is. It could mean another leg lower on US stock markets… and funnily enough, markets are retesting their breakdown points at the time of writing and are seeing a rejection from them as the Dollar moves higher.

This Dollar move is also the basis for our shorts on Gold and Silver that I covered weeks ago. A Gold target to 1800 and Silver down to 20.50.

The truth is nothing moves up or down in a straight line forever. Price moves in cycles composed of waves on all assets. So even though I believe that you want to be out of the Dollar later, because I think there will be issues, I trade the charts that I see, not the ones that I want to see. And right now, we cannot ignore this bottoming pattern. Perhaps we may even see some major geopolitical or political news soon?

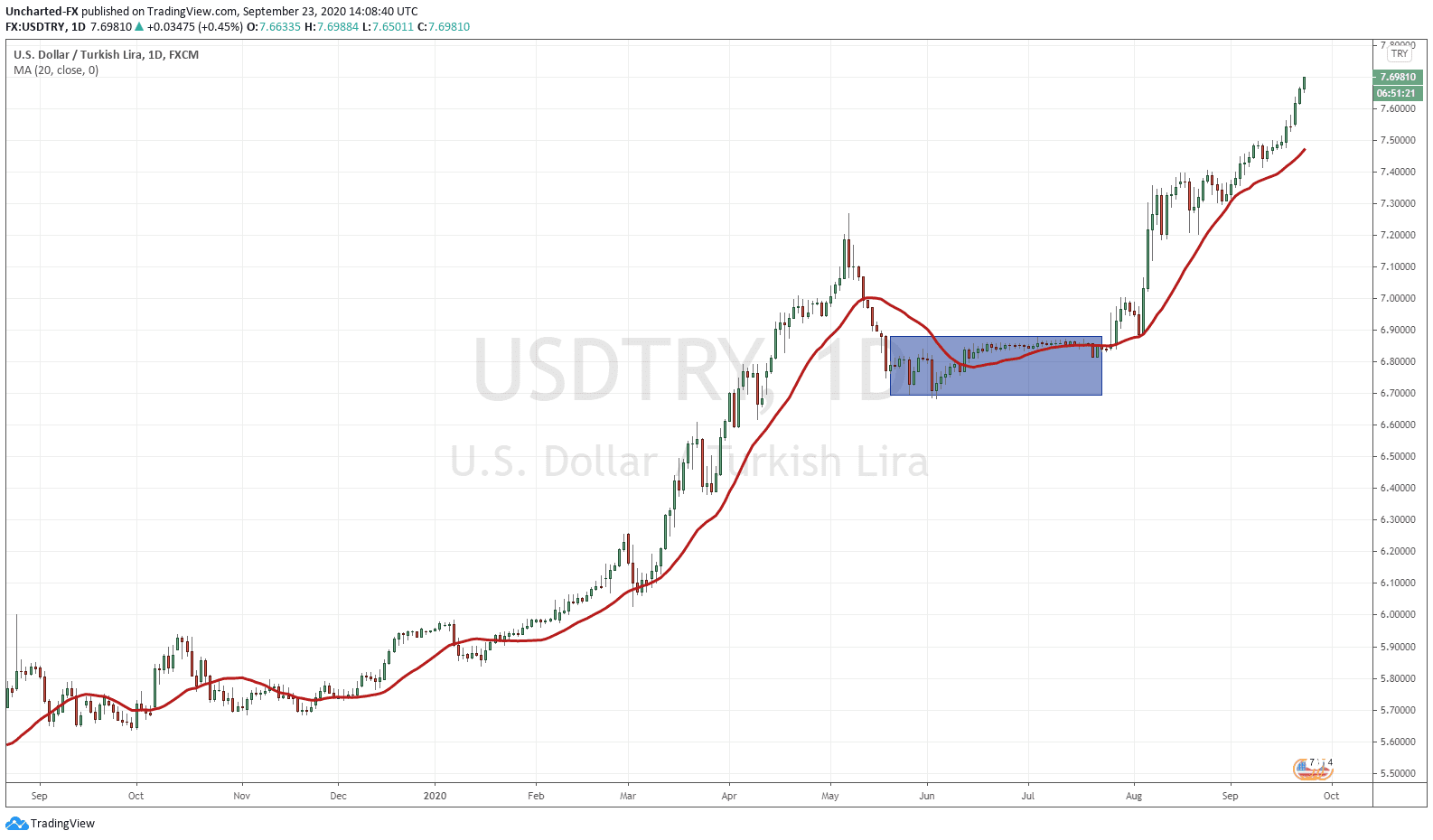

Over on our Discord Trading Room (which is absolutely free to join!), I have noted that the Turkish Lira and the country of Turkey has been one to watch. The Lira is getting decimated.

As you can see, the Lira cannot catch a break. It keeps weakening. I have highlighted the blue box because price was relatively stable. Why? Many are now saying that the Central Bank of Turkey attempted to peg their currency to ensure it would not weaken anymore. It failed. If this was true, it may also explain the US Dollar move lower…was it the Fed attempting to weaken the Dollar to try and help Turkey from imploding? Notice how Erdogan is now saber rattling. Threatening the Greeks and others. To me, this is what happens when a country is failing and the leaders wants to distract the people’s attention away from domestic issues. Keep an eye on this currency pair, and keep an eye on Turkey.

In addition, the Indian Rupee has been doing something similar…notice how Prime Minister Modi and India are now focusing on China and border disputes…

The emerging markets are ones to watch because of one thing: US Dollar denominated debt. Since interest rates were high in emerging markets, and low in the US, many companies and other larger institutions in emerging market countries borrowed from the US due to the lower interest rate. But they were setting up for disaster on a US Dollar bull run. As long as the dollar is weak, it is okay for most nations, but when the Dollar gets stronger, we will have issues with the emerging market nations.

In fact, I believe that the Dollar moving higher triggers some sort of new Plaza Accord, where nations come together to condemn the Dollar and its reserve status. The Fed is then forced to ‘kill’ the Dollar. So I am in that camp, rather than the US Dollar just drops and weakens from here. Could this basing and new uptrend be the beginning of this scenario?

In terms of Emerging Market nations, the ones that are in more danger and will have problems with a stronger Dollar are those that have a large amount of US Dollar denominated debt and do not have enough foreign reserves (Dollars) to cover a portion of that debt. The nations that fit this bill are Turkey, Chile, Argentina, Mexico and Indonesia.

Now to the trade idea.

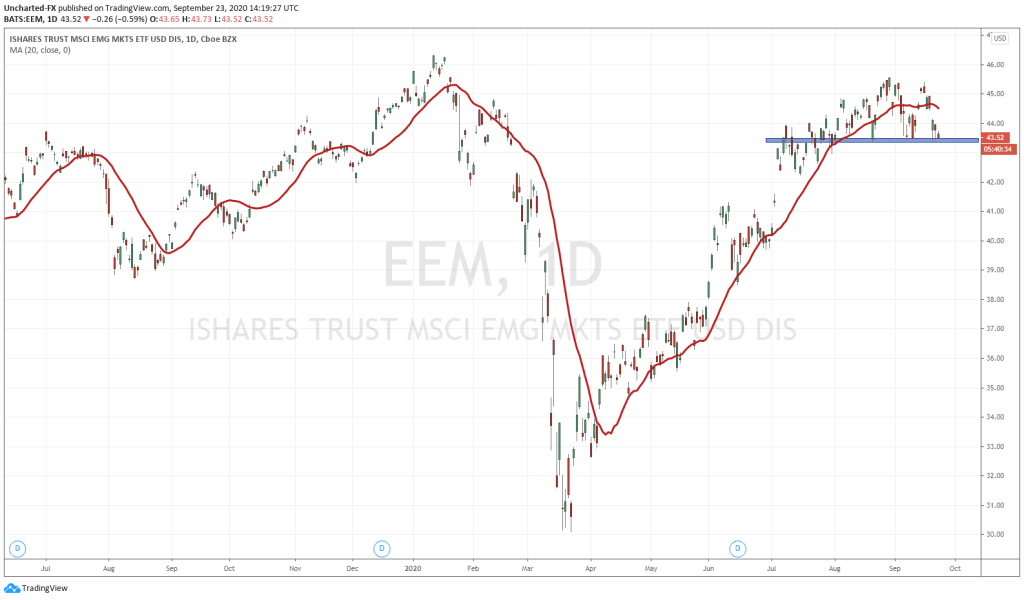

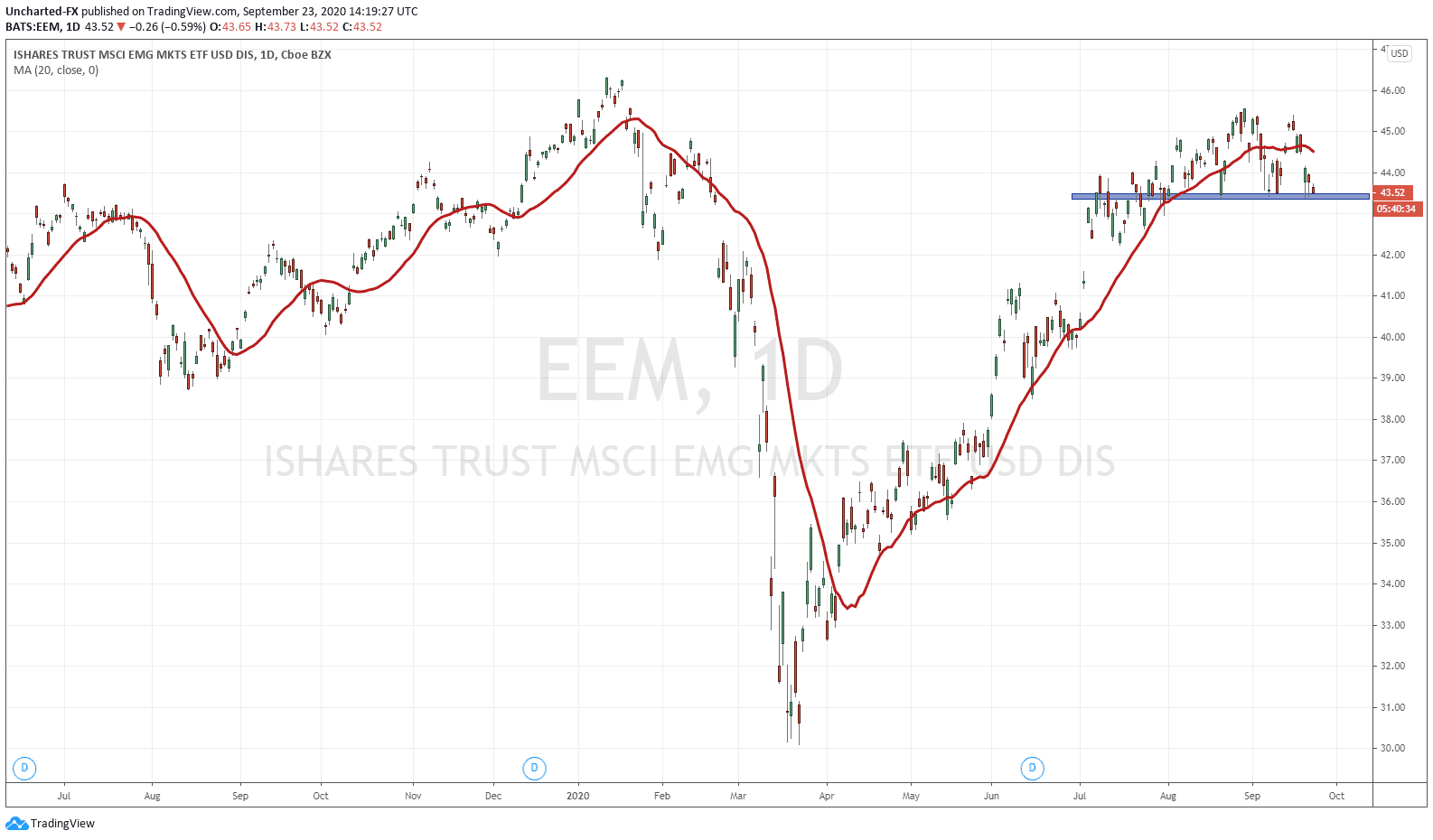

The Emerging Market Index or EEM. This will be a great way to play the US Dollar strength and move higher. Of course you can trade Forex pairs like I am (USDCAD, USDNOK and USDJPY triggered. EURUSD and USDCHF on watch for the trigger), and also going short Gold and Silver. But EEM has not broken out yet, meaning that this is a great opportunity if you missed the other trades.

EEM has had a nice uptrend since April of this year. We can see the multiple higher lows and higher highs on the way up. We then hit a major resistance zone around the 46 zone. You can see we stopped making new higher highs. In fact, we have begun to range. This is telling us the trend is exhausting.

A range is a reversal pattern we like to play, but the key here like all my trades is the trigger. We need to see a candle close BELOW support in order to go short. We are testing this support currently and could see this confirmed close by the end of today.

The 41.00 zone looks like our first target, however, if we hit that zone, we would fill a gap. Filling a gap like this is powerful and would add more bearish momentum downwards. I think this will depend on how the DXY reacts at our 95-96 zone, but if the Dollar moves higher from there, EEM can decline further down to the 39-40 zone.