The common thing between Uber, Airbnb, and Amazon is that they’re not just billion-dollar giants, but a very specific type of platform – a two-sided marketplace.

A two-sided marketplace creates value by offering the power of network effects to two distinct, but complementary user groups. Uber matches drivers with consumers, Airbnb matches hosts with travelers, and Amazon is a classic example of matching buyers and sellers on the internet.

In small-caps, Peak Position Technologies (PKK.CSE) is innovating in fintech by creating a two-sided marketplace.

Peak operates primarily in the commercial lending sector and matches small and medium-sized businesses in need of credit to potential banks and mortgage brokers.

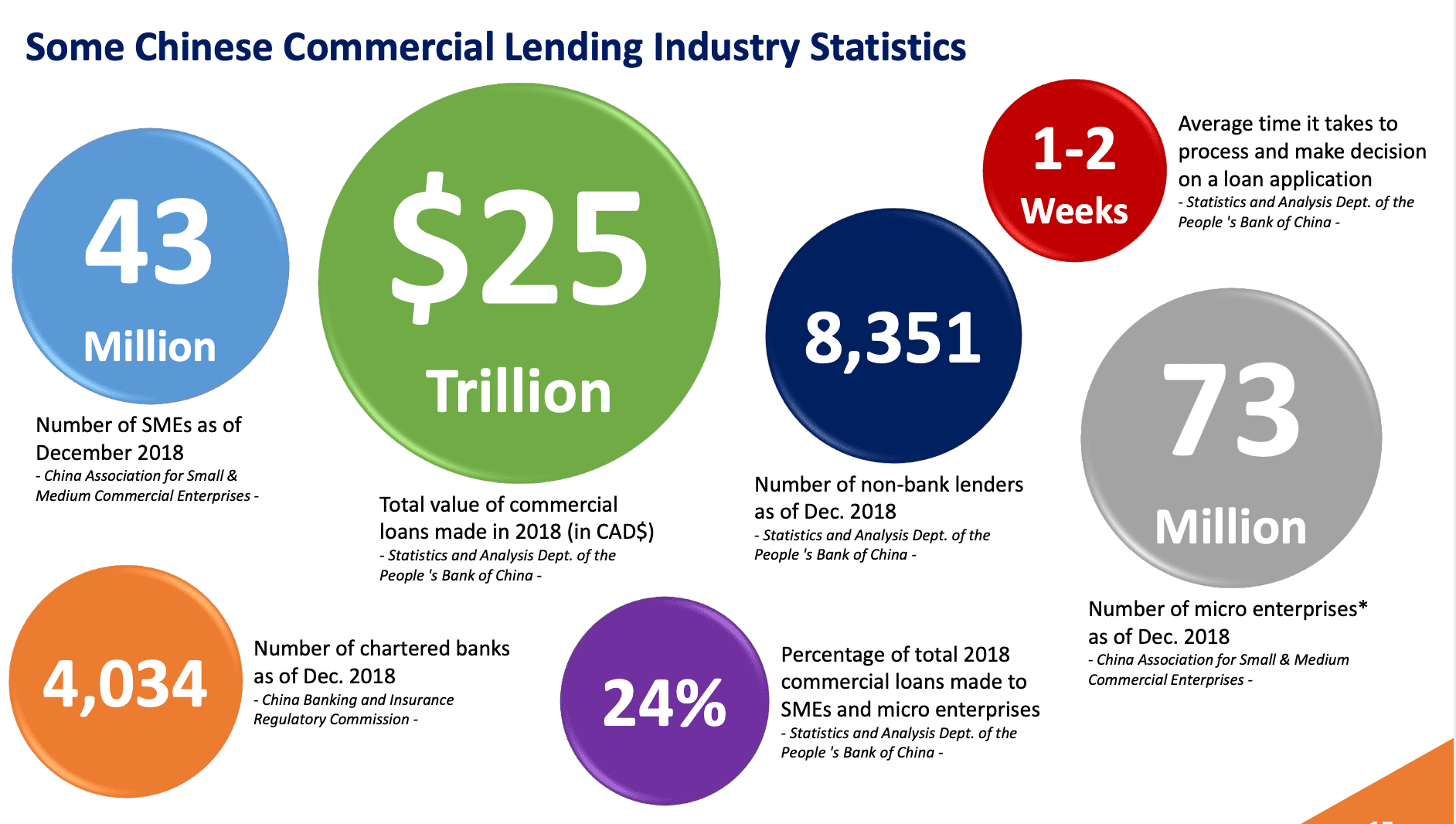

While China’s payments industry and e-commerce landscape has evolved considerably over the past few years, innovation has largely served large and enterprise-level businesses. When corporations serve large businesses, guess who takes a backseat when it comes to getting their problems solved? Small and medium-sized businesses.

Enter Peak Positioning.

Peak is the parent company of a group of smaller players operating in China’s commercial lending industry.

Small and medium-sized businesses are present in almost every industry vertical, but when it comes to credit, face increasing scrutiny and regulation. Not all banks are willing to lend to these individuals, but more importantly, not all banks can lend to all types of businesses given the nature of regulation.

Over 100M small and micro-businesses face this problem and are constantly searching for specific types of brokers or lenders, who often charge high fees when providing credit to businesses in specific verticals.

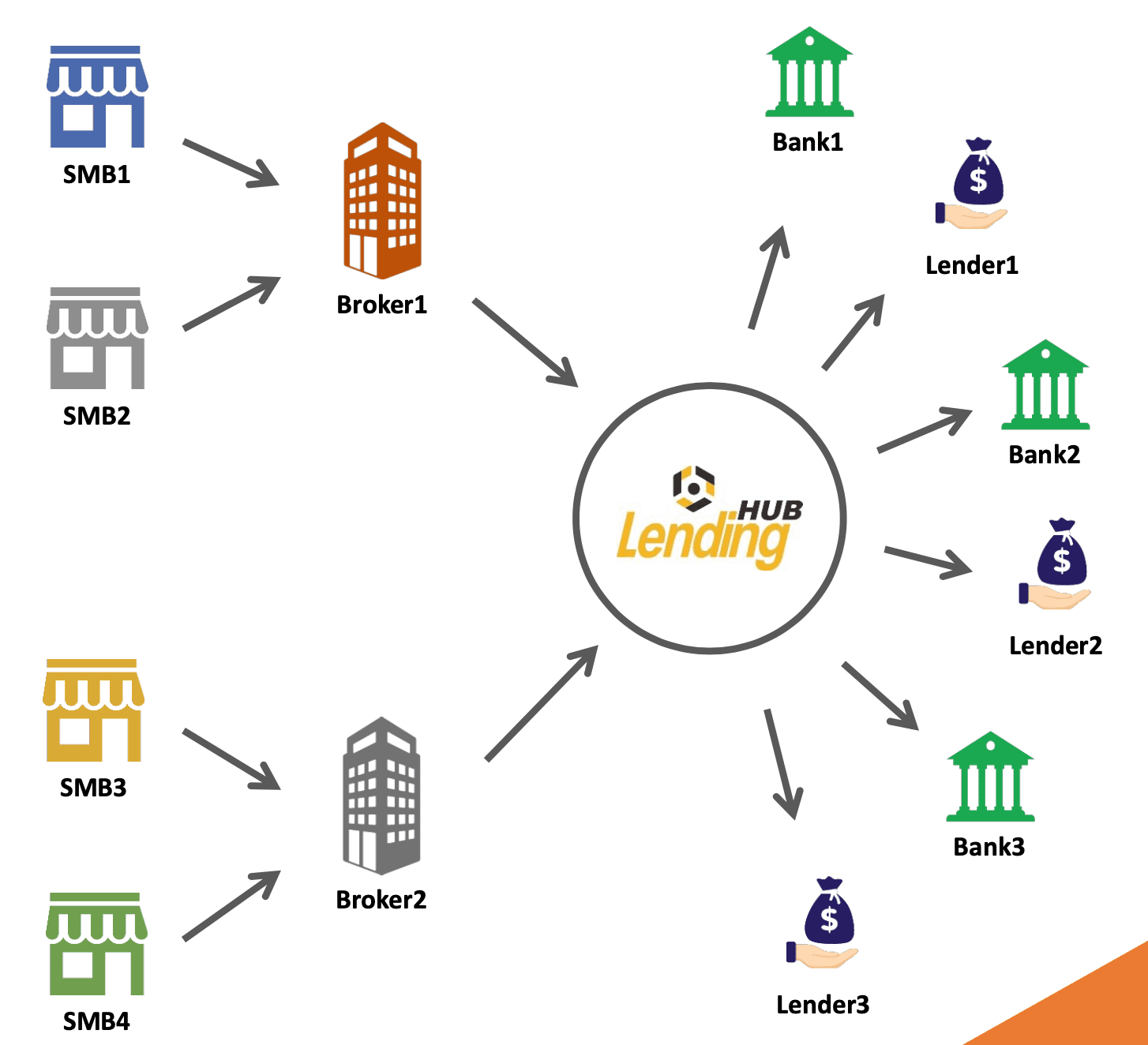

Peak has solved this problem by creating a two-sided marketplace. Their platform, called the Lending Hub, has a large user base of brokers, banks, and businesses. So instead of going on a wild goose chase to find the right broker who will lend them credit, a business in need of capital can simply enter its information on the platform and get matched with a loan provider.

With over 12,000 potential lenders in the market, this means greater choice, opportunity, and access for small businesses. Additionally, the platform helps banks and lenders because instead of paying hefty commissions to search for businesses, lenders are able to develop an automatic pipeline that would automatically match them with the right users.

In creating this two-sided marketplace, Peak is also able to get access to large amounts of data about a specific business and a lender. Peak validates and analyses this information, and uses AI to offer credit risk analysis, potential loan terms, etc for users. So smaller players not only get increased access to credit but are also made aware of their credit risk so that they can avoid instances of predatory lending.

The business model is simple: Peak collects a service fee representing a percentage of the credit provided by the lender.

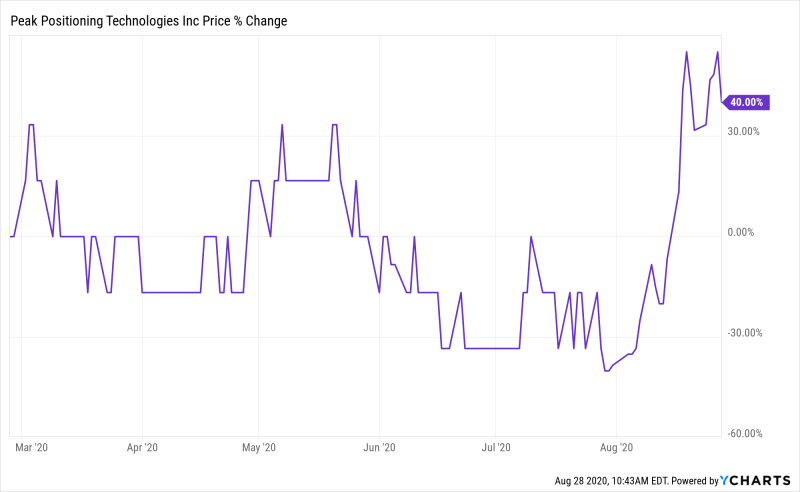

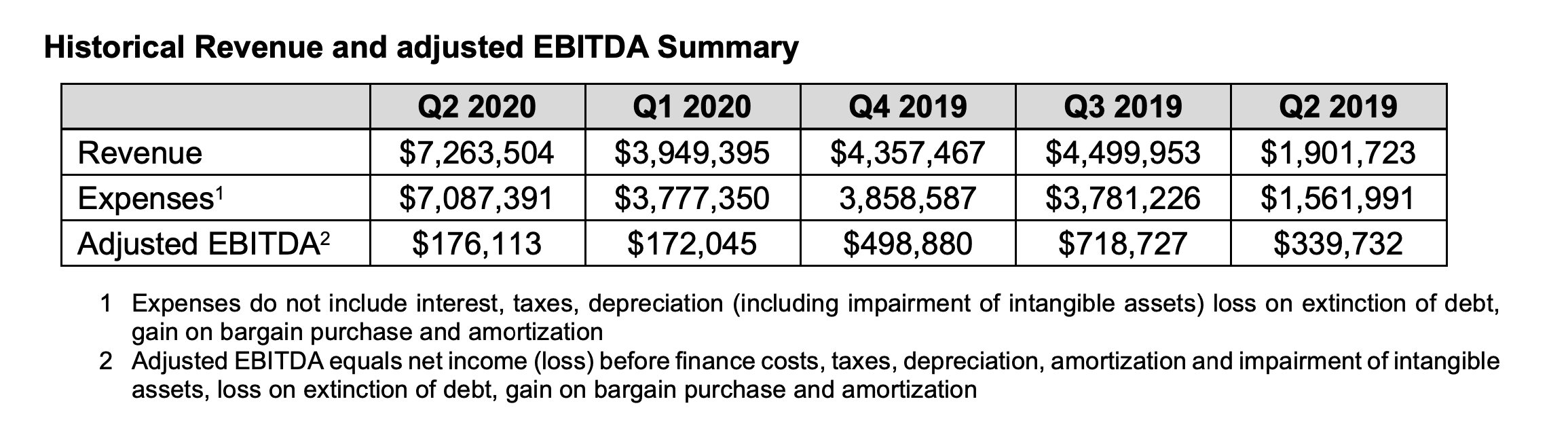

Peak announced earnings yesterday and reported a record $7M in revenue for Q2 ending in June ‘20. Moreover, Peak’s line of business is asset-lite, so market entry into newer cities or provinces is faster. The firm now operates in six cities in China and affords over 50 lenders on its platform.

“We had a very strong second quarter, not just because of the record revenue we posted, but also because of the seeds we planted to position the Company for future growth. We incurred significant expenses during the quarter, but that’s to be expected when a company is growing as rapidly as Peak is right now. At some point before the end of 2020, some of the non-recurring expenses linked to our growth and expansion will begin to wane to reveal why we’re so pleased with what’s currently taking place at Peak,” commented Peak Group CEO, Johnson Joseph.

Peak’s value proposition lies beyond merely increasing access to credit. It lies in creating a transparent ecosystem in what is otherwise an illiquid and opaque market. As the firm’s line of business grows, it has the potential to repurpose the platform to serve other business needs ranging from supply chain and inventory management to logistics and delivery.

An all-star team led by CEO Johnson Joseph, Peak is on its path to disrupt commercial lending in one of the largest economies in the world. Stay tuned as we dive deep into the company’s operations over the coming weeks: