Bitcoin is supposed to be a safe-haven currency. When the markets go to shit like they are today, in theory people evacuate their traditional positions and throw their money into digital currencies and other adjacent crypto-related stock, like bitcoin mining or one of the many digital asset companies offering the proximity and benefits of bitcoin without any of the hassle of actually owning any.

Except that’s not happening. Today’s market collapse saw falling prices in Bitcoin and other cryptocurrencies alongside more traditional assets as today’s perfect storm of oil, covid 19 panic, and political belligerence sprang a selling spree that sent capital markets deep into the red. Given the disparate percentage changes, it’s hard if not impossible, to determine causation given the standard volatility common to cryptocurrencies, but the point remains that they are in fact down, which suggests that they’re not serving as a safe haven. We can say that much at least.

Cryptos

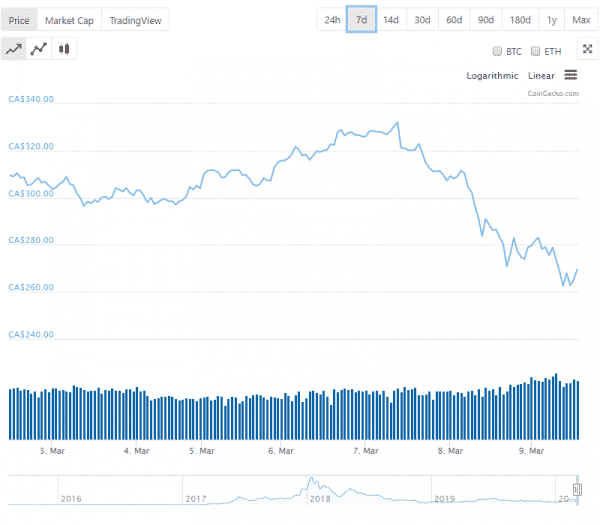

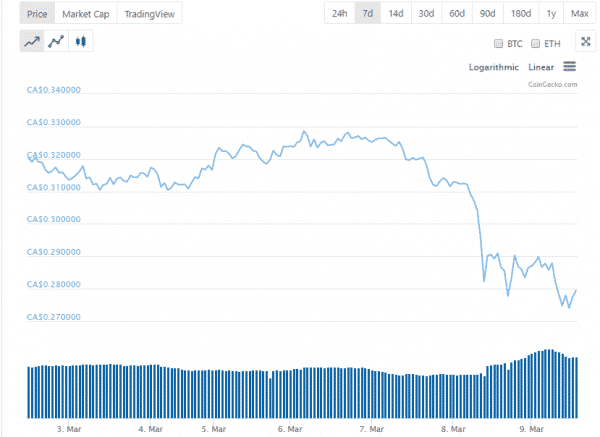

Bitcoin is down 4.2%, which is approximately a $600 drop in price for the world’s number one cryptocurrency by market cap. That’s honestly not anything to write home about for Bitcoin, which can rise and spike in moments well over these percentage points.

The ETH chart shows the results of mostly a bad weekend capping off a dismal week at a 8.4% loss, but nothing again to take note of when compared to what’s happening in the stock market, especially in terms of crypto-volatility. When cryptocurrencies start moving in the twenty and thirty percentage range, that’s when crypto-enthusiasts start wondering if the sky might be falling, and sometimes not even then.

XRP shows more of the same, and actually begins to suggest more of a trend than anything else. They’re the third largest in market cap, and now that we can securely see that BTC, ETH and now XRP are showing ski-slopes at the end of otherwise atrocious weeks, we can start assuming that this is the basis for a trend in cryptocurrency, which does not necessarily reflect that presently going on in the traditional markets. There may be a correlation between the general downward trends, but that’s where it ends. For now.

Crypto Companies

People aren’t putting their money into cryptocurrency adjacent stocks either, as seen by Hive Blockchain’s (HIVE.V) chart. They’re an international cryptocurrency miner that’s recently diversified its mining focus from ASIC-only Bitcoin to include GPU-mineable Ethereum in time for the halving. Remember that Hive has been one of crypto’s biggest movers in the past four months, and they’re down like everyone else. In their case they’re down 21.9%, which is closer to what companies on traditional exchanges have been enduring.

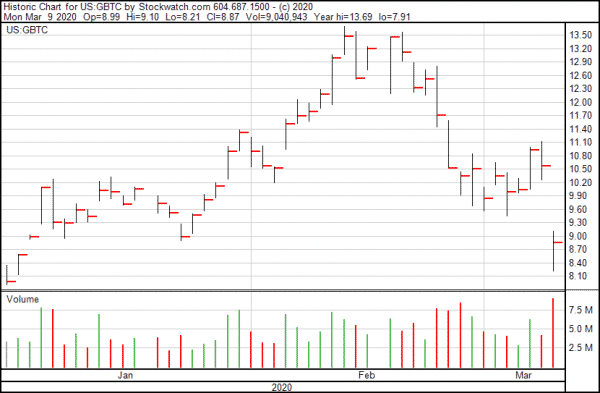

Finally, if Bitcoin were a safe-haven currency, then it would make sense that people exiting their positions in the traditional markets would move digitally – both to Bitcoin and select altcoins (and they’re not) but also to digital management companies like Grayscale Investments (GBTC.Q).

Grayscale is down 16.2% today.

Grayscale offers is access to a pool of cryptocurrencies including Bitcoin and Ethereum without the necessity of ensuring security concerns of actually owning them outright.

We can’t necessarily close the case on whether or not cryptocurrencies and crypto-adjacent stocks serve as safe places to put your money during a downturn based on the information we have. After all, the sky only started falling a few days ago, and who knows what the next few days could bring.

—Joseph Morton