A new crypto derivatives exchange known as Alpha5 is planning to launch in the next two months. Backed by Polychain Capital, Alpha5 plans to offer bitcoin futures and options, as well as exotic or customized derivative products.

Now before we get started we should probably drop some definitions.

According to Investopedia:

“A derivative is a contract between two or more parties whose value is based on an agreed-upon underlying financial asset (like a security) or set of assets (like an index). Common underlying instruments include bonds, commodities, currencies, interest rates, market indexes, and stocks.”

Derivatives are considered secondary securities whose value is based on the value of the primary security to which they’re attached. Futures contracts, forward contracts, options, swaps and warrants are commonly used derivatives.

There are a few places where we can trade in Bitcoin futures. For example, we wrote about Bakkt bitcoin futures, backed by International Exchange (ICE.NYSE), the company behind the New York Stock Exchange, going online earlier this year to relatively tepid reviews. Also, various other organizations, including the Chicago Board Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME) have flirted with bitcoin. The CME is enjoying an extended courtship, but the CBOE bowed out. The total of companies involved can’t be more than five, and not all are available to North American investors.

Compared to traditional trading alternatives, there aren’t many available for cryptocurrency enthusiasts. Most of us basically have access to trading cryptocurrencies. We have arbitrage, and shapeshifting and maybe if we’re technically savvy, we can get onto the ethereum blockchain and get involved in the decentralized application markets and find a way to monetize our time and expertise.

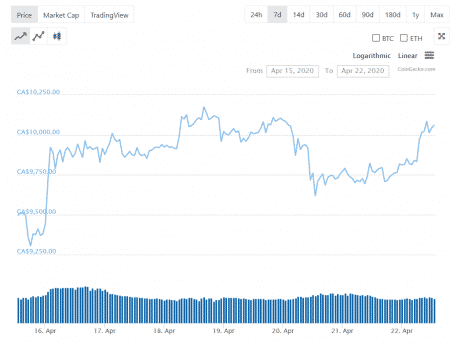

Given how bitcoin is the first asset class to effectively return to its pre-COVID-19 resistance point, breaching CAD$10K for the first time since its precipitous collapse, and likely on the back of oil’s cratering, it’s worth considering.

Alpha5 is building an entirely new risk system with a vision to enhance and build new, multi-dimensional derivative products by way of:

- Becoming the first crypto-exchange to bring basis trades in to fashion with implied orderbook technology

- Digital and other exotic options for set-and-forget trades with pre-determined risk and rewards

- Offering responsible leverage and utilizing benign liquidation methods that benefit traders and limit market impact

- A super-fast and agile infrastructure, that is intuitive to use, and allows for tailored sophistication

In terms of bitcoin, Alpha5 will be offering bitcoin futures and options and more exotic or customized derivative products, including allowing bitcoin miners to hedge the hashrate, which can be loosely thought of as buying some insurance for if Bitcoin’s hashrate fluctuations take it outside of the profitable zone. Whereas difficulty mining swaps, which have also been considered, will help miners manage the risk of increased mining difficulty, which could reduce their anticipated coin production.

“I have been working in this industry for a while, and I have seen a lot of opportunity being squandered. We have entered into a world where there is an unprecedented amount of data at our fingertips, but the tools we have to harness and implement that data, for capitalist pursuits, are far too rudimentary. That’s what Alpha5 is ultimately trying to tackle,” said Vishal Shah, founder of Alpha5.

—Joseph Morton