Are you ready for Gary Kasparov and Grayscale?

It’s time for your Friday coin rundown.

Here are your top ten coins.

Bitcoin

market cap $176,583,345,335

If you’re into chess, you’ll like this: Gary Kasparov, chess grandmaster, free-thinker, Russian democracy advocate and snappy dresser, is bullish on Bitcoin.

Here’s a bit of the Forbes article:

“As with any new technology, it’s not inherently good or bad. It depends on who’s using it and for what purpose. You can use nuclear technology to build a bomb or a reactor. Now, we hear a lot about the potential downsides of cryptocurrencies because they can help bad guys rob money.

Actually, these fears are overrated. When we look at the opposite hand, we see many upsides of cryptocurrencies starting with bitcoin and others that followed it and blockchain as a technology because it allows for more personal control for individuals at a time where more and more of elements of our lives are controlled either by the state, corporations or outside parties that may somehow have a clandestine agenda. So I think it’s a natural response of technology to help the public regain the control that has been gradually lost to outside institutions.”

Always did like that guy.

Ethereum

market cap $31,617,300,722

There are three constants in life: death, taxes and price increases. And if you’re Jeff Bezos then even taxes aren’t guaranteed.

Needless to say, you’re going to pay more for Ethereum and Bitcoin now.

Here’s what the folks on Twitter are saying about the price of Gas.

The gas fee on Ethereum is approaching its new record. This ridiculously expensive cost becomes a heavy burden to users and an obstacle of defi transactions. It’s a golden window for alternative solution to overtake. pic.twitter.com/TjrrZGsSYQ

— Da Hongfei (@dahongfei) July 23, 2020

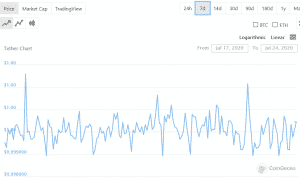

Tether

market cap $10,151,764,733

As you can see from the above number and the below chart, Tether’s jumped over into the $10 billion club, which makes it the clear winner in the cryptocurrency sweepstakes, having gained more than $5 billion in market cap since March.

Where my curiosity lies is in what’s going to happen when governments (and specifically, the United States government) releases it’s own proprietary central-bank funded digital currency (CBDC). A CBDC will carry a heavy surveillance load as the government will be able to effectively track every single one of its coins digitally, which is perhaps one of the strongest arguments towards going completely digital, and Tether still won’t and therefore possibly be the stablecoin of choice. I don’t suspect the one will absorb or otherwise curtail the other, but instead coeist performing different functions.

Still, it’ll be interesting to watch.

XRP/Ripple

market cap $9,215,150,288

Ripple has had a fairly rough go of it this year.

This time, it’s their lawsuit against YouTube, which is in danger of disappearing courtesy of a motion to dismiss. The lawsuit accused YouTube of allowing XRP giveaway scams on its network, claiming that YouTube isn’t doing enough to stop scammers and allows paid ads that encourage viewers to give away their XRP.

They’re claiming that these scams have hurt their brand.

Admittedly, YouTube’s got some explaining to do about a lot of different things to do with their platform, but there’s no way they’re hurting Ripple’s brand by allowing this content. Ripple’s brand couldn’t possibly sustain anymore damage than what it’s already done to itself.

Bitcoin Cash

market cap $4,400,072,853

Here’s an interesting development. Grayscale Investments—think Grayscale Bitcoin Trust (GBTC.Q) or Grayscale Ethereum Trust (ETHE.Q), announced on Monday that shares of Bitcoin Cash Trust and Litecoin Trust have received approval from the Financial Industry Regulatory Authority (FINRA.)

Grayscale will be able to allow institutional investors access to these cryptocurrencies without the necessity of having said investor actually buy the currency, and incur all of the risk.

It’s a fairly sweet deal if you’ve got better things to do with your nights than lay awake wondering if your crypto’s still safe.

Cardano

market cap $3,812,689,593

Cardano is scheduled to fork in five days. Charles Hoskinson, the coin’s inventor, gave a video update wherein he informed viewers about the progress being made on the hard fork—which is being called Shelley, after P.B Shelley keeping with their Victorian poet motif. (The former was called Byron).

There is slated to be another video update on July 30th to address the matter of a concrete schedule for August and provide information on what exchanges and wallets will be effected by the hard fork, and which ones won’t be available directly afterwards.

Bitcoin SV

market cap $3,384,236,185

If you’re the kind of technically-inclined person who likes to playtest apps then this might be for you.

BSV App Testers is offering to perform real-world user experience tests. They’ve created a platform where any developer can post a job and any user can sign on to make money.

Apparently, according to the BSV App Testers group, there’s no technical knowledge required. Developers will need more general experience in testing for features, functionality, design, basic things like grammar and logical consistency, and user experience. You can get an app that works on iOS but not Android, and some features will work fine in a browser that aren’t the best on mobile.

Still, if you’re into that kind of thing, why not get paid for it?

Litecoin

market cap $2,904,787,712

Really, the Grayscale aspect listed above is the biggest news that’s happened to Litecoin this week, but coming in a close second is that crypto custodian Anchorage now supports Litecoin. Institutional investors can now store and trade litecoin from the Anchorage platform. It’s VISA-backed and now supports 27 cryptos, including four of the top five by market cap minus Tether.

Chainlink

market cap $2,890,266,686

When we get further down the crypto top ten, it really becomes something of a crap-shoot as to why various coins jump and others fall. Sometimes it’s because of big news, such as Litecoin being added to Grayscale’s holdings which leads to a buying spree and propels a coin. Otherwise, it’s curious and not immediately obvious.

In this case, cryptocompare.com, which makes its money by providing cryptocurrency analysis, has drawn a direct correlation between twitter popularity and Chainlink’s fortunes. Correlation does not equal causation, though, as in mid-July Chainlink’s Twitter accounted crested 65,000 followers and at roughly the same time LINK’s price hit its all time high of close to $9.

Did it reach that level of popularity on Twitter because of its price raise and the resulting FOMO attack? Or did it reach its price because of its popularity. Hard to tell.

Binance Coin

market cap $2,879,549,279

The Binance team announced their 12th Binance Coin (BNB) coin burn today. This time they burned 3,477,388 BNB. Basically, the removed approximately $60 million worth of BNB permanently from circulation.

The last coin burn took $52.5 million worth of BNB out, reducing the supply by 3.37 million BRB. According to the Binance whitepaper, the supply reduction will continue until there is only 100 million BNB in circulation out of the 200 million minted during Binance’s ICO in 2017.

—Joseph Morton