Be careful what you say in the cryptosphere because it may come back to haunt you. Welcome to the put up or shut up edition.

It’s time for your Friday coin rundown.

Here are your top ten coins.

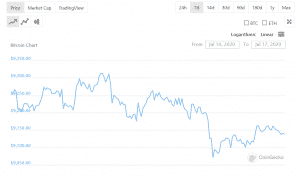

Bitcoin

market cap $168,504,881,484

Does anyone remember the time when crazy John McAfee said he’d eat his own dick if bitcoin hadn’t hit $500 million by 2020?

if not, I will eat my dick on national television.

— John McAfee (@officialmcafee) July 17, 2017

We’re waiting, John.

Ethereum

market cap $26,066,706,401

The Ethereum hype machine ramps it up, and now their transaction volume is closing in on its 2018 all-time high. We could also point out that we’ve seen this kind of hype before—with the tiresome ICO craze of 2017-2018, which is what the hooplah surrounding decentralized finance (DeFi) is starting to sound like. Still, the transaction spikes threaten to slow the network down, which presumably where Buterin’s proposed Ethereum 2.0 will swoop in and save the day.

How much will ETH users put up with?

We’ll see.

Tether

market cap $9,889,740,211

Oh where to start?

First, Tether founder Brock Pierce announced his candidacy for the President of the United States. How much will America put up with following the end of Trump’s presidency? Nobody knows.

Now the United States appellate court has greenlit the New York Attorney General’s seemingly perpetual investigation into Tether’s relationship with BitFinex. The ruling lets the NY Attorney General proceed with the Martin Act investigation. This act is one of New York’s notorious anti-fraud statues, giving the AG the ability to investigate and prosecute incidences of securities fraud.

Good times are coming.

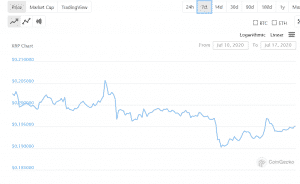

XRP/Ripple

market cap $8,732,729,753

XRP’s making inroads into mass-adoption. Data analysis service Cryptwerk indicated this week that the number of merchants accepting XRP has increased by more than 46% over the last seven months. The majority of these merchants, specifically 22% were located in the US, with runner-ups being in the UK and India.

Bitcoin Cash

market cap $4,124,992,219

This just in. Of all of Bitcoin’s bastards, Bitcoin Cash is the worst performer—and actually the only one underperforming Bitcoin in 2020, according to data from Messari. It’s up 9% year to date.

Most of the alts have performed decently well over the past few months, but BCH hasn’t. It only started underperforming Bitcoin in May, but over the past two months it’s been doing such at a rate of 18% points so far this year.

Cardano

market cap $3,782,371,729

There’s an argument going on that Cardano’s proof-of-stake consensus mechanism confers more decentralization on it than Bitcoin’s proof-of-work. Looking at it with an open mind, it’s not hard to figure out why.

Proof-of-work mining requires heavy operating costs in both equipment, electricity and geography. It’s best suited to countries that keep their electrical demands low, and miners who can keep their operating costs low. So we have a mix of rich companies operating out of a handful of countries that can afford to subsidize this industry—which doesn’t lend itself well to decentralization. Bitcoin isn’t so much the everyman’s coin anymore, capable to be mined out of your mother’s basement. Instead, it’s the cryptocurrency for the rich.

Cardano’s proof of stake, though, only requires the token ADA. It’s independent of energy costs when compared to Bitcoin. ADA retains its value regardless of how much energy costs. You can mine it anywhere if you’ve got a good enough home system—just like Bitcoin, before Bitcoin went mainstream.

Add to this d’apps and smart contracts and there’s an argument for Cardano. Finally.

Bitcoin SV

market cap $3,186,636,188

Bitcoin SV has come out with an online gambling site called Peergame that’s evidently been doing decently well. Most gambling operators are still in the doldrums, trying to figure out how to incorporate blockchain technology and digital currency onto their organization, but Bitcoin SV has apparently figured it out. They’ve recently launched their inaugural game—Dice.

Chainlink

market cap $3,004,202,166

In many ways, the news aspect of the crypto-sphere is reminiscent of the high school gossip mill. In this case, it’s a report from a company called Zeus Capital that’s labelled Chainlink a pump and dump. Zeus claims to be an asset management and research firm, but their website is a laughable wreck.

Even a quick cursory look at the accusations made in the report show its falsehood, though.

For example:

“Chainlink is trying to avoid а commitment of its mainnet launch date at any cost.”

Except that Chainlink launched its mainnet on the Ethereum blockchain earlier this year.

As always—it all depends on how much bullshit you’re willing to put up with.

Litecoin

market cap $2,729,137,973

Litecoin’s been in trouble for awhile now. Its founder Charlie Lee even went so far as to ask for voluntary miner donations to put up funds for his attempts to work on Litecoin Core.

This doesn’t surprise me, though. There’s nothing intrinsically wrong with Litecoin. It doesn’t have the hype, nor the bells and whistles, nor the exposure that Bitcoin does, but it’s basically the same reliable coin-base as BTC. As the hype dries up for the more flashier coins with their fancy gadgets and big promises, and they plummet when they hit the technological limits (like Ethereum has), then there’s always going to be coins like Litecoin to fall back on.

Crypto.com coin

market cap $2,589,195,642

CRO has had a bumpy week this week, having dipped down midweek and levelled out towards Friday. How they’re going to maintain their number ten spot next week is a curiosity, and that’s basically all there is to say about crypto.com’s coin since everything about it from the development to distribution is about as interesting as dirt.

—Joseph Morton