Mainstream financial media has been saying US Fed chair Powell had to walk a tightrope for the FOMC meeting and press conference which occurred yesterday. The experts were expecting Powell to be in the Goldilocks zone; not too hawkish and not too dovish. But we all know what’s up. This market recovery has been all based on financial engineering.

Followers and members of the free Equity.Guru Discord channel know what I was expecting – really more of the same. More money printing, more assurance that interest rates will remain lower for longer, and that more programs bailing out businesses of all sizes would continue.

During our livestream on Discord yesterday, we watched the violent reactions on assets such as the S&P, the US Dollar and Gold. Fed chair conferences and other high risk events are the peak environments for daytrading. A lot of the volatility was from daytraders and the algorithms. I advised our room of traders (mainly swing traders) that it is best to not enter a position before the announcement and conference, and to wait a few hours for the information to be digested by the markets.

The big headline, which I am sure you have seen, is interest rates will be kept close to zero through to 2022. We say this on the Fed’s dot plot which can be seen here.

Powell said that the Fed is not even thinking about raising interest rates. As mentioned previously, we know rates are going to be near 0, or at 0 for a very long time. With the amount of debt that has been issued now, interest rates can never be normalized quite frankly. Similar to Europe and Japan, who are of course in negative interest rates…which I believe will be coming to the US and other western nations (Canada, UK, Australia) even when the Fed is downplaying it and saying it would never happen.

All for optics, in my opinion. They really have nowhere else to go, and negative rates is the only tool left in their tool box once they hit 0.

The big shift here was the admission that rates will stay close to 0 through to 2022. Before this, the Fed said that interest rates would be data dependent. Not anymore. Powell warned the US has a long road to recovery, and this pandemic is very different from the Great Recession of the 20-30’s. The Fed expects the US economy to shrink 6.5% this year and the unemployment rate to be around 9.3% and gradually decrease to 6.5% in 2021.

The Fed has pledged to support the US economy by also increasing purchases of US treasuries and mortgage backed securities. Taking treasuries as collateral for cash (QE) and taking toxic assets away from the banks’ balance sheets (MBS). There are even some who are saying the Fed is actually taking toxic assets like MBS’s as collateral in return for cash to keep banks liquid. Once again, this is how the Fed keeps interest rates suppressed. They buy bonds which increases the price and suppresses the yield (bonds and yield have an inverse correlation).

While listening in on the conference and questions, Powell admitted to three things.

Firstly, he admitted the Fed’s actions have impacted the stock market in a positive way. This is something I have discussed many times. The central banks of the world have created an environment where you MUST be in stocks to make real yield. There is nowhere else to go for yield. People like Jeffrey Gundlach have come out and said this. That these markets are up due to Fed action, and he believes markets have not priced in the social disorder and issues that will occur due to covid and the policies implemented by central banks and governments.

Secondly, Powell admitted that millions will NOT return to their jobs until the fear dissipates. Meaning until treatment or a vaccine is created so people will feel safer heading out and commuting to work. This sort of cast doubt on Friday’s unexpected jobs data, and goes against the recovery narrative of President Trump, Larry Kudlow, and Steve Mnuchin.

Finally, Powell admitted that high earners are seeing their earnings go higher, while those in the middle class and lower class are not seeing improvements in earnings. Now tell me folks, how are interest rates close to 0 going to help the middle and lower class? Sure, they will be able to take more debt (if they are not already tapped out) and be able to service their debt. But 0 interest rates means that the middle class are being robbed blind on their interest earning accounts in the banks. I repeat once more: you must be in the stock market to make real yield. The wealthy will get more wealthier in this environment because they will have more disposable income to buy assets.

There was another data point that came out yesterday that also plays a part in Powell’s conference. We heard that the US year over year budget deficit is up 92% mainly from spending to deal with covid. Near the end of Powell’s press conference, he did talk about fiscal policy. Here at Equity Guru, I have been speaking about the combination of monetary and fiscal policy and how it will impact stock markets and the real economy. Powell hinted at the US government having to continue with their fiscal policies. Congress has been talking about another 1 trillion dollar rescue package, which could see more cheques being mailed to US citizens. Why I want to mention this is I took away something else. To me, it seems that Powell is hinting that the Fed does not want to do more. They slowly are becoming the buyers of last resort and have a huge in now ‘managing’ the stock market. Seemed more like a plea to the government saying the Fed does not want to go down the road of negative rates and essentially being the buyers of everything just to keep things propped.

Just quickly on the fiscal side, nobody is asking how this will all be paid for. Interest rates will have to remain close to 0 largely on the fact so governments can service their debt and take more. Low rates ensures for a longer period of time that the interest payments on this debt do NOT surpass tax revenue. This does mean expect taxes to increase, and expect governments trying to increase living costs as a way to do this. Inflation is taxation. The higher the prices of goods are and real estate, the more taxes you pay in sales tax and property tax etc. This will lead to social issues, and perhaps Modern Monetary Theory (MMT) as a way to keep people happy. Of course with MMT, you will need to increase taxes as a way to handle the rampant inflation from giving people more money to compete for the same number of goods and services since we are not increasing productivity which is key for economic growth and prosperity.

And a quick note on the equity markets.

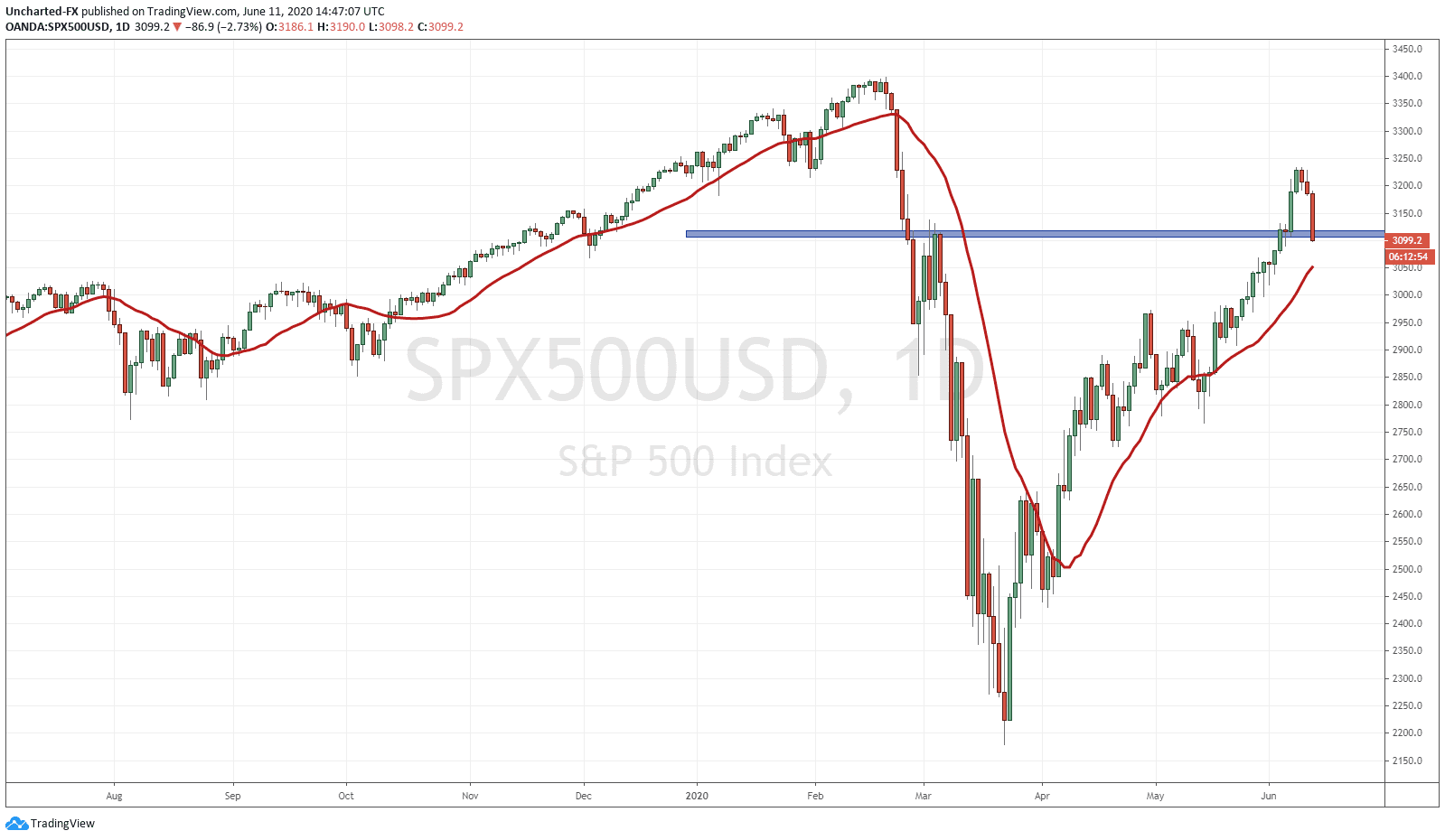

On Discord, I posted that I see a topping pattern on the 4 hour charts of the Russell 2000, the S&P and the Dow. They have continued the sell off BUT this is what I wanted to see. Markets have gone up too much too fast. We needed a pullback. The indices have now reached an important support zone and I am watching to see if we get a signal indicating the buyers are stepping in. Be sure to join us over on discord for my updates on the charts.

The media is saying that markets are down on uncertainties such as the second wave in covid, the Fed’s outlook on the US economic recovery, and the social protests. I agree there are a lot of uncertainties, but this did not stop markets from recovering after their losses this year. In the end, there really is nowhere to go for real yield. You can sit in cash, which is being devalued with the money printing. Bonds were once a place where you could park your cash, but with yields being suppressed you are not beating real inflation. Believe it or not, but I do think Gold will do well in this environment as some see it as money, even better than holding cash, and Ray Dalio has mentioned Gold being a risk off asset overtaking bonds since you can actually still make a return on Gold with its price moves. In this environment, I think stocks will be moving higher to unbelievable levels and the only thing that can derail this is some sort of black swan event.

Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA