Sometimes a deal broken is a good deal for shareholders, especially if you give a red rat’s behind about your favourite company having enough money to survive the year. Lately, we’re seeing a lot of deals that, at one time, were announced with much fanfare, being quietly dropkicked off the bridge as once high flying companies realize they need to make more than they spend.

And if MedMen is canceling deals, of all companies, we truly are in the balance sheet era.

MEDMEN’S BEST DEAL EVER… DIES

Almost a year ago to the day, MedMen (MMEN.C) swore their deal to acquire Pharmacann for $682 million was going to ‘double their market reach’ and turn them into a leading MSO giant.

Today, they backed out of the deal, “In light of market developments over the past 12 months,” and with a claim they’re going to focus on their core assets.

A year ago, it was a different tune.

“This is a transformative acquisition that will create the largest U.S. cannabis company in the world’s largest cannabis market,” said Adam Bierman, Medmen’s chief executive officer and co-founder, announcing the deal on October 11, 2018.

[contextly_sidebar id=”NMTd6fCu4l7PC0joGFGFtpuJgllqSpsk”]The market ate it up, rocketing MMEN stock from $5.50 to $10 per share in days.

The deal was slated to cost $682 million via the allocation of 168m MedMen shares but, in the year since, the value of those has dropped markedly.

If the deal had gone ahead with the 168m shares initially promised, the value of the transaction would have dropped to just CAN$329.2m today.

That option was apparently not attractive to Pharmacann, who were so eager to get out of the MedMen bro-dorm they left their shit in the garage when the Uber showed up.

As part of the agreement to terminate, PharmaCann has agreed to pay a termination fee to Medmen through a transfer of the membership interests in three entities holding the following four assets:

- Operational cultivation and production facility in Hillcrest, Ill.;

- Retail location in Evanston, Ill.;

- Retail licence for Greater Chicago, Ill.;

- Licence for vertically integrated facility in Virginia.

{…} As part of the agreement to terminate and contingent on the successful transfer of interests, Medmen will forgive all amounts outstanding under its existing line of credit to PharmaCann, which totalled approximately $21-million (U.S.), including accrued interest, as of Sept. 30, 2019.

Let’s be clear: MedMen didn’t have the capacity to easily pay for this acquisition to begin with, and certainly wasn’t going to do it comfortably after the ass fell out of their jeans.

And Pharmacann wanted out badly enough that it voluntarily left assets behind in lieu of a break-up fee.

So much for “the largest US cannabis company in the world’s largest cannabis market.”

If we’re being charitable, this deal had taken so long to complete that, chances are, it’s eventual demise was largely already rolled into the MMEN share price.

MedMen, for its part in all this, actually appears to be taking an adult stance on it all for the first time since its inception.

The capital markets, both for the United States and Canadian cannabis industries, have shifted since March, 2019, with the HMMJ index down 47 per cent (1) during that time period. The underperformance has made it increasingly more critical to allocate capital efficiently given the current industry headwinds. While PharmaCann holds several licences across the U.S., a large portion of its assets, particularly related to cultivation and manufacturing in medical markets, require significant capital expenditures.

No shit. But this was the case as much when MMEN announced the deal as it is today. The difference between the two moments of time is, today, they’ve received the memo that profitability – even sustainability – actually matters.

And it’s going to matter even more if the company can’t get some dough in the door quickly, and continues to live on borrowed money.

Medmen is targeting break-even EBITDA (earnings before interest, taxes, depreciation and amortization) by the end of calendar 2020 and will provide further details on the Oct. 28 earnings call.

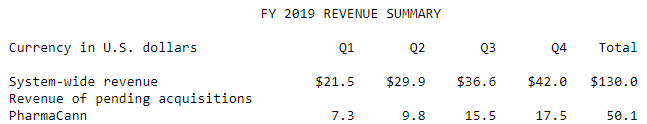

One thing that’s going to be necessary going forward is the removal of Pharmacann revenues from MedMen quarterly financials.

That’s a quarter of MMEN’s revs last quarter coming from something that isn’t there anymore, while those new assets they just acquired are still going to need capital to move them forward.

The company says they’re switching back to their core business, which is fair but has also been a long time coming.

MedMen stock dropped 13.5% on the news.

TIDYING UP THE BALANCE SHEET, EVEN IF IT HURTS

Up in Canada at the same time, GTEC Holdings (GTEC.V) announced it was selling its interest in the Cannabis Cowboy retail chain for a bit over $4m, which helps them pay off that amount of debt in the short term, leaving the company able to cover remaining debt until the end of 2020.

The actual transaction was a merger between CCI and Flower and Fire (FAF.C), but CCI paid out GTEC to make that deal happen.

Upon the closing of the transaction, [Cannabis Cowboy] has settled GTEC’s outstanding $4.06-million debt, in a cash repayment. The repayment will strengthen GTEC’s balance sheet as the company continues its near-term initiatives of completing the development of its two facilities currently under construction, with the expectation to increase its annual production output from its current 4,000 kilograms output to approximately 9,000 kg in 2020.

From an investor perspective, it’s not ideal for GTEC to now be out of the retail game, but there’s something to be said for going back to your core, which is artisanal weed growing in BC’s Okanagan region, and being fiscally prudent.

SUPPLY DEAL BREAKS BECAUSE SUPPLY IS BROKEN

Meanwhile, Aleafia (ALEF.T) has pulled out of a supply arrangement with Aphria (APHA.T) after the latter failed to fulfill its obligations in the arrangement. That deal was initially with Emblem, which was taken over by Aleafia after a cheap acquisition offer.

In Sept. 2018, Aphria agreed to provide Emblem Corp. with up to 175,000 kilograms of high quality dried cannabis flower and crude cannabis oil at preferred wholesale pricing over a five-year period. In March, Aleafia acquired Emblem for $173 million in an all-stock deal. Aleafia said in a security document filed in August that it deposited $22.7 million with Aphria under terms relating to the cannabis supply agreement with Emblem.

Aleafia says the end of the deal won’t negatively affect the business in a big way, but a fight may be brewing as it says, “The termination of the supply agreement by Emblem was made without prejudice to its rights accrued to the date of termination (including its rights to be refunded the unused balance of its deposit) and its rights to seek damages as a result of Aphria’s default and termination thereunder.”

On the other side of the deal, Aphria, which owns a big chunk of Aleafia, isn’t sounding overly impressed with its partner.

“We are disappointed that Aleafia has chosen to terminate its agreement with Aphria Inc. The company had every intention of fulfilling its obligations under the agreement. As a large shareholder of Aleafia, Aphria made good faith efforts to ensure continuation of the agreement, understanding it was in the best interest of all parties involved. However, the termination of this legacy agreement frees up significant supply, allowing the company to service its brands that are in high demand across the country.”

SOME DEALS ARE BEST LEFT UNDONE

An Israeli cannabis IPO has been indefinitely suspended because the market isn’t being kind to folks looking to raise nine figures right now.

Breath of Life International, an Israeli medical pot company, has shelved its planned initial public offering on the Toronto Stock Exchange until market conditions improve. A Bloomberg dispatch to the Post reports that Breath of Life had planned to raise $150-million through a public share offering priced at $27 to $32 a share.

Oh really? Only $150 million? Why not 250 bazillion?

It had revenue of $3.5-million (U.S.) in 2018 and $1.1-million (U.S.) in the first quarter of 2019. Chief executive officer Tamir Gedo said Monday: “We are sitting on the fence waiting for the market conditions to get better. When the market is ready to be bullish, we’ll go ahead immediately.”

On behalf of the market, might I suggest when you’re ready to give yourself a real valuation, call us.

IPO MADNESS AT SUNDIAL BRINGS CLASS ACTION SUIT

It appears not being told that a large quantity of product was being recalled wasn’t exactly what Sundial Growers (SNDL.Q) IPO participants had in mind when they bought into that deal. Lawyers are now involved.

The [class action] lawsuit claims that Sundial’s IPO filings neglected to mention important information, such as the return of 554 kg of cannabis by a customer because of the presence of mould and pieces of rubber gloves. When news of the contaminated shipment broke in August, Sundial’s shares dropped well below the $13 they were initially offered at, a level to which they have yet to return.

Which sounds bad, admittedly, until you learn the firm that has filed the class action suit, Rosen Law, files about eight of those a day.

“We are aware of the complaints that have been filed,” Sundial said in a statement. “It is our policy not to comment on active litigation; however, we believe that the claims are without merit and the company intends to vigorously defend itself. Sundial remains focused on what has made us successful: the growth of our business through a commitment to producing safe, innovative and high-quality products.”

I can see why they’d be upset.

THE SQUEAKY WHEEL GETS THE OIL

Supreme Cannabis (FIRE.T) subsidiary Blissco has been largely touted by the FIRE folks as being their future oil extraction outfit and, true to form, they weren’t lying. Blissco now has its oils license and the plans are big.

The cannabis oil sales licence granted by Health Canada allows Blissco to sell full spectrum cannabidiol (CBD) oil products. As previously announced, Supreme Cannabis closed its acquisition of Blissco in the first quarter of fiscal 2020. The company has since integrated, focused and advanced Blissco’s business, initiating construction on a large-scale ethanol-based extraction lab to expand upon Blissco’s existing carbon-dioxide-based extraction capability. By the end of calendar year 2019, Supreme Cannabis expects that the facility will have the capacity to produce over seven million tincture bottles annually. Supreme Cannabis also expects the Blissco brand to meaningfully contribute to projected revenue in fiscal 2020.

It’s nice to see some deals actually paying off in the cannabis space, but Supreme has a long history of doing what it says it will.

This will be all the more important soon, when the Canadian government rolls out changes to the cannabis products rules, and oil demand picks up accordingly.

— Chris Parry

FULL DISCLOSURE: Supreme and GTEC are Equity.Guru marketing clients

PharmaCann walked from the deal because it was alarmed at MedMens burn rate and Adam Bierman refused to give up his super voting shares.

..great article Chris, thank you for keeping the Supreme fans up to date in light of the unfortunate turmoil in the industry…george