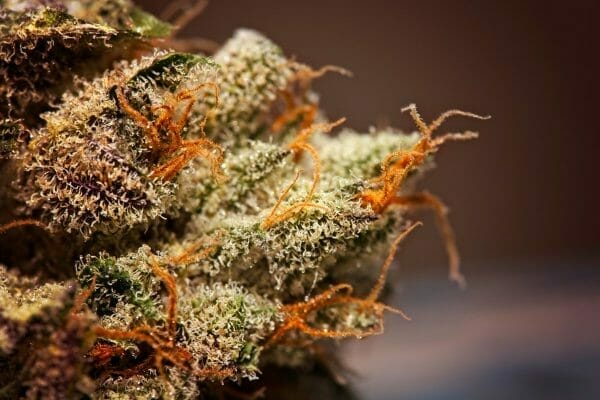

Media Central (FLYY.C) inked a binding letter of intent to acquire on-line cannabis hub Budtree earlier this week.

Budtree was established in 2016 to become an online hub for cannabis vendors, merchants, and customers. The platform gives cannabis connoisseurs in both the recreational and medical markets a safe and secure space to discover new products. Budtree has invested nearly $2 million in their web platform, and Media Central will be able to use this platform to introduce its 6.5 million readers to the online cannabis and CBD market, while opening new revenue avenues for the company.

“Acquiring Budtree.com is a natural extension to our business model for Canncentral.com. This opens up an immediate revenue-generating opportunity to merge Canncentral’s daily enthusiastic cannabis readers directly with an established e-commerce platform. With this acquisition, our loyal readers will be able to easily purchase the cannabis products they are learning about on our site,” said Brian Kalish, chief executive officer of Media Central.

The acquisition is the next step in Media Central’s aggressive M&A strategy to create a brand portfolio with a like-minded audience, and consolidate a 100 million strong audience, connecting to a powerful demographic through content, events, social media and programmatic advertising. Budtree joins Vancouver’s Georgia Straight, Toronto’s Now Magazine, Canncentral and ECentralSports, which are all owned by Media Central.

“We have always wanted to offer our consumers a safe and secure way to access cannabis products. Now, with Canncentral, we will be able to leverage award-winning writers and content producers to showcase and educate consumers on our diverse product. We are aligned with the vision Media Central sees for Budtree and are excited for the next phase of our company,” said Ray Rasouli, CEO of Budtree.

If the deal passes through the due diligence, audit and regulatory approvals phases, Media Central will finalize the acquisition through a share exchange, and the platform will become a 100% owned subsidiary of Media Central. When the deal finally closes, Media Central will issue 85,451,521 shares to Budtree shareholders. After which, Media Central will complete a $1 million private placement at 3.3 cents per share, with both parties sharing 50% responsibility.

—Joseph Morton

Media Central (FLYY.C) – Chris Parry’s Daily Rant Video