On Friday we had some 13F filings from large funds which caused a storm in the Gold community. First off, it was announced that Ray Dalio’s Bridgewater Associate put in $400 Million into Gold in Q2. Mostly in Gold ETFs specifically iShares Gold Trust (Ticker: IAU), and the popular SPDR Gold Trust, commonly referred to as “GLD”. Bridgewater’s GLD position is now around $914.3 Million. This should not come as much of a surprise as Dalio has been bullish on Gold in his interviews about the world paralleling the 30’s and late 40’s. How Gold is going to be the new safe haven bond asset, as government bonds will eventually be yielding negative, and how Gold will be the best CURRENCY in this world of crazy central bank monetary policies. Both of which my readers are familiar with, as I have discussed it many times regarding the bullish case for Gold. Currencies weakening against Gold tells us that inflation is coming. Central banks will cut rates even lower to try to inflate the currency to keep things such as stocks and real estate propped, and is a way to collect more taxes through the property tax and sales tax rather than direct taxes on its citizens.

Of course Ray Dalio does not manage money anymore, but I am sure he still ‘advises’ Bridgewater on topics, and his ideas are held in high regard at the firm. But the big surprise came from a money manager who is still going at it at the age of 89: Warren Buffett.

For decades, Warren Buffett has dissed Gold. Now recent 13F filings show that Buffett has now taken a $564 Million position in Gold miner Barrick Gold. Headlines in the financial media is: Has Buffett bet against America? As Warren Buffett also dropped and trimmed positions in large US banks:

- Berkshire’s JPMorgan Stake Down 62% to 22.2M Shrs

- Berkshire’s Wells Fargo Stake Down 26% to 238M Shrs

- Berkshire trimmed its bet on PNC Financial and M&T Bank as well as Bank of New York Mellon Corp., Mastercard, and Visa.

- Berkshire Exits Goldman stake entirely

This is quite the change for Buffett as his latest positions have been in Natural Gas and adding more to his Bank of America position (Note how it was NOT one of the banks trimmed…leading to more speculation as to why). Whenever the market is falling, financial media plead on air for Buffett to announce he is buying. That is how much clout he has on investors in large. Knowing the Oracle of Omaha is buying leads to money returning back into markets. During 2008, Buffett came out buying banks, GM, GE etc and was buying companies that would do well on a US recovery. He was betting on the US recovery. This time around the big news was the acquisition of a Natural Gas company…not what the financial media wanted to hear, as it points to a safety play.

Both Buffett and Dalio are held in high regards by the hedge fund and money managing community. So much so that their trades are often mimicked. If these funds were NOT looking at Gold, or at a case for Gold…they are now. As discussed earlier, most funds have a tiny allocation in Gold…close to 1%. If this rises to even 5%, there will be a massive price move in Gold which would easily take us past $2000.

I want to caution though: Buffett has had a rough trading year. Perhaps Buffett could have just broken his rules about Gold just to make a good trade to turn out positive for the year. He could easily dump this position afterwards. Be wary of this. This could turn out to be the biggest troll of the year… as he technically is invested in a miner, and not Gold itself.

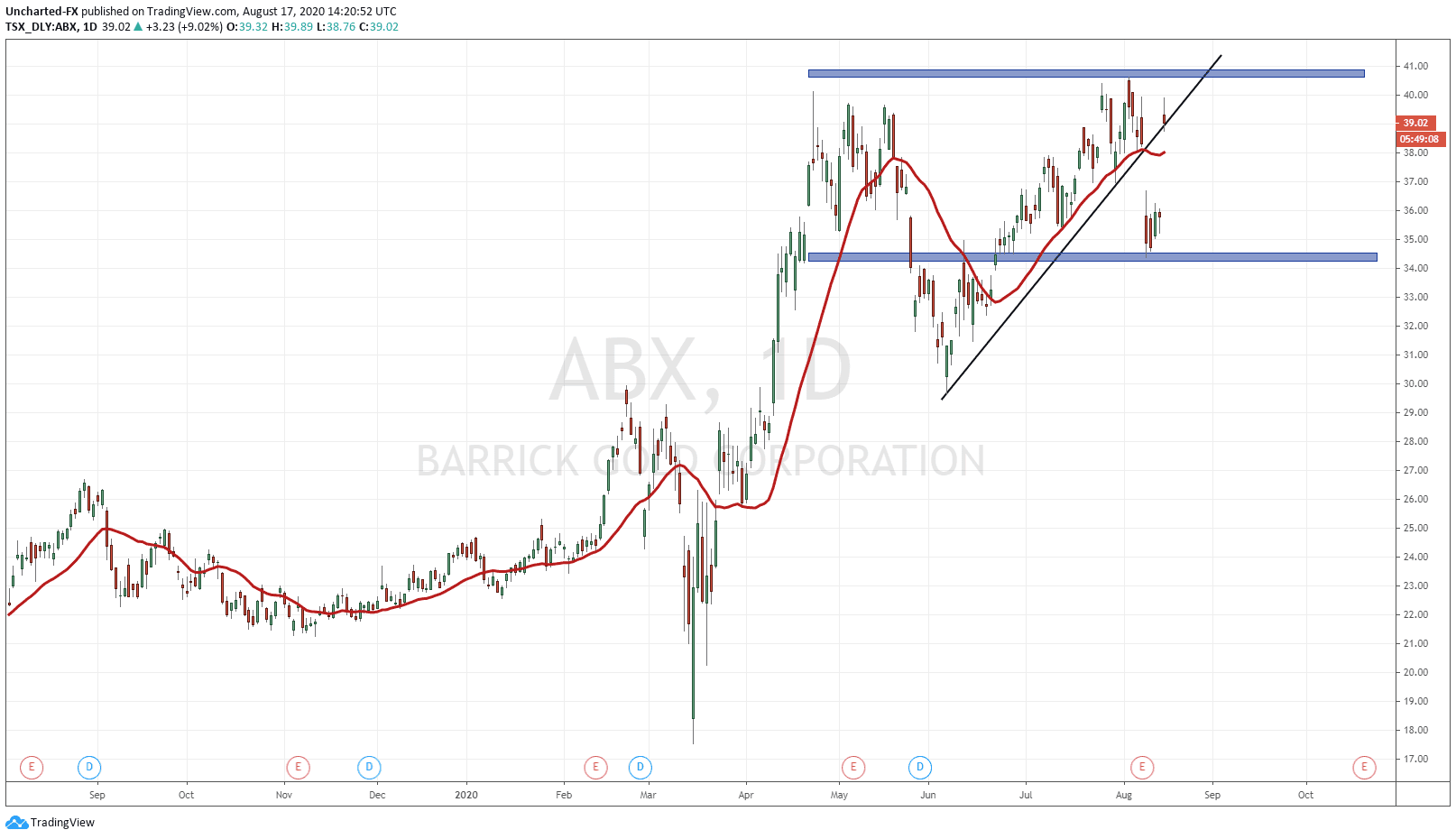

Barrick gapped down on earnings last week, and remained above support at the 35 zone. I even drew a trendline to show you all the uptrend ending…this occurred as Gold began retracing or pulling back from all-time highs. Today’s price action has taken us back ABOVE this trendline. This is important because trendline are generally retested before continuing lower on the break. Today’s daily candle close will be important for Barrick as it will indicate whether this trendline is nullified or not. If we stay above, then resistance at recent highs at $40.60 will be targeted, with a break taking us potentially to the $44-45 zone.

Keep your eyes on Barrick’s close today. But as of now, we are seeing a nice bid in Gold and Gold stocks. This is the power of the Oracle of Omaha. More eyes and focus will be diverted to Gold.