Harvest Health and Recreation (HARV.C) acquired Arizona Natural Selections and their four vertical medical licenses in an undisclosed all stock deal today.

The acquisition brings Harvest two more operational cultivation facilities, including a 55,000 square foot indoor production and cultivation facility in Phoenix, and a 322-acre site for which 25 acres are designated for cannabis with an extra 70,000 square feet of greenhouse space in Willcox, Arizona. The deal also includes the Darwin line of cannabis products.

“We are excited to further deepen our operations in our home state of Arizona expanding our cultivation, processing, and retail operations. “We will look to further the existing reputation and operational excellence Arizona Natural Selections has established across the state and are eager to welcome new members into the Harvest family,” said Harvest CEO Steve White.

This acquisition increases Harvest’s holdings to 14 medical dispensaries, four cultivation facilities and three processing facilities in Arizona, giving them a total of 15 vertical licenses. That means if we include the pending acquisitions, Harvest has a total of 22 vertical licenses in Arizona.

The four licenses acquired through the agreement include retail locations:

- Green Desert Patient Center of Peoria, Inc.,

- Green Sky Patient Center of Scottsdale North, Inc.,

- The Giving Tree Wellness Center of Mesa, Inc.

- and a fourth which is TBA, which will go under the retail brand, Arizona Natural Selections.

The deal beyond Arizona

Earlier this month, Harvest opened a dispensary in Little Rock, Arkansas. The licensee, Natural State Wellness Dispensary, went through its usual bevy of inspections, and received authorization to open their doors by the Arkansas Alcoholic Beverage Control Division. Harvest received authorization to operate the facility as Harvest House of Cannabis by the Arkansas Medical Marijuana Commission. The dispensary will offer 125 different products in various categories for qualified patients.

This is the company’s first time doing business in the state, but not their first out-of-state acquisition this year.

They have also moved into Michigan, forming a partnering with a provisioning centre that will call itself Harvest of Battle Creek. Harvest of Battle Creek will license the Harvest name and branding, and will work collaboratively with Harvest to train employees and develop operating procedures based on Harvest’s extensive nationwide retail experience

Shortly after new years, they penned a $35 million deal with MJardin Group (MJAR.C) for their interest in GreenMart of Nevada, and their Nevada cannabis licensed cultivation facility in Cheyenne, Nevada.

The acquisition added another 32,000 square feet of cultivation and production space to a company with an already quite considerable amount of available space. The first $30 million was financed on new years eve, and the remainder will be paid when the acquisition closes.

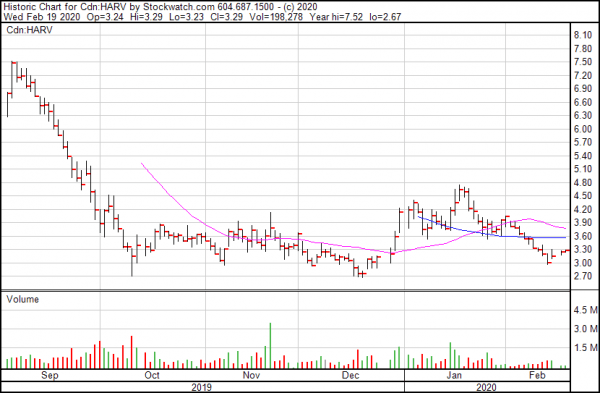

And what effect have all of these acquisitions and other assorted activity had on their share price?

Not much.

The percentages aren’t good. Today Harvest is up 1.2%, but tomorrow they could be down. Or up. Or sideways. If you look around at the various charts and behaviours shown by the companies in the cannabis space, you get a mix of flat movement with a general downward trajectory. Looks damn chilly out there. Time to hibernate.

—Joseph Morton