Well the Netflix idea I talked about yesterday has pulled back, and I am watching those support levels discussed in yesterdays post. Netflix earnings missed expectations, and management gave a weak subscriber guidance for quarter 3 which weighed in on the stock post market. The drop was spectacular, seeing a 13% fall in a short matter of time. Keep an eye on those support levels I had drawn up, they provide an area for entry given the right candle and signal.

Virgin Galactic (SPCE) is a stock we have kept tabs on over at the Equity Guru Discord Channel. Particularly in the trading room.

For some time, it has been our Tesla lagging and “growth” stock trade. Everything on the Nasdaq has been moving…even companies that are likely not to make any cash for a very long time. In the minds of investors, we will get past Covid and a company like Virgin will be making money on its space flights. This gained some steam with Virgin announcing a deal with NASA for commercial space flights. Finally just yesterday, a new CEO was announced, Michael Colglazier a former Disney executive.

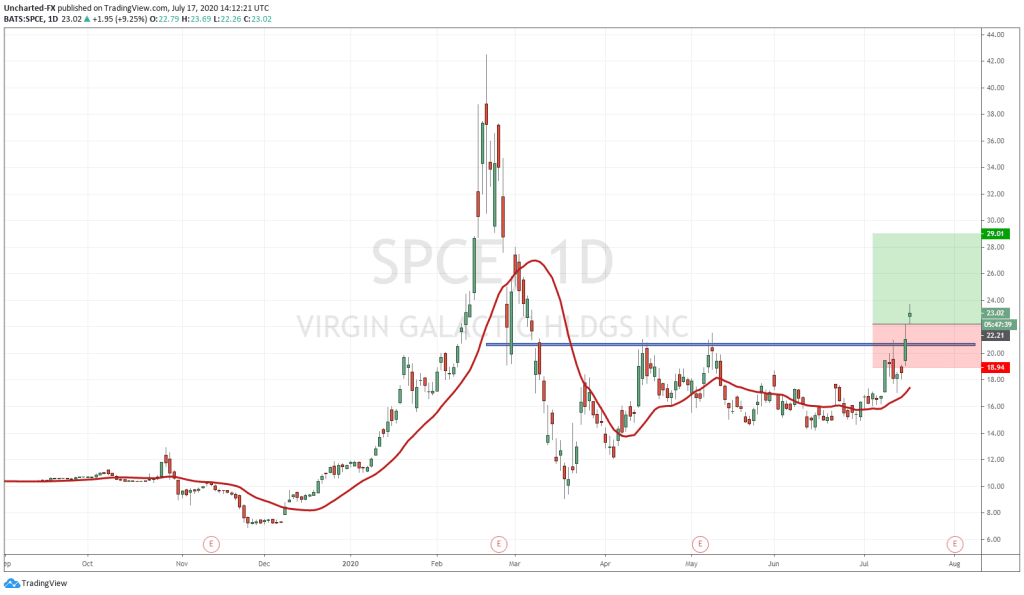

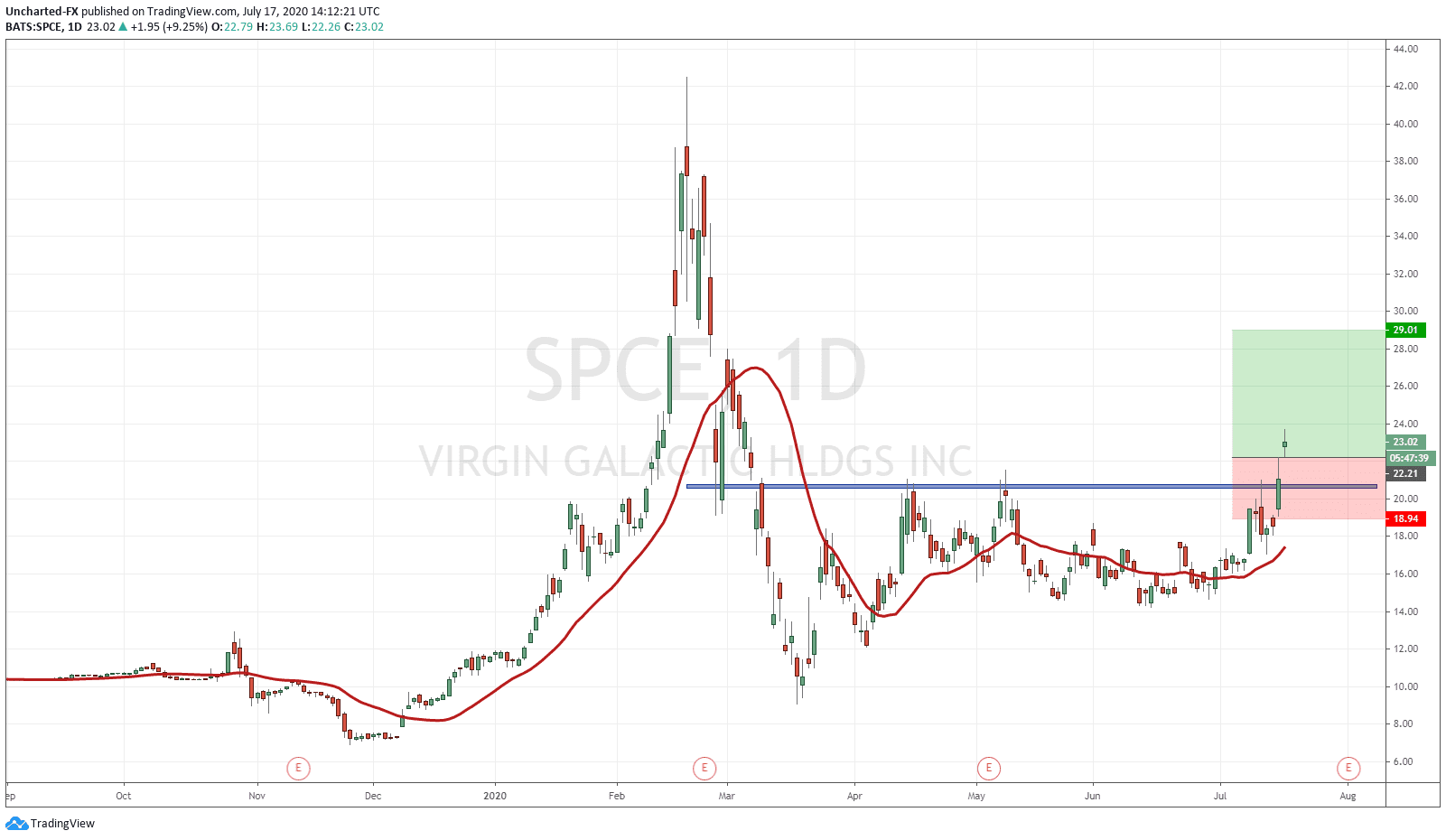

In terms of the chart, we have broken above a very important resistance zone.

You can see we ranged below the 20.90 zone since March of this year. The breakout only happened yesterday with a confirmation daily close above this zone. The market liked the new CEO appointment.

From here what is the game plan? Well the entry was confirmed yesterday, meaning an order could have been placed over night or in the morning. I have set up a risk vs reward set up on the chart. As a swing trade, you would want to have your stop loss below the break out candle, so below 19.18. I would put it a few ticks below just in case stop losses are hunted.

Price could very likely come back down to retest the break out zone at 19.18. A retest before moving higher. If this occurs, one can add more to their position then, OR enter if they have not already. Your risk vs reward would definitely improve. If we see a daily candle close BELOW this support…I would reassess the trade and possibly close my position for a loss depending on how ugly and deep the candle looks.

Going back to the original entry, I have set the target at 29.00. I have done this to have a 1:2 risk vs reward ratio. Honestly, you can hold it longer as there is not much price action on the stock to give us concrete resistance levels. The major one we have is in fact the previous all time highs at 39-42.

All your trades should have at LEAST a 1:2 risk vs reward ratio. This is the key to having a consistent growing account. I aim for a bit more on my Forex trades, but the chart for SPCE does not have much other levels to work with. If you do want to hold the position for longer, then the previous all time highs is a good target which takes your risk vs reward ratio to 1:5!